How to securely stake DYDX and earn USDC (with tutorial)?

TechFlow Selected TechFlow Selected

How to securely stake DYDX and earn USDC (with tutorial)?

dYdX Chain has distributed over 2 million USDC in staking rewards to more than 7,500 stakers within less than two months of launch.

Author: dYdX

Compiled by: BlockBeats

On the decentralized derivatives platform dYdX, users can securely stake DYDX via Ledger and earn USDC.

Stake DYDX and Earn USDC

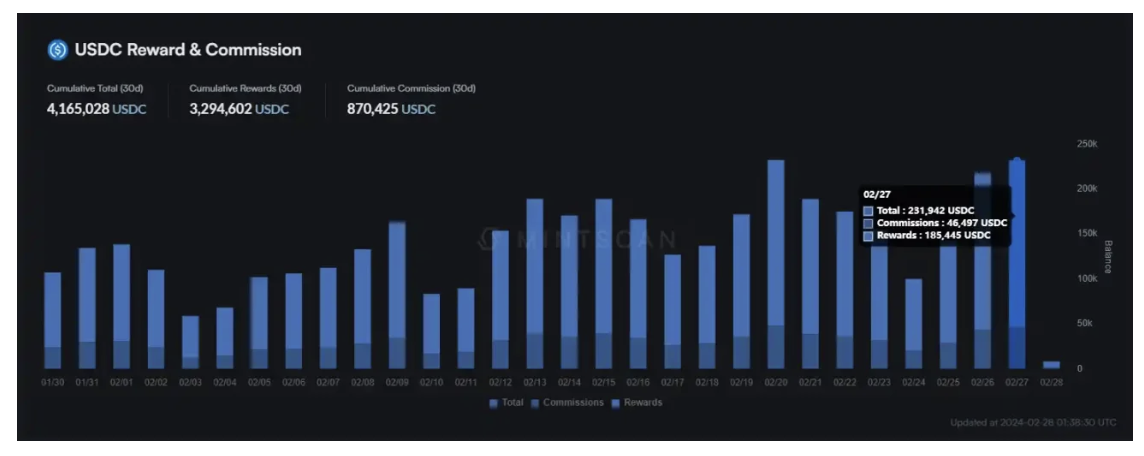

All fees on the dYdX Chain (taker/maker fees) are borne by validators and stakers, primarily distributed in the form of USDC. This creates a reward mechanism that avoids inflationary pressure on the native token while providing utility for validators and stakeholders.

For any staking rewards allocated by the protocol to stakers, validators may set a specific commission rate ranging from a minimum of 5% to a maximum of 100%, applied to delegators of each validator. This commission is deducted from the staking rewards distributed by the protocol to these stakers and retained by the respective validator. Currently, according to Mintscan data, the average validator commission rate on the dYdX Chain is 6.08%.

For more details, refer to the dYdX Foundation's blog post on staking DYDX.

As of January 12, 2024, the annual percentage yield (APY) for staking DYDX ranges from 9% to 25%. This variation occurs because the amount of fees received by the dYdX Chain depends on daily market conditions.

Users can view here how much reward has been paid out to stakers and validators so far.

-

Since stakers receive rewards in USDC, they do not need to worry about the volatility of DYDX.

-

Since dYdX trading fees are the source of staking rewards, stakers do not need to be concerned about inflation of the DYDX token.

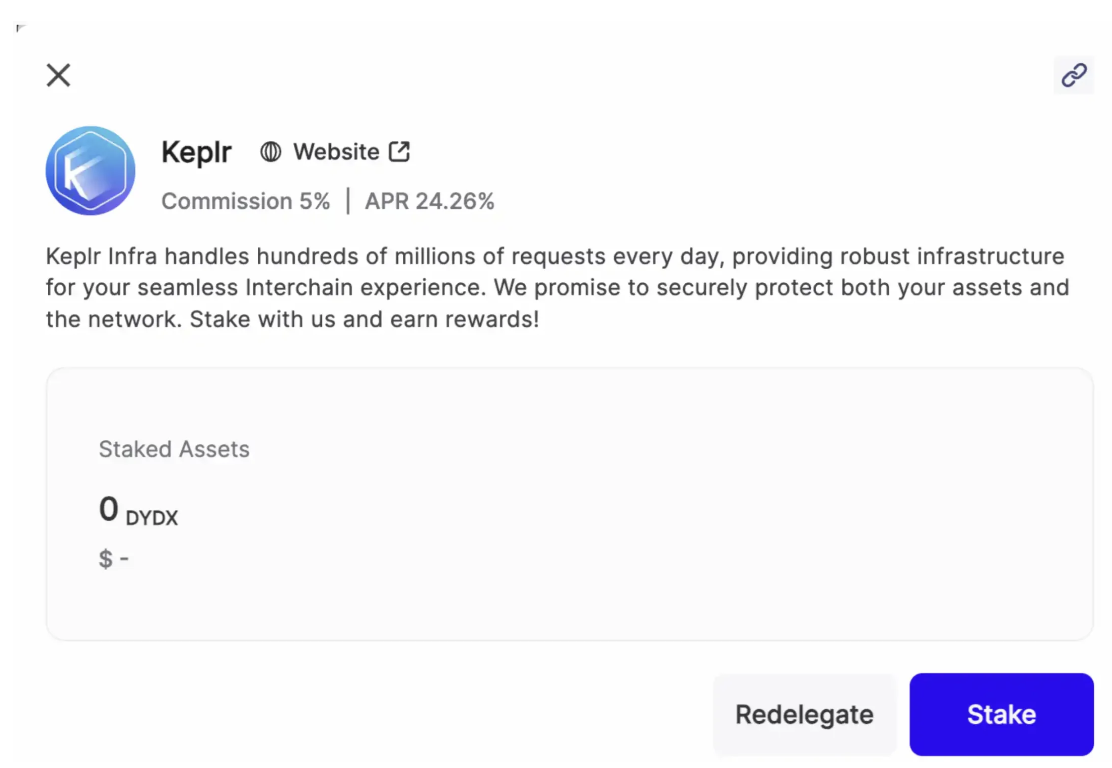

DYDX token holders can stake their DYDX with any active validator through Keplr. Refer to this link for more information.

For instructions on staking DYDX using Keplr, refer to this guide.

To date, within less than two months of launch, the dYdX Chain has distributed over 2 million USDC in staking rewards to more than 7,500 stakers.

Secure Staking Using Ledger

Staking means users hold DYDX long-term, making security critically important. Users can easily stake DYDX through Ledger integrated with Keplr.

Instructions for integrating Ledger with Keplr: Link.

Liquid Staking with Stride (Coming Soon)

DYDX token holders will be able to use https://app.stride.zone/ to perform liquid staking of their DYDX on Stride. In return, holders will receive stDYDX, allowing them to continue earning staking rewards while maintaining liquidity of their tokens. This will enable users to flexibly earn staking rewards and simultaneously utilize these tokens in DeFi protocols, or exit their positions immediately without waiting for dYdX’s 30-day unstaking period.

Learn more here.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News