DYDX Research Report: When September's V4 Meets December's Token Unlock, Worth Watching or Better to Stay Away?

TechFlow Selected TechFlow Selected

DYDX Research Report: When September's V4 Meets December's Token Unlock, Worth Watching or Better to Stay Away?

DYDX will continue to perform strongly, with higher fees, a better user experience, and could even become a full-fledged derivatives platform.

Written by: OUROBOROS CAPITAL

Translated by: TechFlow

Our bullish thesis on DYDX is based on the following points:

1) More people will buy DYDX tokens post-v4, as potential validators accumulate spot tokens to earn trading fees accrued post-v4;

2) After achieving decentralization in v4, product innovation will significantly increase.

Additionally, in the long term, we believe the following factors will drive fee growth:

i) Validators' ability to capture MEV;

ii) Broader adoption through new features such as prediction markets and account abstraction;

iii) Panic sentiment around centralized exchanges (CEXs) will drive DEX growth.

Introduction

DYDX v4 will go live sometime at the end of September. This upgrade will fundamentally change the tokenomics and further enhance product-market fit.

Launched in 2021, DYDX made waves in the market with massive trading volume, briefly even surpassing Coinbase. At that time, volume was primarily driven by incentives and included substantial wash trading to claim rewards. Today, the situation is entirely different—DYDX is now the leading decentralized perpetual exchange with about a 60% market share (fees frequently exceeding incentives).

As more perpetual contracts move from off-chain to on-chain trading, we expect DYDX to continue performing strongly, with higher fees, improved user experience, and potentially evolving into a full-fledged derivatives platform including options, prediction markets, and more.

What is v4?

In short, v4 refers to dYdX's migration to its own chain built using the Cosmos SDK. First announced in January 2022, detailed information about the dYdX Chain was released in June 2022.

Previously, fees did not accrue to token holders but were distributed to stakers, effectively rendering the token a utility-less governance token. With v4 and the dYdX Chain, fees will now flow to token holders, meaning we can view v4 as introducing a fee switch for token holders.

Investment Thesis 1: Post-v4 DYDX Staking Yields Approximately 20% Annualized

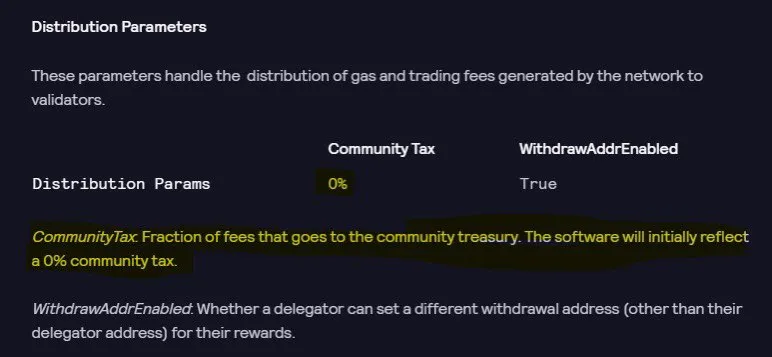

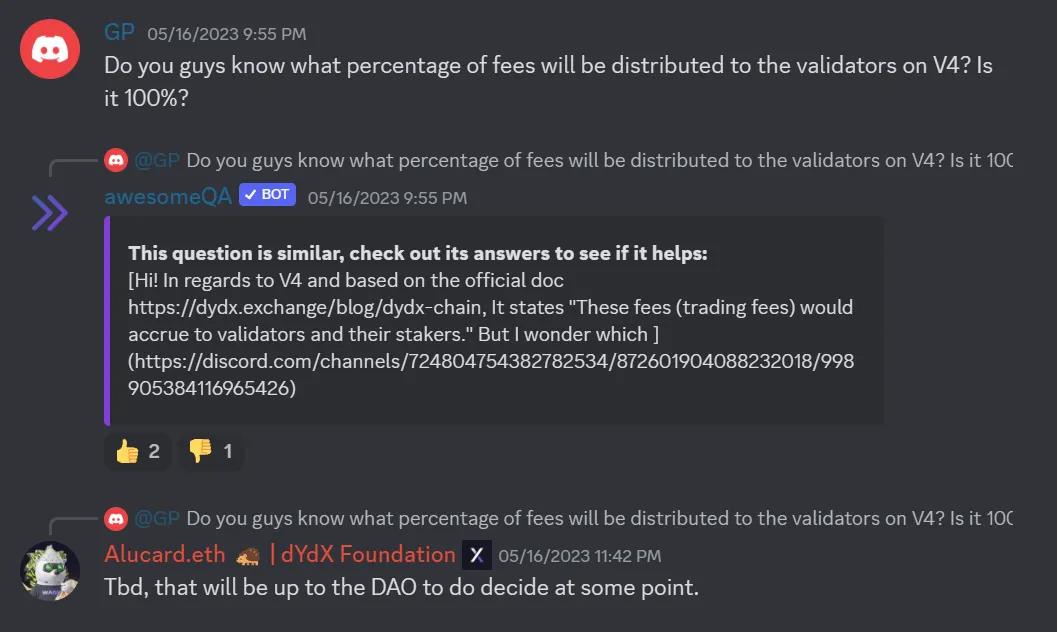

Multiple signals indicate that post-v4, 100% of DYDX fees will be accumulated by token holders.

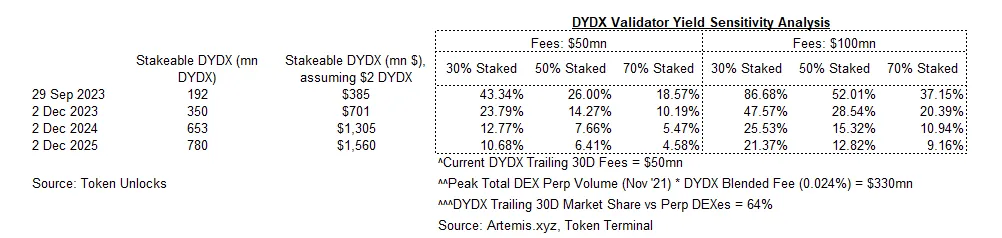

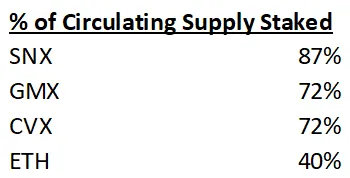

Based on current DYDX fees ($50 million — annualized over the past 30 days), we estimate validator staking yields will start at a minimum of 15% (assuming all circulating DYDX is staked), but more likely approach 20% (assuming staking ratios similar to other high-fee-generating tokens like SNX, GMX, and CVX). Moreover, we believe this fee amount represents a low point in trading volume and expect volumes to rise as speculative demand returns. Currently, perpetual DEX volume stands at about 30% of its historical peak (February 2022). Nevertheless, given that perpetual DEX penetration is now higher and could increase further amid growing CEX panic sentiment, it's reasonable to assume annualized fees could reach $100 million (or higher) in a rising market.

Investment Thesis 2: Decentralization Will Drive Innovation

We believe DYDX’s decentralization has the potential to open up new verticals previously difficult to enter due to regulatory barriers, such as prediction markets, options, and synthetic products. This was also mentioned during the recent DYDX presentation at Nebular Summit.

Investment Thesis 3: Bullish Unlock

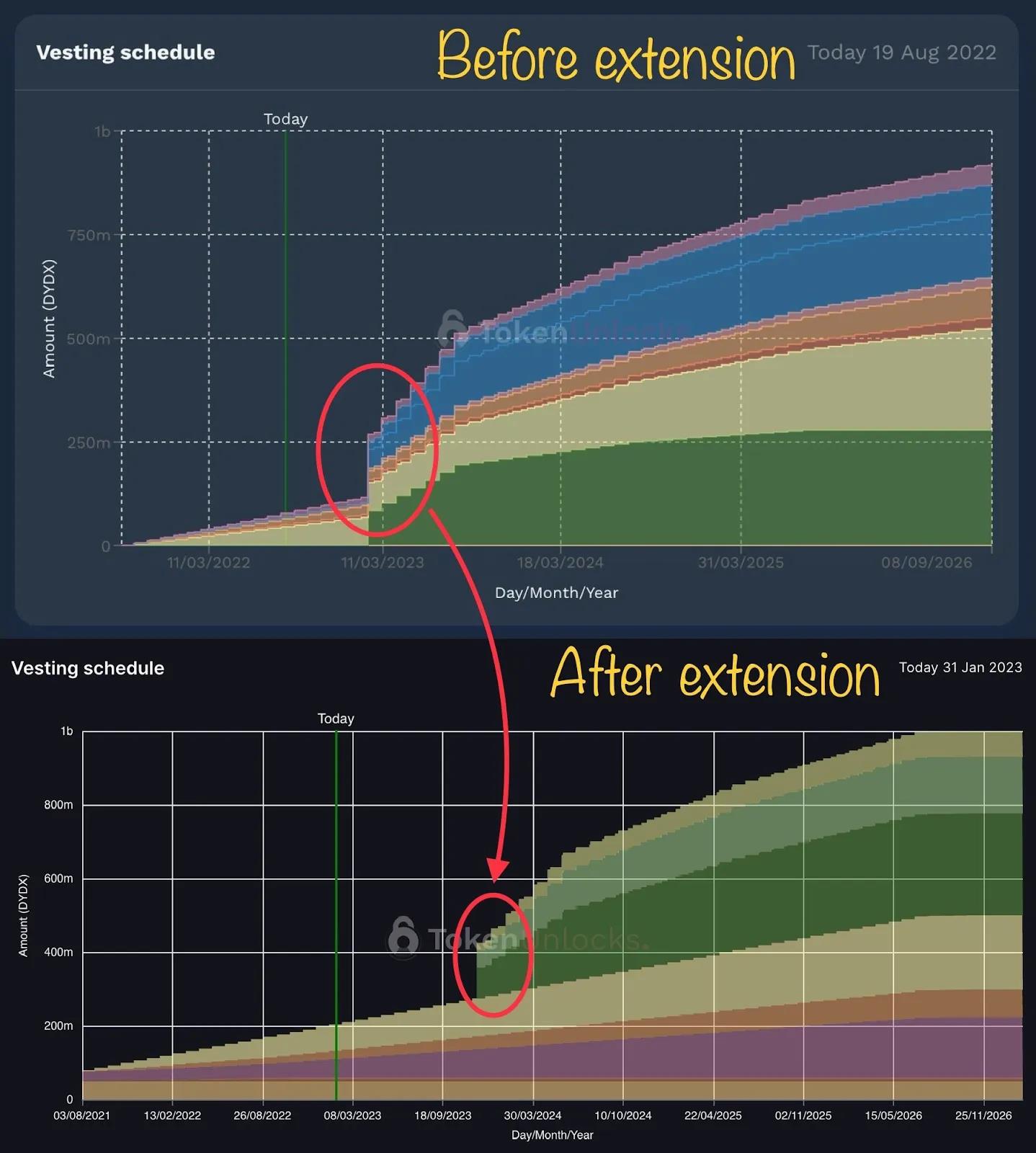

v4 was originally scheduled earlier in 2023 alongside investor token unlocks but was later delayed. We clearly see that the timing of v4 has been synchronized with the unlock schedule to ensure new supply is balanced against demand generated by the improved tokenomics model.

Rumor Debunked

This section addresses common misconceptions we believe exist regarding DYDX.

Misconception 1: Massive Unlock in December Could Lead to Token Dumping

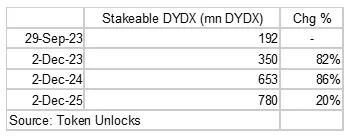

The biggest current concern about the token is the upcoming December unlock. The December unlock will increase token supply by 80%, followed by another 80% increase one year later. However, we believe this concern is overstated, and in fact, the team has strong incentives to ensure the token is well-supported at unlock, reinforcing our bullish outlook.

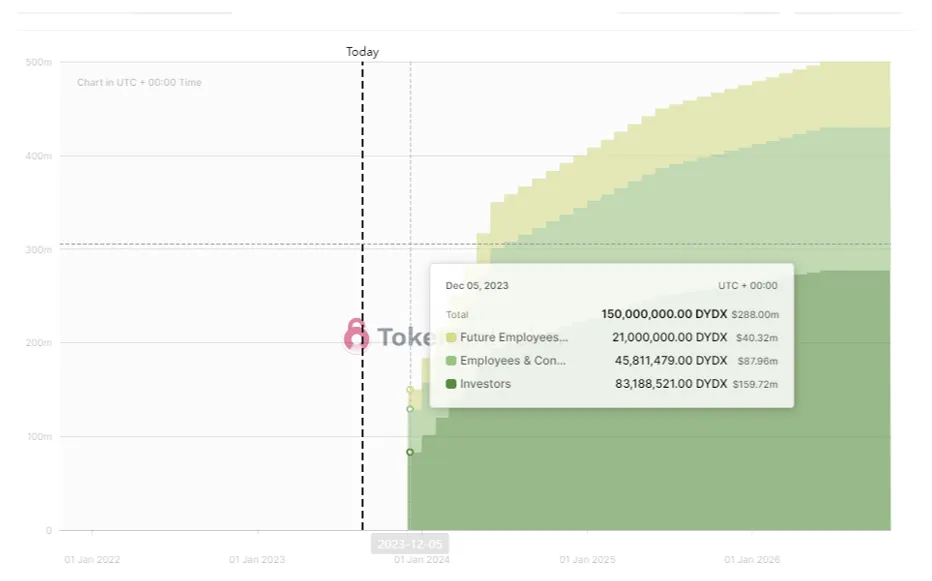

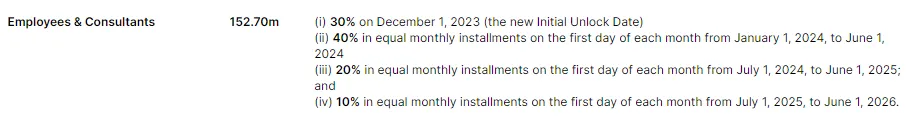

Of the 150 million DYDX tokens unlocking on December 1, 2023, 30% belong to “employees and advisors.” We’ve already seen precedent for this, as previous unlocks were delayed to better align with the delayed v4 timeline—likely to ensure a healthy intersection between token supply and demand after value accrual.

Notably, 70% of the “employees and advisors” tokens won’t fully unlock until June 1, 2024, and 90% won’t fully unlock until June 1, 2025, allowing more time for alignment of interests among token holders.

Misconception 2: DYDX Volume Is Not Real—Market Makers Wash Trade Heavily to Capture Trader/Liquidity Provider Rewards

A common criticism is that market makers engage in heavy wash trading to capture trader/liquidity provider rewards. While in the past, dYdX token rewards to traders and liquidity providers exceeded fees, this is no longer the case.

In fact, we observe that trader/liquidity provider rewards have gradually decreased while fee/trading volume remains stable. Additionally, the protocol has intentionally reduced token incentives to traders and liquidity providers through several governance proposals, yet this has not led to a decline in trading volume.

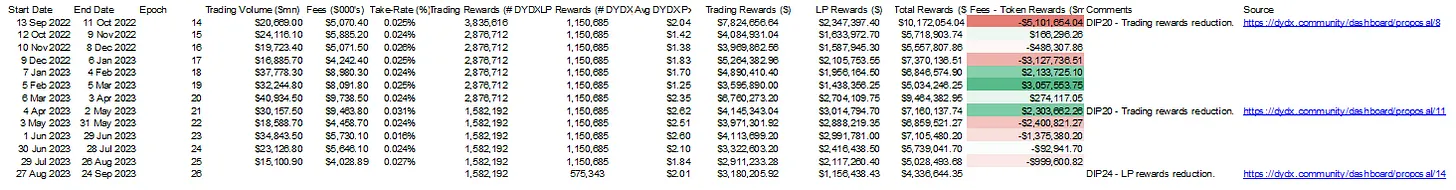

The table below highlights the trend in DYDX’s net margin (fees minus issuance) this year, reaching breakeven in the most recent month. We expect it to return to profitability following the reduction in liquidity provider rewards under DIP-24.

Misconception 3: Perp DEX Fees Are Expensive

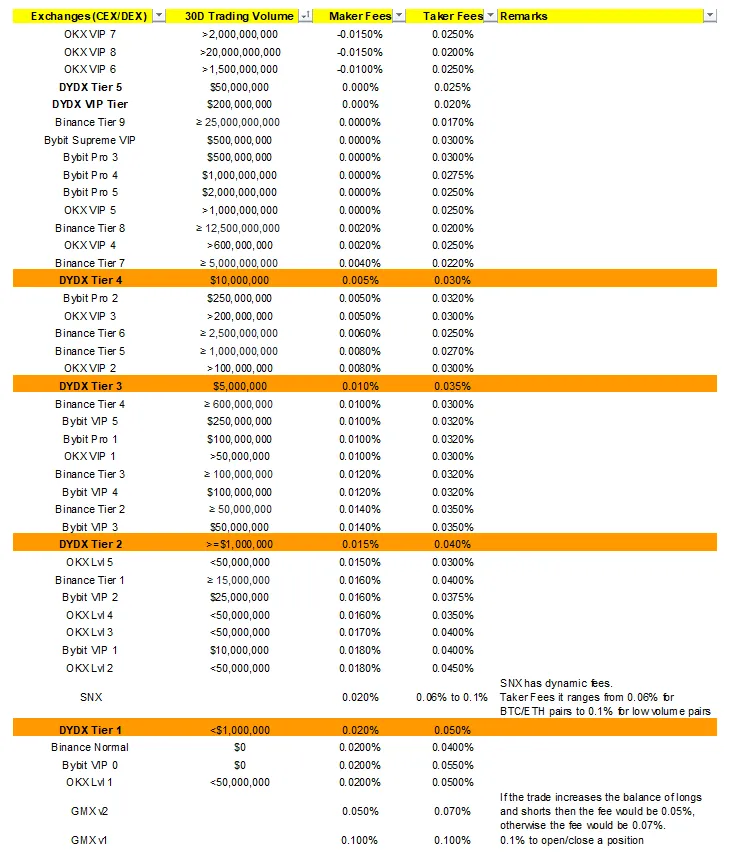

Our comparison of DYDX fees with those of centralized exchanges shows that DYDX fees are already competitive and therefore not subject to fee compression. In fact, considering the DYDX tokens received as trader/liquidity provider rewards, fees may arguably be considered low.

Catalyst 1: Losses at Centralized Exchanges Equal Gains for Decentralized Exchanges (DEXs)

From the FTX incident, we know that when CEXs face panic sentiment, perpetual DEXs tend to gain market share and their tokens perform well. Against the backdrop of increasing regulatory scrutiny on CEXs, this serves as an additional catalyst, and we believe it could benefit dYdX, making it a good "hedge" within portfolios during CEX panic scenarios.

Catalyst 2: Validator MEV in v4

A recently explored idea is that DYDX validators could generate MEV revenue on the exchange. We read Chorus One’s in-depth report on MEV extraction by DYDX validators and are convinced that “validators can boost income by partnering with trading firms to extract MEV,” further enhancing the appeal of accumulating spot tokens to launch validator nodes.

Conclusion

We believe DYDX presents both a trading opportunity in the short term and an investment opportunity in the long term. In the near term, we expect v4 to trigger a “unlock rally” driven by increased token fees and demand from validators accumulating spot tokens. Long-term, we also view it as a solid core holding in a crypto portfolio, given its strong fundamental market performance during crypto bull cycles. Beyond new products post-v4 and potential market share gains from CEXs, it also benefits from genuine value accretion as speculative trading volume returns to crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News