In-Depth Analysis of GMX, DYDX, and SNX: A Comparative Study of Token Economics in Derivatives DEX Protocols

TechFlow Selected TechFlow Selected

In-Depth Analysis of GMX, DYDX, and SNX: A Comparative Study of Token Economics in Derivatives DEX Protocols

This article will compare the token supply and demand of three major derivatives DEX protocols—GMX, DYDX, and SNX—to gain deeper insights into their token economic models and support investment decisions.

Author: duoduo, LD Capital

When fundamentals are comparable, token supply and demand significantly influence price movements. This article compares the token supply and demand of three major derivatives DEX protocols—GMX, DYDX, and SNX—to gain deeper insights into their token economic models and support investment decisions.

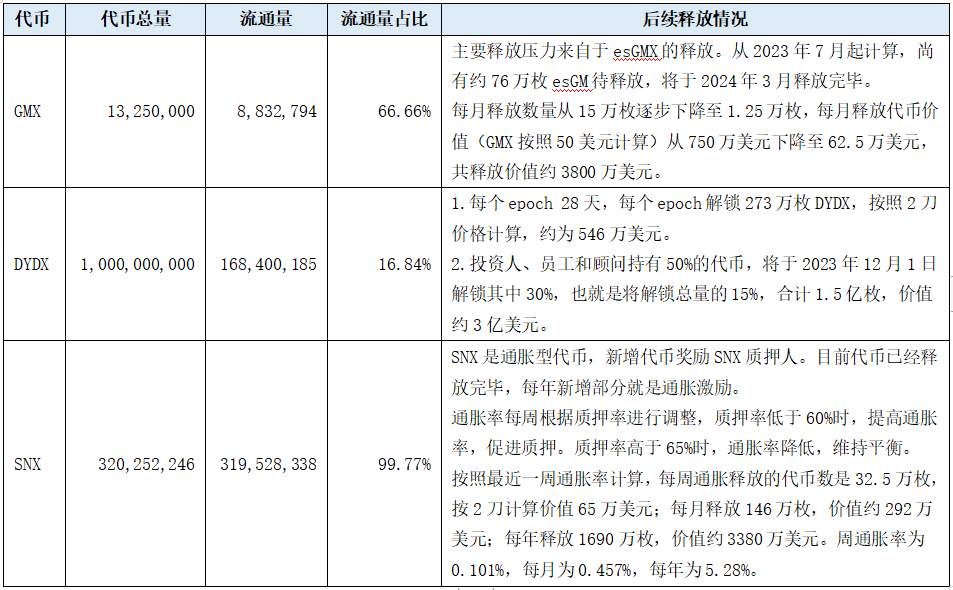

1. Supply

Source: LD Capital

Note: Total and circulating supply data are from CoinGecko. "Future release schedules" are determined based on project documentation and community governance votes. Differences between the two data sources may exist.

GMX's token allocation is shown below:

Source: TokenUnlocks

Excluding esGMX, contributor tokens are released linearly over two years after launch. GMX launched in August 2021, so contributor tokens are still being released, though at a low rate, and thus will not be analyzed separately. All other tokens have already been fully released.

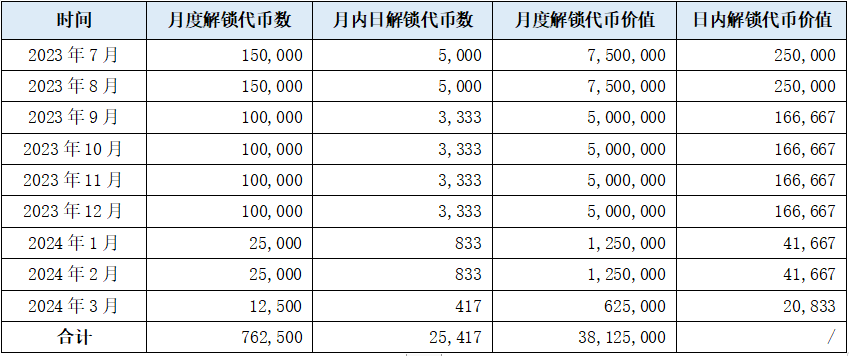

Regarding esGMX, per community voting, issuance of esGMX was halted in March 2023. According to the esGMX vesting rules, it has a one-year release period. Therefore, the specific esGMX release schedule is as follows:

Source: LD Capital

DYDX's token allocation is shown below:

Source: TokenUnlocks

Investors, employees, advisors, and future hires collectively hold 50% of the tokens, originally scheduled for release in February 2023. However, prior to the unlock date, the community voted to delay the release until December 1, 2023.

This represents significant selling pressure. The team is actively exploring new mechanisms to lock these tokens. As planned, the DYDX Chain is expected to launch in Q4, requiring DYDX staking by consensus nodes. Currently, the DYDX Chain public testnet is scheduled to go live on July 5, 2023.

Excluding these locked tokens, current primary selling pressure comes from trading incentives and liquidity provider rewards. Both are unlocked per epoch (every 28 days), totaling approximately 2.73 million DYDX tokens.

SNX tokens are nearly fully circulating, with new supply coming from inflationary minting. SNX stakers receive two types of rewards: fees and newly minted SNX. The inflation rate is adjusted weekly, primarily based on the SNX staking ratio, aiming to incentivize higher staking rates. The specific rules are as follows:

Staking ratio >70%: Inflation rate decreases by 5%; Staking ratio between 60–70%: Inflation rate decreases by 2.5%; Staking ratio <60%: Inflation rate increases by 5%.

The chart below shows the weekly release volume of SNX tokens.

Source: synthetix

Summary:

Comparatively, GMX has the largest market value of token releases over the next two months, with most tokens fully released within six months and minimal subsequent selling pressure. DYDX still faces substantial selling pressure; without effective solutions to lock up its tokens, this could significantly constrain market cap growth. SNX is an inflationary token with continuous new issuance, but its initial supply is already fully circulating. It must absorb the annual ~5% new supply over time.

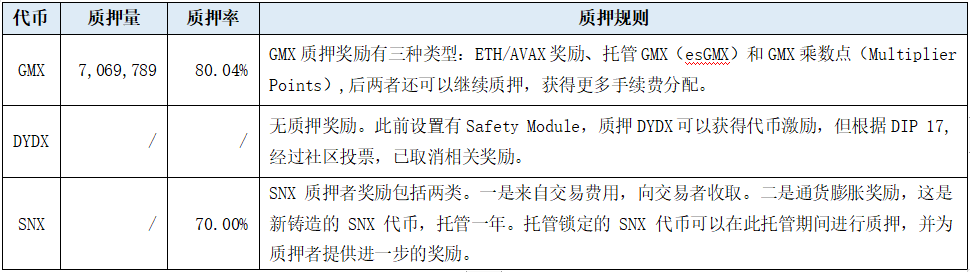

2. Demand

Source: LD Capital

Summary:

GMX’s staking mechanism offers strong incentives, encouraging significant token locking and reducing circulating supply. Most GMX holders convert their stakes into esGMX, which has a one-year vesting period, further promoting long-term holding.

DYDX lacks a staking or locking mechanism, and its token does not offer direct yield utility.

SNX operates similarly to GMX, with a high staking ratio and proven resilience through both bull and bear markets, resulting in a large base of long-term stakers.

Overall, DYDX tokens are primarily used for governance with limited practical utility. In contrast, GMX and SNX are more tightly integrated with their respective protocols, aligning with their "real yield" narratives.

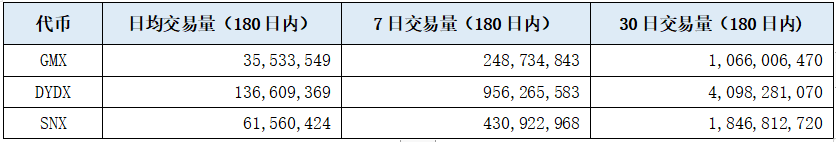

3. Liquidity

Source: LD Capital

Summary:

All three tokens are listed on major exchanges such as Binance and OKX, ensuring sufficient liquidity. DYDX has the highest trading volume, followed by SNX, with GMX having the lowest.

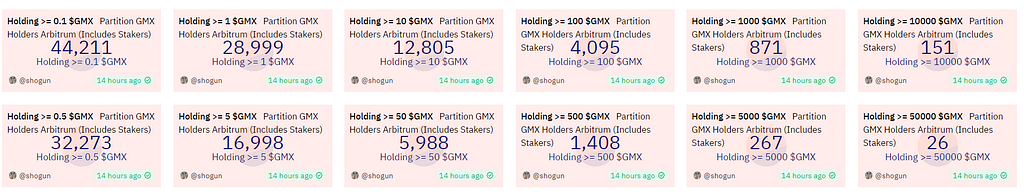

4. Holder Distribution

GMX

On-chain holder distribution

The top 50 addresses collectively hold 2.65 million GMX, approximately 30% of the circulating supply. On June 7, this peaked at 2.71 million GMX.

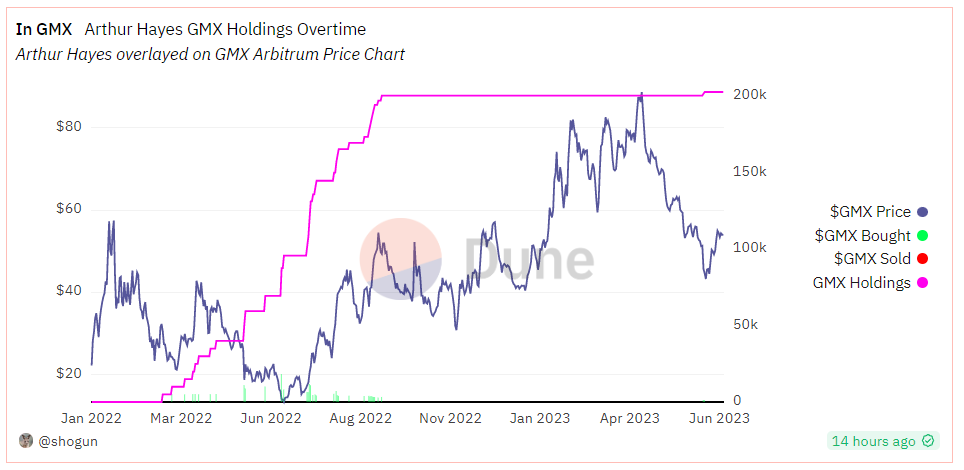

Arthur Hayes is the largest individual holder of GMX, owning over 200,000 GMX and continuously staking.

DYDX

Holder distribution

Smart money holdings reveal numerous institutional investors, including Defiance Capital, Wintermute, Polychain, HashKey, Arca, Dragonfly, Delphi Digital, Alameda, and others.

SNX

Smart money includes many institutions such as Wintermute, a16z, Jump Trading, DWF Labs, and others.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News