The Mystery of Morpho Attracting 12 Billion: What Are These Whales Really Playing At?

TechFlow Selected TechFlow Selected

The Mystery of Morpho Attracting 12 Billion: What Are These Whales Really Playing At?

Over-collateralized lending protocols have become an unexpected solution for market-neutral funds to achieve leveraged returns.

Author: hersch & Dr.Larpist CEO CTO PHD LGBT

Translation: TechFlow

Have you noticed that there's now casually $12 billion worth of assets sitting on Morpho?

Is $12 billion enough to retire?

Let me walk you through what’s actually happening here, because at first glance, this makes absolutely no sense. This is an overcollateralized lending protocol—meaning for every $1 you deposit, it generously lets you borrow $0.75 back. So… who in the world would use this machine? Who would willingly lock up more capital than they can actually pull out? This seems completely backwards. Like the worst deal protocol in history. But hold on—look closer at who’s really using it and what they’re doing, and you’ll find something truly interesting.

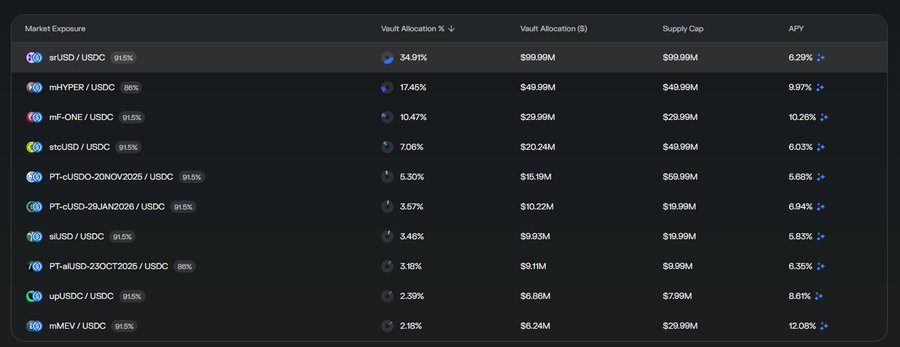

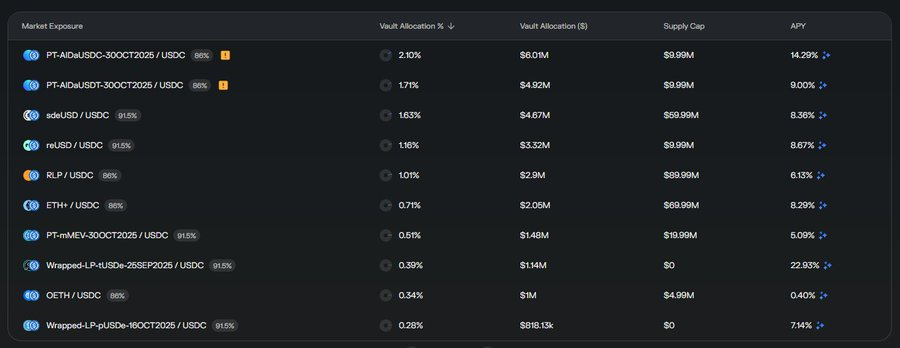

Take a look at the holdings of the second-largest vault on Morpho.

What are these strange tokens?

Seriously, look at this stuff. This isn’t some fool dumping their life savings into meme coins, nor a whale arbitraging across exchanges. This is a carefully constructed portfolio that, on the surface, appears… almost professional? Strategic? As if operated by people who genuinely know what they’re doing?

Turns out, something really cool is going on here…

DeFi is replicating traditional asset management models.

The core playbook of traditional finance: 8 out of the world’s top 10 hedge funds—the real giants managing hundreds of billions in assets—are essentially doing the same thing. They build diversified, market-neutral portfolios, systematically hedge out market risk (Beta) to extract alpha, then apply leverage across the entire portfolio to amplify returns. That’s their playbook. This is how big money operates in traditional finance. It’s not rocket science—just precise risk management combined with leverage to magnify otherwise modest returns.

But strangely: DeFi has no portfolio leverage.

There isn’t a single decentralized exchange (DEX) in the entire industry offering this functionality widely used by nearly every major asset manager. Think about it—we’ve built a full parallel financial system with automated market makers (AMMs), yield aggregators, perpetual contracts, options protocols, lending markets—you name it—but we completely forgot to implement the core tools needed for institutional-grade portfolio management.

So what does this have to do with Morpho? Morpho doesn’t even offer simple unsecured loans, let alone complex portfolio margin features that institutional traders rely on.

This is genuine “fine dining.”

The truth is, those colorful tokens in the screenshot above—things that look like DeFi protocols but feel slightly off—are actually market-neutral funds that trade almost entirely off-chain. These are real funds, managed by real people, running legitimate strategies from traditional markets. The clever part? They wrap these strategies as on-chain tokens purely for distribution. It’s essentially a wrapper allowing DeFi users to access off-chain strategies without dealing with the administrative nightmare of traditional fund management—no compliance hurdles, KYC, accredited investor checks, or sluggish operations.

Vault Curators on Morpho collect these tokens and assemble diversified portfolios of market-neutral, off-chain funds. They effectively act as fund-of-funds (FoF) managers—selecting which strategies to include, assigning weights, and balancing risk across the portfolio. Users and investors can then apply recursive leverage to these diversified, market-neutral portfolios via vaults—deposit collateral, borrow funds, redeposit the borrowed amount as new collateral, and repeat—stacking leverage onto a portfolio built on market-neutral, institutional-grade strategies.

So suddenly, that “75-cent vending machine” makes perfect sense.

If you're running a market-neutral strategy generating stable, low-volatility returns, the ability to amplify it 3x to 4x through recursive leverage turns an 8% annual return into a much more attractive 24%–32%. And because the underlying portfolio is market-neutral and diversified across multiple uncorrelated strategies, the liquidation risk remains relatively low—even under significant leverage.

DeFi has found a way—through the most un-"dumb" overcollateralized lending protocol—to perfectly replicate the core mechanics of traditional asset management: diversification, market neutrality, and portfolio leverage. It’s not elegant. It wasn’t anyone’s original intention when designing the system. But it works. And those $12 billion quietly sitting on Morpho? That’s proof. When you give people tools, they’ll always find a way to rebuild the financial systems they truly need—using makeshift fixes and overcollateralized lending protocols.

My actual reaction to all of this.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News