A New Path for RWA: KUMA's Hybrid Experiment with Bond NFTs and Stablecoins

TechFlow Selected TechFlow Selected

A New Path for RWA: KUMA's Hybrid Experiment with Bond NFTs and Stablecoins

Kuma is exploring a hybrid new path for RWA.

On September 7, 2023, stablecoin issuer Circle, exchange Coinbase, and DeFi giant Aave jointly launched the Tokenized Asset Consortium with several RWA projects (such as Centrifuge), aiming to reach consensus on standardization and push RWA into broader market spaces.

This move resembles the 1792 Buttonwood Agreement, where 24 stockbrokers established mutually beneficial principles to restore confidence in the stock market. It was precisely this shared credit consensus that laid the foundation for the birth of the New York Stock Exchange.

In today's crypto market, the significance of RWA needs no overstatement. DeFi protocols can thus enter traditional financial territories—MakerDAO’s investment in U.S. Treasuries being one example—while CeFi institutions can use blockchain technology to enhance asset transparency and liquidity, as demonstrated by Hong Kong’s "green bond" issuance.

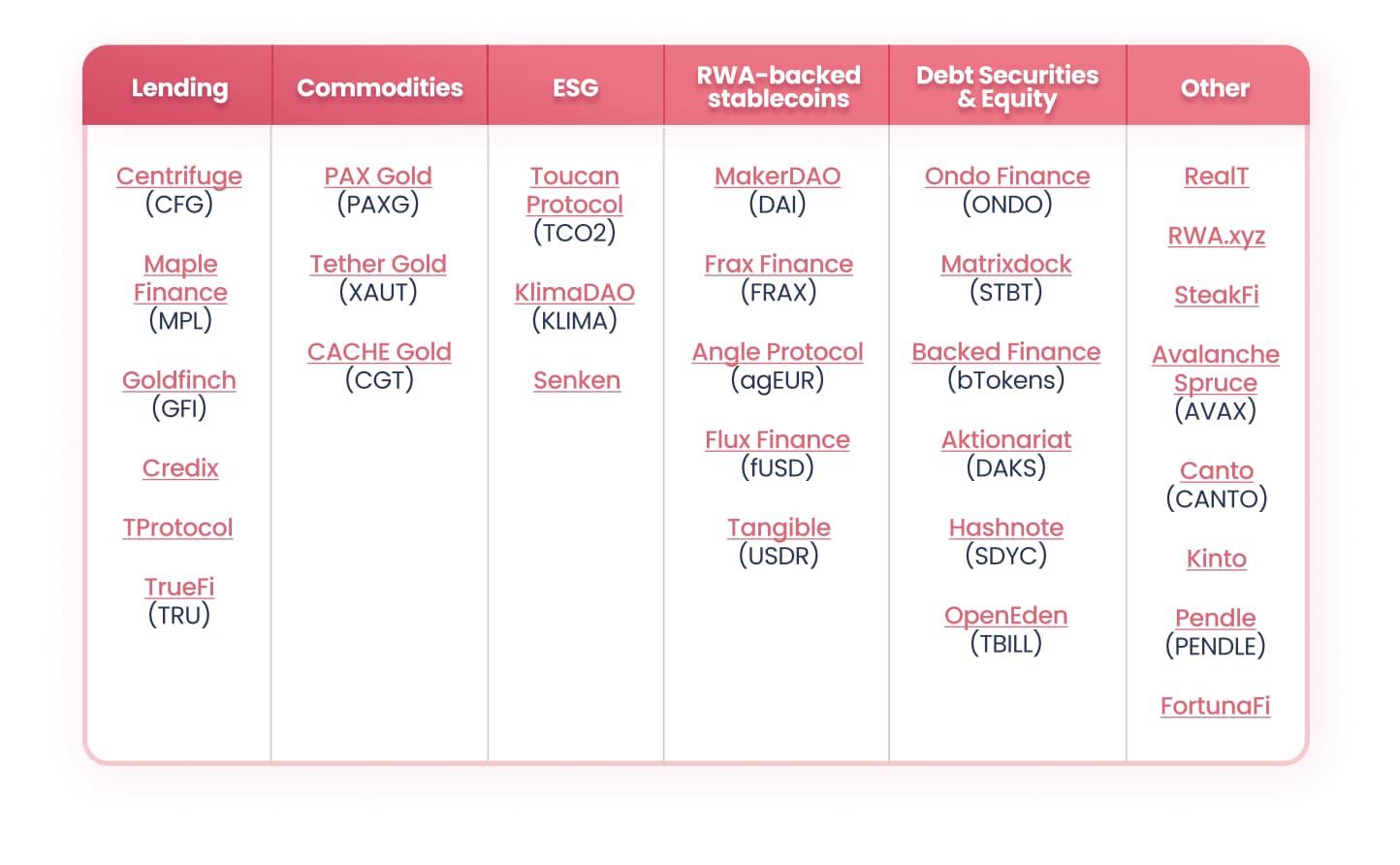

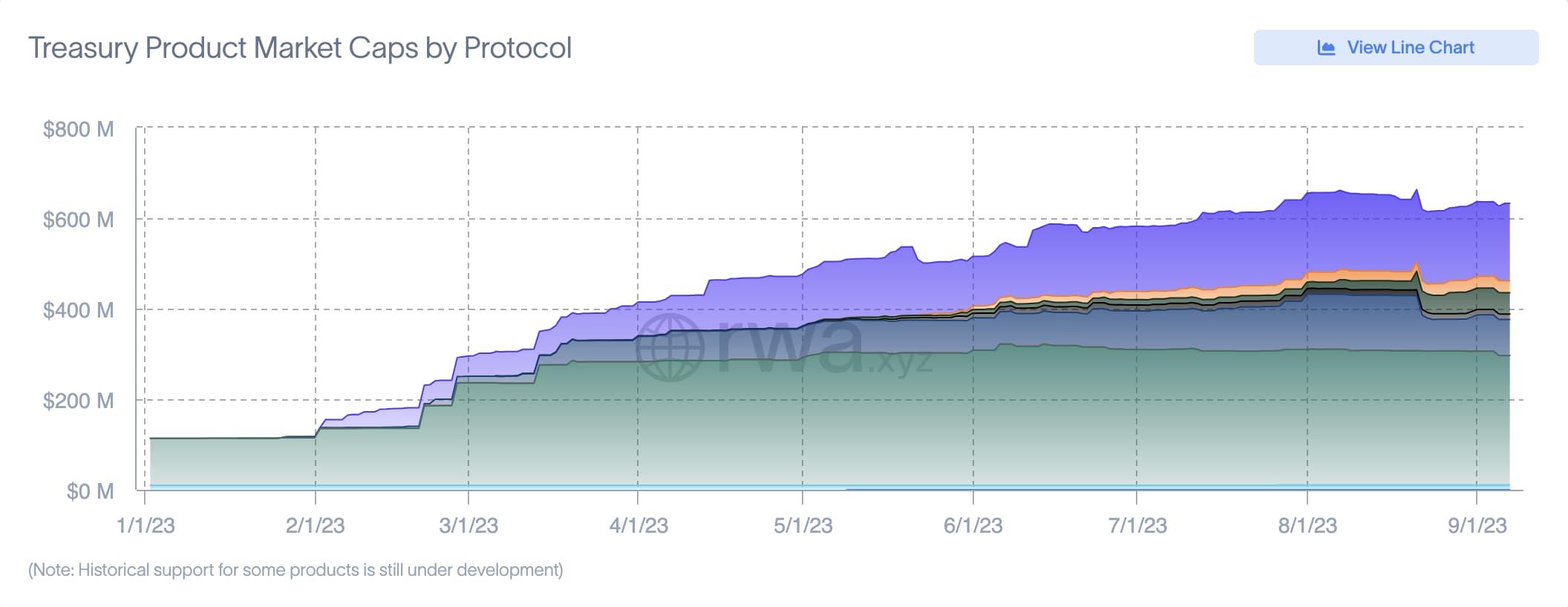

In terms of classification, RWA can be divided into five major categories: lending, gold tokenization, ESG, stablecoins, and bonds. However, in terms of market capitalization, the U.S. dollar, gold, and bond markets dominate. In reality, stablecoin issuers primarily hold U.S. Treasuries; for instance, Tether, the issuer of USDT, holds $72.5 billion in U.S. Treasuries, making it the 22nd largest holder globally.

Stablecoins and U.S. Treasuries constitute the absolute core of RWA, yet their yields have long been exclusively captured by stablecoin issuers, while risks are transferred to holders—creating a mismatch between risk and reward.

Current RWA products face two persistent challenges:

-

Lengthy and cumbersome off-chain verification, such as KYC or audit processes;

-

Even after assets are tokenized, their liquidity remains insufficiently unlocked.

The market cap of tokenized U.S. Treasuries is around $630 million, still far smaller than the tens of billions in stablecoins. Enhancing liquidity on-chain while improving security and efficiency off-chain is essential for building the next-generation RWA exchange.

Dual Governance: MIMO's Overall Approach

As previously noted, dollar-pegged stablecoins are currently the dominant form of RWA, while U.S. Treasuries represent the strongest growth market ahead. At its core, this approach removes intermediaries from stablecoin issuance and democratizes yield distribution within the crypto ecosystem.

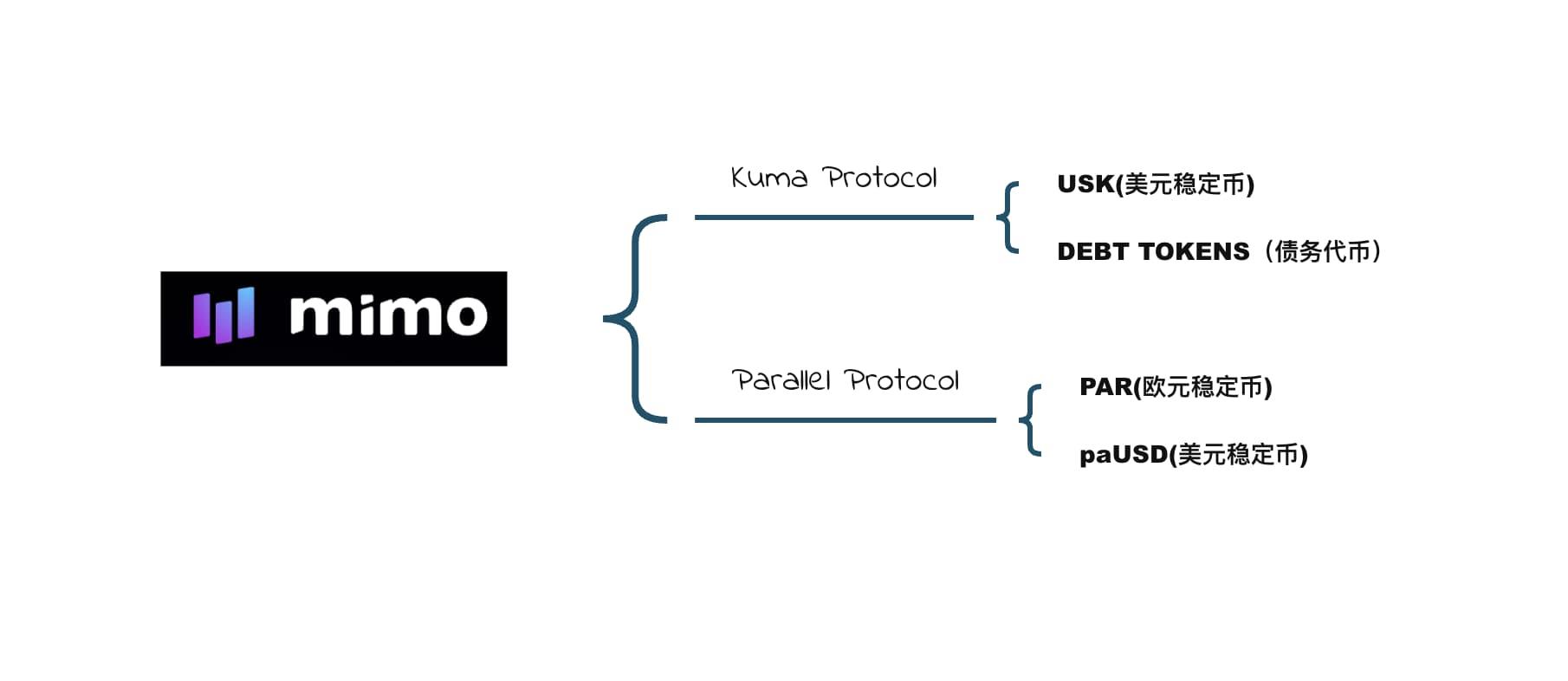

Mimo Labs, focused on real-world asset tokenization (RWA), has been exploring ways to integrate these two elements—bond assets like U.S. Treasuries and the widespread utility of stablecoins—into a unified framework.

However, if users bear all the risks directly, it could severely hinder market expansion. From Mimo’s perspective, risk and return must be decoupled, requiring creative integration of stablecoins and bonds.

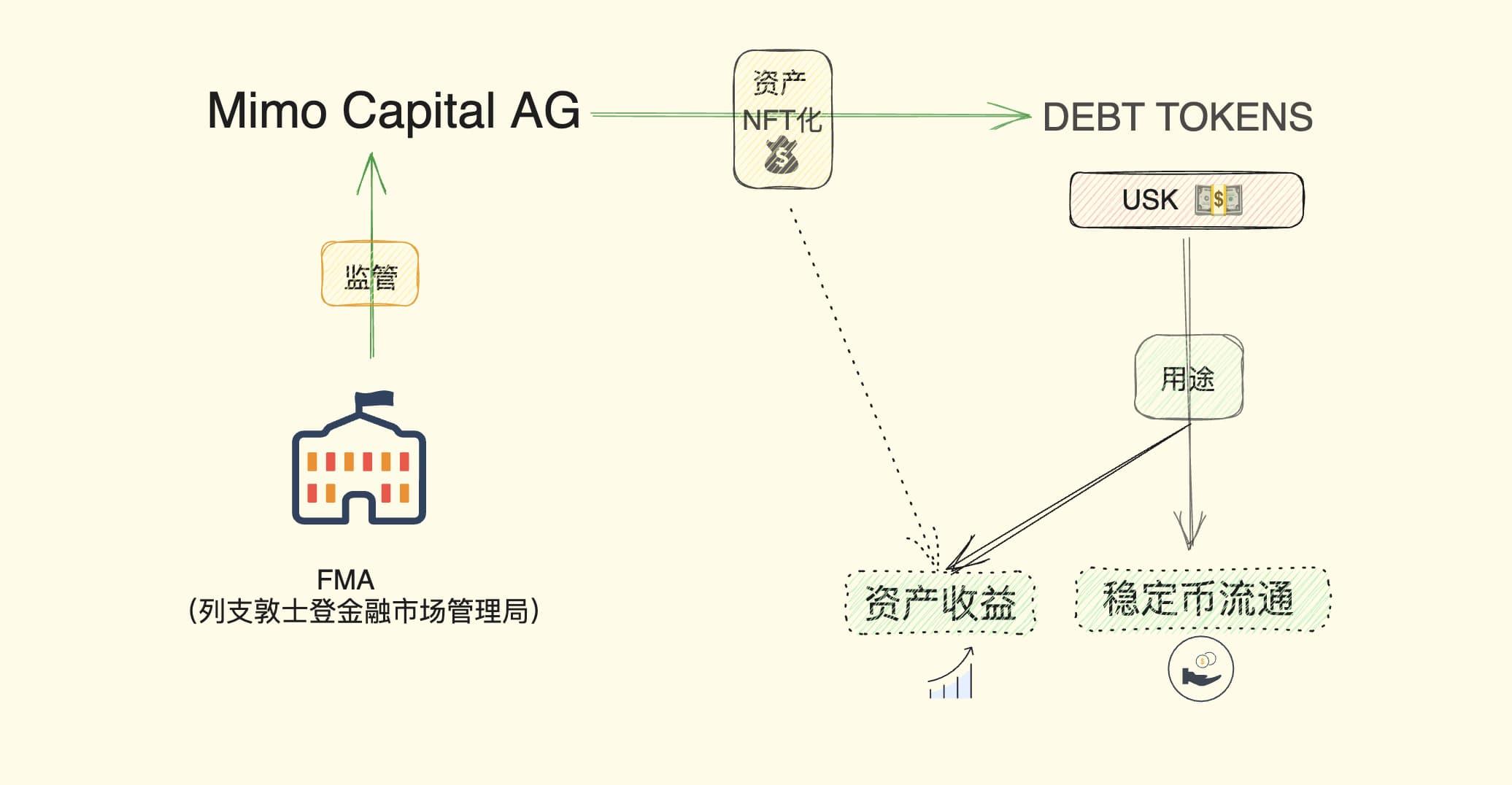

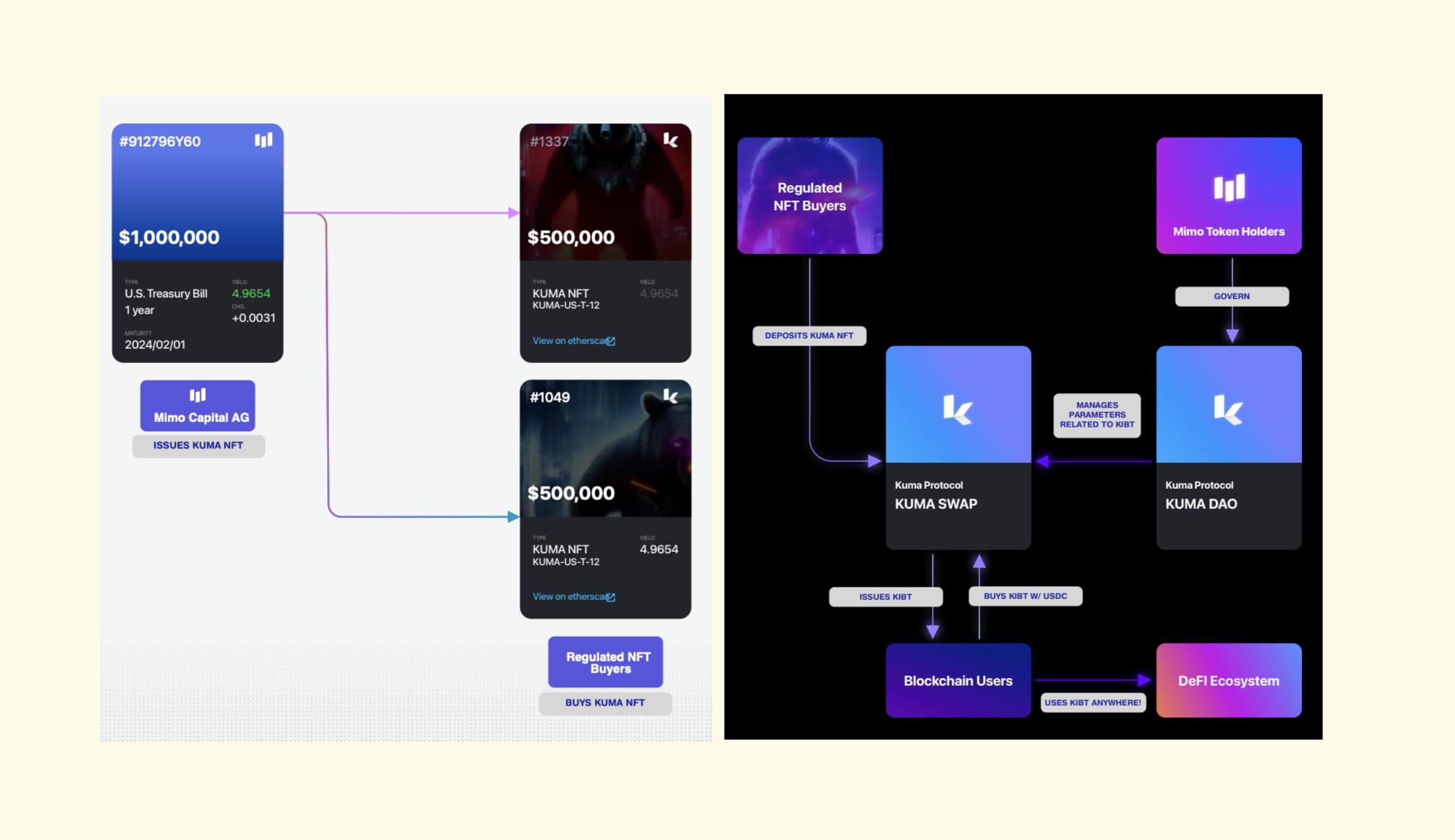

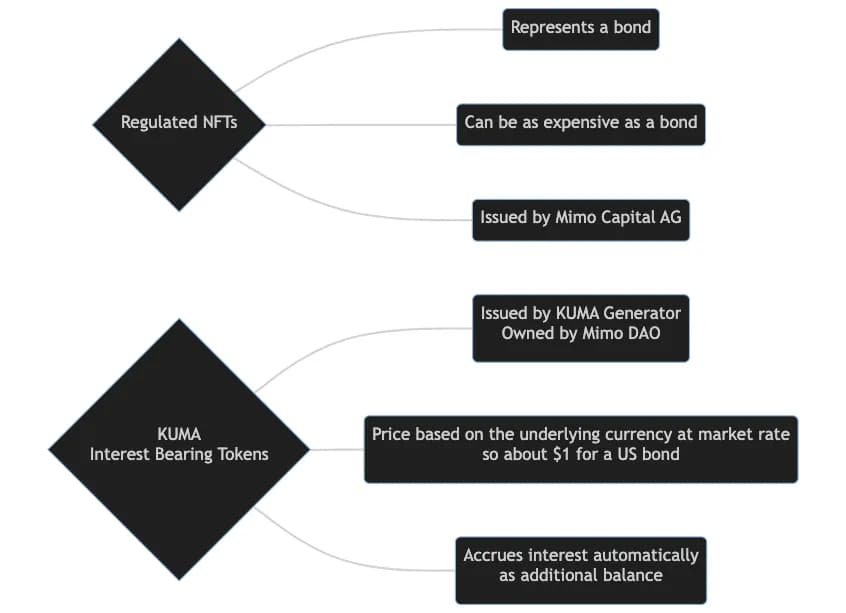

Under this vision, Mimo established Mimo Capital AG, a regulated entity overseen by the FMA (Financial Market Authority of Liechtenstein), ensuring compliance. Using a CeFi approach, it interfaces with bond markets and regulators. Meanwhile, it tokenizes bond assets as NFTs and issues stablecoins backed by these NFTs—for example, USK is a USD-pegged stablecoin backed by U.S. Treasuries. This stablecoin continuously accrues interest and is known as a KIBT (yield-bearing token).

Additionally, tokens can be issued based on different government bonds and maturities—for example, USK is backed by one-year U.S. sovereign bonds, UKK by one-year UK sovereign bonds, and FRK120 by ten-year French sovereign bonds.

Thus, Mimo evolved this system into the Kuma Protocol, which in theory supports issuing bond-backed stablecoins for any asset. This brings three key benefits:

-

A regulated CeFi entity handles regulatory compliance, while DeFi mechanisms (NFT + REC-20 tokens) enable fully decentralized on-chain circulation;

-

Tokens like USK are standard ERC-20 tokens, freely tradable on-chain and interoperable with other DeFi components to generate additional yield;

-

Users continue to share in the native bond asset’s returns, with value appreciating over time, and can directly hold USK to earn yield.

Through this model, Kuma Protocol simultaneously addresses the lack of liquidity for tokenized assets on-chain and enhances regulatory transparency via institutional entities. Central to this is Kuma Swap, a feature allowing NFT holders to exchange NFTs for yield-bearing tokens. These NFTs can also be subdivided into smaller units and combined across different token types.

Moreover, on-chain assets can participate in further yield-generating activities such as DEX trading, lending, yield aggregation, and cross-chain interoperability via deBridge, LIFI, Wormhole, and LayerZero—expanding the utility of Mimo tokens. A prime example is Mimo’s Parallel Protocol.

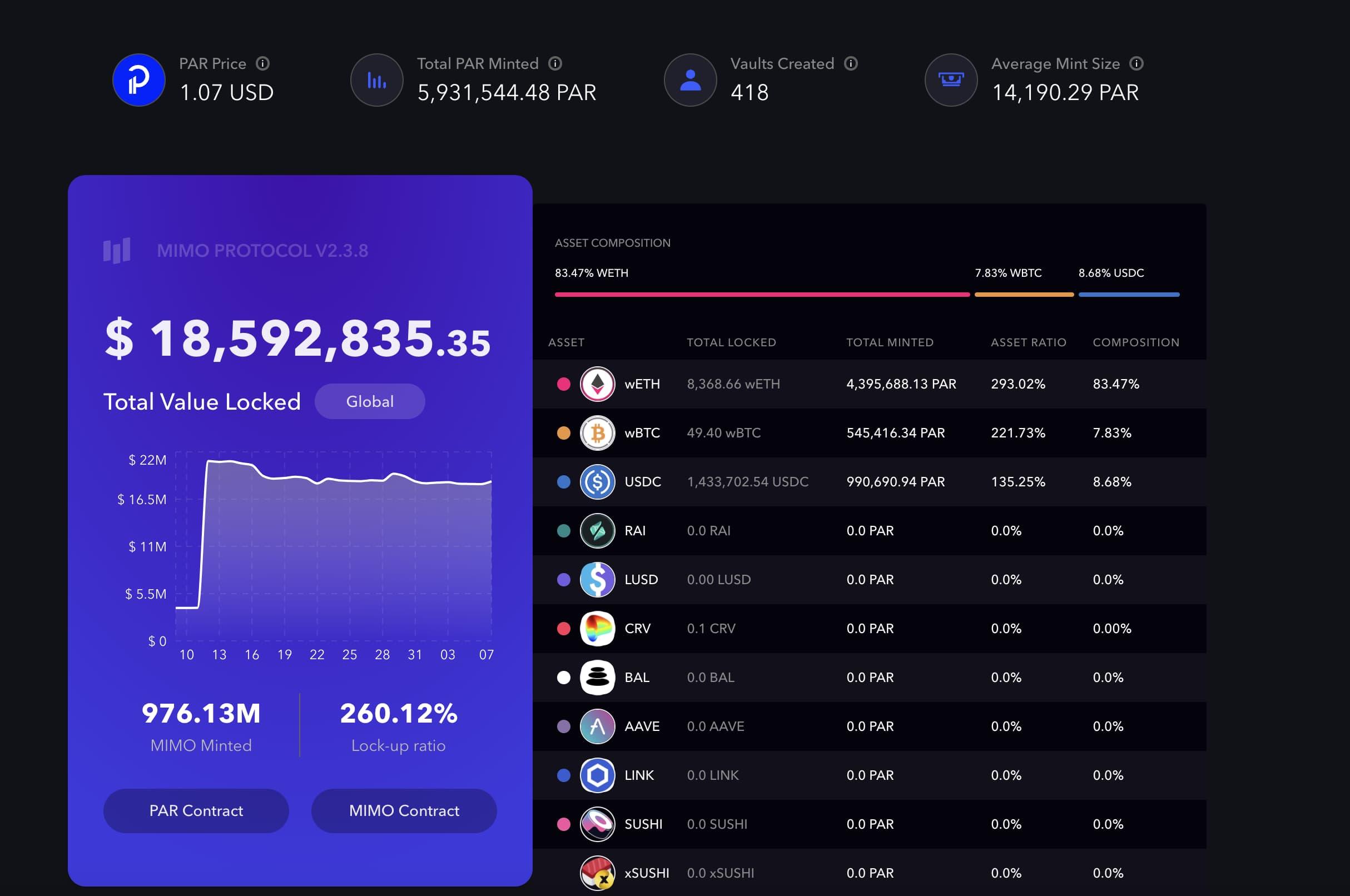

Parallel allows users to over-collateralize assets like WBTC and USDC to mint PAR (a euro-pegged stablecoin) and paUSD (a dollar-pegged stablecoin). In Mimo’s broader vision, both on-chain and off-chain assets will ultimately converge into a unified liquidity layer. Currently, Mimo’s TVL stands at $18 million, with wETH, wBTC, and USDC forming the primary collateral—each maintaining collateralization ratios above 100%, ensuring full redeemability.

More importantly, through bond tokenization and the issuance of PAR, Mimo Labs has injected fresh momentum into the current stablecoin market. Stablecoins backed by diversified bond assets challenge the previous dominance of centralized issuers.

New Paradigm: Unique Advantages of Kuma NFTs

Kuma Protocol’s RWA model is highly distinctive. The issuance of NFTs grants institutional or individual investors flexible management and exit rights. The NFT itself serves as proof of bond ownership, with pricing unaffected by market fluctuations, allowing users to redeem at any time.

After generating an NFT, users can mint bond tokens from it, unlocking on-chain liquidity and enabling participation in DeFi trading—functionally equivalent to regular stablecoins, except that Kuma’s bond tokens are traceable back to the original asset via NFTs.

The NFT model accommodates a wider variety of asset types. Even within bond markets, numerous options exist—corporate bonds, Islamic bonds, yen-denominated bonds, etc.—yet current RWA efforts are mostly concentrated on U.S. Treasuries, leaving smaller bond markets largely overlooked.

Based in Dubai, Kuma Labs recognizes the strong political stability and economic vitality of neighboring Gulf countries, whose bond markets remain underdeveloped compared to U.S. Treasuries. Hence, Kuma chose to tokenize Islamic bonds.

Typically, Islamic finance prohibits interest and requires Shariah compliance. To meet these standards, Kuma’s NFT-based bonds adhere to Islamic financial principles while remaining compatible with the native Kuma Protocol, enabling issuance of tradable bond tokens usable within DeFi ecosystems.

To ensure compatibility across diverse asset types, Kuma operates through two distinct entities: Mimo Capital AG, established by Mimo Labs, and Kuma DAO, governed by Mimo token holders. The former issues NFTs backed by bond assets, while the latter reissues bond tokens based on those NFTs.

These NFT-backed tokens eliminate the need for complex account openings and high fees, while holders continuously earn interest—a mechanism similar to stETH, except replacing ETH with regulated NFTs.

Overall, combining NFT-based asset issuance with DAO governance represents a promising new model for creating liquidity and meeting regulatory requirements for niche assets.

Alternative Investment: Future Potential of KUMA

Currently, there are three main models for RWA issuance:

-

Stablecoin model—a pure CeFi approach. Users hold USDT or USDC, while issuers invest deposited fiat in U.S. Treasuries to earn yield;

-

MakerDAO model—DeFi entering CeFi. Accepts both USDC and on-chain assets as collateral and directly purchases traditional financial instruments;

-

stETH model—a purely on-chain DeFi model. Leverages widely recognized assets like ETH to issue stETH. Lido earns only fees, operating similarly to Circle/Tether.

Kuma’s NFT-based bond token issuance represents a novel hybrid model integrating CeFi and DeFi, especially suited for alternative and private investments. Unlike general retail-focused or U.S. Treasury-centric scenarios, the potential of private alternative investment markets has long been underestimated.

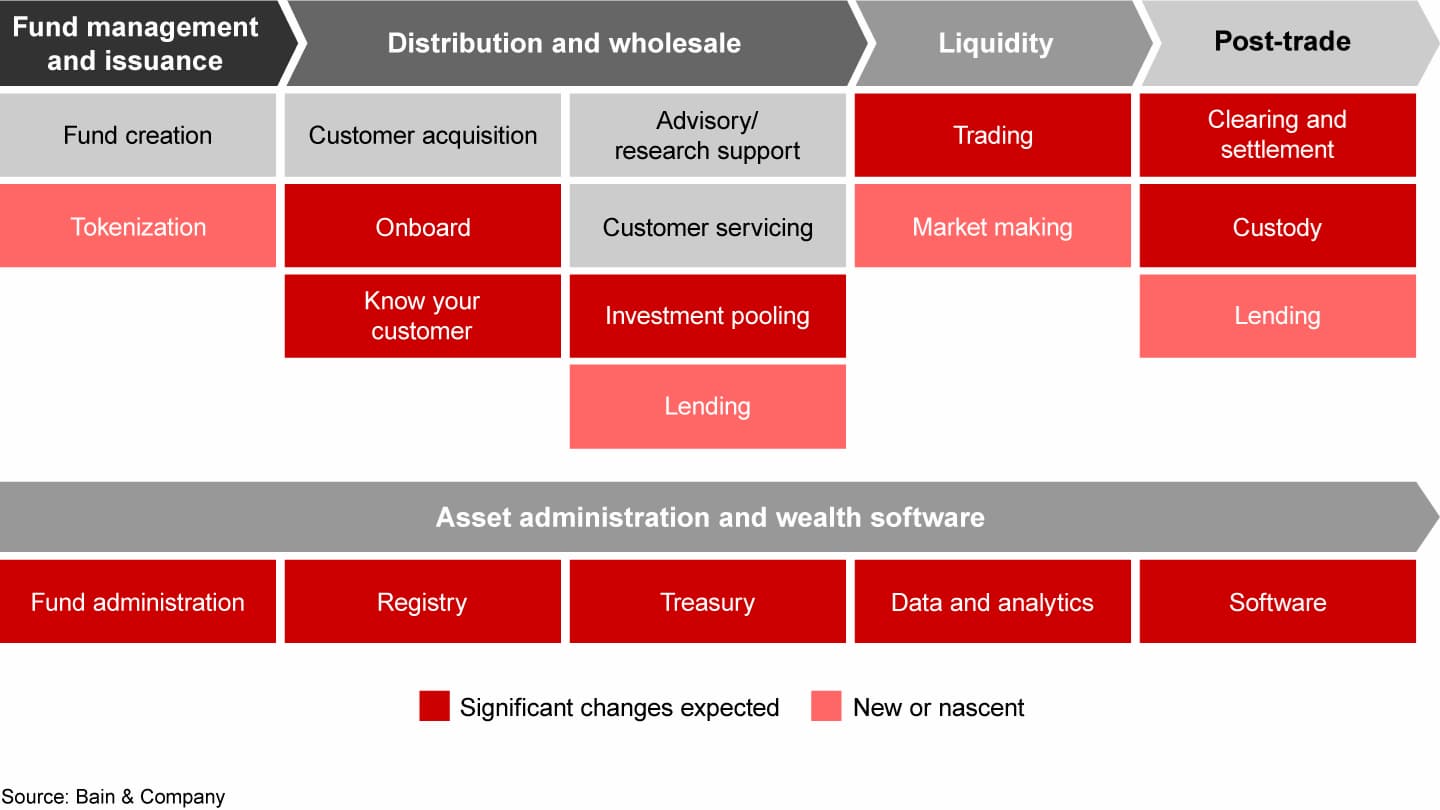

On one hand, existing investment management systems are designed around public markets and large institutions like Goldman Sachs or Binance, leaving infrastructure for private investment transactions, management, and interaction underdeveloped. On the other hand, the private alternative investment market is massive—according to Bain & Company, global available capital in private alternative assets ranges between $8 trillion and $12 trillion.

To transform the current landscape, Kuma’s model offers valuable insights. Regulated NFT issuance meets the risk control demands of high-net-worth individuals and family offices, while robust on-chain liquidity provides greater transparency. The entire asset infrastructure doesn’t need rebuilding—the existing Kuma RWA model already fulfills these requirements.

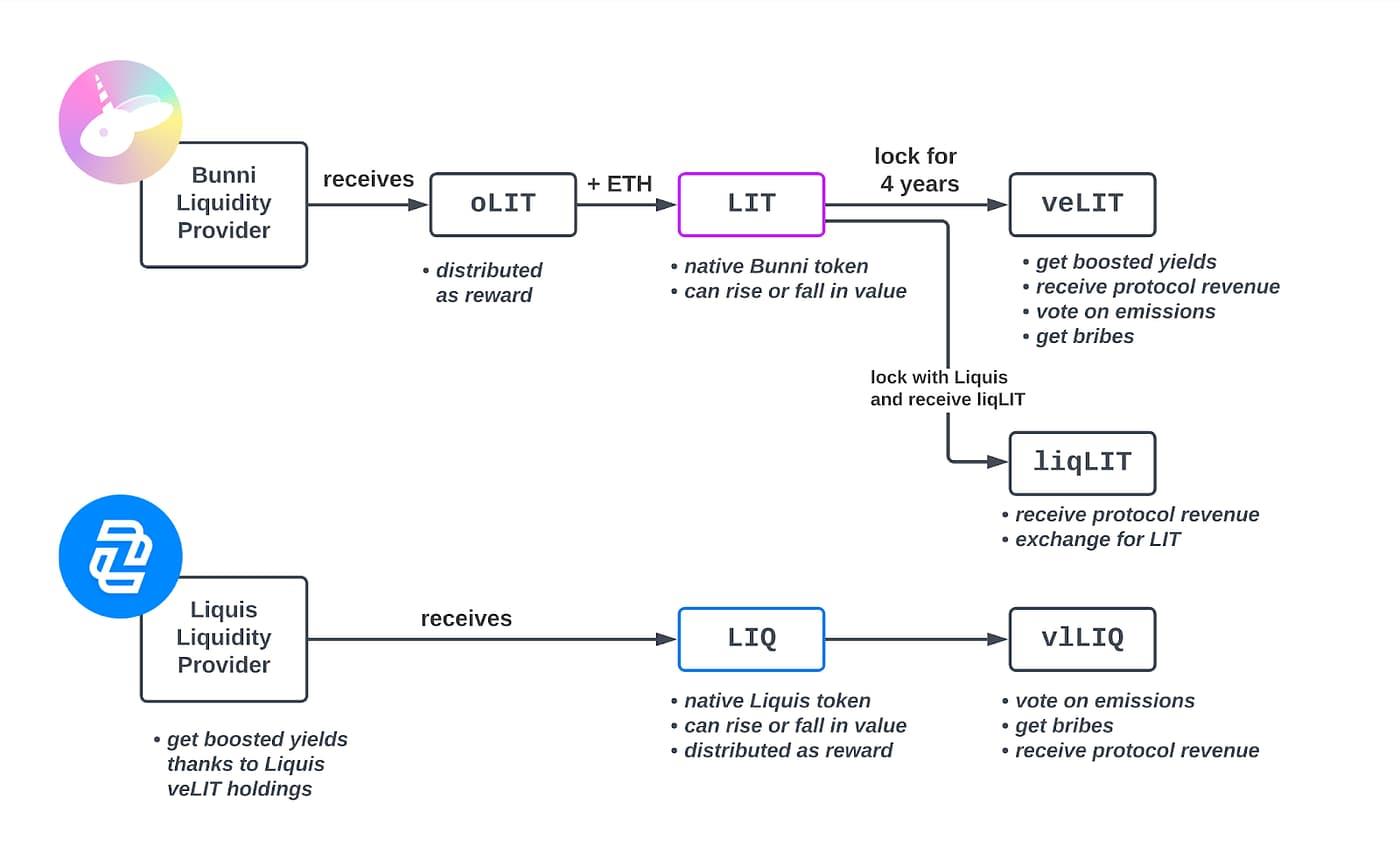

For example, Kuma collaborates with liquidity provider Liquis to build more concentrated liquidity pools, improving market-making efficiency. Similar to Curve, tighter liquidity significantly enhances trading efficiency between stablecoins, giving Kuma-issued stablecoins superior liquidity from the outset.

Such fixed-income products are a crucial direction for private alternative investments. Kuma-issued tokens allow direct protocol yield collection without opaque intermediaries, and the low volatility of stablecoins further enhances their appeal.

RWA and LSD serve as the twin engines driving external and internal growth in the crypto world. Most current U.S. Treasury-focused RWA protocols concentrate on integrating into DeFi, paying little attention to effectively combining CeFi and DeFi—balancing regulatory compliance with on-chain decentralization.

In an increasingly stringent regulatory environment, Kuma actively collaborates with regulators while steadfastly supporting on-chain decentralization. By fully decoupling the issuance, circulation, and redemption of bond-backed stablecoins, it pioneers a hybrid RWA pathway.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News