Inside Soulcial: The Infinite Pump Game — Web3 social assets enter the "group buying" era

TechFlow Selected TechFlow Selected

Inside Soulcial: The Infinite Pump Game — Web3 social assets enter the "group buying" era

Social is a赛道 that emphasizes continuous operation and day-to-day work, where a project's diligent operations and unlocking of more value-driven gameplay will influence its development pace and success or failure.

Written by: TechFlow

After the recent "Uptober" rally in the crypto market, signs of recovery have emerged across various sectors.

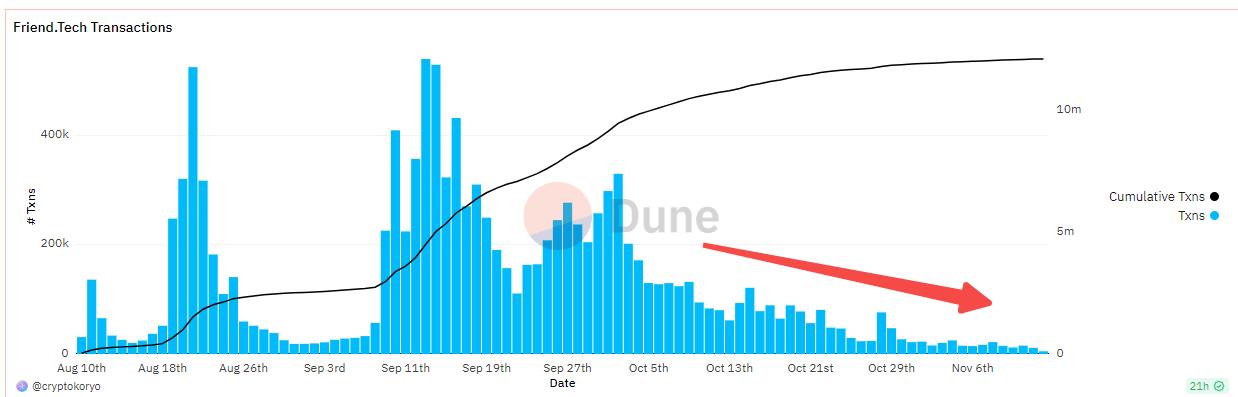

The Bitcoin ecosystem led the surge, and gaming projects are becoming active again... However, SocialFi, once extremely popular, seems to have lost its spotlight in this latest wave:

FriendTech has seen slow product updates, with user growth and engagement stagnating; meanwhile, Star Arena, previously one of the standout clones, has declined sharply after suffering a hack and the departure of its founder.

Despite favorable overall market conditions, the social sector is experiencing a quiet period.

But we all know that cryptocurrency follows a rotation logic among sectors. When the bull lifts its head, capital and attention will seek the best returns and narratives. After a period of stagnation, if funds rotate back into SocialFi, will there be new projects ready to take the baton?

Following the principle of favoring the new over the old, which project can capture and ignite fresh热度 during this post-hiatus phase?

To take the lead in the same赛道, innovation is essential. Pure clones cannot attract sustained attention.

Previously, in "From SixDegrees to FriendTech: Soulcial’s Web3 Social Moment" , we introduced Soulcial, a new social project on Optimism. The product has won awards at multiple hackathons, indicating industry recognition of its innovation.

Recently, Soulcial launched its V2 version and simultaneously initiated a Pump Epoch event, sparking discussions across social media.

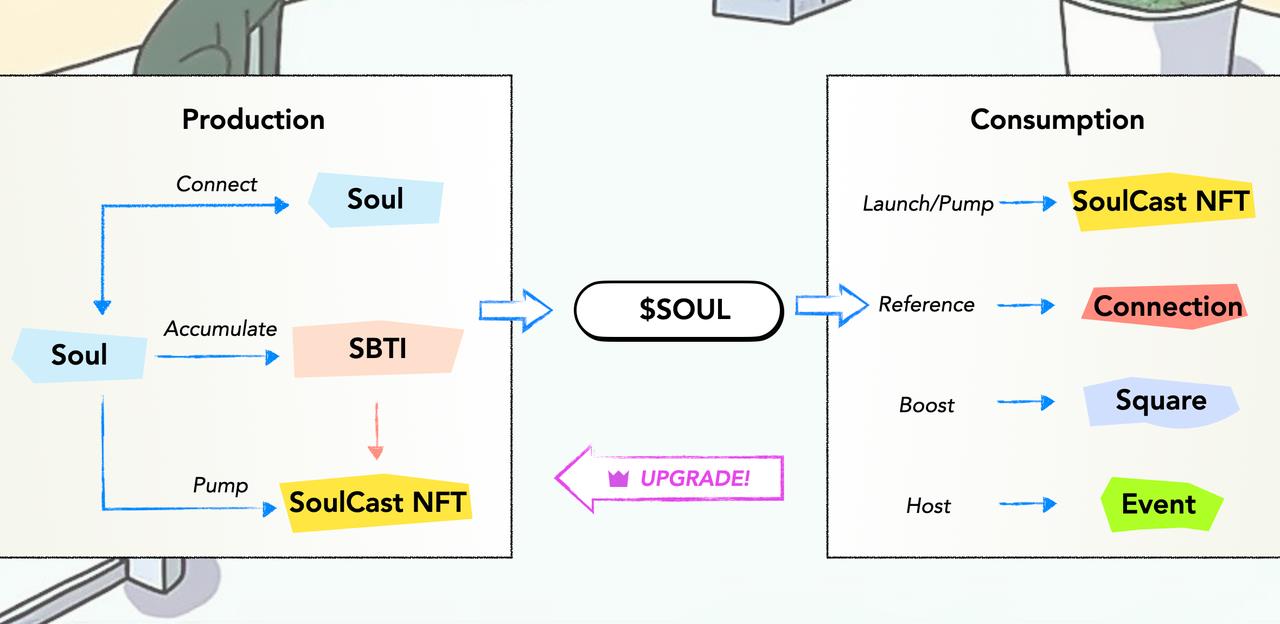

Unlike FriendTech (hereinafter referred to as FT) and StarArena, which focus purely on share trading, Soulcial introduces a “Social Behavior Trait Indicator” (SBTI) and a novel Pump Game design:

The former enhances the social aspect by allowing an individual's social value and connection methods to go beyond traditional social media influence; the latter enriches the Fi component by offering participants new channels to earn rewards and benefits.

Within two days of launch, 3,500 users have already participated in NFT minting. In this article, we’ll dive deep into Soulcial’s product design, economic mechanisms, and token value to explore its innovations in the social赛道, while also providing guidance for interested participants.

More Dimensions to Discover More Valuable People

Previously popular platforms like FT and its clones primarily measure user value based on Twitter account influence. But not everyone valuable has a high number of social media followers.

A prominent on-chain actor might remain unknown, an NFT degen may choose not to speak up, and someone actively contributing to governance may operate behind the scenes...

Therefore, Soulcial introduces the "Social Behavior Trait Indicator" (SBTI), aiming to more comprehensively uncover the value of a Web3 user from multiple dimensions:

For example, Influence represents influence on social media; Connection refers to the scale of a user’s n-degree network within the platform; Energy reflects a user’s level of on-chain activity participation; Wisdom indicates whether they actively participate in community governance; Art directly shows the number of NFTs held by the user; and Courage demonstrates the frequency and scale of on-chain interactions...

These six dimensions collectively cover nearly all aspects of behavior in the Web3 world and reflect each user’s unique "on-chain persona."

Moreover, based on these six-dimensional assessments combined with AI co-creation, Soulcial generates a unique Soulcast NFT for each participating user.

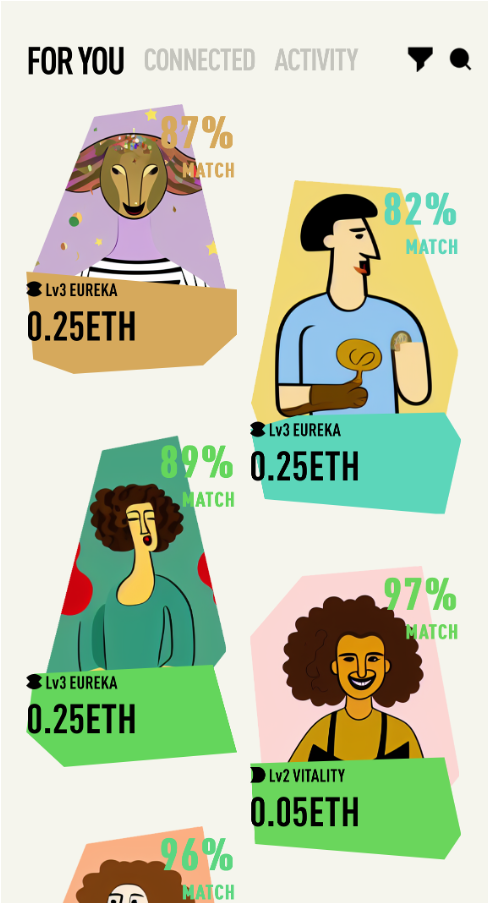

By quickly checking the tags and corresponding dimensions of an NFT, you can instantly understand the personal traits of that user—and identify their social value to you.

More interestingly, the system recommends other users whose personality and behavioral traits match yours, showing compatibility scores. Additionally, you can proactively use the connect feature to build connections with like-minded individuals.

Through lightweight social interaction, users can accumulate network value within their social graph and discover more people who share their interests.

After purchasing another user’s NFT, you unlock the ability to initiate one-on-one chats, further deepening your connection. Also, even if you fail to purchase an NFT, you can still join the group created by that NFT owner and become a member.

Regarding the rules and procedures for NFT purchases, these form Soulcial’s unique asset pricing model, which we will detail later in the economics section.

In addition to introducing more evaluation dimensions, Soulcial has also worked hard to lower usage barriers.

Whether using a desktop or mobile browser, or via PWA (Progressive Web App) mode similar to FT, you can easily log in.

Furthermore, Soulcial adopted social login from day one, allowing users to access the platform using familiar Web2 accounts. It also integrates on-ramp solutions, eliminating the common issue of new users lacking gas fees—making the product easier to spread and go viral.

Clearly, from core product design to fine details, Soulcial has its own distinct characteristics.

However, beyond product features, what interests us more is whether its economic model also brings notable innovations compared to competitors?

Pump Game: A Differentiated Asset Pricing Model

Assessing and discovering a user’s social value through multiple dimensions ultimately still revolves around treating people as assets for valuation.

But all valuations must eventually translate into actual user participation.

For users considering joining Soulcial, the key question is: how can they earn rewards? More fundamentally, are the economic mechanics attractive enough to sustainably generate returns?

To answer these questions, we need to deeply understand Soulcial’s core asset trading mechanism.

Unlike FriendTech and most clones that rely solely on a Bonding Curve model, Soulcial combines “equal-price auction + liquidity incentives + bonding curve,” making significant innovations in both asset appreciation and user engagement.

We can break it down to better understand the gameplay and rules.

-

Transaction Process: Equal-Price Auction in the Pump Game

First, the equal-price auction corresponds to the NFT transaction flow within Soulcial, known as the Pump Game on the product interface:

-

Initial Pricing: Based on the system’s assessment, a user’s Soulcast NFT receives different tier ratings according to their six-dimensional scores, which determine the initial price;

-

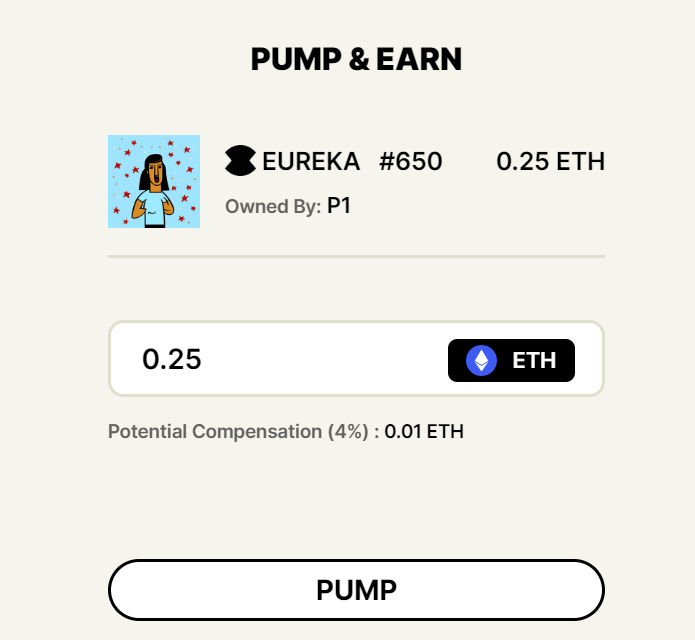

Price Discovery: If you believe a user holds value, their NFT has appreciation potential, or you wish to unlock chat rights, you need to join a group of four to enter a Pump Game—all four submit the same bid price to start an “equal-price auction.”

-

Outcome Determination: A random number is generated on-chain, and only one of the four players wins, successfully purchasing the NFT.

-

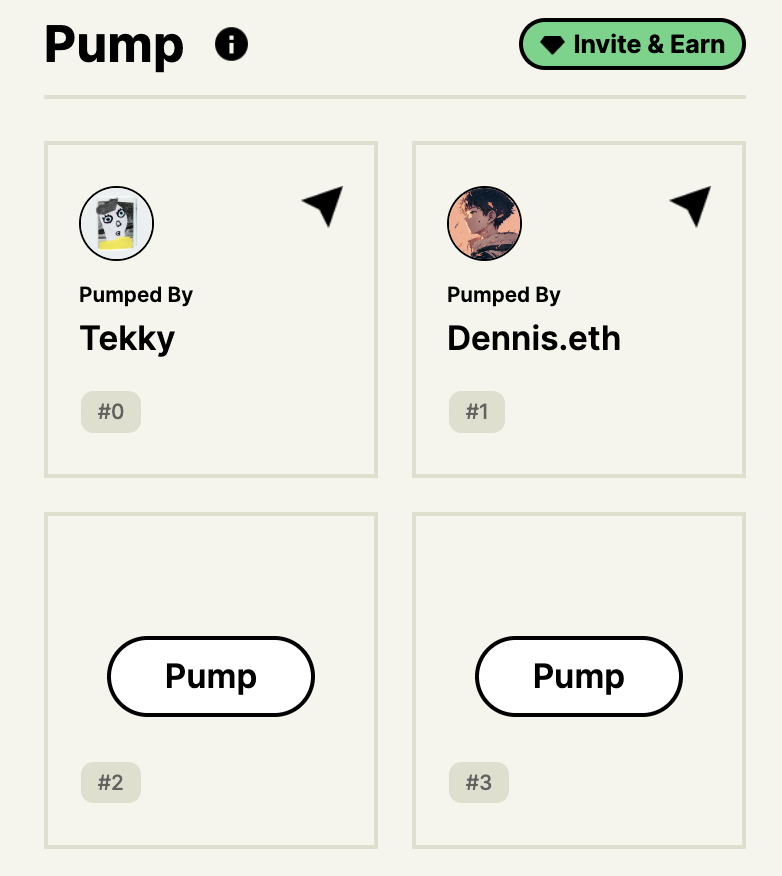

Next Round: The winner can either hold the NFT or initiate the next round of equal-price auction—a new Pump Game where one out of four wins—with the NFT increasing in value in subsequent rounds.

Note that if you already own an NFT, participating in Pump Games earns you vSOUL points from the system, with different NFT tiers offering varying bonus multipliers.

And vSOUL can be exchanged for the project’s SOUL token—the specific rules of which we’ll explain later in the economics section.

-

NFT Asset Price Dynamics: Bonding Curve Creates FOMO Through Upward Pressure

Why does the NFT increase in value in the next round of the Pump Game? The answer lies in the Bonding Curve design.

Similar to other social products, the Bonding Curve controls the price of social assets via certain variables. But Soulcial’s twist is that the NFT price governed by the Bonding Curve only goes up—it never drops.

This is precisely why the auction process is called a “Pump Game”—each round of bidding pushes the price higher; multiple rounds of increases draw more attention, expanding the NFT’s influence and attracting more bidders.

So how exactly does the Bonding Curve raise prices?

In the current version of Soulcial, the NFT price increases by 10% after each round. According to the team, this will soon evolve into a dynamic pricing mechanism that automatically adjusts the increase based on market supply-demand curves—but will never drop below 10%.

This means that currently, each Pump Game round offers a 10% price bump; under dynamic adjustment, we can expect:

For NFTs of the same tier, the more Pump Games participated in (higher demand), and the fewer listed for sale (lower supply), the greater the price increase—market-driven increases with no downside risk.

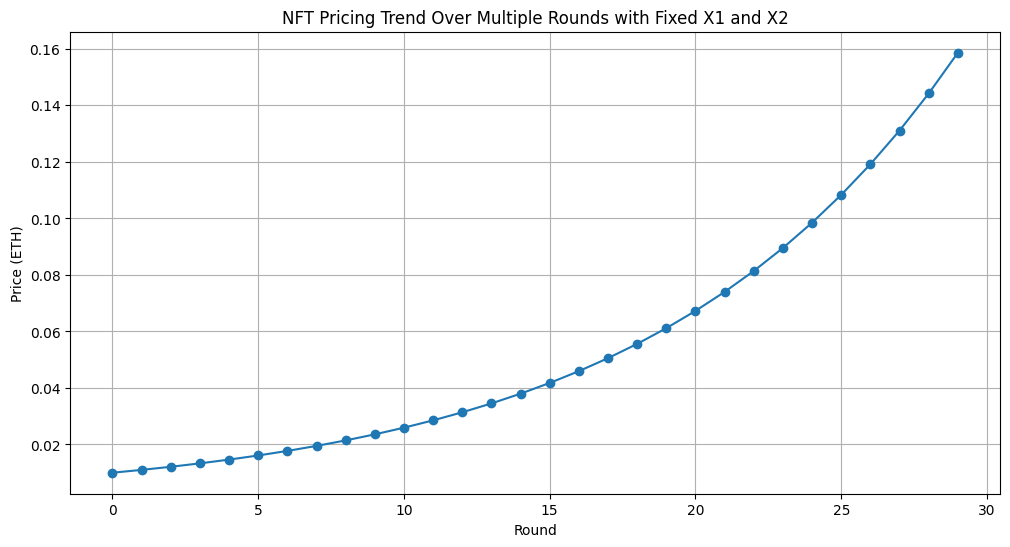

If it’s still unclear, let’s make an assumption: suppose a user’s NFT starts at 0.01 ETH.

Calculations show that just 30 rounds of equal-price auctions could push the NFT price to ~0.16 ETH—an increase of 16x from the starting price. Given that each round requires four participants, without repeat players, only 120 people would be needed to drive this price surge.

Of course, this calculation assumes ideal conditions—the real world is more complex.

Yet from the Bonding Curve design, we clearly see a strong FOMO effect: since each Pump Game requires minimal liquidity (just four people), early participants can discover value earlier, engage quickly, and push prices up. Earlier entrants face lower costs and less competition.

-

Reward Distribution: A Social Version of “Liquidity Mining” to Incentivize Growth and Scale Expansion

You might wonder: if only one out of every four participants wins and buys the NFT, why would the other three rush to join as “also-rans”? What motivates them to play a game with only a 25% chance of winning?

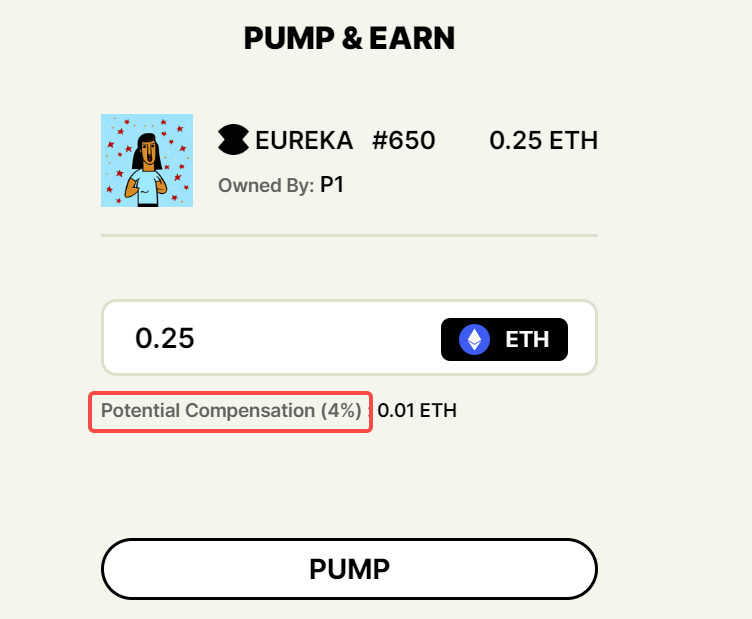

Don’t forget—equal-price bidding means different users contribute the same amount of ETH, effectively providing liquidity. Even if you don’t win, your ETH is fully refunded, and additionally, the system rewards you with 4% of the final NFT sale price as compensation for supplying liquidity.

This means that in any NFT transaction, even non-winning bidders receive 4% of the final sale price as commission, plus full return of their bid amount.

Furthermore, participating in early Pump Games to discover undervalued NFTs becomes a no-lose proposition. Your participation turns into a social variant of "liquidity mining":

Your involvement positively contributes to price discovery and facilitates NFT transactions. In return, the system guarantees you a commission—similar to how LPs earn yields in DeFi.

But unlike DeFi, where APY typically declines over time, in Soulcial, the higher the NFT’s sale price, the larger the absolute commission (though the rate stays at 4%), meaning potential earnings grow over time.

However, later rounds mean increased difficulty—higher prices mean fiercer competition for the limited four-player slots.

Clearly, the system incentivizes early participation, where earning potential is greatest.

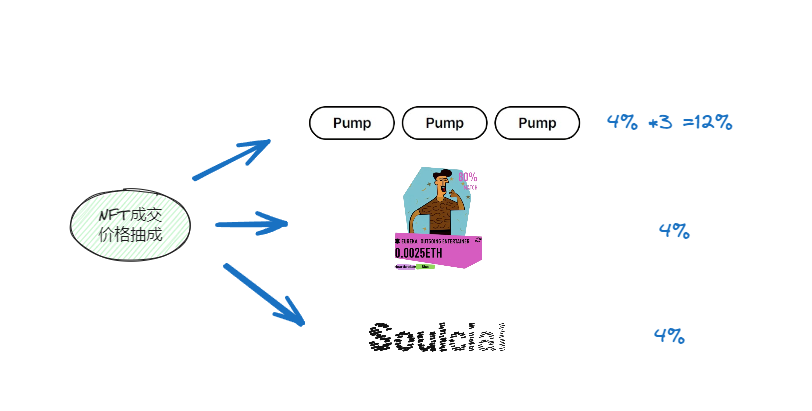

Finally, let’s summarize Soulcial’s overall reward distribution: Of the NFT sale price, 12% (4% × 3) goes to the three unsuccessful bidders, 4% to the NFT creator, and 4% to the platform as fee—totaling 20%.

Based on the integrated design of “equal-price auction + liquidity incentive + bonding curve,” we can summarize Soulcial’s asset pricing model as follows:

-

Avoids direct competition through differentiated design: Unlike profile-picture NFTs requiring matching buy/sell orders, or FT’s pure bonding curve where only a few provide liquidity, this model ensures continuous price curves and lossless trading even with minimal liquidity;

-

Users earn rewards while acting as market makers for others’ social assets, encouraging ongoing expansion of the Soulcial social network;

-

The design has a clear Ponzi-like structure, enabling rapid early diffusion and virality; yet it isn’t purely zero-sum, as continued participation allows others to earn too, rewarding each contributor’s unique role;

-

NFT prices never fall, enabling more direct price discovery for high-quality users:

Under the FT model, talented individuals seeking monetization must grow their social media following. Not everyone has the time, skill, or desire to manage a social account.

Soulcial’s price discovery mechanism offers alternative pathways for valuable individuals to quantify their worth and turn it into sellable products.

From Points to SOUL Token: A Shared Fate Between Users and Project

From the creation of Soulcast NFTs to the Pump Game mechanism, immediate rewards are clearly visible. Yet models focused solely on short-term gains rarely last long in crypto.

Without long-term vision and planning, a sudden influx could easily turn into a mass exodus.

Thus, throughout the process of price discovery and asset trading, Soulcial provides participants with pathways to long-term value.

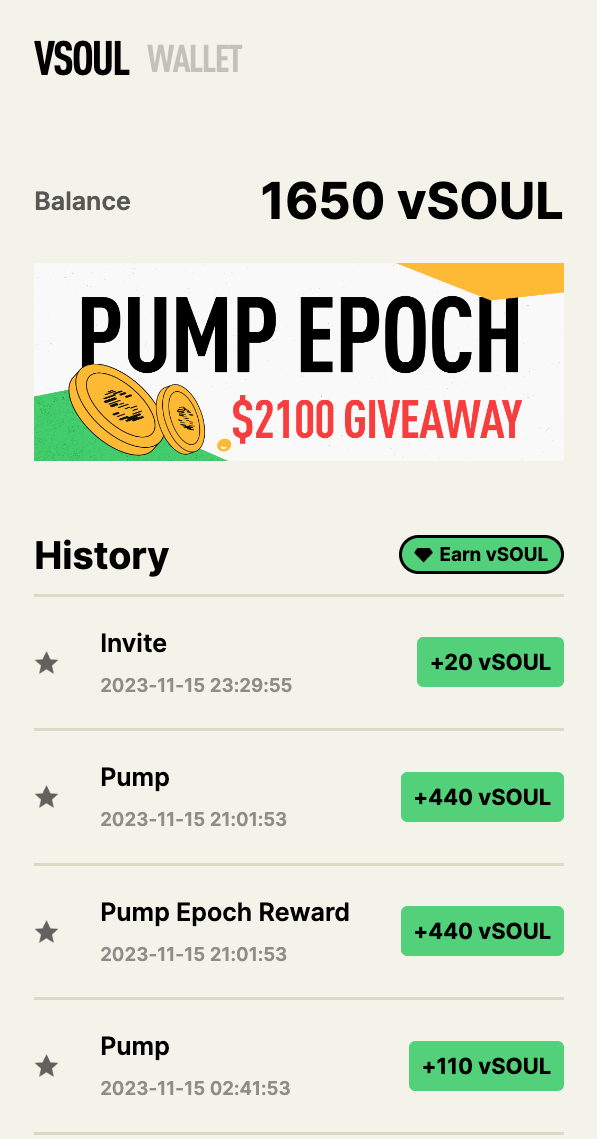

As seen on the current product page, besides wallet assets and collected NFTs, users can earn vSOUL points—acquired at every step of participation:

-

Registering via an invite code grants points;

-

Inviting others to join Pump Games earns you points;

-

Participating in Pump Games yourself earns points;

-

Winners of Pump Games earn more points than losers, and point amounts vary based on how many NFTs they hold.

Note: To participate in Pump Games and earn points, you must hold at least one NFT.

This means users must decide: cash out immediately for profit, or hold the NFT to join more auction rounds and earn points for long-term gains.

According to currently published rules, vSOUL points can be converted into the project’s SOUL token.

Since SOUL will be fully airdropped to all users per season—with no pre-allocation or private rounds—the token’s value depends entirely on user consensus and participation levels.

However, the conversion ratio from vSOUL to SOUL decreases over time, meaning early participants gain more; from a growth perspective, this expected early advantage helps kickstart and expand the social network.

Long-term, 100% fair launch essentially makes the project a shared ownership model.

Soulcial’s success and the value of SOUL depend on whether users stay active and engaged—creating a true community of aligned interests. To earn, users must participate early and actively, growing the project’s momentum while capturing value.

Asset First, Long-Term Operations Will Define Soulcial’s Future

Overall, in my view, Soulcial’s strengths lie in:

-

A unique economic model highly beneficial for rapid early expansion and hype generation;

-

Differentiated asset pricing avoids being just another clone;

-

During this social赛道lull, it may become a breakout point when capital rebounds.

At the same time, we should maintain healthy skepticism and objectively consider the following:

-

Can Soulcast NFTs sustain long-term value?

Lessons from FriendTech remind us: heavy on mechanics, light on operations, with little evolution in product or gameplay, failing to unlock new utilities or add value to asset-backed rights.

Whether Soulcial can enhance NFT utility—such as equipping avatars in a social metaverse or granting long-term revenue sharing—through sustained operational depth, may ultimately determine its fate.

-

Anti-bot Mechanisms

Given the “early bird gets the worm” model, preventing bots from farming Pump Games is critical—otherwise, real users may be locked out, damaging ecosystem health and activity.

-

Does unlocking chat functionality offer sufficient value?

If both the first and last buyer of an NFT get the same one-on-one chat access, but the conversation quality is identical, will the latter pay a much higher price for the same function?

Therefore, observe how the project evolves in terms of NFT-linked functions and permissions.

Finally, excellence comes from diligence, not idleness. Social is a赛道that demands continuous operation and daily effort. The project’s sustained work and unlocking of new value-generating features will shape its pace and ultimate success.

Likewise, for users, Web3 always moves asset-first rather than waiting for perfection. Diligent research and timely participation remain the optimal path to capturing value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News