Why Ambient Is Currently the Most Efficient DEX on Ethereum?

TechFlow Selected TechFlow Selected

Why Ambient Is Currently the Most Efficient DEX on Ethereum?

As a trading protocol combining the features of CEX and DEX, Ambient introduces novel DeFi-native functionalities, delivering a premium experience for users.

Ambient (formerly CrocSwap) is a decentralized exchange protocol that enables a bidirectional AMM combining concentrated and ambient constant-product liquidity on any pair of blockchain assets. Ambient runs the entire DEX within a single smart contract, where individual AMM pools are lightweight data structures rather than standalone smart contracts. This design makes Ambient currently the most efficient Ethereum-based DEX.

Mechanism Analysis

Automated Market Maker (AMM)

In Ambient, liquidity is provided through an Automated Market Maker (AMM) mechanism. Unlike traditional limit order books (LOBs), liquidity is not supplied by individual orders but by the aggregate liquidity from funds contributed by liquidity providers (LPs).

Each liquidity pool in Ambient represents a two-way market between a pair of interchangeable assets or tokens. At any given time, each liquidity pool has a single exchange rate determined by the ratio of its virtual reserves. End users can swap one token for another in the pair according to a deterministic formula.

Ambient liquidity pools use the Constant Product Market Maker (CPMM) algorithm. Regardless of the size or direction of the swap, the product of the two sides of the virtual reserves remains constant (except for collected fees and increases from concentrated liquidity). When a trader sends a certain amount of base tokens into the pool, the liquidity pool returns a corresponding amount of quote tokens based on this constant product relationship. As a result, the pool's exchange rate rises, increasing the value of the quote token relative to the base token.

This mechanism balances supply and demand by proportionally adjusting prices based on the size and direction of trades. Therefore, traders do not receive the instantaneous rate but instead get a slightly worse price depending on the size of their trade relative to the liquidity in the pool. This difference is known as price impact.

Additionally, traders pay a liquidity fee based on the notional value of their trade. The liquidity fees are redistributed proportionally to LPs according to their contribution to active liquidity in the pool. Fee rates vary by specific liquidity pool and may be adjusted based on market conditions, but typically range from 0–1%.

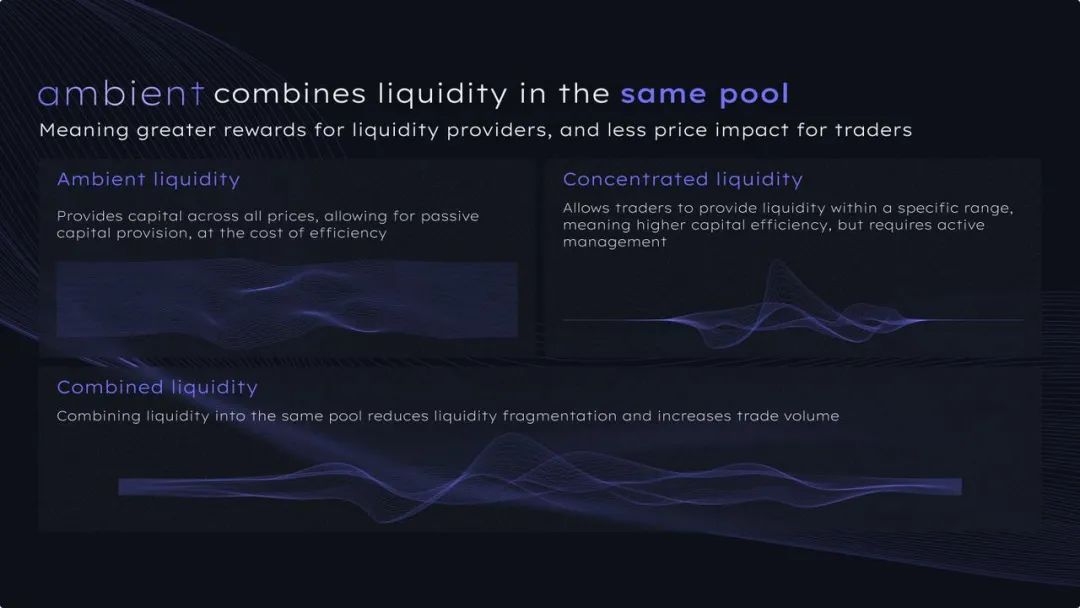

Concentrated Liquidity

Concentrated liquidity allows users to provide liquidity over any predefined price range along a single AMM curve. This contrasts with Ambient liquidity, where liquidity remains active across all possible prices from zero to infinity.

The primary advantage of concentrated liquidity is capital efficiency. Liquidity providers (LPs) only need to commit collateral required to support liquidity within a limited range. For example, a stablecoin pair trading between $0.99 and $1.01 requires significantly less capital when using concentrated liquidity.

A disadvantage of concentrated liquidity is that LPs no longer accumulate fees if the curve price moves outside their specified range. Therefore, concentrated liquidity providers must either carefully define their price ranges or regularly "rebalance" their positions back into range.

Ambient also supports native Ambient liquidity, which differs from "full-range concentrated liquidity." The first advantage is that, unlike fees accumulated in separate side pockets, fees earned by Ambient liquidity providers automatically compound back into their original position without requiring manual management. The second advantage is significantly lower gas costs for minting and burning Ambient liquidity provider positions. The third advantage is that all Ambient liquidity provider positions on a given curve are naturally interchangeable and can be easily packaged into "LP tokens."

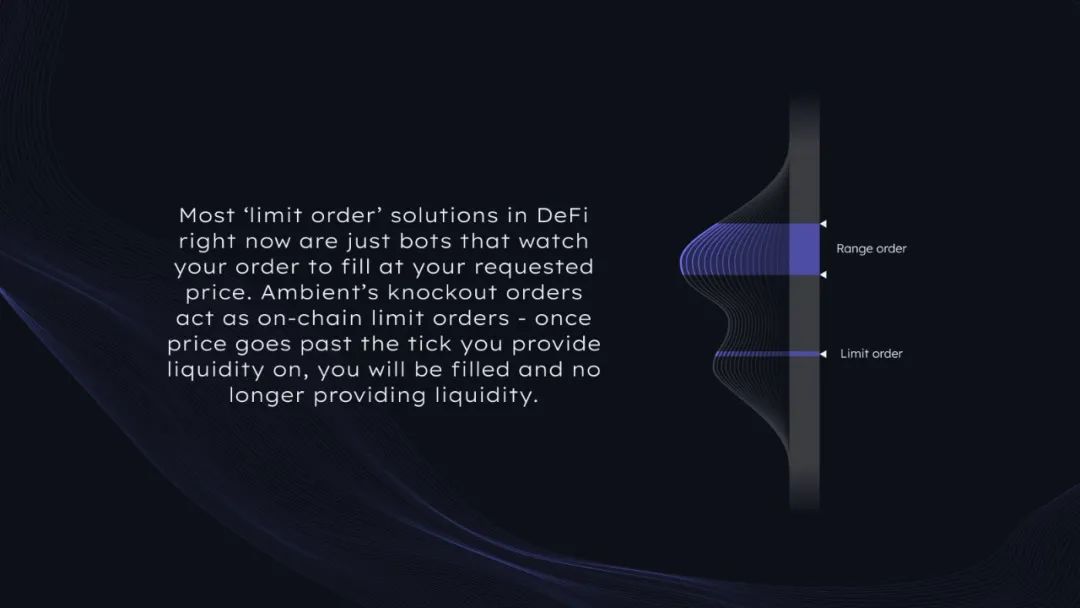

Eject Liquidity

The behavior of eject liquidity is similar to range-based concentrated liquidity, except that liquidity is permanently removed from the AMM curve whenever the curve price exceeds the edge of the range. Eject liquidity can be set so that it triggers when the curve price drops below a buy price or rises above a sell price.

Eject liquidity behaves somewhat like an "irreversible limit order" on a traditional centralized limit order book. Users who want directional execution at a better price than the current market price can place a buy (sell) in the pool at a bid (ask) below (above) the current price. Once the price reaches that point, the user’s order executes. Unlike standard concentrated liquidity range orders, once filled, the user’s purchased tokens do not revert even if the price moves back above the fill price. For this reason, eject liquidity is a useful tool for users seeking directional execution while obtaining more favorable pricing than traditional swaps.

Eject liquidity orders offer better pricing:

-

Waiting for cheaper prices

-

Receiving rather than paying swap fees

-

Avoiding price slippage on the AMM curve

In practice, eject liquidity tends to have some limitations for users:

-

Unlike typical concentrated liquidity, the width of the range order for all eject orders across the entire pool is fixed (typically narrow).

-

Eject bids must always be below the current curve price, while eject asks must be above the current curve price.

-

For full ejection, the price must move completely across the entire range. If the curve moves only to the middle of the range, the order may be "partially filled." If the price moves back into the range without reaching the ejection price, it converts back.

User Level

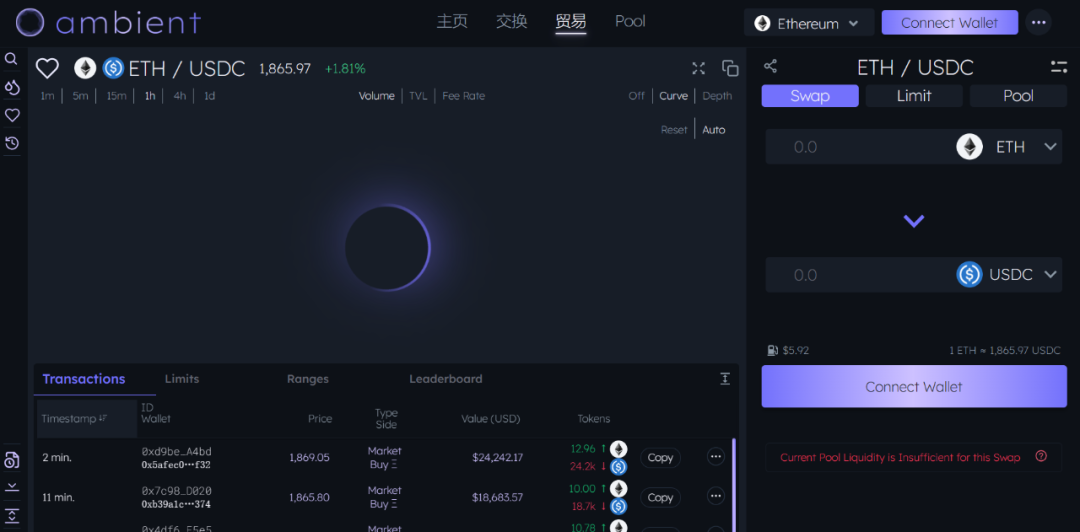

Token Swaps

Ambient’s core functionality allows users to exchange one type of token for another at a fair market price. If there is liquidity for a given trading pair in the DEX contract, users will be able to swap between tokens. Additionally, the front-end web application provides an interface for regular swap operations.

Residual Collateral

Users can directly deposit a certain amount of tokens into the DEX contract as static balances. Residual collateral acts as lightweight working capital, reducing overhead and transaction costs compared to handling ERC20 token transfers during every swap, mint, or burn operation. Excess collateral can be deposited directly by users sending tokens to the DEX contract. Alternatively, it can be received as output from swap, burn, or harvest operations. Additionally, residual collateral can be withdrawn directly, allowing the user’s wallet to receive the corresponding underlying tokens.

Governance & Policy

Governance of the Ambient protocol is ultimately controlled by a DAO multi-sig. There are two main multi-sig entities: the operational multi-sig and the treasury multi-sig.

Powers of the multi-sig include:

-

Setting and modifying pool parameters (e.g., liquidity fees, JIT quote spacing, JIT thresholds, etc.)

-

Initializing new pool type templates

-

Setting, enabling, or disabling protocol fees

-

Setting sub-price size improvement token size thresholds

-

Setting minimum liquidity commitments for newly initialized pool types.

-

Installing strategy oracle pipelines with any functionality approved by the operational multi-sig.

The treasury multi-sig is reserved for more serious administrative actions, requiring a higher degree of commitment and longer delays. The treasury multi-sig combines a Gnosis Safe with a 5-day timelock. In addition to standard operational multi-sig permissions, the treasury multi-sig can also:

-

Upgrade the code in the DEX contract

-

Transfer DEX permissions to a new strategy controller contract

-

Collect accumulated protocol fees within the DEX

-

Force-unload a strategy oracle before its expiration

-

Force conversion of permissioned pools into permissionless pools (in case the permission oracle misbehaves)

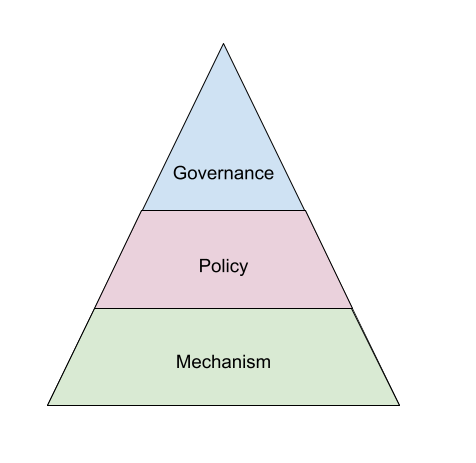

System Overview

Governance fulfills the traditional role of a DAO. It holds full authority over the protocol and is controlled via an M-of-N multi-sig combined with a timelock solution.

Strategy is an intermediate layer situated between DAO governance and the DEX contract itself. It can directly pass decisions from the governance layer, or delegate limited administrative control of the DEX to external smart contract strategy oracles explicitly installed by DAO governance.

Mechanism refers to the underlying DEX contract itself. CrocSwapDex (the core smart contract holding decentralized liquidity and positions) is built with adjustable parameters that can be dynamically tuned by external strategy oracles. This enables the protocol to improve and experiment with new features in a safer and more controlled manner than direct upgrades to the base DEX smart contract.

Advantages

As a completely new codebase, Ambient incorporates best engineering practices and innovative smart contract architecture choices. This gives it several core advantages over other DEXs:

-

Significant gas savings.

-

Combining concentrated ("UniV3 style"), ambient ("UniV3 style"), and eject liquidity (behaving like limit orders that atomically fill and lock positions in a single direction) on the same liquidity curve.

-

Dynamically adjusted pool fees, maximizing returns for liquidity providers relative to market conditions and demand for liquidity.

-

Because fees from concentrated liquidity providers are automatically reinvested into ambient liquidity, users earn compounding returns even without manually harvesting.

-

Prevention of JIT (Just-In-Time) liquidity attacks by using minimal TTL parameters on concentrated liquidity positions, allowing ordinary liquidity providers to earn higher fees.

-

Users can pre-fund tokens on the DEX in the form of "residual collateral." By deferring token transfers until net settlement, active traders operate more efficiently.

-

Enables users to conduct "gasless" trades via the EIP-712 off-chain standard, paying fees in swapped tokens.

-

Unique support for the "permissioned pool" primitive, delegating control and restriction of pools to general-purpose smart contract oracles running inside or outside the protocol.

Summary

The liquidity provision model in Ambient combines characteristics of both decentralized and centralized exchanges. Unlike other AMMs, liquidity for trading pairs is not fragmented. Ambient can run the entire DEX system within a single smart contract, enabling lower-cost trades, greater liquidity incentives, and a fairer trading experience. As a trading protocol blending CEX and DEX features, Ambient introduces novel DeFi-native functionalities, delivering a superior user experience.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News