What benefits can blockchain bring to the carbon credit market?

TechFlow Selected TechFlow Selected

What benefits can blockchain bring to the carbon credit market?

A Guide to 5 Protocols Bringing Carbon Markets onto the Blockchain

Written by: Risk Taker88

Compiled by: TechFlow

To mitigate climate change, many countries have begun issuing carbon credits to companies that produce greenhouse gases. These credits are tradable certificates allowing their holders to emit a predetermined amount of carbon. Once used, these credits are retired from circulation—this seems straightforward enough.

What is the Voluntary Carbon Market (VCM)?

However, in some cases, a company may generate emissions greater than or less than the number of credits they hold. This is where the voluntary carbon market (VCM) comes into play—it acts as a secondary market where entities can buy and sell carbon credits among themselves. These credits are based on greenhouse gases removed from or reduced in the atmosphere. As a result, companies have been able to incorporate the accumulation and sale of these credits into their business models—enabling the survival of some ventures that would otherwise be financially unviable.

These markets exist off-chain and have significant room for improvement.

Why Do Traditional Carbon Markets Fail?

Traditional, or off-chain, carbon markets are inefficient and flawed in several ways:

-

Lack of price discovery. Most voluntary carbon trades occur over-the-counter (OTC), leading to poor market transparency. The value of a carbon credit depends on multiple factors such as project type, vintage year, or country. This makes it difficult to determine the true market price of voluntary carbon credits.

-

Poor liquidity. As noted above, the voluntary carbon market operates primarily through OTC transactions rather than centralized exchanges, resulting in a highly fragmented and illiquid market. The heterogeneity of carbon credits means that trading volumes for different types of offsets remain low.

-

Lack of market transparency. Because the market is voluntary and not regulated by a single entity, it is difficult or even impossible to obtain reliable information about current carbon credit owners or detailed project data.

Blockchain Solutions

Bringing carbon markets onto the blockchain can resolve most of these issues. A blockchain is a decentralized public ledger where no entry can be altered, making on-chain carbon markets significantly more transparent than traditional ones.

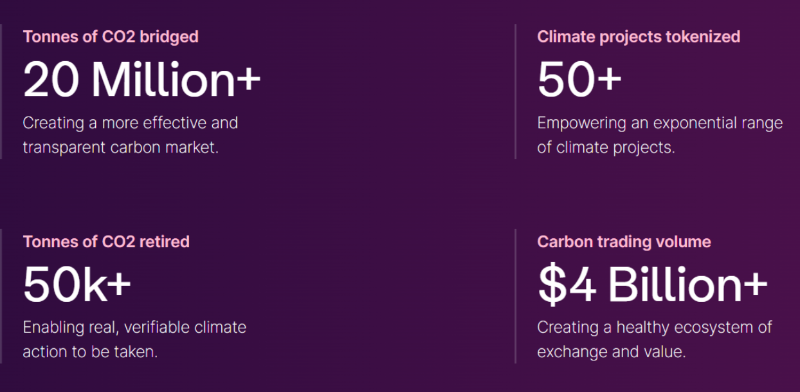

Furthermore, tokenization of carbon credits increases market liquidity by introducing new participants who otherwise would not have access to the market. Moving carbon offsets onto the blockchain also improves price discovery, as similar carbon credits are pooled together, enabling easier comparison.

Several protocols have already emerged in this space; we list some notable ones below.

Toucan

Toucan's carbon stack consists of three modules:

- Carbon Bridge

- Carbon Pools

- Toucan Meta-Registry

Anyone can use the Carbon Bridge to bring their off-chain carbon credits onto the blockchain. To transfer carbon credits from a traditional registry to the Toucan registry, users must first retire them in the original registry to prevent double counting. Once bridged, the carbon credits can be tokenized into TC02 tokens—where "T" stands for "Toucan," "Tonne," or "Tokenized," and "C02" refers to carbon dioxide.

If Toucan stopped here, it would offer no advantage over traditional carbon markets. Given the large number of carbon projects and the project-specific nature of most credits, the carbon market often suffers from low liquidity. Pooling credits with similar characteristics is a natural solution to this problem—and this is exactly why the protocol introduced Carbon Pools.

Carbon trading mainly occurs over-the-counter rather than on centralized exchanges. This means these markets lack full transparency and effective price discovery.

Toucan’s Carbon Pools group similar carbon credits into pools, creating deeper liquidity and clearer price signals across various carbon categories. Once tokenized, standardized tokens called carbon reference tokens are created. These tokens can then be traded on deep-liquidity decentralized exchanges. Thus, Carbon Pools greatly enhance liquidity, reduce fragmentation, and improve transparency in the carbon market.

The Toucan Registry stores all fractionalized carbon credits and records additional details such as project-specific information and retirement status.

Klima

One of Toucan’s greatest visions is that other projects or protocols will build on its infrastructure. This is precisely what KlimaDAO does. It is a project aiming to create a carbon-backed currency. Users can exchange its KLIMA token for BCT—the native token of Toucan. The KLIMA token is backed 1:1 by BCT, which in turn is linked to real-world carbon offset projects.

When BCT tokens are deposited into the KlimaDAO treasury, more KLIMA tokens are minted into circulation. You can think of KlimaDAO as a black hole for BCT—they lock up both BCT and carbon offsets from the market, thereby driving up the price of carbon credits. Investors are rewarded through bonds and staking.

Bonds

Bonds involve depositing reserve assets such as MC02 (see below) or BCT into the KlimaDAO treasury in exchange for KLIMA tokens. Importantly, this allows users to acquire KLIMA at a discount.

Staking

Staking is another value accrual mechanism within the protocol. By staking your KLIMA tokens, you receive sKLIMA tokens at a 1:1 ratio with KLIMA.

How does the protocol reward stakers?

Recall that KLIMA is backed by real carbon credits. When the treasury acquires additional credits to back KLIMA, it mints new tokens and distributes them to stakers. Staking is a win-win for both the protocol and users. For KlimaDAO, it helps because staked tokens are locked up for a period, reducing selling pressure. Users benefit from staking rewards—in this case, an APY of 21% at the time of writing.

Moss

MOSS is an environmental platform operating in Brazil, a country home to 40% of the world’s tropical forests—often referred to as the “Saudi Arabia of carbon credits.” While the country holds immense potential, its carbon credits are among the cheapest in the world.

MOSS consists of two separate initiatives: the MC02 token and the Amazon NFT project. MC02 is an ERC-20 token representing one carbon credit, minted by MOSS based on supply and demand dynamics of carbon credits.

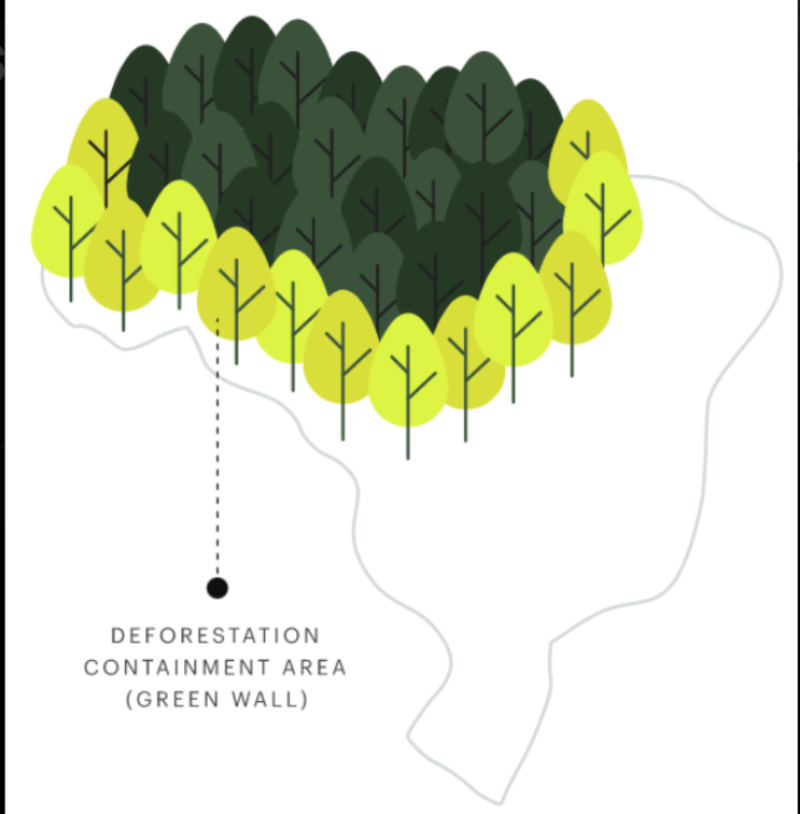

Amazon NFTs represent parcels of the Amazon rainforest. Proceeds from NFT sales fund the Green Wall project, aimed at combating deforestation in the region. The mission of Green Wall is to protect the threatened borders of the rainforest. According to the whitepaper, saving the Amazon—covering 600 million hectares—would cost far less than commonly believed. Since most deforestation stems from human activity rather than natural disasters, building a protective wall along forest edges is both environmentally and economically rational.

Flowcarbon

Flowcarbon is one of the leading projects in the climate technology space, operating as follows:

-

First, carbon credits from multiple environmental projects are deposited into a special-purpose vehicle (SPV).

-

Next, these credits are tokenized into GC02 tokens. However, since these tokens are tied to specific years and projects, they are pooled together with similar carbon credits from other projects.

-

Finally, GNT tokens are minted from this bundle: the number of GNT tokens issued equals the total number of GC02 tokens held in the bundle’s smart contract.

Their GNT token is backed by carbon credits from multiple “market-recognized carbon registries.” These credits have not yet been retired, so once purchased, they can be withdrawn off-chain and utilized by the holder.

In addition to GNT, Flowcarbon uses NFTs to raise awareness about climate change. On November 28, they launched a collection of 200 digital art pieces called Flow3rs. Approximately 70% of the proceeds from NFT sales will be used to retire carbon credits.

Universal Carbon

REDD+ credits specifically refer to carbon credits designed to “Reduce Emissions from Deforestation and Forest Degradation in developing countries.”

Universal Carbon, or UPC02, is the first tradable REDD+ carbon credit token. Developed by the Universal Protocol Alliance, it is backed by voluntary REDD+ carbon credits.

Controversy

When KlimaDAO entered the market, it attempted to “pump” prices by encouraging crypto users to buy the cheapest available carbon credits. Their argument was that if low-quality or useless credits were absorbed from the market, only high-quality project credits would remain.

The problem with this approach is that these low-grade credits are associated with low-quality, questionable environmental projects. These projects have poor reputations and cannot be sold on major carbon markets. Experienced carbon credit traders have avoided these credits for years because they understand their limited value. Yet, these same credits became part of KlimaDAO’s treasury backing KLIMA.

Given this, Verra—the operator of the Verified Carbon Standard (VCS), one of the world’s leading carbon credit programs—issued a statement on November 25, 2021. It distanced itself from KlimaDAO and the Toucan protocol by emphasizing that it “does not administer these activities or tokens and assumes no responsibility whatsoever,” and that these tokens “are not licensed, verified, endorsed, or recognized by Verra as representing or equivalent to VCUs or related environmental benefits.”

Unsurprisingly, KLIMA and BCT (Toucan’s Base Carbon Tonnes) tokens lost a significant portion of their value following the statement. Below is the BCT price chart:

And here is the KLIMA price chart:

Summary

While carbon markets have the potential to help combat climate change, they come with their own set of flaws. They suffer from poor liquidity, lack of transparency, and limited accessibility for most investors.

Blockchain technology can transform this landscape in multiple ways.

-

First, aggregating carbon credits with similar characteristics improves price discovery—a key deficiency in traditional carbon markets.

-

Additionally, tokenization of carbon credits leads to better liquidity.

Taken together, this corner of the cryptocurrency ecosystem holds strong disruptive potential, and we may see substantial growth in this area in the coming years.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News