From Lending Product to Infrastructure: Morpho's Journey of Financial Transformation

TechFlow Selected TechFlow Selected

From Lending Product to Infrastructure: Morpho's Journey of Financial Transformation

Walking the transformation path of Morpho.

Author: TechFlow

Although MEME coins have dominated the market in recent months while DeFi has drawn less attention, with interest rate cuts now materializing, confidence in a "DeFi resurgence" is reigniting. As one of the three key pillars of DeFi development, decentralized lending is drawing renewed anticipation. Even Trump’s team has entered the space, announcing a lending project called WorldLibertyFinancial (WLF).

In discussions over who will lead DeFi's revival, Morpho—having recently announced an $50 million funding round in early August and accumulating over $80 million in total funding—is frequently mentioned.

Given its substantial funding scale, many are now asking:

Why has Morpho stood out in such a fiercely competitive lending landscape? And what is Morpho planning with this latest influx of capital?

The name “Morpho” can be directly translated as “morpho butterfly,” and its logo resembles a butterfly with wings spread. Indeed, Morpho is undergoing a stunning transformation—from its origins in 2021 as Morpho Optimizer, a lending product built on top of Aave and Compound, to today’s ambition of integrating decentralized finance with foundational internet protocols, driving private financial infrastructure toward becoming a public good.

How is this transformation unfolding? How does Morpho, as financial infrastructure, empower lending, DeFi, and even the broader financial industry?

This article explores Morpho’s evolution.

Transformation: Morpho Driving the Shift from Private Financial Infrastructure to Public Goods

Why Become Financial Infrastructure?

Morpho believes that current decentralized lending faces issues such as concentration of mainstream assets, inefficient capital utilization, suboptimal interest rates, and poor user experience. To address these, Morpho aims for systemic optimization. Financial infrastructure refers to foundational systems where multiple market participants converge to conduct financial operations. However, existing financial infrastructure stacks suffer from limited accessibility, fragmentation, poor interoperability, inefficiency, and lack of flexibility.

To systematically improve the lending sector, a complete rebuild from the ground up is necessary. Thus, Morpho aims to build a universal infrastructure layer upon which anyone can participate and innovate, pushing the boundaries of DeFi and unlocking new waves of innovation.

From a project perspective, within the crypto world there is a strong belief that being "infrastructure" offers not only greater credibility but also higher growth potential compared to being just a single product. Decentralized lending already surpasses DEXs in total value locked (TVL), making it the largest capital-absorbing segment in DeFi. By positioning itself as the foundational layer for lending, Morpho enhances its long-term growth prospects significantly.

Why Must Morpho’s Financial Infrastructure Be a Public Good?

The answer is clear: if infrastructure is privately owned, it tends to serve specific entities rather than the broader ecosystem, compromising its neutrality and purity in advancing industry-wide progress.

Morpho defines financial infrastructure as a "public resource"—something everyone can use without diminishing its availability, with all code and rules fully transparent. The only thing users need to trust is the verifiable technology itself.

What Does Morpho’s Public-Good Financial Infrastructure Look Like?

Morpho aims to build decentralized infrastructure with an internet-native ethos—one that leverages blockchain advantages while extending services beyond crypto through permissionless access and high flexibility, ultimately serving the global financial system.

Thus, Morpho’s public-good financial infrastructure has the following characteristics:

First, the base layer adheres strictly to decentralization principles. It provides provable security, trustless operation, stable functionality, and resistance to single points of failure, allowing participants to integrate confidently.

Second, the base layer is permissionless. Open to all, it offers high flexibility and freedom, enabling any developer to join and serve any user, thereby expanding reach and fostering innovation.

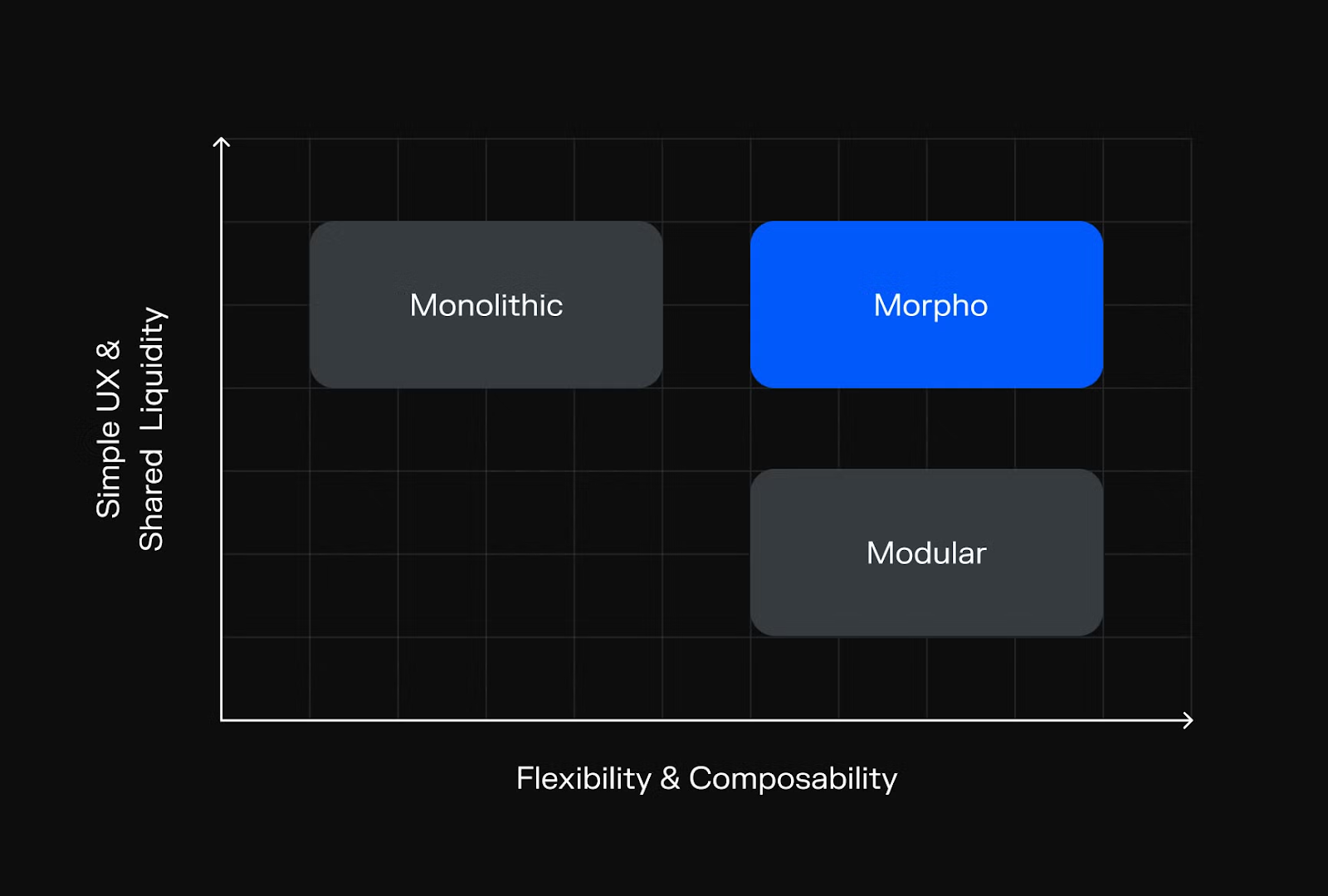

Most importantly, the base layer is primitive and composable. Many view Morpho as a modular solution, but this is a misconception. In reality, Morpho is a compositional solution, combining the strengths of both integrated and modular lending architectures. Its overall design consists of two layers:

-

Primitive Market Layer: Designed with minimalism, immutability, and flexibility, this layer offers strong security advantages, excels at connecting diverse financial applications, and supports reuse across various use cases.

-

Modular Layer built atop Primitive Markets: Focuses on delivering customized support in user experience, liquidity management, and risk control.

This structure allows Morpho’s lending solution to aggregate advantages across multiple dimensions:

In terms of security, benefiting from rigorously audited, formally verified, and immutable codebases, all lending variants are built on a robust foundation. Upgrades or changes to individual modules do not affect others.

Regarding flexibility, Morpho is not only permissionless but also avoids the limitations of unified liquidity pools and rigid risk models found in integrated lending solutions, enabling anyone to easily create and participate in lending markets with diverse assets, risks, and returns.

For liquidity, traditional modular lending often fragments liquidity due to differing logic and assets per pool, resulting in poor UX. In contrast, Morpho’s layered architecture enables reusable primitive markets, allowing different modules to pool liquidity through shared primitives.

Morpho believes that if financial activities operate on a truly decentralized, permissionless, flexible, and efficient public infrastructure, finance will enter a new era of explosive growth.

While such a public-good financial infrastructure sounds highly appealing, it may seem like trying to have it all. So how does Morpho plan to achieve this transformation?

Execution: How Do Morpho Markets and Morpho Vaults Revolutionize Lending?

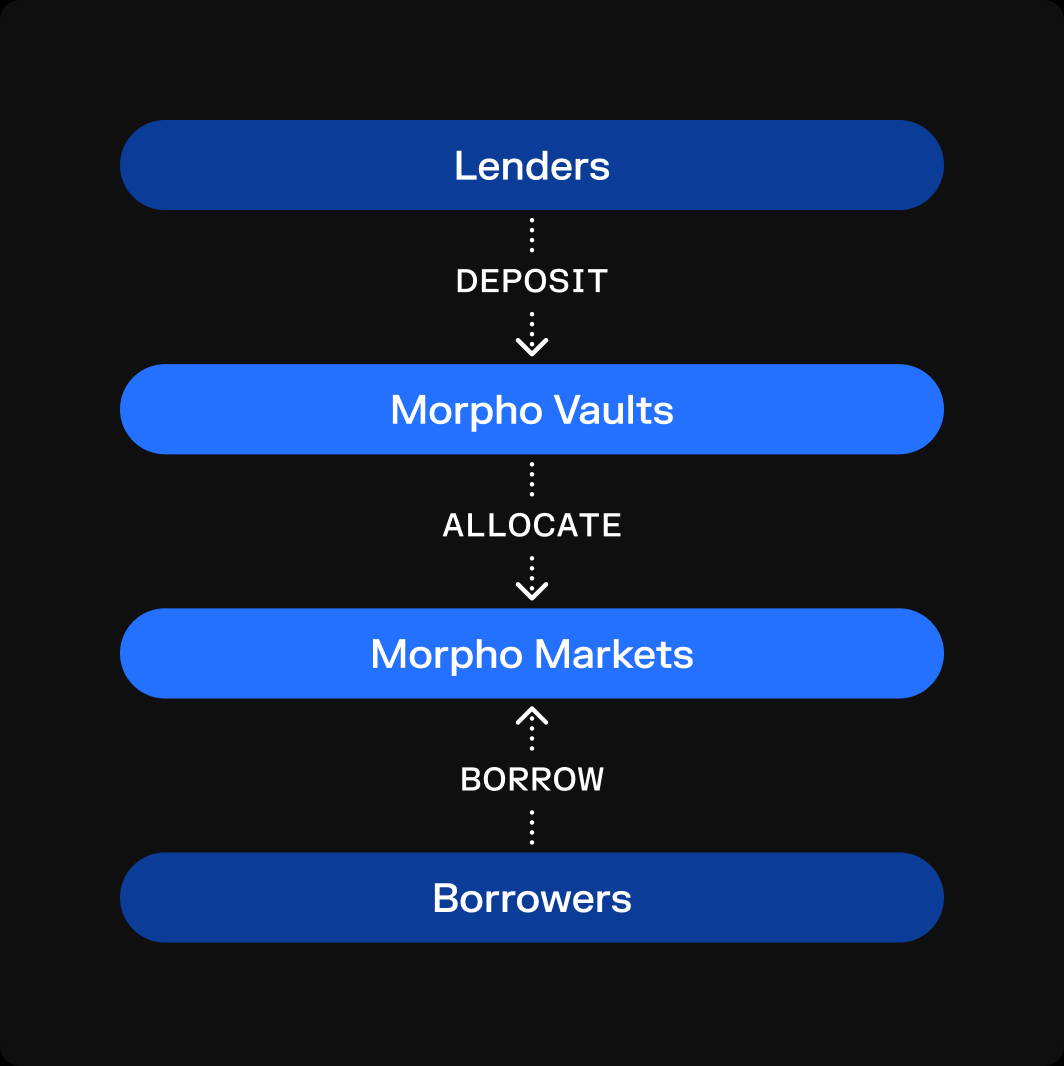

At its core, a lending market matches borrowers with lenders. Morpho aims to build an open, efficient, and flexible platform where anyone can earn yield or borrow any asset.

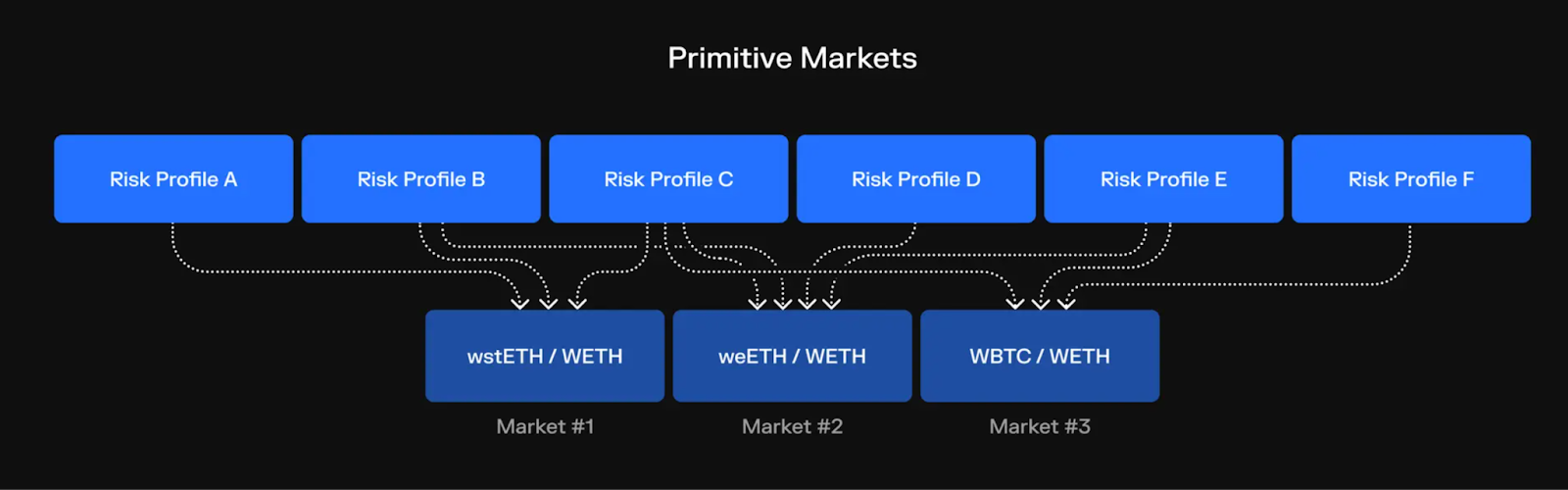

Morpho Markets is a simple, immutable single-collateral/single-loan asset market (corresponding to the primitive market layer mentioned earlier),granting creators significant autonomy. Anyone can deploy an independent lending market by specifying one collateral asset, one loan asset, an Interest Rate Model (IRM), Loan-to-Value threshold (LLTV), and oracle integration.

Additionally, since Morpho Markets are isolated, losses are immediately borne solely by users who supplied capital to that specific pool, without cross-pool risk sharing.

Morpho Vaults are professional lending vaults built on top of Morpho Markets and curated by external risk experts (corresponding to the modular layer above the primitive market).Each vault holds one loan asset and offers distinct risk/reward profiles.

Users can deposit their loan assets into a vault based on their risk appetite. The vault then aggregates liquidity into Morpho Markets, enhancing liquidity depth and improving borrower-lender matching efficiency.

For ordinary users:

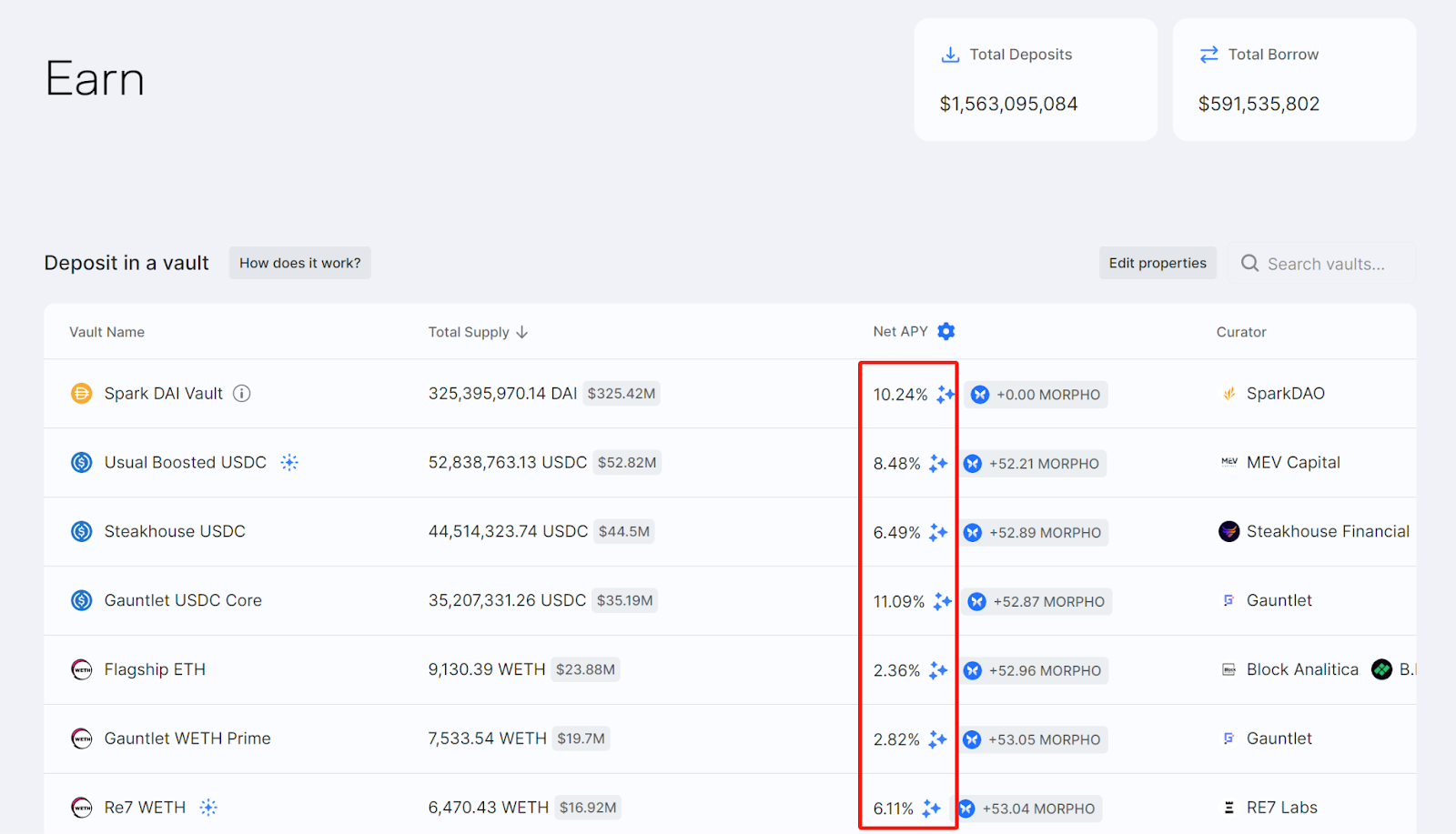

When depositing assets, users gain stronger security, more diverse participation options, and higher interest yields.

On one hand, the non-custodial nature of Morpho Vaults gives users full control over their assets.

On the other hand, users can choose vaults based on desired returns. To attract deposits, vault managers strive to optimize risk-return strategies and often share profits generously. While vault managers can earn up to 50% of interest income under protocol rules, some currently distribute 100% of earnings to users.

Currently, annual yields across multiple Morpho vaults range around 4%, with some reaching as high as 11.4%, generally outperforming other lending protocols.

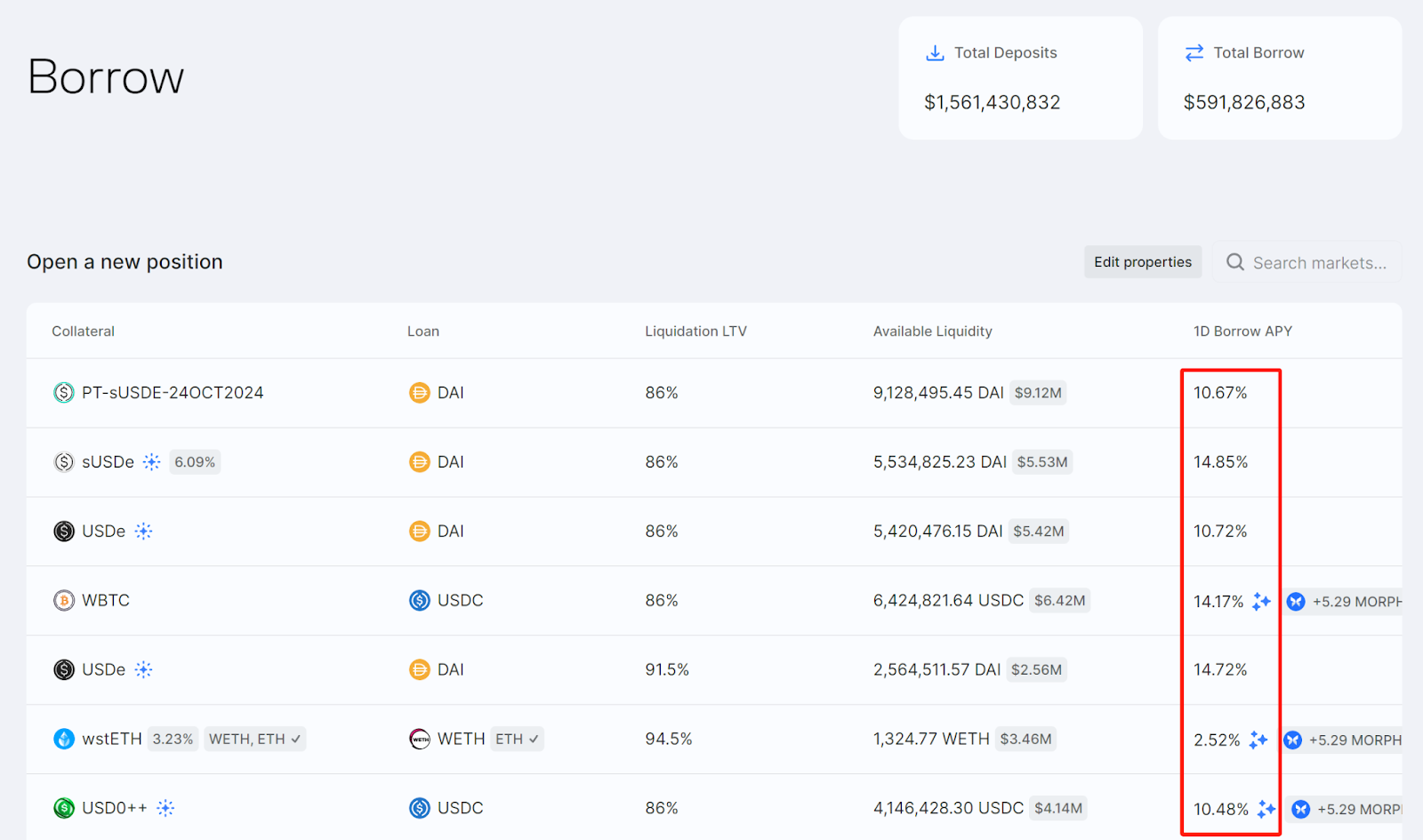

When borrowing, users benefit from higher collateral factors, allowing them to draw larger loans and maximize capital efficiency. Although Morpho’s borrowing rates are slightly above Aave’s, it charges no platform fees, resulting in lower overall borrowing costs and narrower spreads.

For enterprises and developers:

Building on Morpho allows faster and simpler deployment of tailored vaults and markets (with different assets, risks, and returns) while retaining full control. More importantly, as public financial infrastructure, Morpho shares foundational architecture—significantly reducing development time and cost while achieving superior liquidity aggregation.

Adoption: From Web3 to Web2 — Morpho’s New Phase of Ecosystem Expansion

Transformation is a serious undertaking, but positive market feedback continues to validate Morpho’s strategic direction.

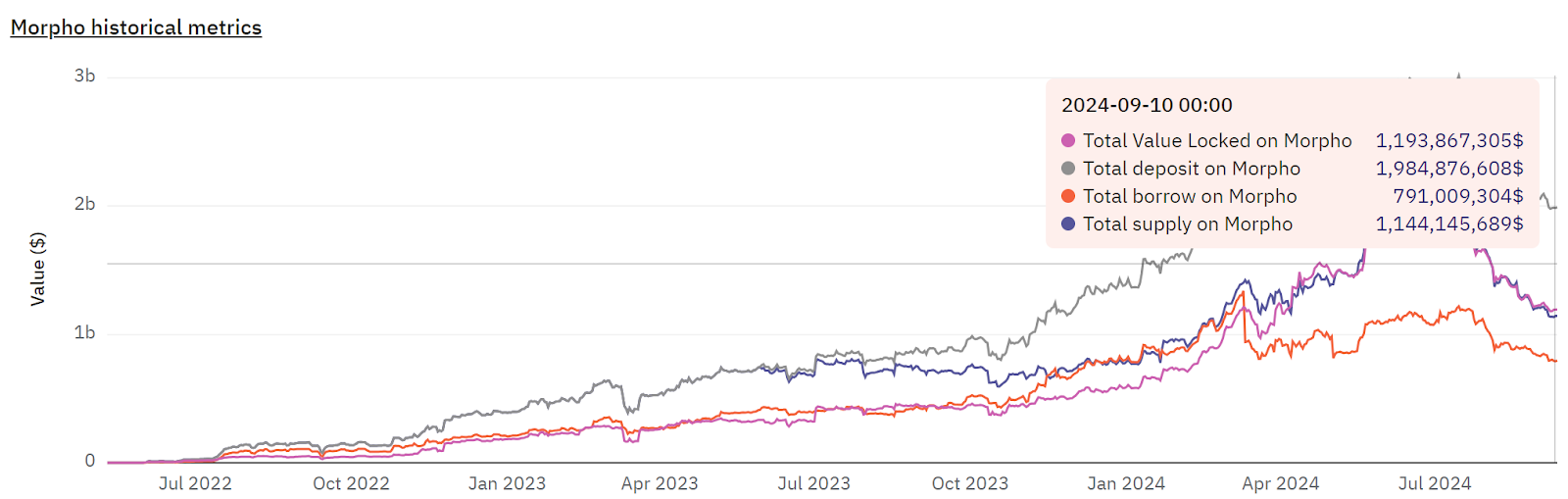

In recent months, both on-chain data and ecosystem partnerships reflect Morpho’s counter-trend growth.

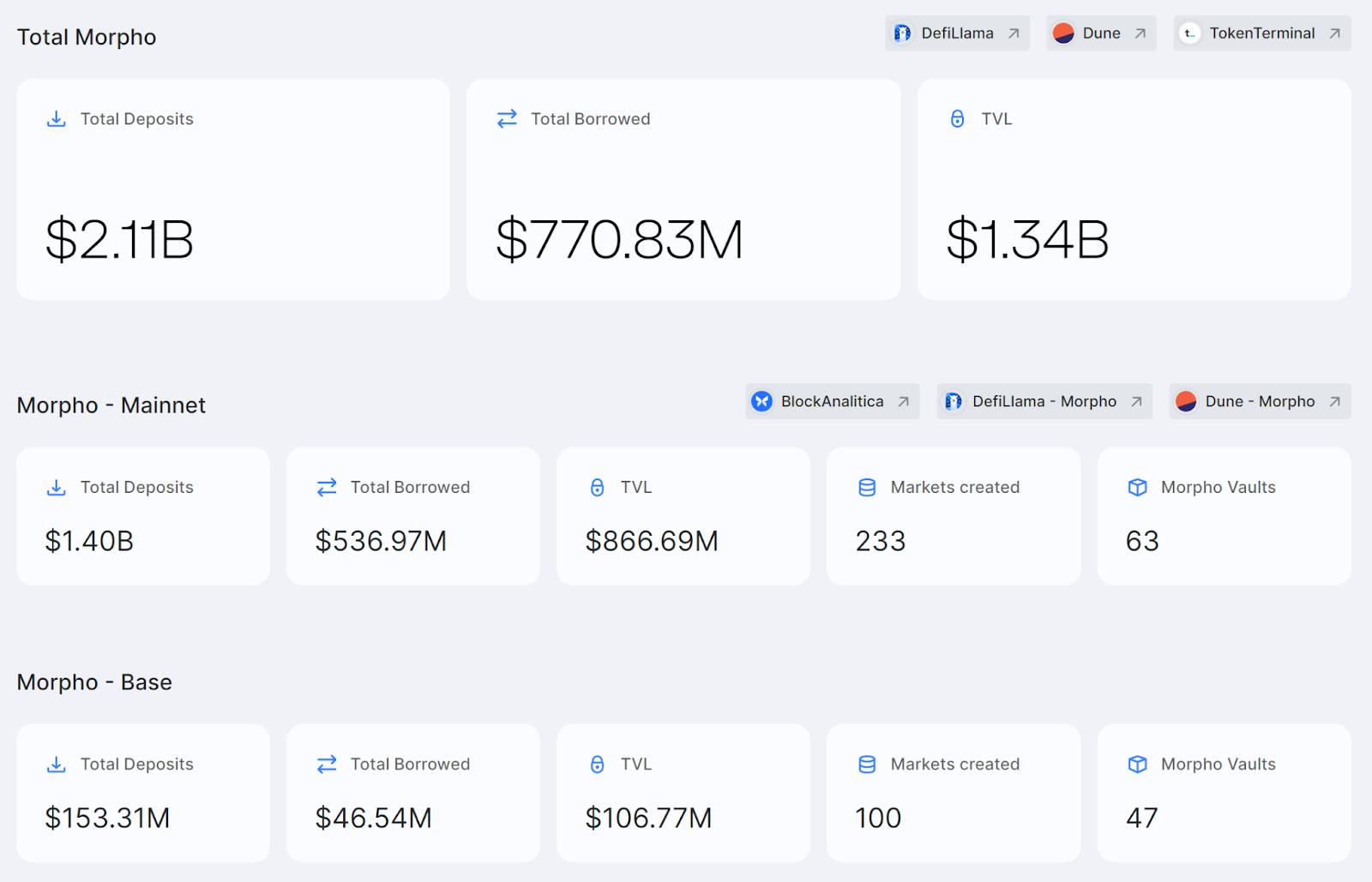

According to Morpho Analytics, total deposits exceed $2.1 billion, total borrows surpass $770 million, and on-chain TVL exceeds $1.34 billion—up over 220% from $600 million at the start of the year. Per DefiLlama rankings, Morpho ranks sixth in the lending sector.

In terms of deployed Markets and Vaults, over 333 Morpho Markets have been created across Ethereum and Base networks, with 110 Morpho Vaults established.

Notably, since announcing its expansion into the BASE ecosystem in June, Morpho has become the fastest-growing DeFi protocol on BASE.

Currently, Morpho’s total deposits on BASE exceed $153 million, total borrows stand at $46.54 million, and TVL has surpassed $100 million. Additionally, 100 Morpho Markets and 47 Morpho Vaults have been launched on Base, highlighting Morpho’s strong engagement within the BASE ecosystem.

This on-chain growth is driven by Morpho’s thriving ecosystem. As public financial infrastructure, Morpho actively integrates with fintech platforms and enterprises, leveraging decentralization to transform traditional finance while attracting new users through improved UX.

As Morpho puts it: Fintech in the frontend, Morpho in the backend.

We see this philosophy reflected throughout Morpho’s ecosystem map.

According to its official website, Morpho’s ecosystem now includes over 200 projects,including major DeFi players such as Elixir, Aragon, Contango, Safe, SummerFi, and Stream, all building on Morpho.

As public financial infrastructure, Morpho empowers not only DeFi projects but also extends into traditional finance, achieving notable success in areas like RWA (Real World Assets).

In DeFi, the most representative collaboration is with MakerDAO (now known as Sky). In March, Spark—the lending protocol under MakerDAO—deployed $100 million in new DAI liquidity via Morpho, allocated to sUSDe/DAI and USDe/DAI markets. Users can leverage efficient positions backed by MakerDAO to borrow Ethena’s stablecoins USDe and sUSDe, using Maker’s liquidity to increase exposure. Analysts suggest this move was intended to strengthen MakerDAO’s competitiveness against Aave’s launch of its own stablecoin, GHO.

BTCFi, a key narrative in this cycle, hasn’t been overlooked either—recently, Coinbase’s cbBTC and Lombard’s LBTC are set to launch on Morpho.

In transforming traditional finance, Morpho has been especially active lately:

In August, Morpho partnered with blockchain firm Centrifuge and top-tier exchange Coinbase to launch an institutional real-world asset (RWA) lending market.Built on Coinbase’s Layer 2 network Base and powered by Morpho Vaults, the market accepts tokenized U.S. Treasuries—including Centrifuge’s Anemoy Fund, Midas’ short-term mTBILL, and Hashnote’s USYC—as collateral, providing instant liquidity without requiring bond redemptions.

Earlier this month,SwissBorg, a crypto-focused fintech platform serving European markets, announced a USDC yield product powered by the Morpho protocol.Now live for SwissBorg app users, the product connects to Morpho’s WBTC/USDC and wstETH/USDC markets.

This collaboration enables SwissBorg users to access higher security and risk-adjusted returns without exposure to high-risk assets, offering crypto newcomers easy access to on-chain yields. It also grants broader Web2 audiences access to custom Morpho Vaults, showcasing Morpho’s potential for explosive growth in transforming traditional finance.

As SwissBorg praised in describing the partnership:Morpho Vaults provide customizable infrastructure that allows traditional financial platforms to develop proprietary products, reducing risks associated with standard Web3 lending protocols.

It’s worth noting that Asia remains a critical region in the crypto industry. At this year’s TOKEN2049 summit in Singapore, several industry leaders highlighted Asia’s leadership in crypto adoption, with 40% of top-ranked countries in user adoption located in Asia.

Accordingly, Morpho is actively pursuing partnerships in Asian markets and expanding its presence—particularly in China and South Korea. More developments in Asia are expected soon, aiming to bring Morpho’s public financial infrastructure to a wider audience of Asian crypto users, delivering more efficient and flexible lending experiences.

Future Growth: Token Launch Sparks Excitement, Participation Rewards Await

Talk is cheap—true understanding comes from participation.

Enterprises and developers can engage with Morpho via the Curate / Build pages:Through Curate, participants can use open-source code to quickly launch custom vaults with personalized strategies, permissions, and governance, earning revenue by managing lending vaults. For DAOs, fintech firms, apps, and CEXs, Morpho Stack enables rapid development of bespoke products—drastically cutting development time and cost while benefiting from enhanced security, flexibility, and liquidity.

Regular users can participate via Earn / Borrow pages:

The Earn page lists various Morpho Vaults, allowing users to select vaults based on risk tolerance and deposit assets for yield. Returns vary per vault and fluctuate with market conditions, consisting of three components: native yield (interest paid by borrowers), reward APY (from third parties), and MORPHO token incentives.

The Borrow page allows users to supply collateral and take out loans—with simpler operations, higher capital efficiency, and lower costs.

Earning or borrowing is currently the only way to earn MORPHO tokens.

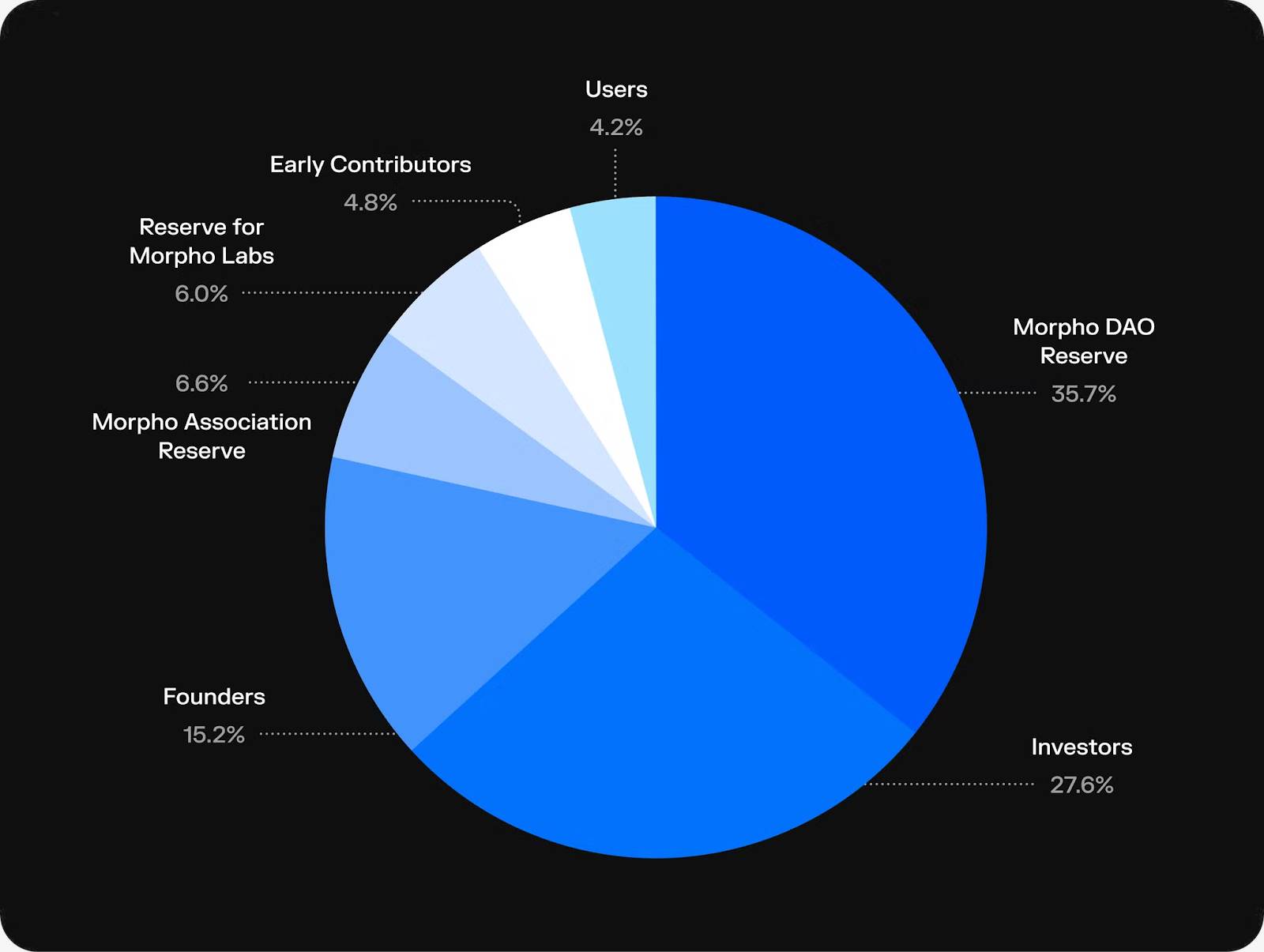

As a governance token, MORPHO has a total supply of 1 billion. Morpho DAO governs the protocol and is composed of MORPHO token holders and delegates. Holding MORPHO grants voting rights on protocol upgrades and changes.

As of August, the overall distribution of MORPHO tokens was as follows:

Note that MORPHO tokens are currently non-transferable—they cannot be traded or listed on any CEX/DEX. However, in late August, Morpho DAO initiated a community discussion on enabling MORPHO token transferability, receiving broad support.This suggests MORPHO tokens could officially launch before year-end, potentially accompanied by airdrops or other user incentives. This milestone has sparked high expectations for Morpho’s future growth and strongly motivates users to participate in Earn/Borrow now to accumulate more rewards ahead of the token release.

On the ecosystem front, Morpho’s permissionless nature enables anyone to build innovative applications, fueling inherent innovation momentum. Going forward, while continuously refining the Morpho Stack, Morpho will deepen ecosystem collaborations—maintaining growth in the BASE ecosystem and forging more partnerships with leading fintech platforms to extend its public, decentralized financial infrastructure to broader Web2 and Web3 audiences.

In crypto, surviving full market cycles is often a mark of success, but sustained competitiveness requires constant innovation rooted in market needs.

As a veteran in DeFi, Morpho has evolved from a niche lending optimizer unlocking innovation in Web3, to becoming a truly decentralized, permissionless, flexible, and efficient public financial system—pushing beyond Web3 to revolutionize the broader global financial landscape.

Looking ahead, as its ecosystem expands and its token launches, Morpho is poised for rapid growth in the next phase—emerging as a key force driving the DeFi revival in this cycle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News