Aptos Takes the Baton from Solana: The New Public Chain Cycle Law

TechFlow Selected TechFlow Selected

Aptos Takes the Baton from Solana: The New Public Chain Cycle Law

Phased reflections on several specific issues regarding new public blockchains.

Author: Wang Ye, Mint Ventures

This article attempts to position Aptos as the next Solana. Under the constraints of blockchain's impossible trinity, new public chains always exhibit cyclical development. In the previous cycle, new chains led by Solana rapidly rose due to their aggressive low-cost, high-speed model, but are now potentially being overtaken by newer chains like Aptos due to inherent flaws. Meanwhile, established chains like Ethereum have already built strong moats in a multi-chain future.

Recently, I was invited by Bitvavo to participate in the "Web3 Builder, East or West" event, where I was asked: "Top institutions such as A16Z, Binance, and FTX are very bullish on new public chains like Aptos—could these chains challenge Ethereum’s dominant position?" Given the broad interest in this topic, I’ve compiled my thoughts into this comprehensive review of Solana, Aptos, and the landscape of emerging public chains. I position Aptos roughly where Solana stands in the market today.

For clarity, technical aspects such as blockchain consensus and communication principles are simplified.

The following represents my current-stage reflections on several key topics related to new public chains, presented more as a discussion than formal analysis.

Preliminary Categorization of the Public Chain Landscape

In 2015, Ethereum launched and ushered in the era of smart contract platforms, making public chains an indispensable Web3 infrastructure.

In 2017, the ICO boom and the viral success of CryptoKitties nearly paralyzed the Ethereum network. Since then, all industry participants realized that existing blockchains were utterly inadequate for large-scale real-world transaction demands, and scalability would remain a long-term essential need in Web3.

To focus our discussion on new public chains, we’ll temporarily set aside Ethereum—which already hosts numerous applications, developers, and massive influence—but is burdened by legacy stakeholders that slow its transformation. Instead, we examine newer chains with lighter historical baggage, free to adopt cutting-edge high-performance solutions. Solana was once the undisputed king of this space, but now Aptos is widely seen by investors as the “Solana Killer.”

High-Performance New Chain Race: Aptos Takes the Baton from Solana

First, I believe Aptos has a significant chance of challenging Solana’s position.

Before Ethereum fully implements sharding and achieves sufficient performance, the high-performance new chain segment will follow a certain cyclical pattern.

Specifically, a new chain grows rapidly due to aggressive speed and low fees, but eventually enters a negative feedback loop due to vulnerabilities introduced by those same design choices.

Solana’s high-performance narrative is fading. Its nickname is shifting from “Ethereum Killer” to “Chain That Keeps Crashing,” and capital is now seeking the next successor under this cycle.

Solana’s Rise and Fall — Speed and Low Fees

The Story of Ultra-High TPS

Solana’s high TPS stems from 10x larger blocks, lower redundancy, 1/30th block time, and about 10x faster parallel computation, achieving theoretical TPS ~3000 times that of Ethereum.

(1) Block Size

Specifically, Solana increased block size from ~1MB to 10MB, boosting performance tenfold.

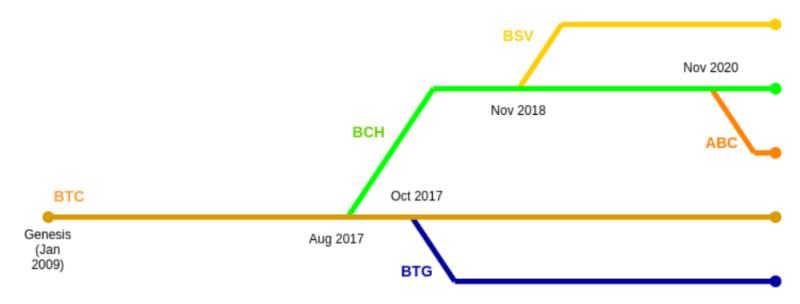

However, increasing block size isn’t ideal because while it enhances system throughput, it creates two clear drawbacks: a sharp drop in the number of full nodes capable of storing complete blockchain data, and longer transmission times for large blocks across the network, making them more vulnerable to attacks (famous Bitcoin forks like BCH and BSV arose from debates over block size, with Bitcoin ultimately sticking to smaller blocks).

Source: https://vitalik.ca/general/2020/12/28/endnotes.html

Although Solana made various communication improvements to mitigate risks, its large blocks still raise the barrier for running full nodes, reducing their number and negatively impacting decentralization and network security.

(2) Consensus-Level Improvements – Block Time and Low Redundancy

-

Centralized Transaction Processing

In centralized Web2 systems, take Alipay as an example: since only official servers handle transactions, processing is simple:

① Transaction info sent to Alipay

② Alipay directly confirms and executes

③ No verification needed—users trust Alipay won’t act maliciously.

Total: 1 send, 1 execution, 0 verifications—negligible time.

-

Decentralized Transaction Processing

But in public chains, becoming a validator is nearly permissionless—we can't blindly trust any single validator. Thus, many validators are needed, and verification becomes complex:

- Ethereum

Let’s see how Ethereum confirms transactions:

(1) After completion, transaction data takes 6 seconds to propagate across Ethereum’s n nodes

(2) A randomly selected node processes and packages the transactions into a block

(3) The block is sent to all n nodes for validation.

This greatly increases transmission and verification rounds; each block takes 12 seconds.

Due to untrusted individual nodes, blockchain systems require multi-round game mechanisms where nodes verify each other, ensuring final accuracy at the cost of time and redundant computation—the core reason behind the blockchain impossible trinity.

Solana significantly speeds up both transmission and block validation. It reduced block time from Ethereum’s 12 seconds to just 0.4 seconds (max 0.8), achieving ~30x scaling.

- Solana

Here’s how Solana handles accounting:

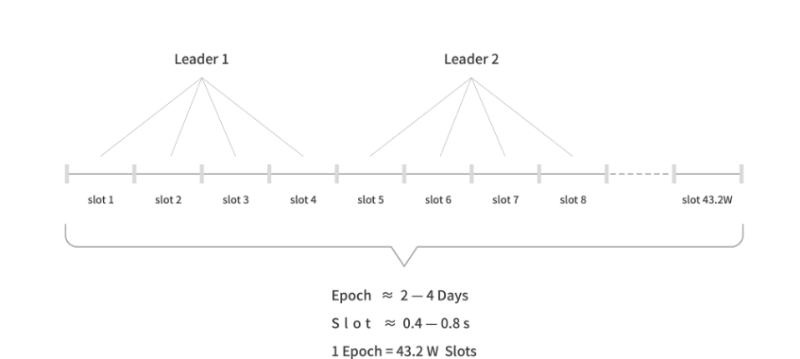

(1) Transaction Transmission Layer: Solana pre-announces the leader responsible for each slot within an epoch. Thus, transactions only need to be sent to the leader, not broadcast network-wide, reducing propagation redundancy.

Image source: CatcherVC

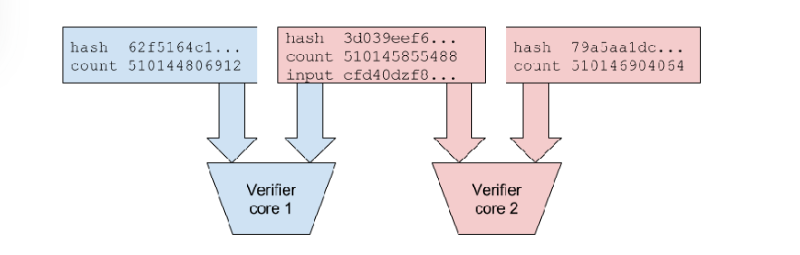

(2) Transaction Validation Layer: The leader divides the block, and other validators only verify their assigned portion instead of the entire block.

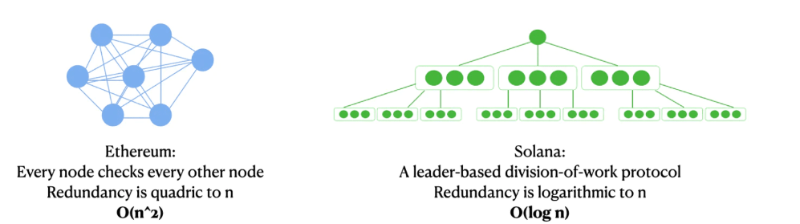

Under Solana’s mechanism, computational redundancy drops from n² to logn, enabling far greater efficiency (explained simply below).

Recall some classic math problems:

(1) If every pair among n people must exchange ledgers, how many exchanges occur? Answer: n(n−1), or O(n²).

(2) Conversely, if everyone exchanges with a known “leader,” how many exchanges? Answer: 2(n−1), or O(n).

(3) Now suppose the leader exchanges only parts of the ledger with each person—how many total exchanges? Clearly less than O(n); we can approximate it as O(logn).

Here, (1) corresponds to Ethereum, and (3) to Solana.

As illustrated below, Solana’s consensus drastically reduces redundant computation required per block, significantly improving speed.

Image source: Twitter @TheAntiApe

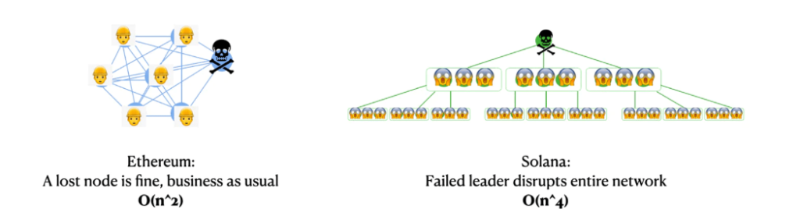

At inception, this design enabled Solana’s lightning-fast operation. But its flaws are evident: the leader handles receiving transactions, identifying valid ones, packaging, splitting blocks, assigning validation tasks, and collecting results.

The leader node bears immense pressure and easily crashes under high transaction volume or spam. As shown below, if the leader fails, the whole system struggles to function—leading to frequent network outages.

Image source: Twitter @TheAntiApe

Moreover, pre-announced leaders are vulnerable to bribery and targeted attacks—centralization issues that negatively impact overall blockchain security.

Since Solana’s ecosystem exploded in September 2021, it has suffered multiple outages. These repeated failures limit its growth potential. In the next bull market, users will demand a new chain that doesn’t crash frequently (or at least shows no signs of high outage risk).

(3) Parallel Computing

Beyond basic consensus, Solana improved smart contract handling via parallel processing.

Early Ethereum used EVM, which relies on serial computation (processing transactions one after another)—an inefficient approach. While there are plans to upgrade EVM to eWASM, implementation remains distant.

Solana uses Sealevel to support parallel smart contract execution, leveraging NVIDIA’s 4096-core GPU for powerful parallel computing. This gives Solana exceptional performance in most cases.

Image source: Solana Whitepaper

However, Solana faces specific challenges:

(1) It must correctly identify which transactions can run in parallel; misjudgment may cause errors.

(2) If transactions are deemed serial, Solana’s processing speed becomes slower than Ethereum’s.

In summary, the 4096-core parallel computing capability makes Solana extremely efficient when tasks are parallelizable. But when faced with non-parallelizable transactions, its efficiency drops below Ethereum’s—and may even trigger crashes. Additionally, Solana’s low redundancy—achieved through “leader-assigned tasks”—enables high normal efficiency. But during failures, Ethereum’s high redundancy allows quick recovery, whereas Solana’s low redundancy makes collapse more likely. Overall, Solana introduced many valuable innovations, allowing early rapid rise via high TPS, but later paid the price with frequent outages.

This is the blockchain version of “using redundancy to fight uncertainty.”

The Story of Ultra-Low Fees

(1) Public Chain Revenue, Expenses, and “Printing Money”

Another pillar of Solana’s rise is low fees. Broadly speaking, low fees stem from both ultra-high processing capacity and system token subsidies. Let’s break down this subsidy model.

If we consider a public chain’s business logic—it provides an environment for projects and taxes all users—it resembles a nation, and its native token acts like legal tender used for tax payments.

Further analysis reveals common traits: a chain’s revenue comes from user transaction fees, while expenses go toward validator incentives. If you read government fiscal reports, you’ll often see the term “balanced budget.”

Just as nations aim for fiscal balance, so should public chains.

Yet, examining actual revenues and expenditures across chains shows most spend more than they earn:

Validator rewards – transaction fees = chain deficit

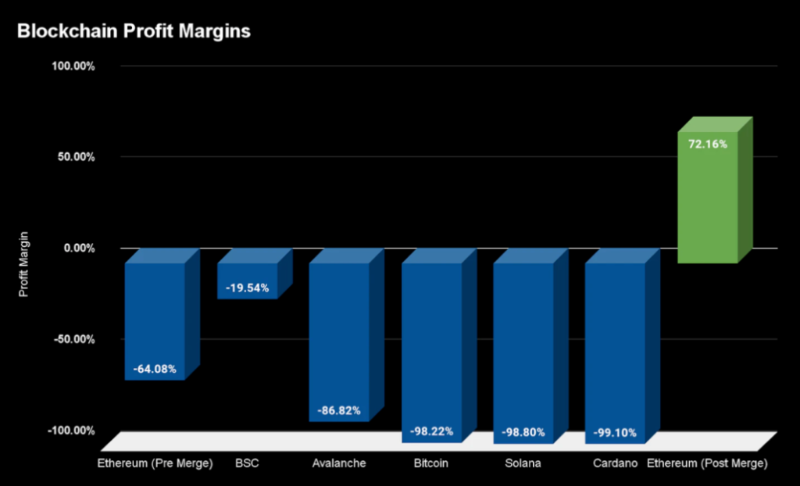

Bankless once published statistics on public chain deficits:

Image source: Bankless

When a chain’s income falls short of validator payouts, the shortfall is typically covered by “printing money”—issuing new tokens as subsidies:

Chain deficit = inflationary rewards

Thus, validator rewards usually come from two sources: regular income and “printing subsidies”:

Transaction fees + inflationary rewards = validator payouts

For Solana, when validators should receive $100 in “wages,” around $98.80 often comes from “printing subsidies,” with only ~$1.20 from actual user fees. This figure changes over time, but Solana remains far from sustainable financial equilibrium.

(2) “Printing Money” Leads to Chain Inflation

By likening public chains to nations and tokens to fiat currency, we expect total currency value to match total goods value.

Imagine a country producing only apples: Year 1, 100kg apples, 100 units of currency → apple price = $1/kg. Year 2, output doubles to 200kg, currency supply also doubles → price stays $1/kg. Year 3, output stagnates at 200kg, but currency supply increases again → price rises to $1.50/kg—significant inflation occurs.

Similarly, for a fast-inflating “nation” like Solana, early rapid growth in on-chain economic value offsets the negative effects of monetary expansion.

But once Solana hits clear bottlenecks and total token supply diverges from economic value, continuing to print tokens to cover deficits—or reducing printing while raising “taxes”—becomes detrimental. Some call this the “cycle law of new public chains.”

At minimum, the next cycle demands a chain that re-finds balance—or at least grows so fast initially that imbalance isn’t felt. Currently, Solana may be passing the torch, and Aptos could be the next bearer.

Let’s also examine Ethereum’s business model: after implementing EIP-1559 fee burning in 2021 and reducing operational costs post-Merge in 2022, the equation became:

Transaction fees + issuance – burns = validator payouts

Using profit = revenue – expenses:

Profit = burns – issuance

Post-Merge, annual issuance dropped from 4.5M to 180K–209K ETH, while burn rate depends on usage. Simple math shows that when gas prices exceed 15 gwei, Ethereum likely operates above break-even. Sustained conditions could ensure long-term viability.

(3) Case Studies from a Revenue-Expense Perspective

Revenue and expenses are often overlooked, but even in the new Web3 world, basic commercial logic remains rooted in income and expenditure.

In June 2022, Immutable X (IMX) on Starkware introduced fees, and dydx migrated to build its own chain—both hint at how revenue-expense dynamics shape chain landscapes. Let’s analyze both from this lens.

IMX

For Immutable X, let’s break down its revenue and expenses:

As a zkRollup, IMX claimed zero gas fees before June 2022, meaning primary revenue was nearly zero.

As a Starkware-based zkRollup, it batches transactions onto Ethereum for verification and storage (ensuring security), paying Ethereum gas fees—a major expense. IMX also pays usage fees to Starkware.

This imbalance led IMX to introduce a 2% transaction fee in June 2022 to restore fiscal balance.

DYDX and the Short-Lived App Chain Trend

Now consider DYDX’s revenue and choices:

On Starkware, DYDX revenue = trading fees; expenses = fees to StarkEx + Ethereum gas + app-chain costs.

If building its own chain on Cosmos, revenue = trading fees + captured gas fees; expenses = chain development costs.

Thus, migrating saves Ethereum fees, captures gas revenue, and adds dev costs—while losing some Ethereum ecosystem traffic. Given high Ethereum fees and low Cosmos setup costs, DYDX’s move was economically rational.

However, once Ethereum’s sharding rolls out and fees drop, self-hosted chains will become less economical. The app-chain narrative championed by DYDX and others may thus reach a turning point.

Following the logic of high TPS, low fees, and cyclical trends, Solana has clearly hit a wall. A successor in the new chain race is emerging. Judging from investor enthusiasm, technical redesigns, and the Move language narrative, that successor may well be Aptos.

Aptos Poised to Take Over

Currently, Aptos shares many investors with Solana, and several Solana executives and ecosystem projects are shifting toward Aptos—offering significant momentum. Moreover, Aptos’ re-balancing of performance trade-offs and the Move language story give it strong competitiveness. Whether Aptos can successfully take over—and thrive afterward—depends heavily on team execution.

On launch day, Aptos sparked controversy over token distribution and community management, making me cautious about the team’s capabilities.

The High-Performance Narrative

(1) Diem-BFT V4 Consensus Mechanism

Key innovations include:

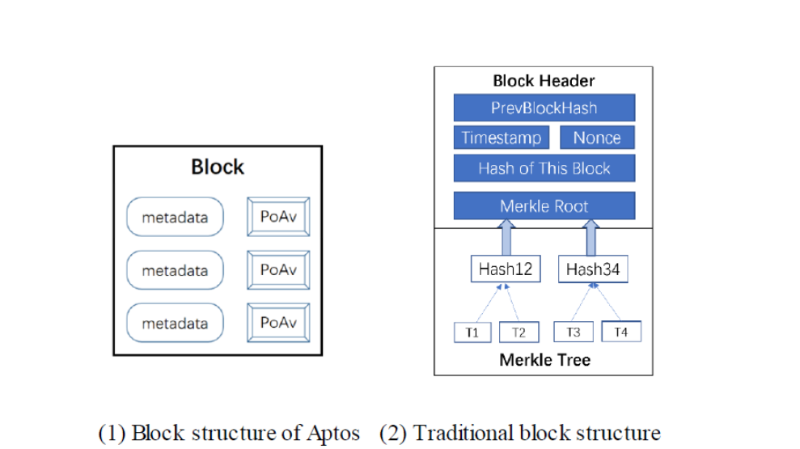

① The system compresses a batch of transactions into a “summary” (labeled “PoAv” in diagram).

② Blocks contain only the “summary,” not full transaction records.

Thus, same-sized blocks carry more transactions, achieving higher scalability. However, compression introduces risks—batches must be split without overlap or omission, otherwise processing errors occur.

Image source: Huobi Research

Since Aptos’ disclosed tokenomics remain vague, we won’t delve deeply into its economic sustainability yet.

(2) Parallel Computing

Aptos uses optimistic assumptions—assuming transactions are independent and processing them in parallel. If transactions are mostly unrelated, Aptos gains major speedups. If highly interdependent, processing slows slightly below Ethereum levels, but consequences are milder.

Still, Aptos chose 16-thread parallel processing, demanding high-end hardware and reducing eligible node count (a trend visible in current node selection), sacrificing decentralization and security.

Technically, Aptos’ parallel computing is more of a trade-off than true innovation; I remain skeptical about optimistic execution models.

The Move Language Narrative

Move language is a core narrative for Aptos and indeed holds strong appeal.

Move is a statically typed programming language emphasizing safety. For example, it disallows dynamic dispatch—requiring all code paths to be fully transparent before execution—making it inherently safer, especially valuable in finance. Solidity supports dynamic calls, prioritizing flexibility.

Overall, Move is suitable for many blockchain use cases. Yet Solidity’s flexibility and vast ecosystem ensure it retains a substantial user base.

Image source: Buidler DAO

New Chains vs. Ethereum: The Showdown

I’m pessimistic about Aptos challenging Ethereum. Although both differ in performance trade-offs, in a multi-chain future, Ethereum and Aptos aren’t truly comparable:

Ethereum has built a secure, large-scale multi-chain ecosystem (including Optimism, Arbitrum, Starkware, Zksync, and other Rollups), some approaching the scale of leading new chains. Aptos, meanwhile, remains a liquidity-siloed single chain. This secure multi-chain architecture forms Ethereum’s invisible moat.

The Multi-Chain Future

First, due to blockchain’s inherent impossible trinity and the growing diversity of on-chain sectors (DeFi, GameFi, NFTs…), no single chain can meet all needs—thus, the future is multi-chain.

Cross-Chain Risks

In 2021, high-performance new chains and specialized chains boomed. But users quickly noticed a glaring issue: cross-chain risks and fragmented liquidity.

If a user buys domains on Aptos, plays Stepn on Solana, and purchases NFTs on Flow… they must constantly transfer assets between chains. Yet, no truly secure cross-chain interaction method exists today.

Cross-chain bridges, having suffered multiple hacks, are now dubbed “hackers’ ATMs” by the industry.

It’s well known that a single blockchain, constrained by consensus, is secure.

But when two chains interact, no unified consensus secures the bridge—leaving irreducible security risks.

Hence, my prediction for the multi-chain era is a secure multi-chain system—not a collection of isolated, liquidity-siloed chains.

Security of Multi-Chain Systems

In the multi-chain era, Ethereum acts as a shared security layer, with specialized Rollups meeting diverse user needs—an inherently secure multi-chain framework.

Imagine: users deposit assets into IMX to play Illuvium, or transfer funds via Ethereum mainnet to Arbitrum for Odyssey quests. These cross-Rollup transfers are secured by Ethereum itself, avoiding most cross-chain pitfalls.

Ethereum’s Powerful Multi-Chain Ecosystem

Ethereum’s multi-chain ecosystem is already highly competitive. Its two major OP Rollups—Optimism and Arbitrum—rank in the top 8 by TVL.

With Ethereum’s upcoming Shanghai upgrade, interaction costs between Rollups and Ethereum are expected to plummet, triggering another leap in Rollup development and solidifying Ethereum’s role as the foundational secure layer in the multi-chain landscape.

Image source: Defillama

Additionally, ZK Rollups on Ethereum are advancing rapidly. Long-term, ZK Rollups offer higher ceilings than OP Rollups in security, speed, and cost.

With Zksync launching its mainnet this month, and Polygon zkEVM and Scroll progressing, ZK Rollup ecosystems may soon rival top-tier new chains. Even if Aptos pursues multi-chain ambitions, challenging Ethereum’s robust, secure multi-chain system remains extremely difficult.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News