Mimo launches KUMA Protocol: Bond-backed NFTs and interest-bearing tokens

TechFlow Selected TechFlow Selected

Mimo launches KUMA Protocol: Bond-backed NFTs and interest-bearing tokens

The launch of the KUMA protocol could potentially revolutionize the way bondholders receive interest.

Author: Mimo Labs

Compiled by: TechFlow

Mimo Labs recently launched the "KUMA Protocol"—the first DeFi protocol backed by regulated NFTs, which in turn are supported by sovereign bonds. With approval from the FMA (Liechtenstein Financial Market Authority) for Mimo Capital AG to issue such tokens, this launch marks a significant milestone.

The introduction of the MIMO protocol represents a major advancement both for itself and for the broader DeFi space, becoming the first and only protocol to issue interest-bearing tokens backed by traditional fixed-income products. The MIMO protocol offers investors new options for maintaining diversified portfolios on-chain—an approach that is particularly valuable in the current economic climate and during bear market downturns, providing diversification beyond traditional crypto assets.

Mimo Capital AG, a Regulated Entity

Over the past two years, Mimo has been working closely with government officials, industry experts, and regulatory authorities across various jurisdictions to ensure that the development of new financial products complies with all applicable laws and regulations.

(TechFlow Note: The "AG" in Mimo Capital AG stands for Aktiengesellschaft, meaning "joint-stock company" in German.)

These collaborative efforts with regulators have now borne fruit. Mimo now holds the rights and operates within a legal framework enabling it to offer a new financial product to the blockchain market—one accessible to global investors—and thereby opening up novel opportunities in the blockchain industry.

Bond tokenization attempts have already begun elsewhere. However, Mimo holds a distinct advantage as the first regulated institution operating within the European Economic Area (EEA) under a hybrid CeFi and DeFi model.

How Does KUMA Work?

Mimo designed the KUMA Protocol and its tokens to be more user-friendly than traditional bonds. Unlike conventional corporate and retail investor instruments, which can be difficult to understand and access, KUMA interest-bearing tokens can be easily bought and sold on any decentralized application, making them accessible to a much wider user base. Additionally, because the KUMA Protocol leverages blockchain technology, the entire token issuance process is auditable, transparent, and secure.

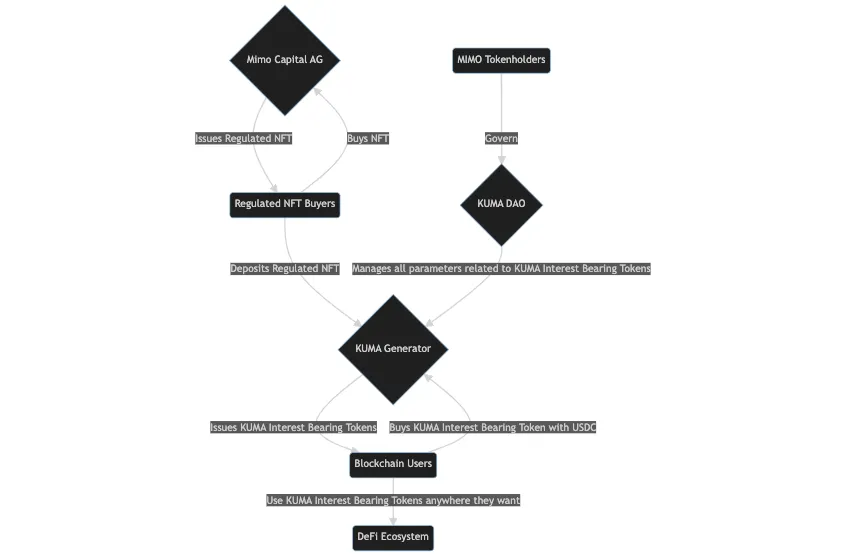

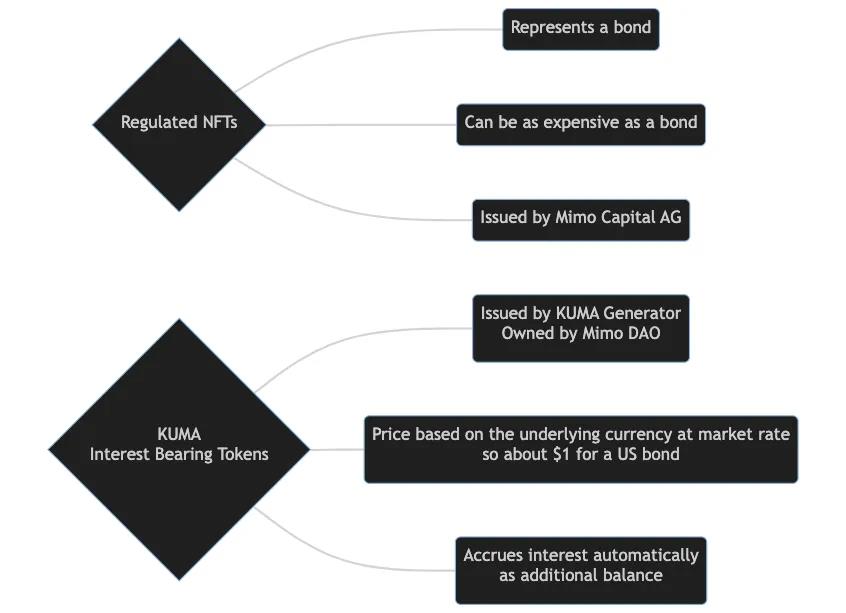

The KUMA Protocol is the result of collaboration between two distinct entities: Mimo Labs and the newly established Kuma DAO. Mimo Capital AG tokenizes bonds using NFT technology, while the KUMA Protocol is a decentralized entity governed by holders of MIMO tokens. This protocol utilizes the bond-backed tokens to issue KUMA interest-bearing tokens—fractional bond yield tokens secured by KUMA NFTs. These tokens behave similarly to other auto-compounding stablecoins. You can see the difference between these two types of tokens in the diagram below.

Mimo Capital AG initially selected sovereign bonds from countries with high credit ratings, traditionally viewed as safe assets. While this choice exposes users to the underlying credit and interest rate risks of the sovereign bonds, the use of blockchain standards in KUMA tokens provides greater transparency and utility.

The launch of this protocol could also revolutionize how bondholders receive interest payments. Traditional bonds typically pay interest semi-annually, annually, or at maturity. In contrast, thanks to smart contracts, KUMA interest-bearing tokens can distribute yields regularly—by default every four hours—providing investors with a far more consistent income stream without requiring any claim actions.

To date, all Mimo partners—including Fantom, Swissborg, SingularityDAO, and Akt.io—have expressed their intention to adopt KUMA.

It will be exciting to observe market reactions and whether investors embrace KUMA tokens as a new asset class.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News