MT Capital Insight: Application Chain Migration and Economic Model Update Drive DYDX Flywheel Growth

TechFlow Selected TechFlow Selected

MT Capital Insight: Application Chain Migration and Economic Model Update Drive DYDX Flywheel Growth

dYdX's newly launched early incentive program, Noble's upcoming native USDC integration, and the recent significant increase in secondary market liquidity and volatility will all benefit dYdX's fundamental development.

Author: Severin

Special thanks to @0X_IanWu for providing in-depth guidance and advice for this article.

TL;DR

-

The updated dYdX tokenomics model requires team members, early investors, and other token holders to stake DYDX tokens in order to capture protocol fee revenue. This will increase the DYDX staking rate, reduce circulating supply, prevent large-scale token dumping, and enhance DYDX’s value accrual capability.

-

dYdX's migration to an application-specific blockchain (appchain) eliminates profit-sharing with StarkWare. The performance improvements and increased customizability from the appchain strengthen market expectations for dYdX’s future performance.

-

dYdX’s newly launched early adopter incentives, Noble’s upcoming native USDC integration, and recent significant increases in secondary market liquidity and volatility are all positive catalysts for dYdX’s fundamental development.

-

A massive token unlock is expected in December, but we anticipate it will not lead to significant selling pressure. The team and early institutional investors may choose to stake their tokens to capture dYdX’s growth potential instead.

Introduction

Recently, dYdX completed its migration from StarkWare to a Cosmos-based application chain and executed its first transaction on November 13. Additionally, dYdX has updated its V4 tokenomics model, significantly enhancing DYDX’s value capture ability. We expect that under the combined impact of these two developments, dYdX’s fundamentals will substantially improve, allowing DYDX to capture greater gains in the secondary market.

Updated Tokenomics Empower DYDX’s Value Capture

1. dYdX Revenue Goes to Stakers

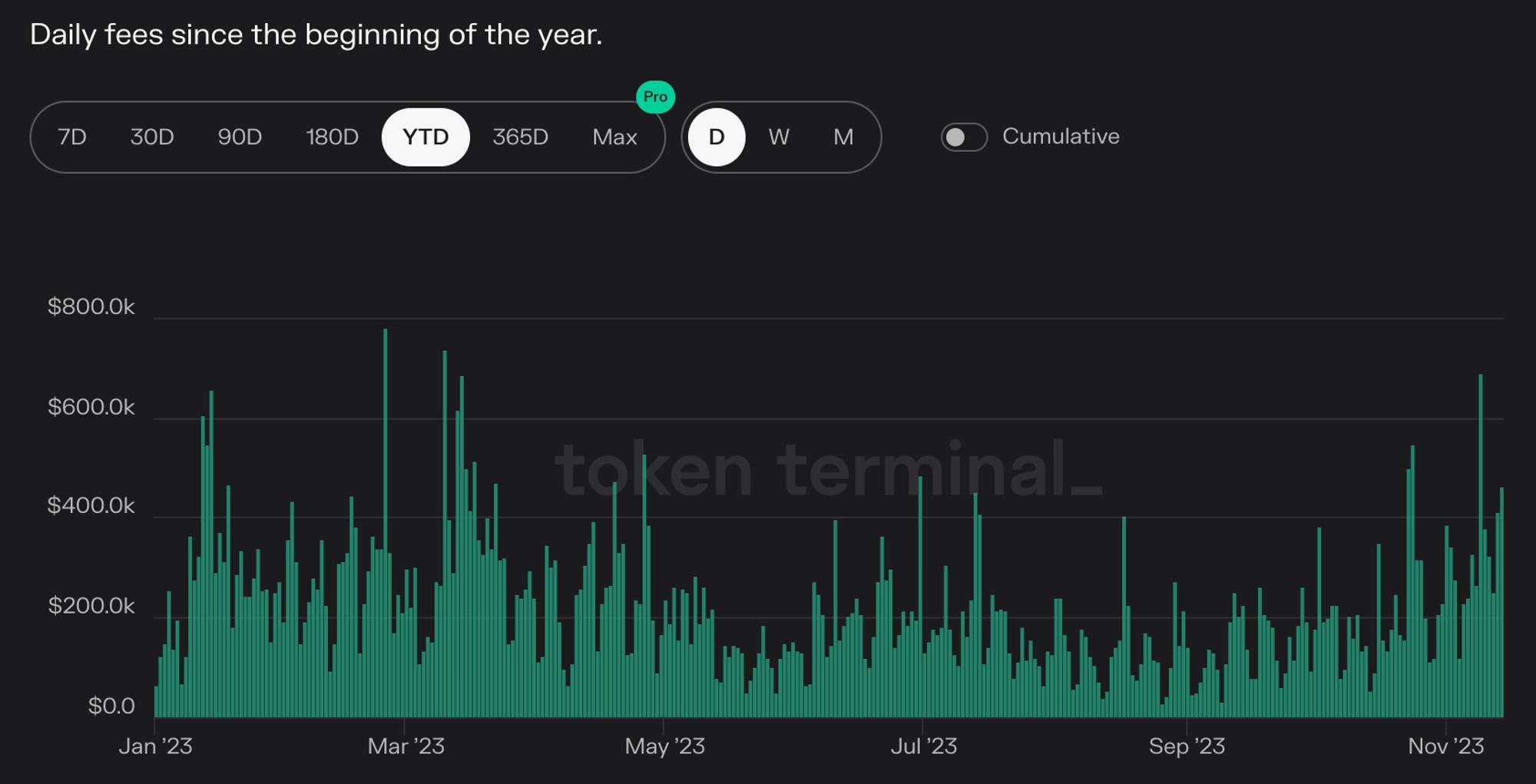

dYdX founder Antonio announced that dYdX Trading Inc. has officially become a Public Benefit Corporation and will not generate any fee revenue from the operation or trading activities of dYdX V4. Instead, the dYdX Chain will distribute all protocol fees—including trading fees denominated in USDC and gas fees paid in DYDX—to validators and stakers. Notably, even the dYdX team must stake tokens to earn a share of protocol fees, which helps mitigate the risk of large sell-offs by major token holders. With dYdX currently generating approximately $105.47 million in annual revenue, distributing this income among validators and stakers significantly strengthens DYDX’s value accrual mechanism.

dYdX Daily Fees

source:https://tokenterminal.com/terminal/projects/dydx

2. Updated DYDX Token Model

Previously, the DYDX token was used primarily for protocol governance, fee discounts, and capturing inflationary staking rewards. dYdX V4 has upgraded the governance and staking modules, expanding governance rights and enabling stakers to earn real yield.

First, DYDX holders can now vote on key parameters and functional components of dYdX, including trading fee structures, incentive mechanisms, third-party price feeds, and adding/removing markets. This expanded governance empowers token holders to dynamically adjust trading parameters and protocol features in response to market conditions, making governance rights more valuable.

Second, DYDX stakers will now receive yields composed of trading fees and gas fees, replacing the previous inflation-based rewards. This shift significantly improves stakers’ real yield. As a result, the DYDX token evolves from a mere mining reward into a utility token with strong value accrual, wealth effects, and governance rights across the dYdX Chain. Increased trading volume and improved fundamentals boost protocol fee income, making staking more attractive. This further reduces circulating supply, amplifies demand for DYDX, drives price appreciation, and creates a positive feedback loop.

dYdX Price & Fees

source:https://tokenterminal.com/terminal/projects/dydx

(The chart above shows DYDX price and protocol fee performance before the token model update. We expect the new model to further strengthen the correlation between token price and protocol fee growth.)

Appchain Migration Strengthens Market Expectations

1. Pursuing CEX-Level Performance

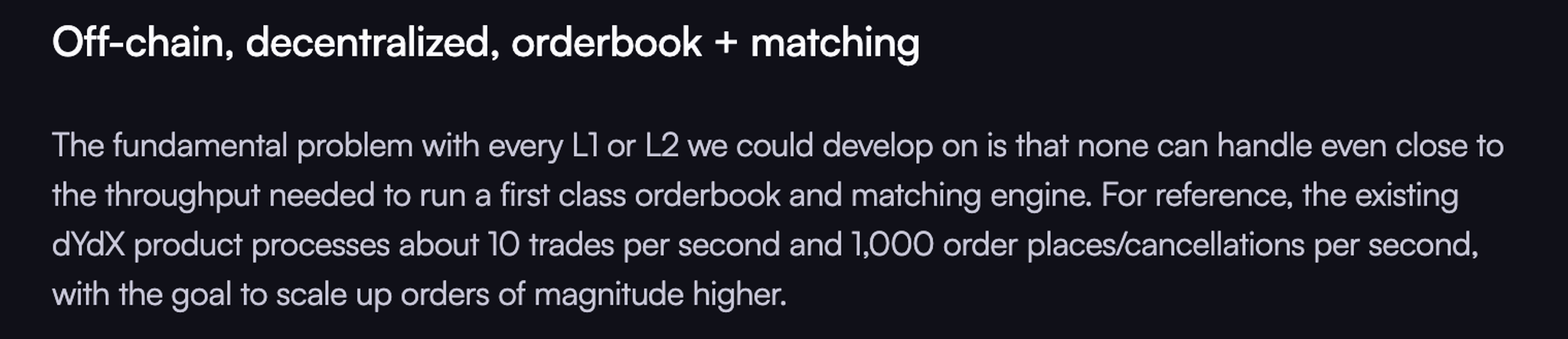

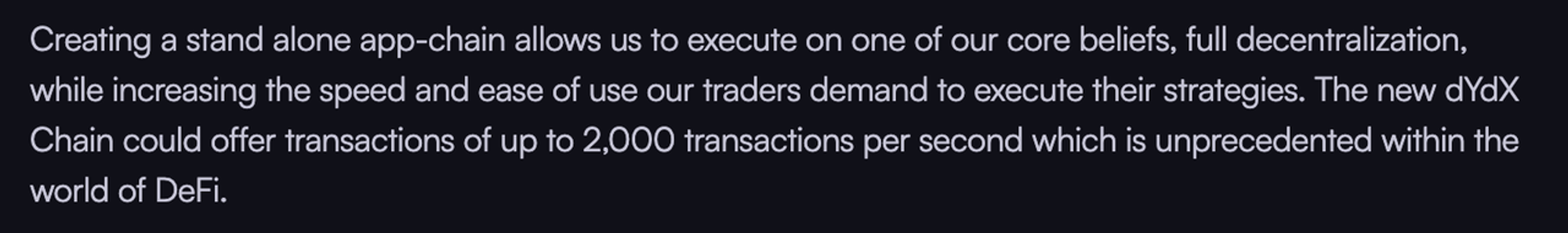

One of the main reasons dYdX left StarkWare is that StarkWare’s upgrade path and current performance—along with cost constraints—are insufficient to support dYdX’s ambition to rival centralized exchanges. A purpose-built appchain allows dYdX to operate independently without competing for resources, fully utilizing the chain’s performance to lower on-chain transaction costs and better meet the high-throughput demands of an order book and matching engine. Before the migration, dYdX could process about 10 trades per second and handle up to 1,000 order placements/cancellations per second. After the migration, dYdX can now handle up to 2,000 trades per second. Beyond performance gains, operating independently also means dYdX no longer needs to share profits with StarkWare, significantly increasing stakers’ expected share of future protocol revenues.

source:https://dydx.exchange/blog#

2. Customization Enables Better Trading Experience

Another major benefit of migrating to an appchain is that dYdX gains greater customization over the blockchain and validator workflows to better serve decentralized derivatives trading needs.

In dYdX v4, each validator runs an in-memory order book that never reaches off-chain consensus. Order placement and cancellation are propagated through the network, while only matched transactions confirmed via consensus are submitted on-chain—ensuring consistency across all validators’ order books. Under this design, placing and canceling orders are off-chain actions that do not require gas fees. Users only pay gas fees when a trade is successfully matched and settled on-chain.

Additionally, dYdX has partnered with Skip Protocol to develop an MEV dashboard that exposes harmful or dishonest nodes. Community-driven penalties against such actors help ensure fairness within the dYdX trading network. The appchain migration enables deeper optimization of user experience, increasing users’ willingness to trade on dYdX.

MEV Dashboard on dYdX

source:https://dydx.exchange/blog#

Additional Catalysts and Risk Considerations

1. Early Incentive Program

The dYdX community has approved a launch incentive proposal for dYdX v4, allocating $20 million worth of DYDX from the dYdX Chain community treasury to fund a six-month incentive program for early adopters deploying on v4. This initiative will encourage users to bridge funds to dYdX Chain, boosting trading volume and fee revenue.

2. Native Cross-Chain USDC

Circle’s Cross-Chain Transfer Protocol (CCTP) will go live on Noble, a Cosmos appchain, on November 28, enabling users to transfer native USDC directly from Noble to dYdX Chain in a single transaction. The rollout of CCTP on Noble simplifies, secures, and accelerates USDC deposits into dYdX Chain.

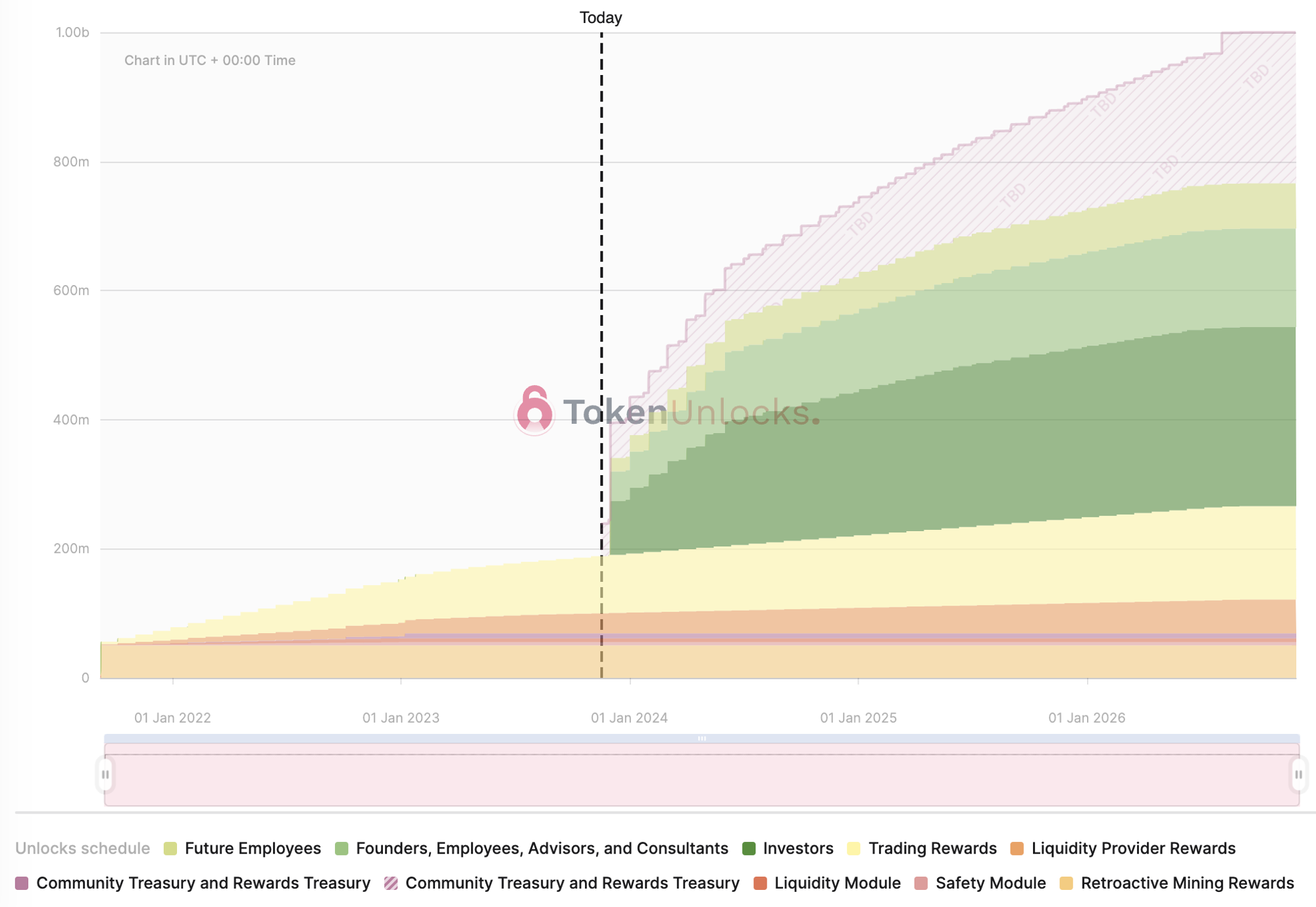

3. Massive Token Unlock in December

The most significant near-term risk facing dYdX V4 is the massive token unlock scheduled for December. According to TokenUnlocks data, 15% of the total DYDX supply will be unlocked on December 1. However, this event may not necessarily trigger heavy selling pressure. As previously discussed, staking DYDX offers substantial returns from trading and gas fee distributions. Most of the unlocked tokens belong to the core team and early investors. Given the recent bullish momentum in the broader market and the upgraded tokenomics, both teams and institutional holders may opt to stake their tokens to capture dYdX’s long-term value growth.

DYDX Token Unlocks

source:https://token.unlocks.app/dydx

In summary, we believe that following the completion of dYdX’s appchain migration and the upgrade of its token economics, dYdX’s fundamentals are on a stable upward trajectory, and the DYDX token is well-positioned to capture more of dYdX’s growing value. Meanwhile, since October 25, the broader crypto market has rebounded significantly, with notable increases in volatility and liquidity. The sharp rise in DYDX’s price reflects strong market optimism regarding sustained bullish momentum, continued expansion in platform trading volume, and rising fee income.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News