Ambient Finance: How Does This Ethereum-Based DEX Reduce Gas Fees and Protect LP Interests?

TechFlow Selected TechFlow Selected

Ambient Finance: How Does This Ethereum-Based DEX Reduce Gas Fees and Protect LP Interests?

While Ambient's design aims to address the main issues faced by LPs, Singleton AMM appears to strike a perfect balance between meeting LP needs and enhancing the trader experience.

Author: DEFI CHUCK

Translation: TechFlow

Introduction

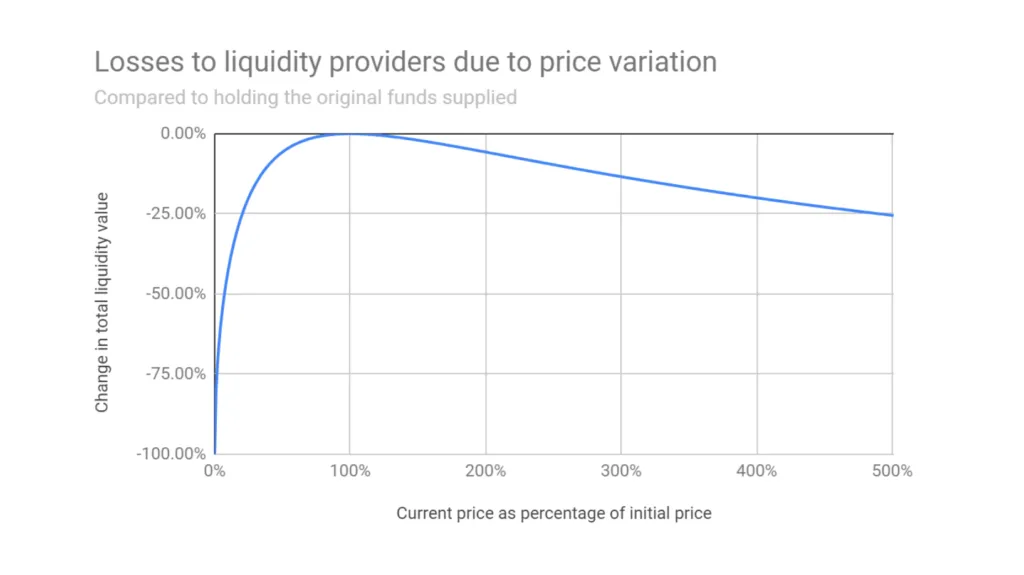

Automated market makers (AMMs) are foundational to DeFi, revolutionizing trading by enabling users to trade assets, create markets, and generate yield 24/7 without intermediaries. Since their inception, AMMs have facilitated over trillions of dollars in trading volume. While AMMs have successfully provided sufficient liquidity to support such volumes, they have long faced potential threats to sustainability—thereby also threatening the broader decentralized finance ecosystem. Although liquidity providers (LPs) should profit from participating in DeFi, for some LPs, revenues (i.e., trading fees) are offset by costs (i.e., impermanent loss). Impermanent loss (IL) refers to the opportunity cost of providing liquidity versus simply holding the assets. IL occurs when the prices of tokens in a pool (the deposited LP tokens) change.

Fortunately, the DeFi world is known for its rapid pace, continuous evolution, and protocols designed to enhance accessibility to global financial products. In this report, we will explore Ambient’s fundamental AMM design. Our goal is to highlight the most compelling features we’ve encountered and how they ultimately support the sustainability and wider adoption of DeFi.

Challenging Layer-1 Limitations

Due to relatively high gas fees on Layer-1 networks, AMMs and DEXs built solely on Ethereum face significant challenges. This has led most newly launched DeFi protocols to support various Layer-2 networks like Arbitrum at launch. Ambient defies this trend by choosing initially to support trading only on the Ethereum network.

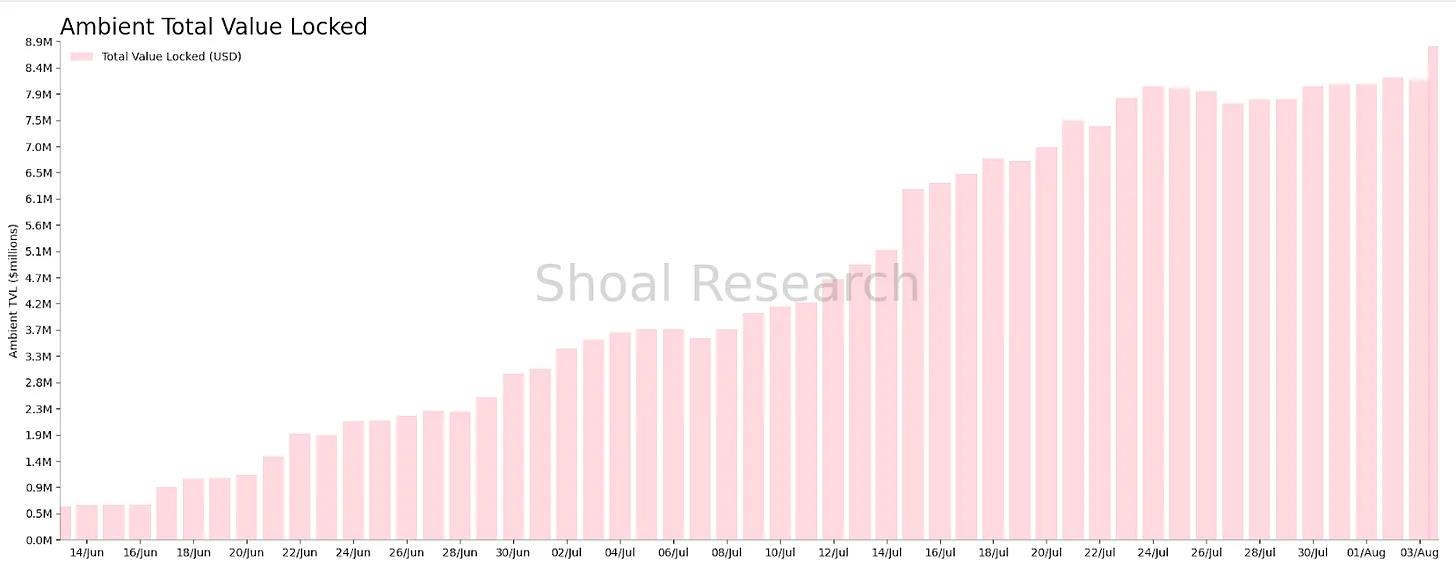

Despite congestion issues on the Ethereum network, Ambient has achieved remarkable success across key metrics, especially since the summer of 2023. From early June to the end of July, Ambient’s total value locked (TVL) increased approximately thirteenfold, and its trading volume tells a similarly impressive story. On June 13, Ambient’s trading volume was around $36,000. By July 14, its peak daily volume reached $1,410,000.

While Ambient offers traders several notable features—including the ability to place limit orders and pay gas fees with any ERC-20 token—if you're wondering what drives Ambient's success, it largely comes down to its Singleton AMM model. Let’s examine Ambient’s architecture and how it delivers incremental innovation for both liquidity providers and traders.

Singleton AMM

Ambient, formerly known as CrocSwap, is a decentralized exchange protocol that enables a unique form of automated market making. Ambient is a Singleton AMM, meaning it operates within a single smart contract, making swaps significantly more efficient. Using one smart contract brings a major benefit for traders and, ultimately, liquidity providers—drastically reduced gas costs associated with multi-hop swaps.

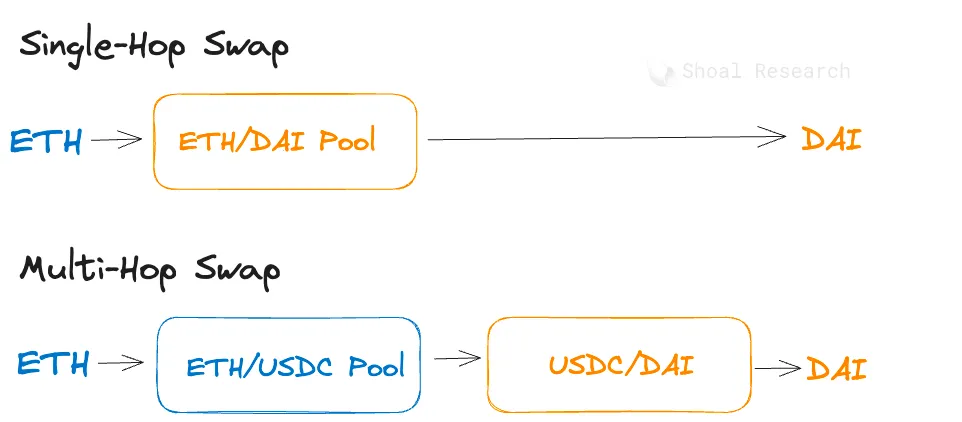

When trading via an AMM, there are two types of swaps: single-hop and multi-hop. A single-hop swap is a straightforward route that directly exchanges token A for token B through a single pool. In contrast, a multi-hop swap requires routing the trade across multiple pools. Multi-hop swaps are executed only when a single-hop path cannot fulfill the order, as single-hop swaps incur far less gas. Most AMMs are structured so that each pool has its own smart contract, making multi-hop swaps across multiple pools extremely gas-intensive.

Because Ambient is a Singleton AMM—with all pools operating within a single smart contract—it executes multi-hop swaps much more efficiently than traditional AMMs. Ambient does not transfer any intermediate tokens involved in multi-hop swaps, significantly reducing gas consumption during execution compared to other AMMs. Theoretically, as transaction gas costs decrease, trading volume on the AMM should increase. This leads to higher fee distributions for liquidity providers. Lower gas costs are particularly attractive to savvy arbitrageurs, whose trading activity helps maintain price efficiency. Ultimately, traders enjoy lower gas fees and more efficient pricing, while LPs benefit from increased overall trading activity and associated fees.

The Singleton model has now been adopted by projects like Uniswap, which recently introduced a similar architecture in the Uniswap v4 whitepaper. This further validates that Ambient is on the right track in advancing innovative AMM design mechanisms.

Ambient’s Liquidity Pools

Ambient is at the forefront of optimizing the liquidity provider (LP) experience. Since the beginning of DeFi—and even today—impermanent loss remains a persistent burden for LPs. To eliminate past pain points for LPs, Ambient supports two types of LP positions: Ambient Liquidity and Concentrated Liquidity. By offering both LP product types, Ambient upgrades liquidity provision for experienced LPs while attracting new DeFi participants with an optimal LP experience.

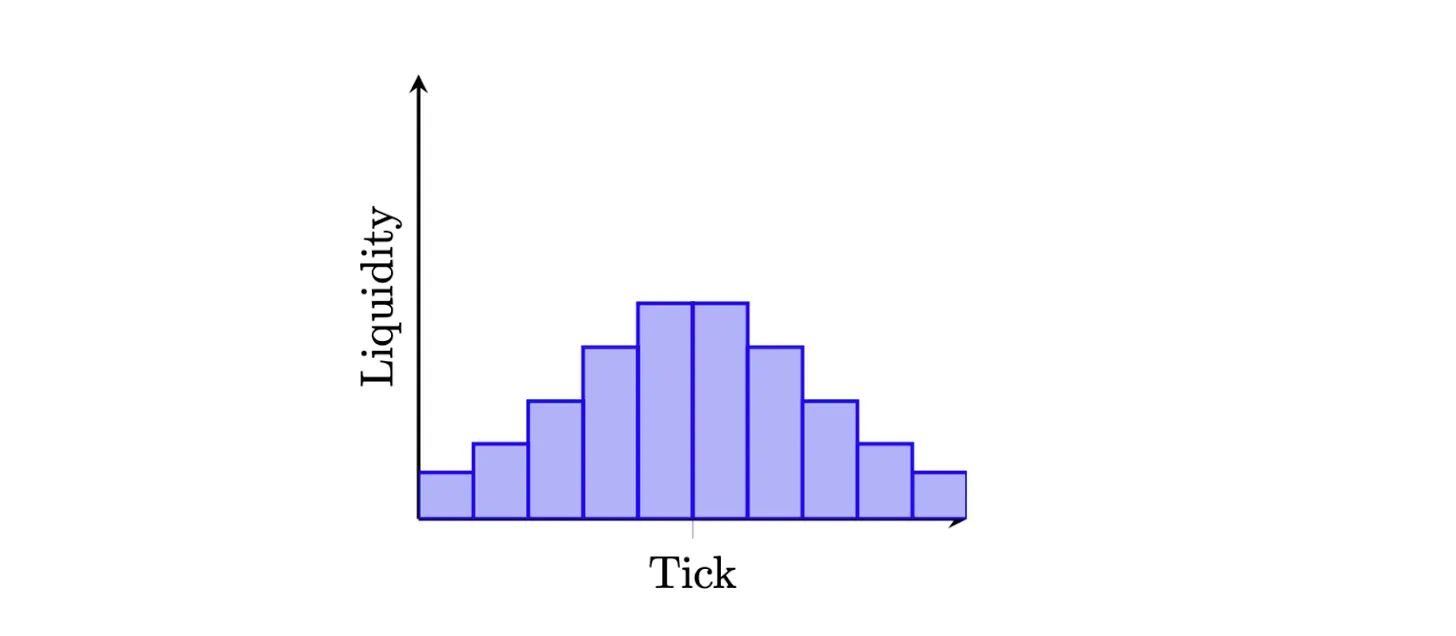

Users who wish to customize how and when their funds are used can opt for concentrated liquidity. An LP specifies a price range, determining when their liquidity is active in the pool. This means LPs earn a share of trading fees only when the underlying asset’s price stays within the specified range. When the asset price moves outside the range, the liquidity becomes inactive, and the LP stops earning fees.

Concentrated Liquidity Model

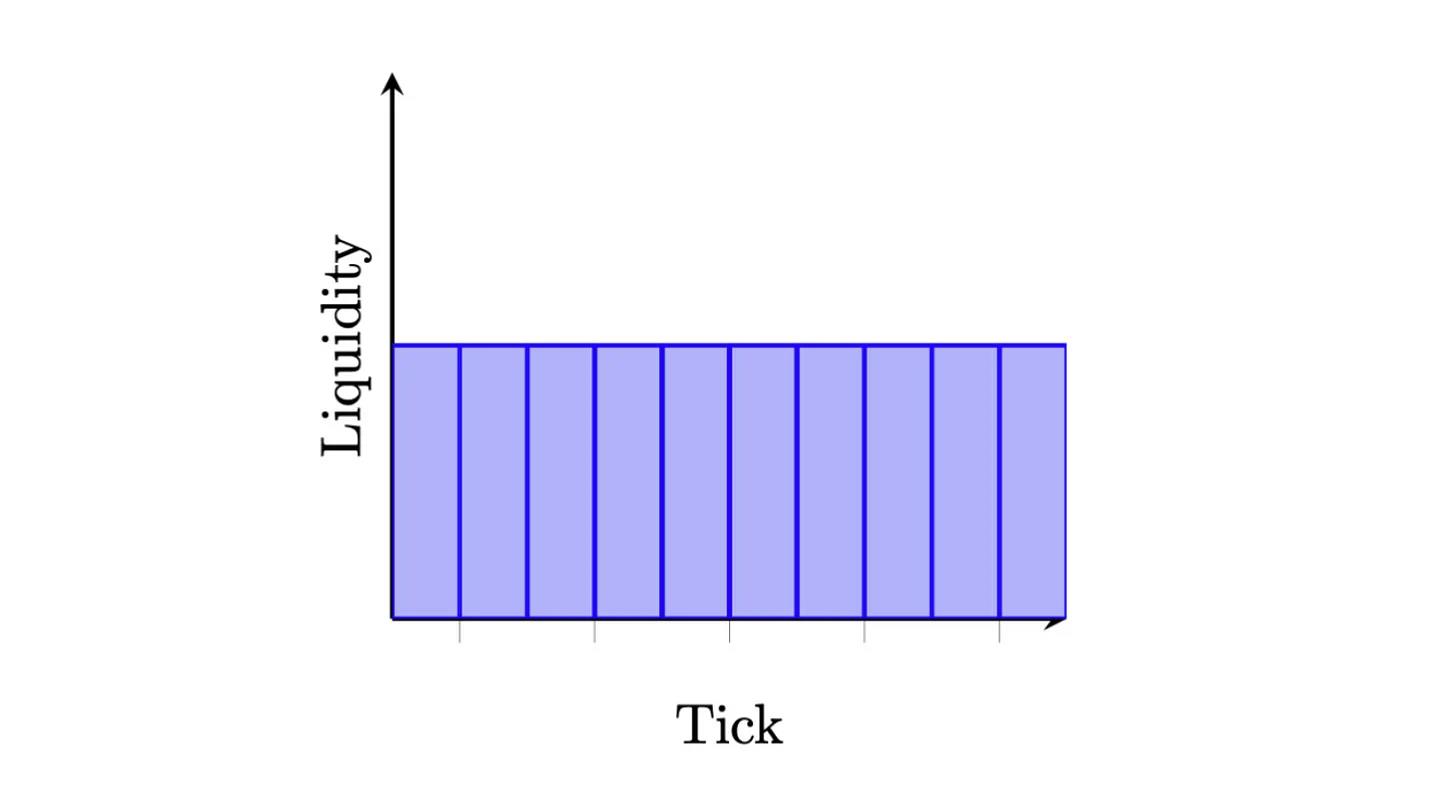

Concentrated liquidity suits more sophisticated LPs, as it requires greater DeFi knowledge and experience, and is typically the most capital-efficient LP position supported by Ambient. Ambient Liquidity is the other type of LP position offered by Ambient, suitable for all DeFi users because it does not require setting a price range and works better for non-volatile assets. The Ambient model uses a constant product formula, where liquidity remains active across all price levels of the underlying assets in the pool.

Constant Product Liquidity Model

Regardless of which liquidity position type an Ambient LP chooses, all LPs benefit from the protocol’s use of smart contract extensions called “Hooks.” Hooks allow Ambient to continuously modify existing pool parameters, including fee tiers. Hooks are particularly valuable for LPs because they ensure maximum capital efficiency and automatically grant access to optimal fee rates. For Ambient, liquidity fees are dynamically adjusted based on market activity.

Neither concentrated nor constant product liquidity is without flaws. If asset prices move beyond the supported range of concentrated liquidity, traders may suffer significant slippage (price impact). On the other hand, constant product liquidity is spread across all price levels, which benefits traders, but LPs cannot boost capital efficiency by targeting specific price ranges. Ambient studied both design mechanisms and merged them under the Singleton contract. Combining these two liquidity strategies allows LPs to maintain capital efficiency while enabling traders to execute cheaper swaps with deeper liquidity. Additionally, the integrated model eliminates fragmentation of liquidity across separate pools.

Limit Orders

Ambient offers limit orders on supported assets, known as Knockout Positions, enabled through directional concentrated liquidity. "Directional" means that when liquidity is added to a specific range, it gets locked once the price crosses that range. Most AMMs are bidirectional, allowing assets to be swapped back and forth as long as the LP is in-range. With directional Knockout Positions, once the price moves beyond the user-defined concentrated liquidity range, the position is removed. This act of removing liquidity upon crossing the range functions as a limit order. The range for a Knockout LP is kept narrow to ensure execution. Note that although the range is narrow, the liquidity is only “knocked out” once the price fully exits the range.

Gasless Transactions

Ambient leverages account abstraction to enable gasless transactions. Account abstraction allows third parties to pay gas fees on behalf of users. In this case, Ambient uses signatures to let users pay for swaps solely in the traded asset. Tips can be paid to third-party relayers who send ETH on the user’s behalf, enabling completely gasless swaps.

Dynamic Fees

Fees are directly tied to the pool, similar to major pools like USDC/ETH on Uniswap. Uniswap employs three fixed fee tiers—0.05%, 0.30%, and 1%—with LPs typically selecting based on implied volatility (expected price movement). These fees compensate LPs for bearing IL. In Ambient, fees are dynamically adjusted according to market volatility (actual price movements). Dynamic fees offer LPs greater capital efficiency and reduce the need for active management or withdrawing liquidity to adjust to expected fee tiers during periods of low or extreme market volatility.

Conclusion

While Ambient’s design aims to address the main challenges faced by LPs, the Singleton AMM appears to strike a perfect balance between meeting LP needs and enhancing the trader experience. Traders can participate in DeFi directly on Ethereum’s base layer with reduced gas fees and access efficiently priced markets. LPs benefit from trading fees while gaining access to innovative features Ambient offers for its liquidity pools. In summary, Ambient is undoubtedly committed to making the future of DeFi brighter.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News