Morpho Lending Protocol: How Did It Raise Over $80 Million?

TechFlow Selected TechFlow Selected

Morpho Lending Protocol: How Did It Raise Over $80 Million?

According to the latest data from DefiLlama, in the DeFi lending sector, Morpho ranks fifth by TVL, behind Aave, JustLend, Spark, and Maker.

By Karen, Foresight News

On the first day of August, lending protocol Morpho Labs announced a $50 million funding round led by Ribbit Capital, with participation from top-tier venture capital firms including a16z crypto. Notably, this marks a16z's second investment in Morpho.

So, what exactly is the Morpho lending protocol? What unique advantages does it offer, and how has it attracted such significant capital backing?

What is Morpho?

Morpho first launched two years ago with its core product, Morpho Optimizer. Acting as an optimization layer atop Aave and Compound, Morpho Optimizer used peer-to-peer matching algorithms to improve users' borrowing and lending interest rates.

Today, Morpho has evolved into independent financial infrastructure. Its lending layer, Morpho Blue, operates independently from Morpho Optimizers and enables permissionless creation of efficient lending markets.

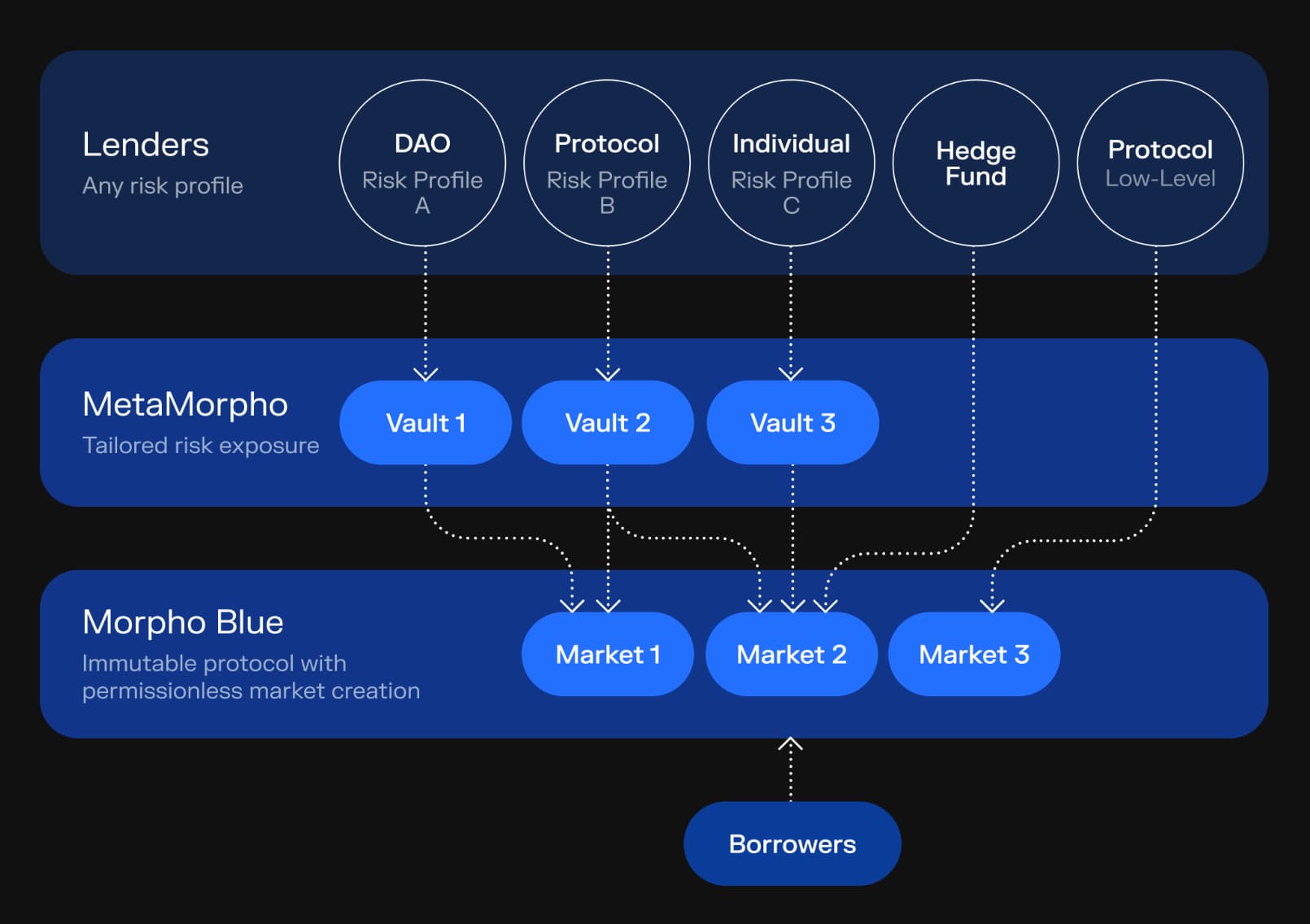

Notably, Morpho Blue also supports additional modular layers built on top of it. These modular layers can provide users with diversified risk configurations and more specialized lending services while still relying on Morpho Blue as the foundational layer.

Regarding team background, Morpho Labs has four co-founders: Merlin Egalite, Paul Frambot (CEO), Mathis Gontier Delaunay (protocol lead), and Julien Thomas. According to Forbes, CEO Paul Frambot secured seed funding during his final year as a four-year engineering student. Merlin Egalite previously served as a smart contract white-hat at blockchain dispute resolution layer Kleros and worked as a software development engineer at Commons Stack.

In mid-2022, Morpho raised $18 million in a round led by a16z and Variant, with participation from 80 institutions and individual investors including Nascent, Semantic Ventures, Cherry Ventures, Mechanism Capital, Spark Capital, Standard Crypto, and Coinbase Ventures.

Earlier this month, Morpho Labs closed another $50 million funding round, again led by Ribbit Capital, with participation from a16z crypto, Coinbase Ventures, Variant, Pantera, Brevan Howard, BlockTower, Kraken Ventures, Hack VC, IOSG, Rockaway, L1D, Semantic, Mirana, Cherry, Fenbushi, LeadBlock Bitpanda Ventures, Robot Ventures, and over 40 other firms.

How Does Morpho Work?

The Morpho Blue platform is designed with flexibility, allowing for permissionless deployment of isolated markets. Specifically, by defining a collateral asset, a loan asset, a liquidation loan-to-value ratio (LLTV), an interest rate model (IRM), and selecting an oracle provider, anyone can deploy an independent lending market. Once set, all parameters are fixed and immutable.

This design allows project teams to more effectively tailor incentive strategies for specific use cases. This is primarily enabled by the Universal Reward Distributor (URD) mechanism, which simultaneously satisfies external project incentives and MORPHO token rewards, resolving complexities associated with DeFi reward distribution.

For price data, Morpho Blue maintains simplicity by integrating external oracles and is compatible with multiple oracle providers such as Chainlink, Redstone, and Uniswap.

For liquidations, Morpho Blue employs a straightforward mechanism: when a user’s loan-to-value (LTV) ratio exceeds the market’s LLTV threshold, their position becomes eligible for liquidation. Anyone can repay part of the borrower’s debt in exchange for equivalent collateral assets plus an incentive bonus.

Additionally, Morpho Blue adopts a distinct approach to bad debt management compared to conventional lending protocols. If, after liquidation, a position still holds outstanding debt with no remaining collateral, this loss is shared pro-rata among all lenders in that market. While this design—where liquidity providers bear bad debt risk—has drawn some community skepticism, according to Morpho CEO Paul Frambot, the protocol remains solvent even with bad debt, which only affects the specific isolated market involved.

Notably, unlike Aave or Compound, which use aTokens or cTokens to represent user balances, Morpho Blue uses a smart contract-level mapping mechanism to track user positions. Under this system, user assets are managed in terms of “shares,” enabling highly precise tracking of asset allocation within the protocol. This ensures accurate valuation of both assets and liabilities, provides more precise display of supply and borrow balances, and effectively prevents potential manipulation of share prices.

To enhance lending efficiency and simplify user experience, Morpho Blue focuses solely on lending operations, while MetaMorpho—built atop it—enables permissionless market creation and risk management.

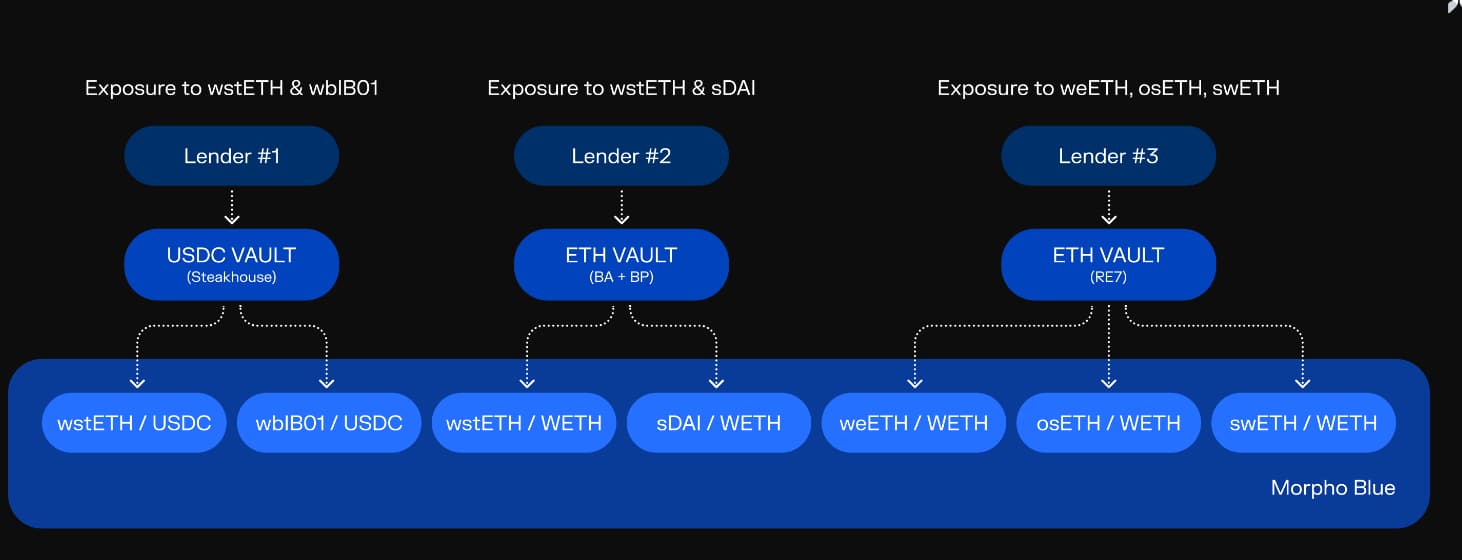

MetaMorpho is a yield vault protocol built on Morpho Blue, corresponding to the Earn section within Morpho. As shown below, DAOs, protocols, individuals, and hedge funds can all permissionlessly create vaults on MetaMorpho. Each vault holds one lending asset and can customize risk exposure, allocating deposits across one or more Morpho Blue markets.

During this process, vaults earn returns by providing capital to borrowers, who must deposit collateral to access underlying liquidity and pay interest to the vault.

MetaMorpho vault returns consist of native annual percentage yield (APY), reward APR, and MORPHO token incentives.

What Makes Morpho Stand Out?

The primary advantage of Morpho Blue lies in its permissionless nature. This design allows users to autonomously deploy isolated lending markets by setting various parameters, without requiring external governance approval to list assets or adjust settings. This grants market creators high autonomy, enabling them to independently assess and manage risk-return profiles according to their own criteria, thus catering to diverse risk preferences and use cases.

MetaMorpho simplifies the lending process, improves user experience, and aggregates market liquidity. It not only gives users access to isolated markets and lending pools but also allows them to provide liquidity conveniently and earn passive interest.

Another key strength of MetaMorpho vaults is their customizable risk strategies and performance fee parameters. Each vault can configure different risk exposures and fee structures based on its goals. For example, a vault focused on LST assets will hold only LST-related risk exposure, while an RWA-focused vault may specialize in real-world asset lending. This flexibility enables users to precisely select and invest in vaults aligned with their personal risk tolerance and investment objectives.

Morpho Blue also incorporates a fee switch mechanism, opening the possibility for future dynamic fee adjustments through community governance. This feature allows the protocol to charge borrowers between 0% and 25% of interest collected in any given market, with all fees directed straight to Morpho DAO. It should be clarified that Morpho DAO cannot charge fees on MetaMorpho; instead, MetaMorpho vaults earn performance fees directly from users. This design preserves alignment of interests between vault operators and users.

How Is the Morpho Token Distributed?

MORPHO, the core governance token of the Morpho protocol, has been officially issued but is currently non-circulating. Its primary value lies in granting holders voting rights on major protocol decisions. Whether it's deployment strategies for Morpho smart contracts, ownership control, activation or adjustment of the fee switch, or DAO treasury management, MORPHO holders can vote to shape the protocol’s future direction.

The total maximum supply of MORPHO is 1 billion tokens: 27.6% allocated to investors, 15.2% to the founding team, 4.8% to early contributors such as developers, independent researchers, and advisors, 6% to Morpho Labs reserve, 6.6% to Morpho Association reserve, 35.7% to Morpho DAO, and 4.2% to users (this amount may increase).

How Has Morpho Blue Performed?

Since launching on Ethereum mainnet earlier this year, Morpho Blue has attracted a total of $1.35 billion in deposits and $510 million in total loans as of writing. Notably, since launching on Base in mid-June, Morpho Blue has rapidly gained traction, adding $110 million in deposits and $36.84 million in loans. Meanwhile, Morpho Optimizer continues to perform strongly, with $910 million in total deposits.

Morpho Blue currently hosts 43 MetaMorpho vaults on Ethereum and 32 on Base, offering users diverse options for lending and asset management tailored to various risk appetites and investment needs.

According to the latest data from DefiLlama, Morpho ranks fifth in TVL among DeFi lending protocols, trailing only Aave, JustLend, Spark, and Morpho itself (note: likely a typo in source ranking).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News