T2T2 Product Analysis: How to Create a Token Flywheel Through Decentralized Copy Trading?

TechFlow Selected TechFlow Selected

T2T2 Product Analysis: How to Create a Token Flywheel Through Decentralized Copy Trading?

T2T2 enables regular users to receive additional arbitrage subsidies and share in the system's inflationary rewards, beyond just copy trading.

On November 7, T2T2's decentralized copy trading product officially launched its internal testing phase, with a batch of top traders beginning to join, including institutional traders, top performers from Binance Futures leaderboards, and Telegram bot teams.

Judging from the current roster of traders, T2T2’s trading rooms are tightly integrated with Twitter, allowing users to evaluate a trader’s performance on Twitter or other public channels before deciding whether to pay for copy trading access.

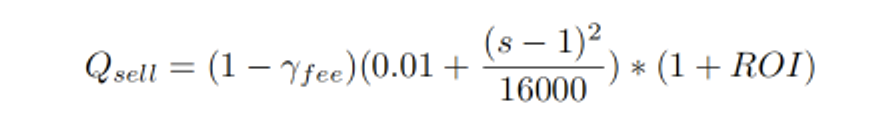

We can understand the underlying social logic from the formula presented in T2T2’s v1 whitepaper:

T2T2 v1 Whitepaper

Where:

-

S represents the number of KEYs, derived from Friend Tech’s social model—more participants mean higher earnings for room owners, and earlier participants earn more.

-

ROI refers to the fund net value from copy trading. During periods when both memecoins and blue-chip assets surge, explosive ROI growth is common in crypto.

-

Fee denotes the commission shared with the room owner.

-

The constant term 0.01 is designed to prevent bots.

Crypto user needs are simple and fundamental. When the market takes off, users primarily focus on zero-cost farming, chasing memecoins, front-running blue-chips, opening leveraged positions, or engaging in PvP speculation—not on high-level socializing.

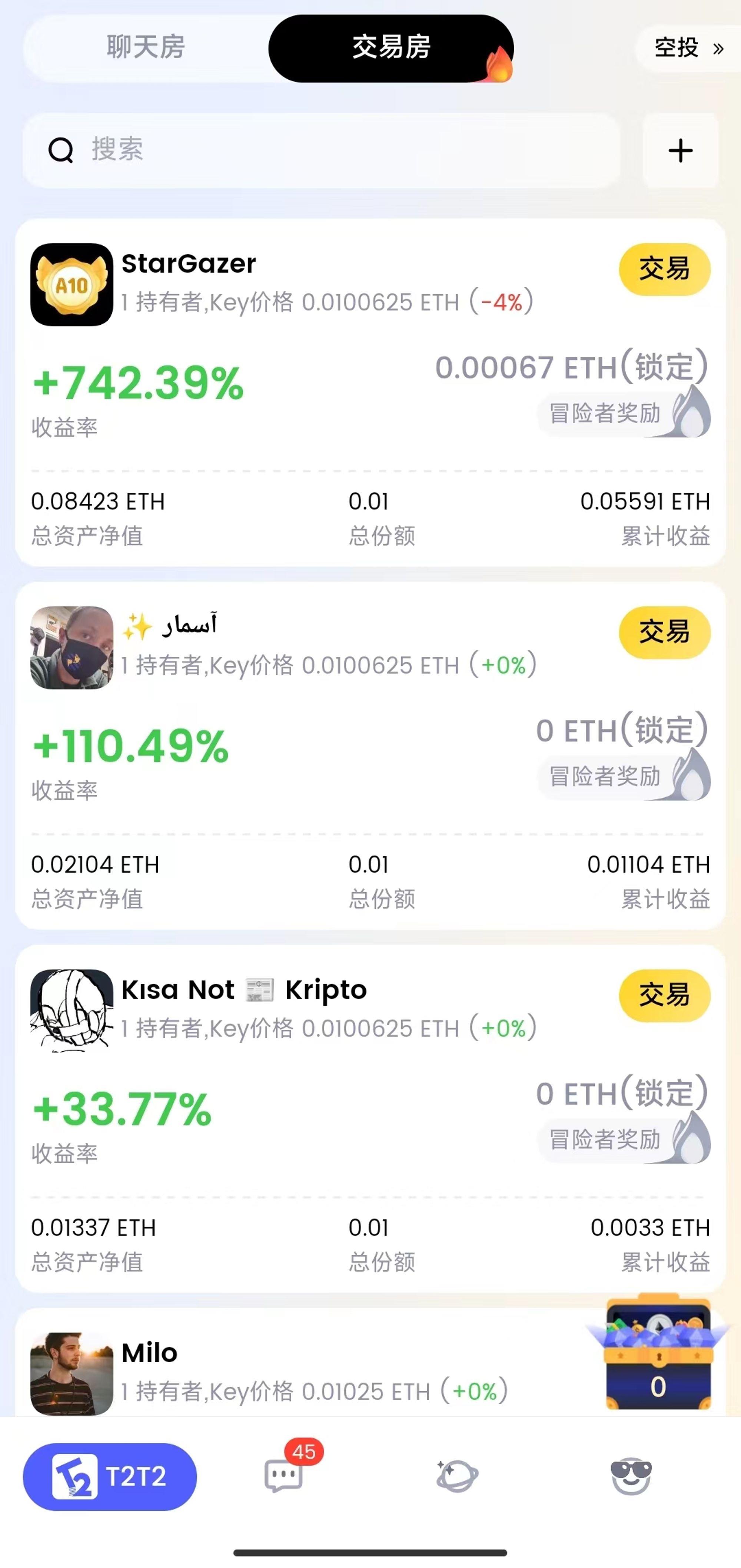

On-chain ROI rankings on T2T2

T2T2 is exploring a new social model by abandoning attempts to satisfy so-called "upward socialization" demands, instead focusing on the core asset side: enabling users to follow trading signals, starting from DEXs, with future expansion into contract-based DEXs—all fully on-chain. Whether or not Friend.tech launches its own token will not affect T2T2’s business model or user network.

Meanwhile, T2T2 has also released its tokenomic model. Building upon its latest copy trading mechanism, it introduces a new token flywheel whose core idea is: allowing ordinary users not only to copy trades but also to receive additional arbitrage subsidies and share in the system’s inflationary rewards.

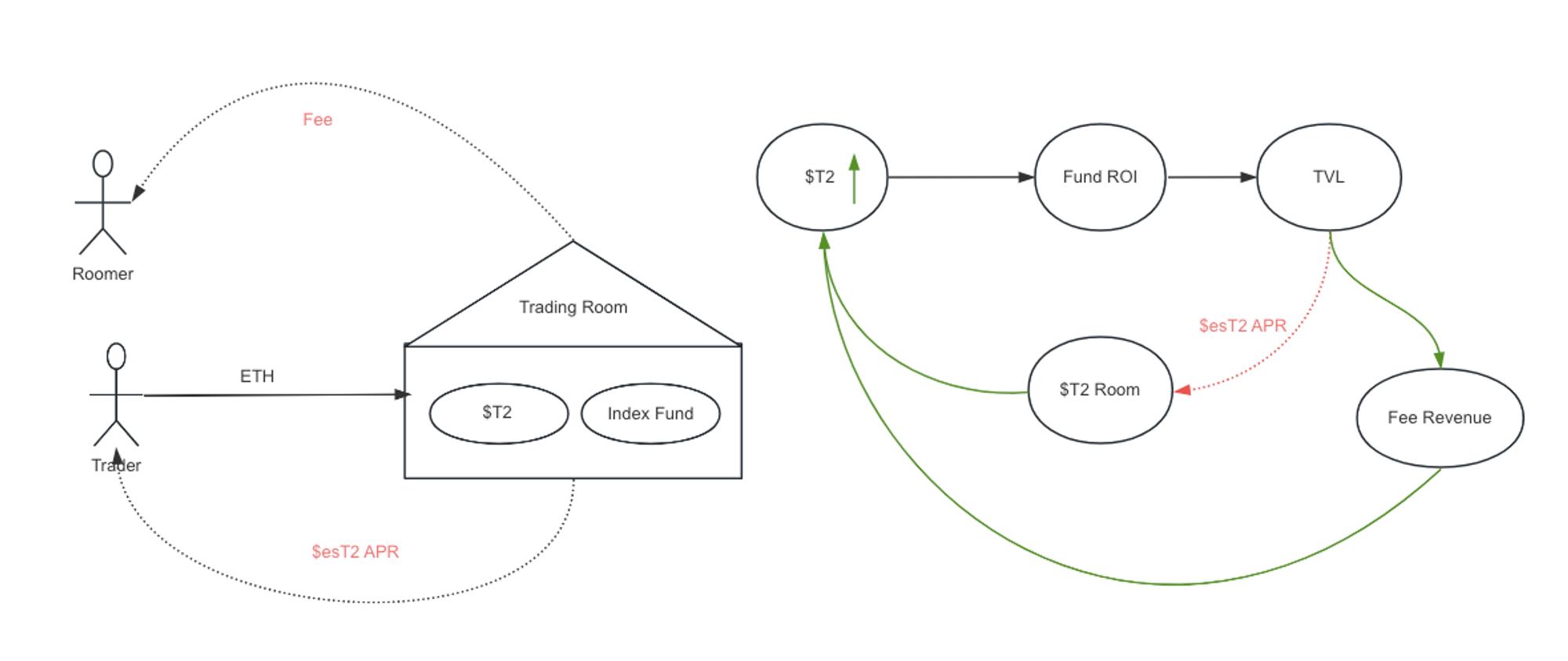

As shown, the left side illustrates the standard logic of users following room owners’ trades. Room owners can configure an index fund, or partially or fully allocate to $T2.

The flywheel mechanism is thus clearly defined:

-

As T2 price rises, the ROI of copy trading increases significantly, attracting more users to participate and contribute TVL (total value locked), generating transaction fees that are distributed as commissions to room owners and the platform. This forms the first flywheel: rising prices increase income for both room owners and the platform, thereby providing value support for further T2 price appreciation.

-

As platform fees and room owner earnings grow, room owners have greater incentive to allocate more of their portfolio to T2, since this boosts their room’s ROI and TVL. The higher the allocation ratio, the stronger the upward pressure on T2’s price, and the greater the inflationary rewards shared among participating followers. This creates the second flywheel.

Under the stimulation of these two flywheels, early adopters holding KEYs can experience rapid appreciation. Early users who successfully identify high-quality traders can also profit from the subsequent rise in KEY value driven by later followers.

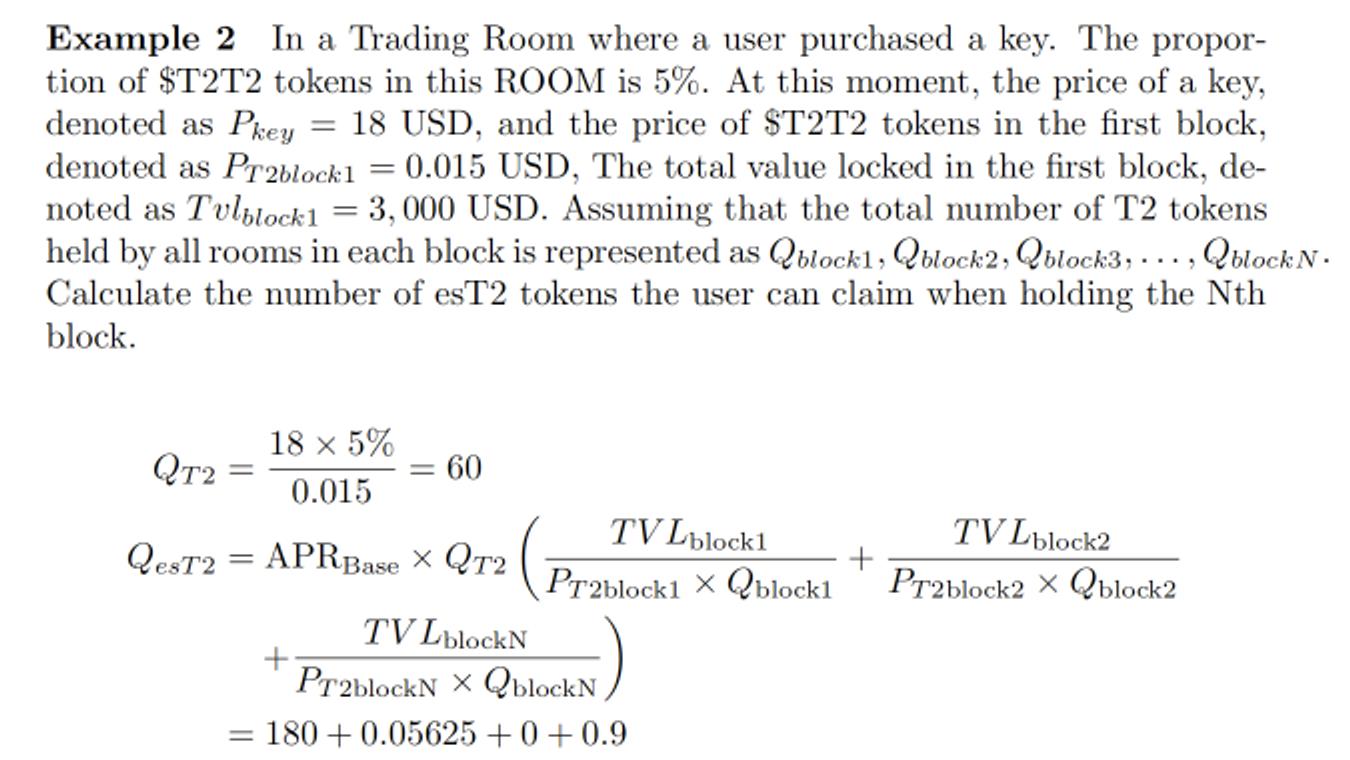

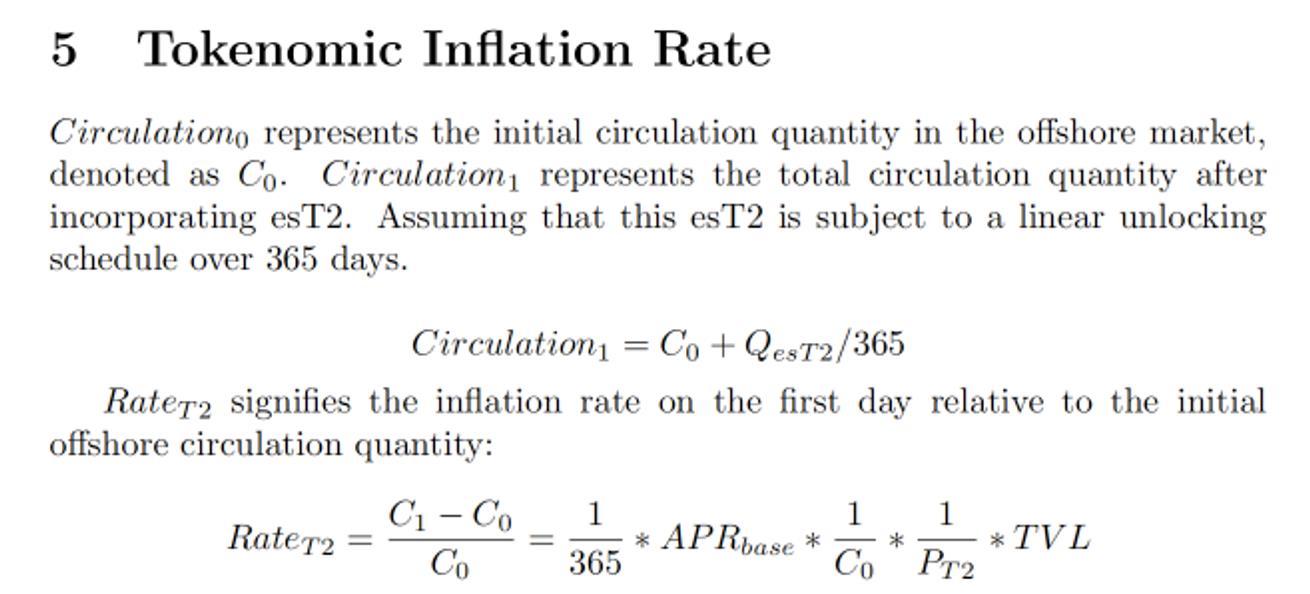

Regarding the second flywheel, the whitepaper provides clearer details on inflation incentives with examples:

This section translates to: inflation incentives are tied to system transaction fees (TVL)—the higher the fees, the larger the share of inflation rewards. More importantly, they are strongly correlated with the room’s T2 holding percentage: the higher the T2 allocation and the longer the room remains active (accumulating more block rewards), the greater the inflation incentives received. In extreme cases, when the room coefficient reaches 100%, all inflation incentives are evenly distributed among rooms holding T2. Rooms that do not allocate to T2 receive zero inflation rewards. This reallocation mechanism effectively channels the entire system’s earnings into T2-holding rooms.

In Chapter 5 of the whitepaper, the platform models the distribution of inflation incentives, which are linearly unlocked over 365 days. From an inflation modeling perspective, during the initial 3–6 months, the system operates largely in a deflationary state, thereby stimulating early flywheel dynamics.

Overall, T2T2’s design is relatively innovative and possesses its own moat. For both room owners and retail users, participating in T2T2 is equivalent to simultaneously engaging in Friend Tech + Telegram bots + ve(3,3) + futures copy trading. Throughout this process, the user network will gradually expand.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News