AVAX Begins to Recover: A Quick Look at 7 Notable Representative Projects in the Ecosystem

TechFlow Selected TechFlow Selected

AVAX Begins to Recover: A Quick Look at 7 Notable Representative Projects in the Ecosystem

Avalanche focuses on attracting trillions of dollars in institutional capital, launching innovative DeFi solutions, and fully leveraging gaming and NFTs.

Author: Emperor Osmo

Compiled by: TechFlow

Avalanche's recovery cycle appears to be on the horizon.

A series of recent announcements, partnerships with major institutions, and surging interest in gaming and NFTs have driven AVAX up 130% over the past month. In this article, we’ll dive into these developments and explore how to leverage this narrative.

Over the past week, the Avalanche ecosystem has seen a flurry of exciting announcements.

It started with Avalanche House, which launched alongside the unveiling of Avalanche 2.0 and is currently under development. This upgrade aims to enhance the speed, integration, and interoperability of the Avalanche network.

Avalanche has strategically pivoted to become a leading blockchain for RWA and forex applications, providing critical infrastructure for trillions of dollars in assets that remain on the sidelines—and it’s starting to pay off. Notable partners include:

-

JPMorgan

-

Citi

-

WisdomTree

-

T. Rowe Price

-

KKR

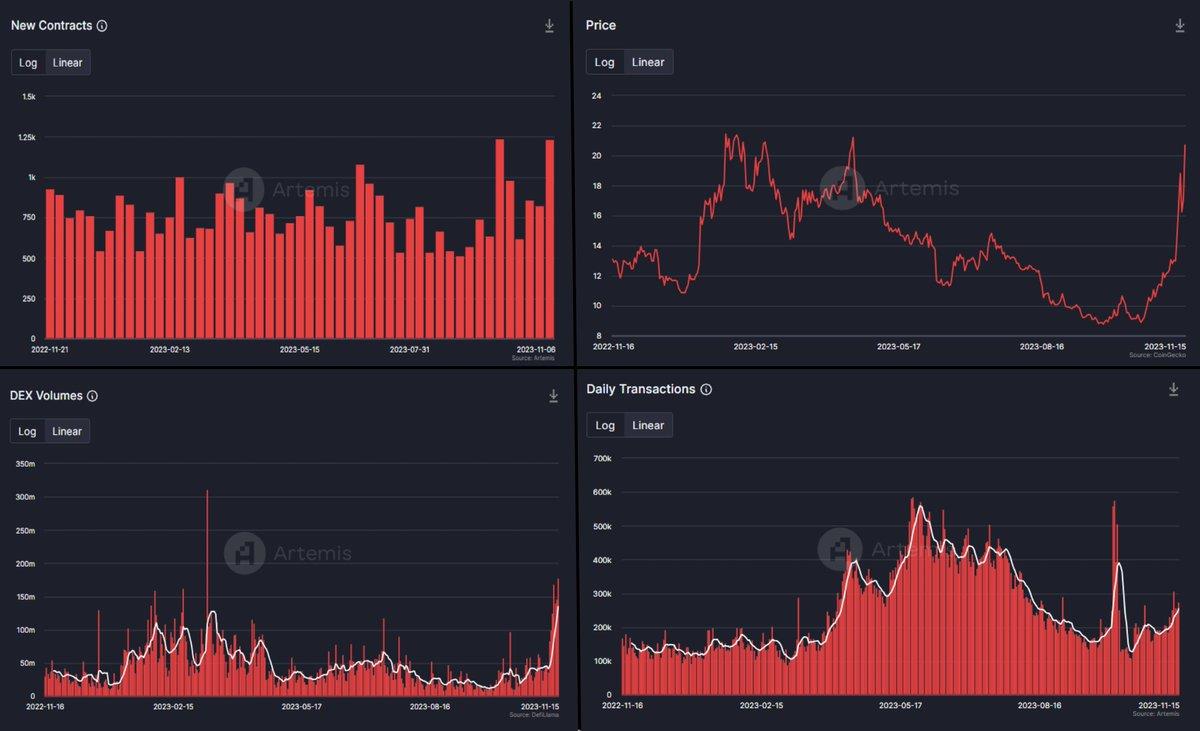

All of this has led to significant growth across all key metrics for Avalanche over the past year, signaling a return of positive sentiment:

-

Increase in contract deployments

-

Rise in $AVAX price

-

Growth in C-Chain transactions

-

Increase in DEX trading volume

This renewed excitement is expected to spread throughout the ecosystem, benefiting both retail and institutional participants.

Below are seven projects worth watching, which are well-positioned to benefit from increased liquidity and improving market sentiment.

DeFi

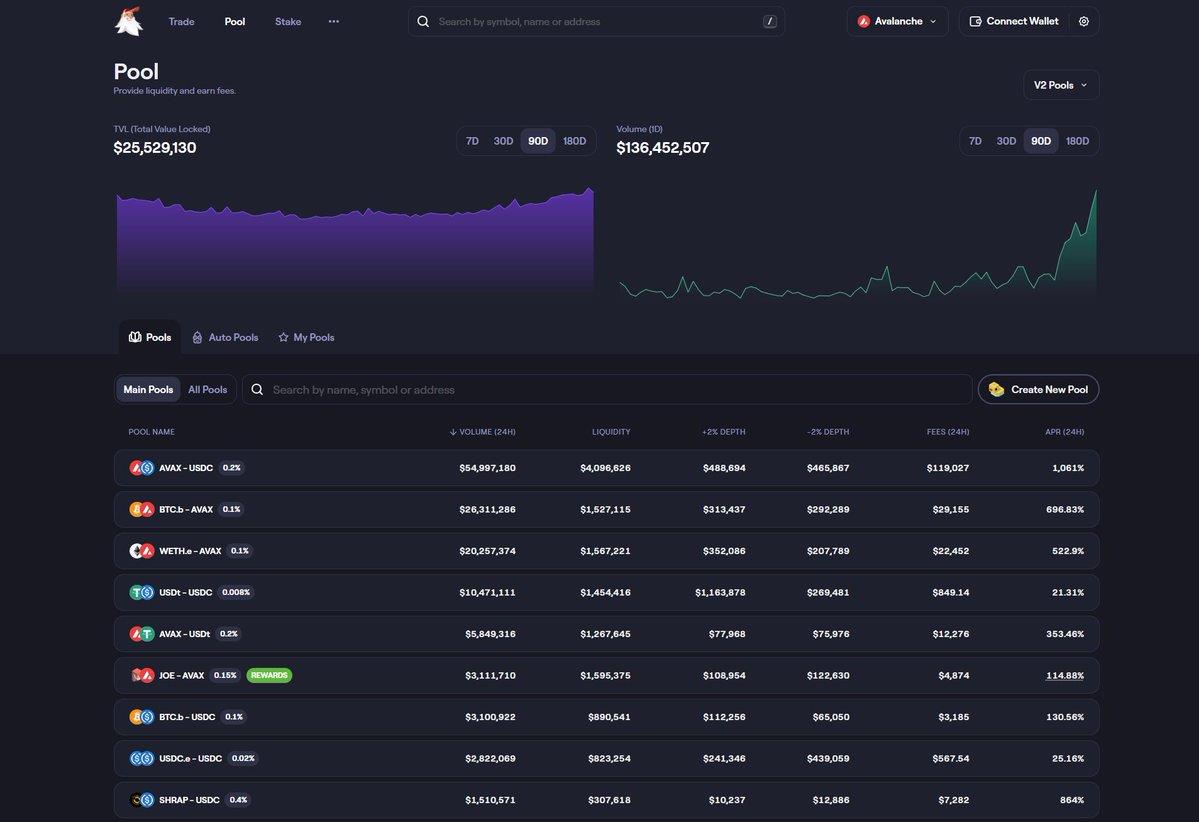

The leading DEX on Avalanche, Trader Joe achieved over $800 million in trading volume in October alone. Clearly, a stronger Avalanche ecosystem directly benefits Trader Joe.

Users can stake $JOE to earn $USDC from swap fees.

SteakHut is building the Web3 liquidity layer by optimizing liquidity management on top of Trader Joe.

Their goal is to simplify liquidity management in DeFi. SteakHut’s vaults will soon allow anyone to deploy and customize liquidity strategies easily.

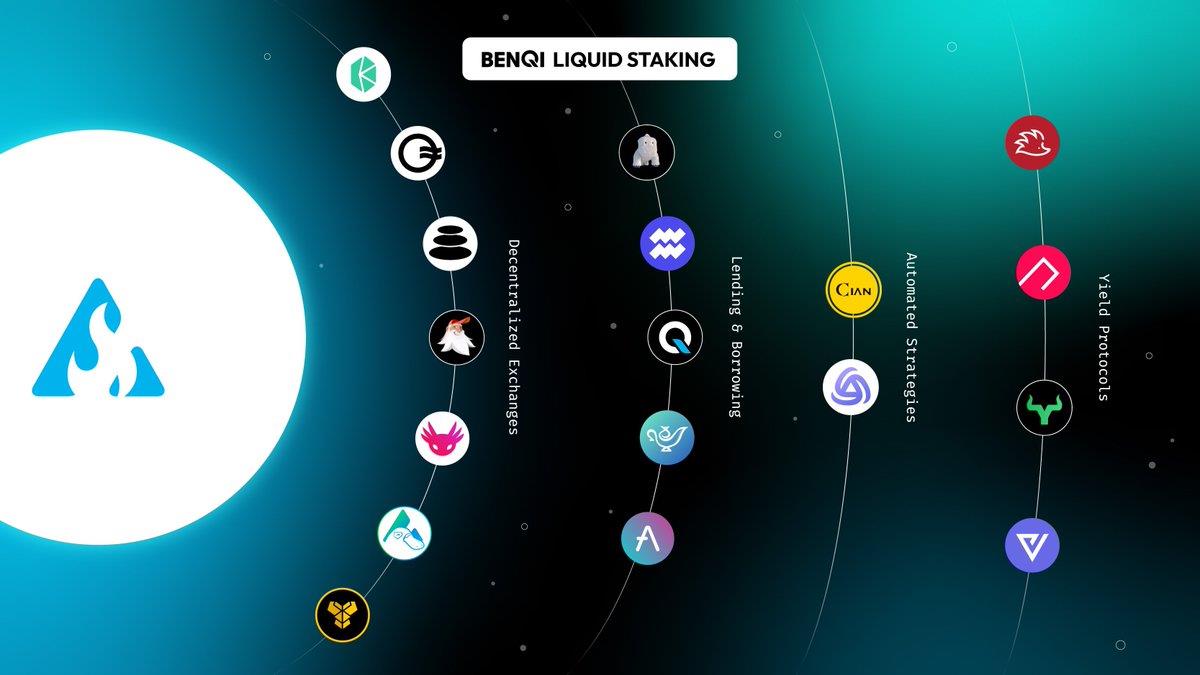

Benqi serves as both a money market and a liquid staking platform on Avalanche.

Users can lend, borrow, and perform liquid staking with AVAX tokens for use across various DeFi applications.

$QI tokens are used for mining, rewards, and governance.

Meme

One of the earliest dog-themed meme coins in the Avalanche ecosystem, AvaxHusky has been around for over two years. Consider it a pure meme bet—the Doge of the Avalanche ecosystem.

Token: $husky

Gaming

Shrapnel is one of Avalanche’s most anticipated annual first-person shooter games. The $SHRAP token will be central to rewarding creators and players, enabling purchases of maps, skins, and other content.

If you believe in the rise of Avalanche GameFi, then you should be bullish on $BEAM.

They’ve already funded most of the major games in the space, with growing capital and an expanding list of partnered titles.

NFT

Every strong community needs a blue-chip NFT, and Dokyo fills that role.

With exceptional artwork and a rapidly growing community, Dokyo is one of the fastest-rising NFTs during the bear market, priced at 38 $AVAX at the time of writing.

Avalanche’s multi-pronged strategy is finally paying off. By targeting trillions in sidelined institutional assets, launching innovative DeFi solutions, and embracing gaming and NFTs, Avalanche is gaining momentum.

The Avalanche story is far from over.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News