The Underrated RGB: The Foundation Building BTC's Complex Ecosystem

TechFlow Selected TechFlow Selected

The Underrated RGB: The Foundation Building BTC's Complex Ecosystem

The RGB protocol leverages the security of Bitcoin's mainnet UTXO to provide security assurances for off-chain asset issuance or contract logic.

1. Rambling Preface

Recently, the BTC ecosystem has been exploding with activity. Although most protocols across various directions are still in early stages and infrastructure remains quite immature, this hasn't dampened people's enthusiasm for chasing these innovations.

From a long-term perspective, the majority of today’s projects, tokens, or NFTs will eventually fade away. However, that doesn’t prevent them from generating significant wealth effects during their early development phases.

I’ve consistently followed the BTC ecosystem mainly due to the following considerations:

1️⃣ BTC’s price cannot rise forever. As we approach halving events, miners’ revenue becomes less secure. While dynamic equilibrium may exist, given the understanding that “hash power is the foundation of security,” new narratives are required to address this issue.

2️⃣ One solution is building a BTC ecosystem—generating more transactions to provide sufficient transaction fees for miners. Another possibility is increasing supply (though many claim this is impossible, I don’t believe it’s entirely out of the question). Relatively speaking, the second option could damage BTC’s consensus, making the first one clearly superior—and the first naturally brings forth a new narrative.

However, due to limitations in BTC’s underlying architecture, development progress across all fronts has been slow. In the fast-moving, information-dense world of crypto, it’s easy to lose focus—and as a result, I missed early opportunities in some rapidly developing BTC ecosystem sectors.

Personally, I believe BTC-chain NFTs face constraints due to block space limits, and I tend to view inscriptions more as “ornaments” (although my understanding might be flawed). While both play important roles in fueling the BTC ecosystem boom—being easy to grasp and conducive to FOMO—they still aren’t, in my view, foundational enough to support complex ecosystems.

My attention leans more toward innovations that could fundamentally transform the entire BTC ecosystem. So today, let me talk about a protocol I find particularly promising:

2. Discussing the RGB Protocol

2.1 What Is the RGB Protocol?

In simple terms, you can think of this protocol as being designed specifically to enable smart contracts on the Bitcoin network. One key reason for ETH’s rise was the introduction of smart contracts, which gradually enabled a vast and diverse ecosystem. Various assets and financial models were introduced via contracts (which I personally understand as functions), even linking to the real world (today’s RWA).

So, if we introduce smart contracts into the BTC system, couldn’t we also generate many interesting applications?

Absolutely! (I don’t agree with the notion that BTC only holds store-of-value utility.)

But because BTC’s codebase differs greatly from ETH’s, building contracts directly on it is extremely difficult—requiring highly crypto-native innovation.

2.2 The UTXO Model

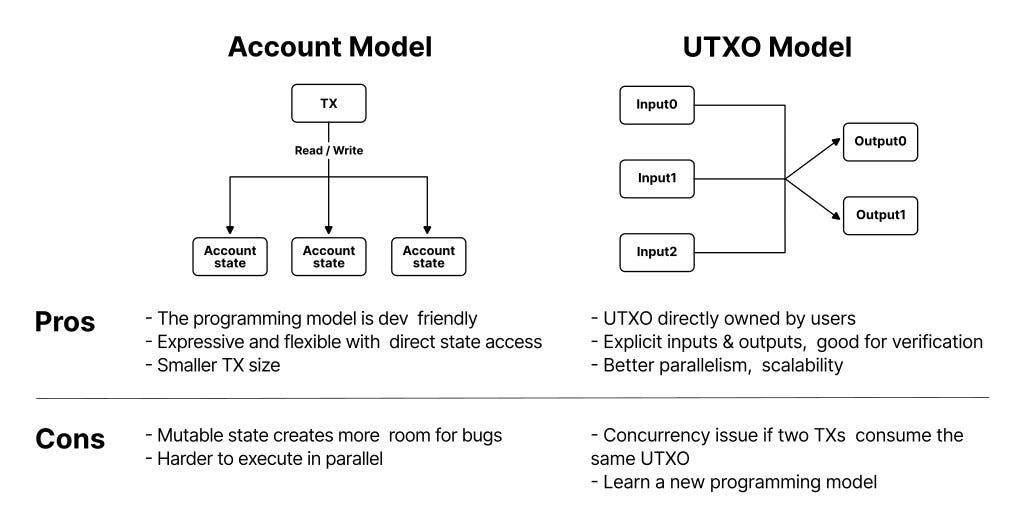

Before diving deeper, let’s first look at Bitcoin’s account model (because without this, later parts will be hard to follow).

We’re familiar with traditional account models: accounts with balances, where transactions simply transfer a certain amount of tokens from A to B.

But the UTXO model works differently—it has no accounts or balances, only transaction records.

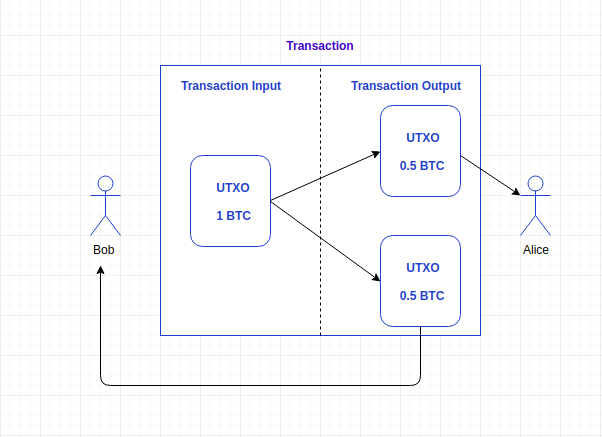

Speaking of transactions, they have inputs and outputs. But even this concept of “transaction” differs from our conventional understanding—see the diagram below:

You’re Bob, holding 1 BTC, which exists within a single UTXO. Now you send 0.5 BTC to Alice (ignoring gas fees here). This results in two new UTXOs: one worth 0.5 BTC assigned to you (bottom right), and another 0.5 BTC UTXO assigned to Alice (top right). The original UTXO becomes unusable. Of course, if your input (on the left) consists of multiple UTXOs (e.g., your 1 BTC is actually composed of 0.8 BTC + 0.2 BTC), things get more complicated.

You can see that transaction data is propagated by continuously creating new UTXOs from old ones—a mechanism completely different from ETH’s account model (where account states resemble traditional databases, with names and balances that update upon spending…).

2.3 How RGB Works

According to its official documentation, the RGB protocol operates as follows:

1️⃣ An asset issuer creates a new asset on the client side, generating a one-time seal and a commitment. At this point, the asset is tied to a Bitcoin UTXO (either existing or newly created).

2️⃣ The issuer anchors the new asset to the Bitcoin network by embedding the commitment into a Bitcoin transaction output (UTXO).

3️⃣ The recipient verifies asset validity by accepting the commitment and validating the one-time seal.

4️⃣ During asset transfers, the old one-time seal is destroyed, while new seals, commitments, and transaction data are anchored to the Bitcoin network.

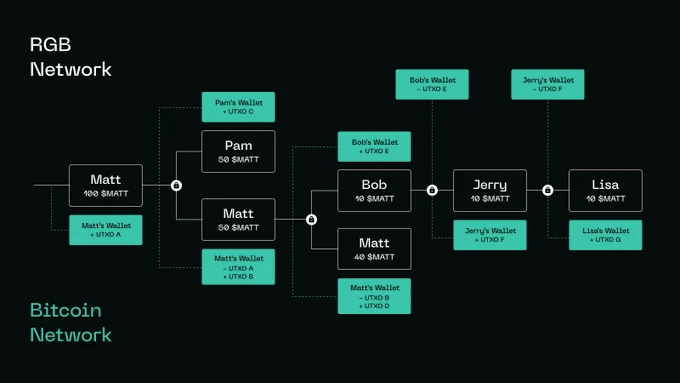

Twitter user @trustmachinesco explained this process more intuitively:

1️⃣ Matt issues 100 $MATT tokens for himself on the RGB network.

2️⃣ On the Bitcoin network, Matt’s token issuance corresponds to his current Bitcoin UTXO A.

3️⃣ Matt sends 50 $MATT tokens to Pam.

4️⃣ On the Bitcoin network, Matt’s transfer corresponds to a new UTXO B, while UTXO A from step 2 is destroyed.

5️⃣ On the Bitcoin network, Pam receiving the tokens corresponds to a new UTXO C, representing her current Bitcoin UTXO.

6️⃣ Similarly, when Pam makes a transfer, her previous UTXO C is destroyed and replaced with a new UTXO D.

As $MATT tokens continue changing hands, each transfer is represented by a corresponding UTXO on the Bitcoin mainnet.

But since we can’t create contracts directly on-chain, how do off-chain contracts map to UTXOs? This is where another RGB innovation comes in: client-side validation.

In the RGB protocol, transaction validation and data storage occur on the client side (e.g., wallet software), not on the blockchain. This keeps transaction data off-chain, enhancing privacy. Client-side validation also reduces on-chain data storage needs, improving network scalability—this is a major difference between RGB and BRC20. Since transaction data resides off-chain, RGB can theoretically alleviate current network congestion and high fee issues.

In summary:

The RGB protocol leverages the high security of Bitcoin’s mainnet UTXO model to guarantee the security of off-chain asset issuance and contract logic.

2.4 Advantages of RGB

1️⃣ Security: Inherits the robust security of the BTC network;

2️⃣ Privacy: Transaction details are not publicly recorded on-chain, offering confidentiality. However, this privacy is relative—those holding the corresponding UTXO can trace back historical data;

3️⃣ Scalability: Can seamlessly integrate with Layer-2 solutions like the Lightning Network—a feature I highly value. If the Lightning Network enables faster transactions on Bitcoin and RGB introduces smart contracts, wouldn’t this effectively replicate ETH’s high-speed smart contract system?!

Some might ask: what’s the point of replication? There absolutely is a point!

1) BTC offers higher security, meaning smart contracts built atop it would also enjoy relatively stronger security;

2) It unlocks dormant capital on BTC or attracts users who only trust the Bitcoin network, giving them more use cases;

3) Enables DeFi, which would significantly help solve the miner revenue issue mentioned earlier;

4) Reduced congestion: Only homomorphic commitments requiring extra storage are kept on-chain;

5) Upgradable without hard forks: Off-chain operations leave the main chain unaffected;

6) Stronger censorship resistance than Bitcoin itself: Since transaction details aren’t visible, miners cannot observe asset flows within transactions.

3. The RGB Ecosystem

Although the RGB protocol has existed for a while and enjoys strong legitimacy, it has remained relatively under the radar (though I believe awareness will grow). Currently, the ecosystem includes the following projects:

3.1 Infinitas

Website: https://www.iftas.tech/

Infinitas is a Bitcoin application ecosystem integrating the RGB protocol and the Lightning Network, aiming to deliver enhanced privacy, superior throughput, and low-latency transaction processing.

Reportedly, Infinitas will implement an intrinsic economic incentive model, initially distributing tokens through mining to promote long-term ecosystem growth.

3.2 COSMINMART

Website: https://cosminmart.com/

COSMINMART is a new Bitcoin application ecosystem built on the Lightning Network, compatible with protocols like RGB and supporting smart contracts. Its product suite includes:

COSM Wallet

COSM Market

COSM Launchpad

3.3 Pandora Prime Inc

Website: https://pandoraprime.ch/

Pandora Prime aims to pioneer Bitcoin Finance (BitFi) by combining RGB smart contracts with the Lightning Network. Starting with programmable assets on Bitcoin (RGBTC and CHFN), these assets can scale transaction throughput via the Lightning Network to Visa/MasterCard levels. They also offer convenient facilities for exchanging these assets, enabling transactions under 1,000 Swiss francs without cumbersome KYC procedures (compliant with Swiss regulations). Current products include MyCitadel (wallet), RGB Explorer (block explorer), and Pandora Network.

3.4 DIBA (Digital Bitcoin Art)

Website: https://diba.io/

Products include DIBA and Bitmask

DIBA

The first marketplace for trading Bitcoin NFTs using the RGB smart contract protocol and the Lightning Network (referred to as such by DIBA).

Bitmask

A wallet developed by DIBA, serving as the first NFT wallet in the RGB ecosystem. It runs in web browsers and interacts with RGB contracts similarly to how MetaMask operates on Ethereum.

3.5 Bitswap-BiFi

GitHub: https://github.com/BitSwap-BiFi/Bitswap-core

The RGB ecosystem is actively exploring DEX solutions to address liquidity challenges for RGB assets. Bitswap’s demo and proof-of-concept show how “SWAPS” can be introduced into a DEX, though AMM or LP mechanisms are not yet implemented. Still in early validation phase—very nascent, but worth watching.

4. Participation Opportunities

After reviewing these projects, I found the infrastructure still very immature, and wallet experiences subpar. Yet precisely because it’s so early, we have greater opportunities to get involved at the ground level.

Suggestion 1: Start using the wallets—especially testnets if available. Try them out not just to understand the flow, but also to provide feedback to project teams.

Suggestion 2: Keep an eye on similar projects. I’m currently tracking “Taproot (Taro),” which shares a very similar design to RGB. However, it’s backed by the “Lightning Labs team,” which raised $70 million—well-funded and well-staffed—while the RGB team faces more challenges. That said, RGB’s code is open-source and holds a first-mover advantage in technical circles.

Suggestion 3: Pay close attention to meme and NFT-type projects within the RGB ecosystem—they might yield pleasant surprises.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News