Will the rapidly growing Morpho be a potential competitor to Aave?

TechFlow Selected TechFlow Selected

Will the rapidly growing Morpho be a potential competitor to Aave?

How promising is the newly launched Morpho Blue business, and could it challenge the leading positions of Aave and Compound? What are the other potential impacts?

Author: Alex Xu

Introduction

After going through the bull and bear cycle from 2020 to 2023, we observe that in the Web3 business world, at the application layer, DeFi remains the only truly viable business model category. DEXs, lending protocols, and stablecoins continue to be the three pillars of DeFi (with derivatives also making significant progress in recent years). Even during bear markets, their operations remain resilient.

Mint Ventures has previously published numerous research reports and analytical articles on DEXs and stablecoins—covering ve(3,3)-type projects such as Curve, Trader Joe, Syncswap, Izumi, and Velodrome for DEXs, and MakerDAO, Frax, Terra, Liquity, Angle, and Celo for stablecoin projects. This edition of Clips returns focus to the lending sector, with particular attention on Morpho, a rising player whose business data has grown rapidly over the past year.

In this article, I will review Morpho’s current operations and its recently announced lending infrastructure service, Morpho Blue, attempting to answer several key questions:

-

What is the current market landscape in the decentralized lending space?

-

What businesses does Morpho operate? What problems is it trying to solve? And how is its business developing?

-

How promising is the newly launched Morpho Blue? Will it challenge the dominant positions of Aave and Compound? What are the potential implications?

The views expressed below represent the author's opinions as of publication and may contain factual inaccuracies or biases. They are intended solely for discussion purposes, and feedback from other researchers and investors is welcome.

Market Landscape of Decentralized Lending

Organic Demand Becomes Mainstream, Ponzi Characteristics Fade

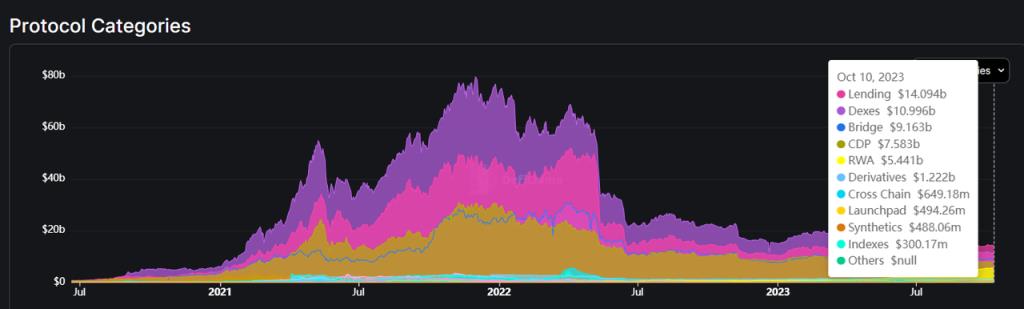

Decentralized lending consistently ranks among the top sectors by capital capacity and has now surpassed DEXs to become the largest segment in DeFi by total value locked (TVL).

Source: https://defillama.com/categories

Decentralized lending is one of the few commercial categories in Web3 that has achieved product-market fit (PMF). Although during the 2020–2021 DeFi summer boom many projects heavily subsidized borrowing activities with token incentives, this phenomenon has greatly diminished in the bear market.

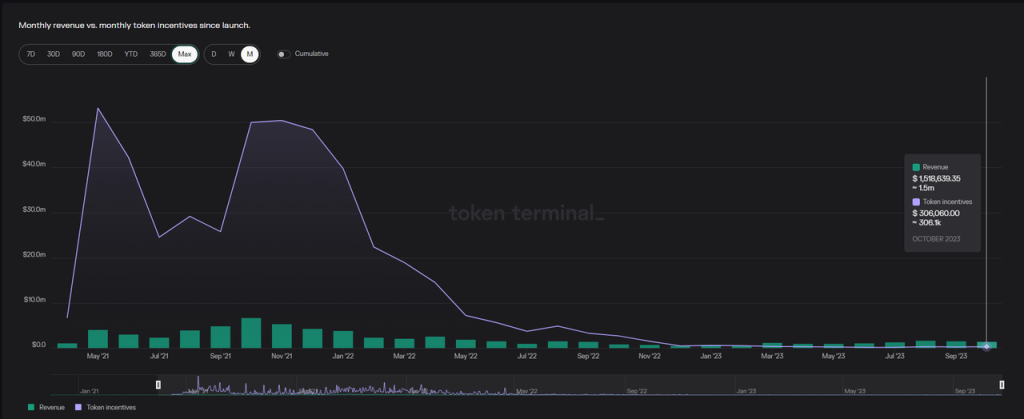

As shown below, Aave—the leading protocol in the lending space—has seen its protocol revenue exceed token incentive disbursements since December 2022, and currently far surpasses them (protocol revenue was $1.6 million in September, compared to $230,000 in AAVE token incentives). Moreover, Aave’s token incentives are primarily used to encourage AAVE holders to stake tokens as a backstop for covering bad debts when treasury funds are insufficient, rather than incentivizing deposit or borrowing behavior. Therefore, Aave’s deposit and borrowing activities are now entirely “organic,” not sustained by liquidity mining or Ponzi-like structures.

Monthly comparison of Aave’s incentive disbursements vs. protocol revenue

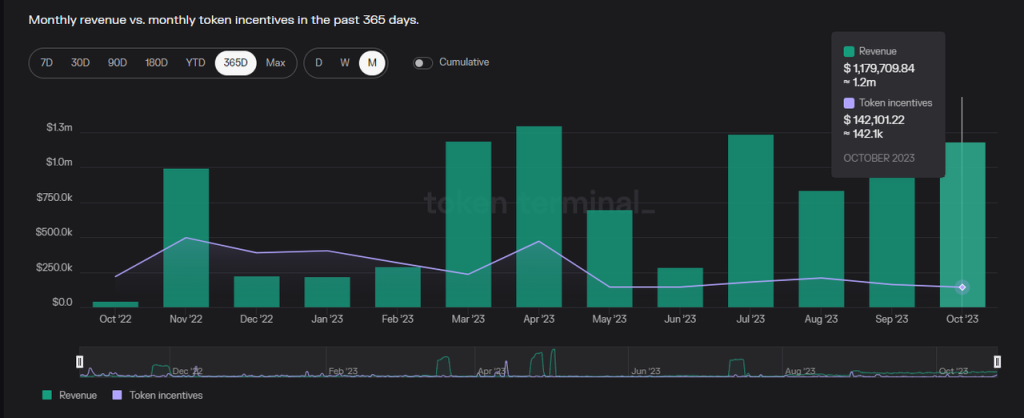

Additionally, Venus, the leading lending protocol on BNB Chain, has also achieved healthy operations where protocol income exceeds incentive payouts after March 2023, and currently offers little to no subsidies for deposits or borrowings.

Monthly comparison of Venus’ incentive disbursements vs. protocol revenue

However, many lending protocols still rely on high token subsidies, where the cost of incentivizing supply and demand far exceeds the revenue generated.

For example, Compound V3 continues to provide COMP token rewards for both deposits and borrows.

Nearly half of the USDC deposit rate on Ethereum mainnet under Compound V3 comes from token subsidies

On Base mainnet, 84% of the USDC deposit rate in Compound V3 is provided by token subsidies

If Compound maintains its market share through generous token subsidies, then another protocol, Radiant, represents a pure Ponzi structure.

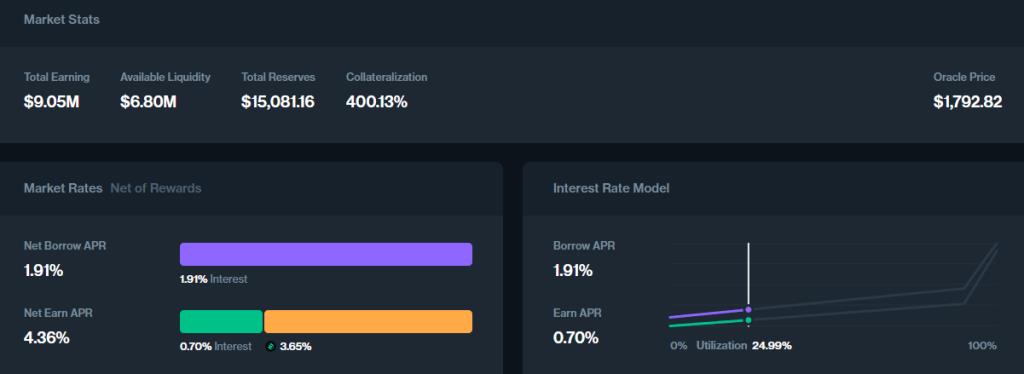

On Radiant’s lending market page, two unusual phenomena can be observed:

First, its borrowing rates are significantly higher than market norms. While typical stablecoin lending rates hover around 3–5%, Radiant charges 14–15%, and rates for other assets are 8–10 times higher than mainstream markets.

Second, the platform actively promotes circular lending—encouraging users to repeatedly deposit and borrow the same asset, amplifying their "total deposit/borrow volume" to maximize mining rewards in RDNT tokens. In essence, the Radiant team is indirectly selling their RDNT tokens to users via borrowing fees.

The problem is that the source of these fees—the borrowing activity—is not driven by genuine organic demand but by users chasing RDNT tokens, creating a self-referential Ponzi economy. In this system, there are no real “financial consumers.” Circular lending is not a healthy model because the depositor and borrower of the same asset are often the same user, and the economic source of RDNT dividends is also the user themselves. The only risk-free beneficiary is the platform, which takes 15% of interest income as profit. Although mechanisms like RDNT’s dLP staking delay short-term death spirals during price drops, unless Radiant transitions toward a sustainable business model, a collapse seems inevitable in the long run.

Overall, however, leading players like Aave are gradually moving away from reliance on heavy subsidies and returning to healthier business models.

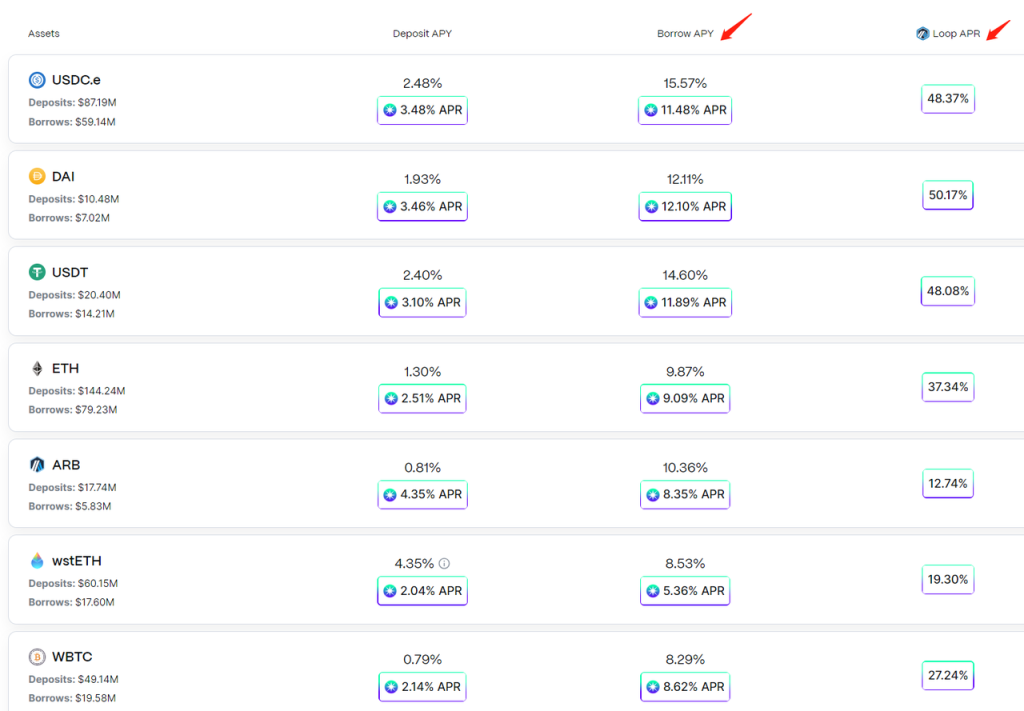

The chart below shows active loan volume in the Web3 lending market from May 2019 to October 2023—from initial levels of hundreds of thousands of dollars, peaking at $22.5 billion in November 2021, dropping to $3.8 billion in November 2022, and now recovering to around $5 billion. The lending market is slowly bottoming out and showing strong commercial resilience even during bear conditions.

Strong Moats, High Market Concentration

As core DeFi infrastructure, lending protocols enjoy stronger moats compared to the fiercely competitive DEX market. This is evident in two aspects:

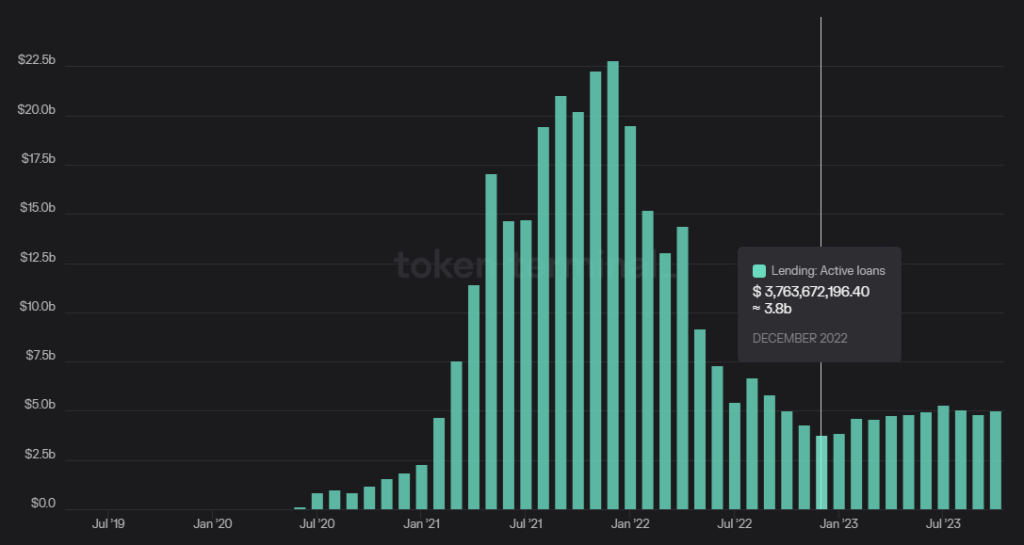

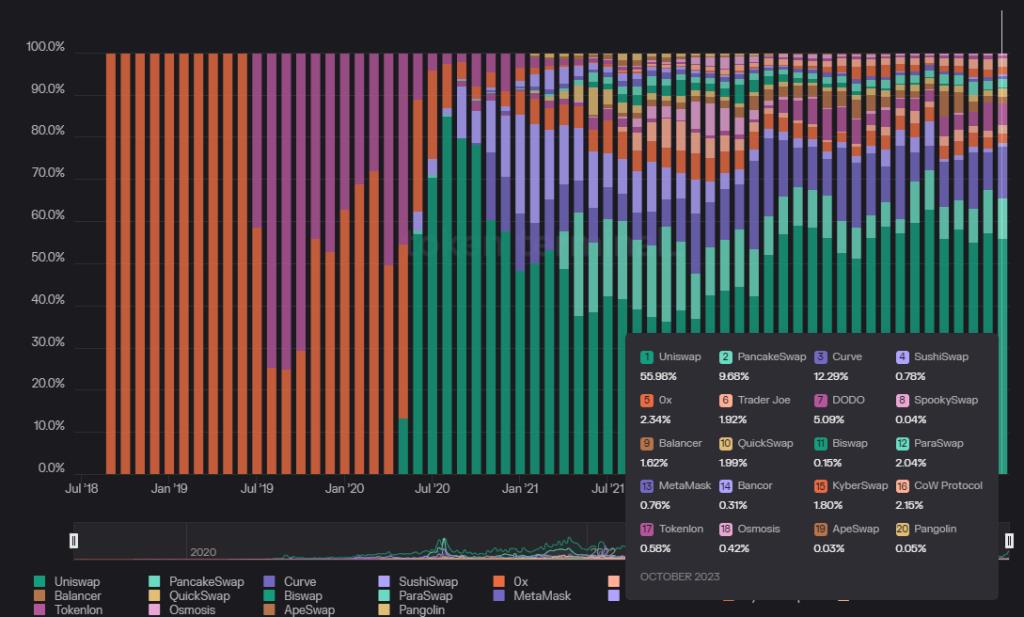

1. More stable market share. The chart below shows the evolution of active loan volume share across protocols from May 2019 to October 2023. Since Aave ramped up efforts in mid-2021, its market share has remained steadily between 50% and 60%. Although Compound has seen its share gradually eroded, it remains firmly in second place.

In contrast, DEX market shares have been more volatile. After Uniswap quickly captured nearly 90% of trading volume upon launch, competition from Sushiswap, Curve, and Pancakeswap caused its share to drop to 37%, though it has since recovered to around 55%. Additionally, the number of DEX projects far exceeds that of lending protocols.

2. Stronger profitability among top lending protocols. As discussed earlier, protocols like Aave already generate positive cash flow without subsidizing borrowing activity, earning monthly net interest income of approximately $1.5–2 million. Most DEXs, by contrast, either do not charge protocol fees (like Uniswap, which only charges front-end fees) or spend more on token emissions than they earn in fees, operating at an effective loss.

The moat of leading lending protocols can be broadly attributed to brand-based security, further broken down into two points:

-

Long history of secure operation: Since DeFi Summer 2020, numerous forks of Aave or Compound have emerged across various chains, but most suffered hacks or large-scale bad debt losses shortly after launch. Aave and Compound, however, have never experienced major thefts or unmanageable defaults. This track record of prolonged, secure operation in live environments serves as the strongest security endorsement for depositors. New entrants, no matter how innovative or high their APY, struggle to gain trust—especially from whales—without having weathered multiple years of operation.

-

Ample security budget: Leading protocols generate higher revenues and maintain well-funded treasuries, enabling robust investments in security audits and risk management. This is crucial for both new feature development and onboarding new assets.

In summary, lending is a market that has proven organic demand, healthy business models, and relatively concentrated market share.

Morpho’s Business Operations and Current Status

Business Model: Interest Rate Optimization

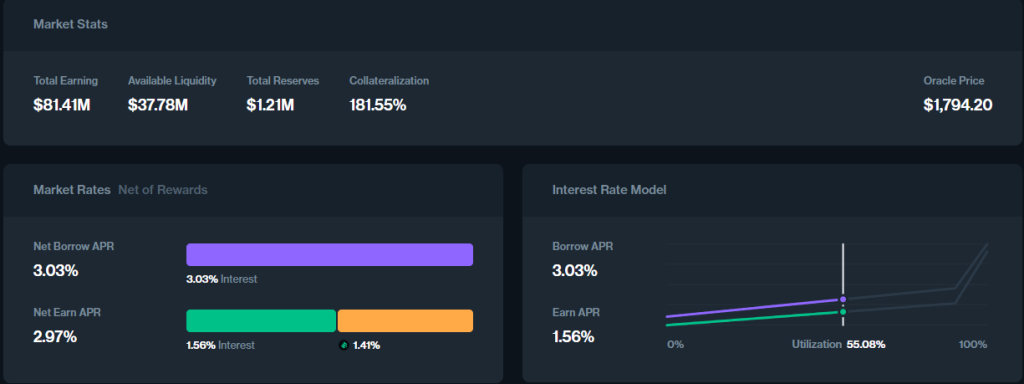

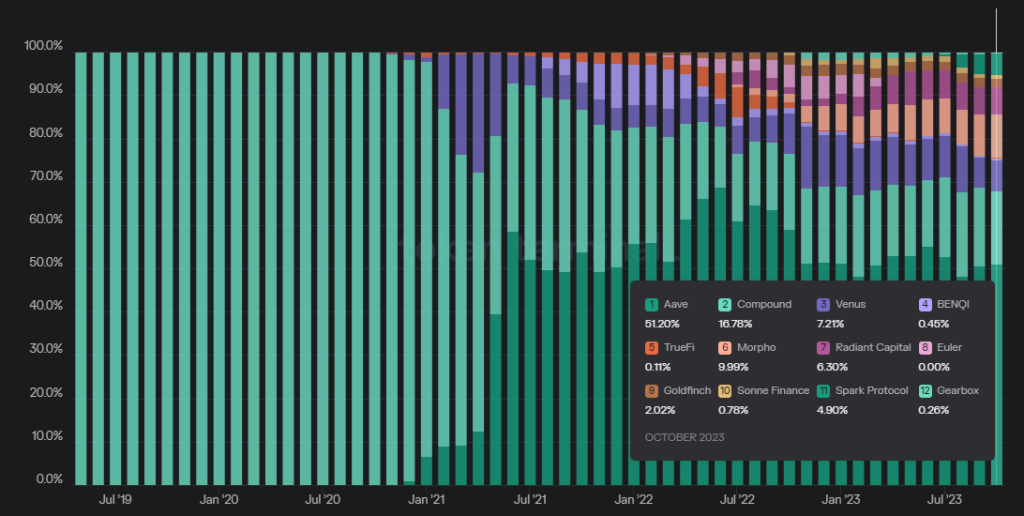

Morpho currently operates a peer-to-peer (P2P) lending protocol (also known as an interest rate optimizer) built atop Aave and Compound. Its purpose is to address inefficiencies in pool-based lending protocols like Aave, where mismatches between deposits and loans lead to suboptimal capital efficiency.

Its value proposition is simple and clear: offer better interest rates—higher yields for lenders and lower borrowing costs for borrowers.

Pool-based models like Aave and Compound suffer from capital inefficiency because the total size of deposited funds always exceeds the amount actually borrowed. For instance, a USDT market might hold $1 billion in deposits but only lend out $600 million.

For depositors, idle funds dilute yield distribution—only $600 million generates interest, yet it must be shared among all $1 billion in deposits. For borrowers, although they use only part of the pool, they effectively pay interest on the entire pool balance. This mismatch creates inefficiencies.

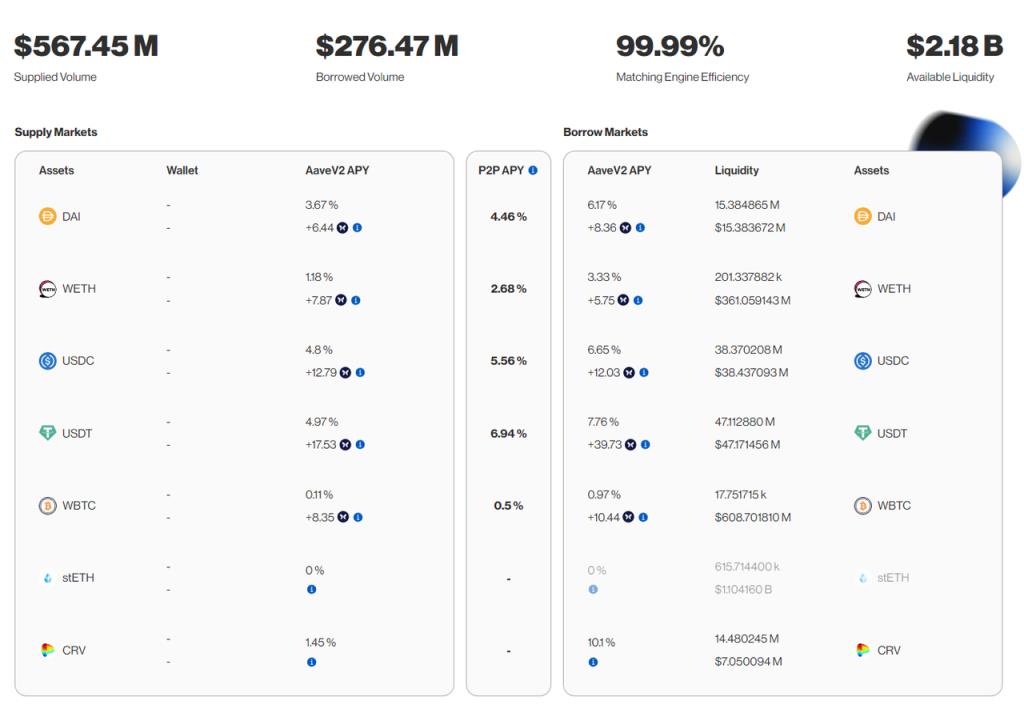

Let’s examine how Morpho addresses this using its Aave V2-based interest rate optimizer—the largest module by deposit volume.

-

Deposit: User BOB deposits 10,000 DAI into Morpho. Morpho first deposits this into Aave V2’s money market, where the base rate is 3.67%.

-

Borrow & Collateralize: Borrower ALICE deposits 20 ETH as collateral into Morpho and requests to borrow 10,000 DAI. Morpho deposits the ETH into Aave V2.

-

Matching: Morpho withdraws the 10,000 DAI previously deposited by BOB from Aave and directly lends it to ALICE. Now, BOB’s deposit is fully utilized and matched with ALICE’s loan. BOB earns a higher rate (4.46%) instead of the pool’s 3.67%; ALICE pays only 4.46% instead of the full pool rate of 6.17%. Both sides benefit from optimized rates.

*Note: Whether the P2P rate (e.g., 4.46%) leans closer to the underlying protocol’s deposit APY or borrowing APY is determined by parameters set through governance.

-

Mismatch Handling: If BOB wants to withdraw his funds before ALICE repays, and no other lender is available on Morpho, Morpho uses ALICE’s 20 ETH as collateral to borrow 10,000+ DAI plus interest from Aave to fulfill BOB’s redemption request.

-

Matching Priority: To minimize gas costs, larger deposits and loans are matched first. Smaller amounts may not be matched if gas costs outweigh benefits.

From the above, we see that Morpho essentially uses Aave and Compound as capital buffers, offering interest rate optimization via P2P matching.

The brilliance lies in leveraging composability: Morpho attracts capital seemingly out of thin air. Users are drawn because:

1. At worst, they receive the same rates as Aave or Compound; when matches occur, their returns/costs improve significantly.

2. Built on Aave and Compound, Morpho inherits their risk parameters and capital allocation, thus benefiting from their established reputations.

This clever design and clear value proposition enabled Morpho to reach nearly $1 billion in deposits within just over a year—second only to Aave and Compound in scale.

Business Data and Token Status

Business Metrics

The chart below shows Morpho’s total deposits (blue), total borrows (light brown), and matched amounts (dark brown).

Overall, all metrics show steady growth, with deposit matching at 33.4% and borrow matching at 63.9%—impressive figures.

Token Overview

Source: Official documentation

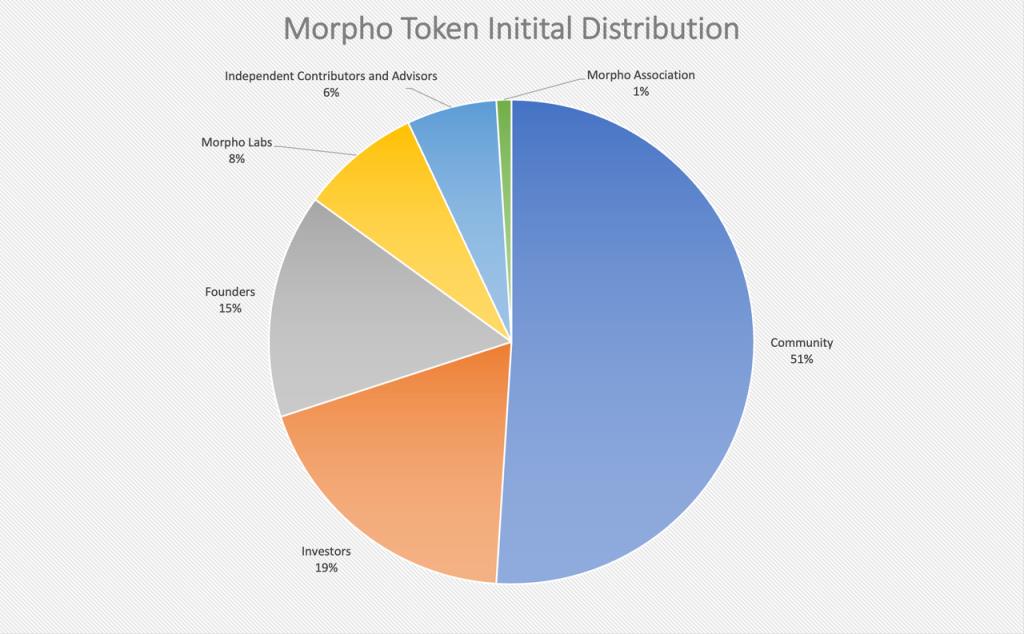

Morpho’s total token supply is 1 billion, with 51% allocated to the community, 19% sold to investors, 24% held by founders, Morpho Labs (development company), and Morpho Association (operating entity), and the remainder to advisors and contributors.

Notably, while the Morpho token has been issued and used in voting and incentives, it remains non-transferable. There is no secondary market, so recipients—including investors—can participate in governance but cannot sell.

Unlike protocols like Curve, which hardcode future token emissions and incentives, Morpho distributes tokens in batches—quarterly or monthly—allowing governance to flexibly adjust incentive strategies based on market dynamics.

This pragmatic approach may become the standard for Web3 token incentive models.

Morpho incentivizes both depositing and borrowing, but token allocations remain modest—only 30.8 million tokens (3.08% of total supply) distributed over the past year. As shown below, token spending on incentives is rapidly decreasing without slowing business growth—a positive signal indicating strong PMF and increasingly organic demand. With nearly 48% of the community allocation remaining, ample room exists for future business expansion.

Still, Morpho does not yet charge fees for its services.

Team and Funding

Morpho’s core team is based in France, primarily operating from Paris. All key members are publicly identified, with the three founders coming from telecommunications and computer science backgrounds, with prior experience in blockchain startups and development.

Morpho has completed two funding rounds: a $1.3 million seed round in October 2021, followed by an $18 million Series A in July 2022 led by a16z, Nascent, and Variant.

Source: Official website

Assuming the $19.3 million raised corresponds to the disclosed 19% investor allocation, the implied valuation is approximately $100 million.

Morpho Blue and Its Potential Impact

What Is Morpho Blue?

Simply put, Morpho Blue is a permissionless lending infrastructure layer. Unlike Aave or Compound, Morpho Blue opens up most lending dimensions, allowing anyone to build custom lending markets with choices over:

-

Which assets serve as collateral;

-

Which assets are lent out;

-

Which oracle to use;

-

Loan-to-value (LTV) and liquidation thresholds (LLTV);

-

Interest rate models (IRM);

What value does this create?

According to official materials, Morpho Blue’s key features include:

-

Trustless, because:

-

Morpho Blue is immutable—no one can alter it, adhering to minimal governance principles

-

Only 650 lines of Solidity code—simple and secure

-

-

Efficient, because:

-

Users can choose higher LTVs and better rates

-

Platforms avoid third-party audit and risk management fees

-

Uses a singleton smart contract (like Uniswap V4), reducing gas costs by ~70%

-

-

Flexible, because:

-

Market creation and risk management (oracles, lending parameters) are permissionless—no longer following a single standardized model dictated by a central DAO (as with Aave and Compound)

-

Developer-friendly: Supports modern smart contract patterns including gasless interactions, account abstraction, and free flash loans accessible in a single call—as long as repaid within the same transaction

-

Morpho Blue follows a Uni V4-style philosophy: act solely as foundational infrastructure, opening up higher-level modules for others to build upon.

The key difference from Aave: while Aave allows permissionless deposits and borrows, decisions about which assets can be traded, whether risk policies should be conservative or aggressive, which oracles to use, and how to set interest and liquidation parameters are made by Aave DAO and supporting service providers like Gauntlet and Chaos, who manage over 600 risk parameters daily.

Morpho Blue functions like an open lending operating system—anyone can build their ideal lending market atop it. Professional risk managers like Gauntlet or Chaos can enter the ecosystem as service providers, offering risk modeling and earning fees.

In my view, Morpho Blue’s core value isn’t just trustlessness, efficiency, or flexibility—it’s enabling a free market for lending innovation, facilitating collaboration across all layers of the lending stack and offering richer choices for every participant.

Will Morpho Blue Threaten Aave?

Possibly.

Morpho differs from previous challengers to Aave. Over the past year, it has accumulated several advantages:

-

$1 billion in assets under management—approaching Aave’s $7 billion scale. While currently tied to Morpho’s rate optimizer, there are multiple pathways to migrate this capital to new products;

-

As the fastest-growing lending protocol over the past year, and with its token not yet tradable, Morpho retains significant upside potential—its major new features could easily attract widespread participation;

-

Ample and flexible token reserves allow early-stage user subsidies;

-

A solid operational history and substantial capital base have helped build credibility in security.

That said, Aave isn’t necessarily at a disadvantage. Most users may lack the ability or desire to evaluate numerous lending options. The standardized products offered under Aave DAO’s governance may still remain the most popular choice.

Moreover, Morpho’s rate optimizer largely inherits Aave and Compound’s security reputation, making users comfortable. But Morpho Blue is a new product with standalone code—whales will likely hesitate before committing large sums, especially given recent incidents like Euler’s hack involving permissionless lending.

Furthermore, Aave could theoretically build its own version of a P2P optimizer to meet demand for better capital matching and push Morpho out of that niche. While unlikely now—Aave even granted funding to NillaConnect, a Morpho-like P2P project, in July instead of building in-house.

Finally, Morpho Blue’s underlying business model isn’t fundamentally different from Aave’s. Aave can observe and replicate successful lending models emerging on Morpho Blue.

Regardless, once launched, Morpho Blue will create a more open testing ground for lending innovations—offering unprecedented composability across the lending stack. Could any of these new combinations rise to challenge Aave?

We’ll have to wait and see.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News