Quick Overview of 16 New Projects That Continue Innovating During the Bear Market

TechFlow Selected TechFlow Selected

Quick Overview of 16 New Projects That Continue Innovating During the Bear Market

The black swan events of 3AC, Terra, and FTX have cast dark clouds over the cryptocurrency market, which had already entered a bear market cycle.

Written by: hangry

Compiled by: TechFlow

The black swan events of 3AC, Terra, and FTX have cast dark clouds over an already bearish cryptocurrency market. Yet, amidst this turmoil, numerous innovative projects continue to emerge. It is precisely their persistence in building through such difficult conditions that makes them worthy of our attention. Here, I’ve selected 16 such projects to share with you:

Tapioca Dao

Tapioca DAO is building cross-chain DeFi products using Layer Zero technology. They are also planning a selective airdrop at some point soon.

Expected launch: January 2023

Morpho

Morpho addresses capital inefficiencies in lending markets like Aave and Compound. Through Morpho, users can access P2P loans using P2Pool liquidity. The platform is already live.

Vaults Pro

Vaults Pro uses Layer Zero technology to enable cross-chain yield farms. It could be described as a yield strategy-driven version of STFX. Not yet launched.

Sentiment

Sentiment enables users to obtain undercollateralized loans via controlled, risk-reduced accounts. Users can leverage Sentiment to achieve higher yields in DeFi.

IPOR

An interest rate swap protocol allowing users to speculate on future yields. Interest rate swaps represent a massive market in traditional finance (TradFi), and we may see similar adoption within crypto in the future.

Silo Finance

Silo allows users to borrow one token against another through isolated markets called Silos. Unlike lending markets such as Aave and Compound, Silo Finance’s unique risk isolation mechanism enables it to support a wide variety of tokens.

CVI

The Cryptocurrency Volatility Index (CVI) creates a decentralized VIX. With CVI, users can hedge and trade implied volatility and black swan events (such as FTX). They recently launched CVI V3 on Arbitrum.

Armadillo

A product built by the CVI team designed to protect against impermanent loss. By paying a premium, users can earn back assets they would otherwise lose due to impermanent loss.

DYAD

DYAD is a uniquely structured overcollateralized stablecoin backed by ETH. Users who own dNFTs can deposit them into ETH vaults and mint DYAD. The testnet will launch soon.

Sodium

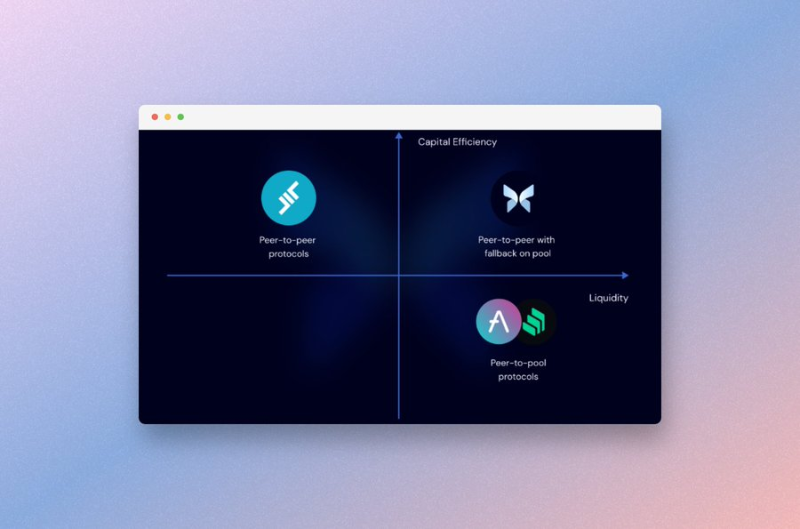

Sodium is a hybrid liquidity NFT-Fi platform leveraging both P2P and P2Pool markets. Because markets are isolated, users enjoy higher interest rates while the protocol reduces risk.

Vendor

Vendor Finance allows users to lend out idle assets by creating their own lending pools. Users can set interest rates, LTV ratios, collateral types, loaned tokens, and repayment schedules.

Reserve

This project has existed for a while but recently caught my attention. Citizens in high-inflation countries can use Reserve to save and transact in USD.

Dolomite

Dolomite aims to become the most capital-efficient DeFi platform. Assets on Dolomite can generate yield across multiple venues simultaneously, with capital efficiency and composability being top priorities.

Eigenlayer

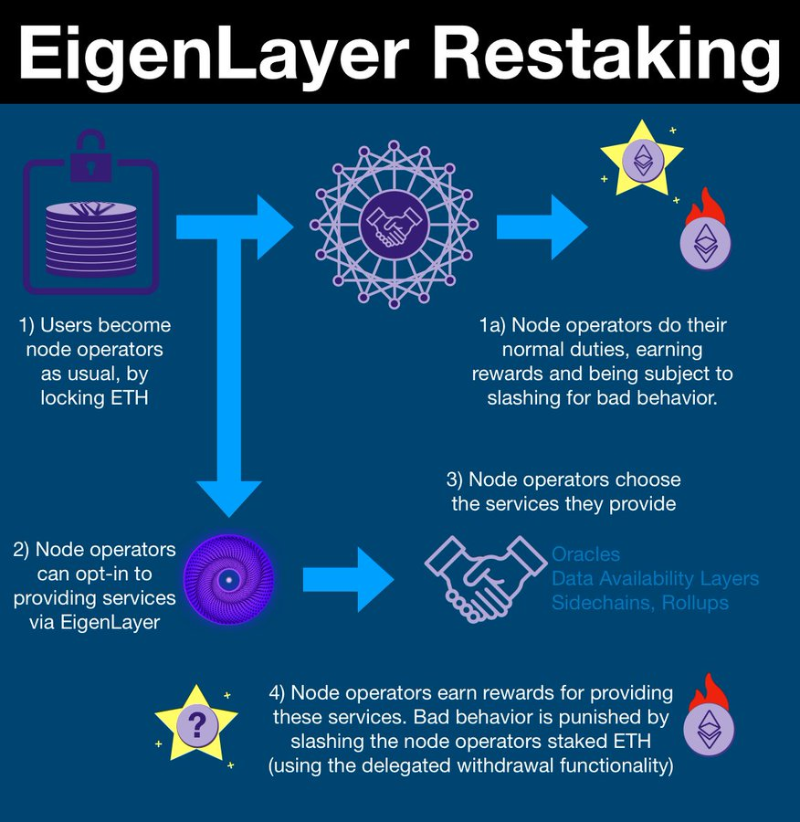

Through Eigenlayer, Ethereum validators can "re-stake" their ETH to provide security for other chains, oracle networks, bridges, and more. They are also building their own data availability service called EigenDA.

SturdyFinance

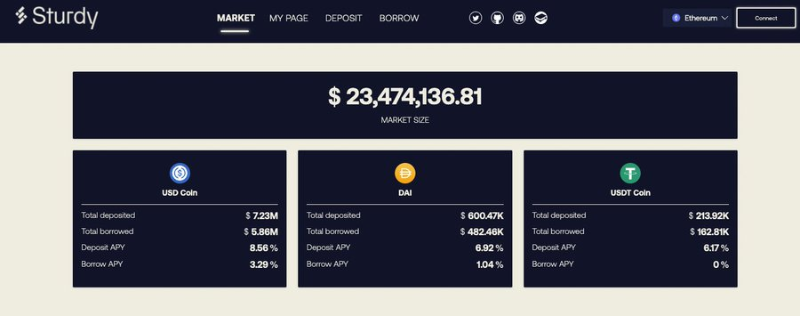

Sturdy is another project that has been around for a while but only recently gained attention. Sturdy Finance is a money market offering high lending yields, with the notable feature of providing interest-free loans.

Sherlock

Audits are crucial for any project but often take too long, are expensive, and inefficient. Sherlock aims to solve this by creating a new auditing system. The platform is now live.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News