Halving Narrative and Reflexivity: Why Is LTC Falling Instead of Rising—Can BTC Halving Still Bring a Bull Market?

TechFlow Selected TechFlow Selected

Halving Narrative and Reflexivity: Why Is LTC Falling Instead of Rising—Can BTC Halving Still Bring a Bull Market?

From the perspective of the industry as a whole, perhaps only by convincing the majority that the "Bitcoin halving" will bring a bull market can a real bull market actually emerge.

Author: TechFlow Cleaning Staff

At 23:00 on August 2, Litecoin (LTC), once hailed as "Bitcoin is gold, Litecoin is silver," reached block height 2,520,000. The block reward officially halved, reducing mining rewards from 12.5 LTC to 6.25 LTC.

Litecoin's official Twitter promptly celebrated the event with a post.

However, the market responded with a cold splash: LTC prices steadily declined, dropping 7% within 24 hours.

While one might reasonably argue "when the good news is out, it becomes bad news"—that people sell after the halving to lock in profits—the real issue is that LTC didn't rally much before the halving either, merely moving in sync with the broader market. Therefore, most sellers weren't "profit-taking" but rather "reluctant selling."

Neither its "digital silver" label nor the halving narrative managed to boost LTC’s price. More importantly, people are now questioning: will next year’s Bitcoin halving really matter?

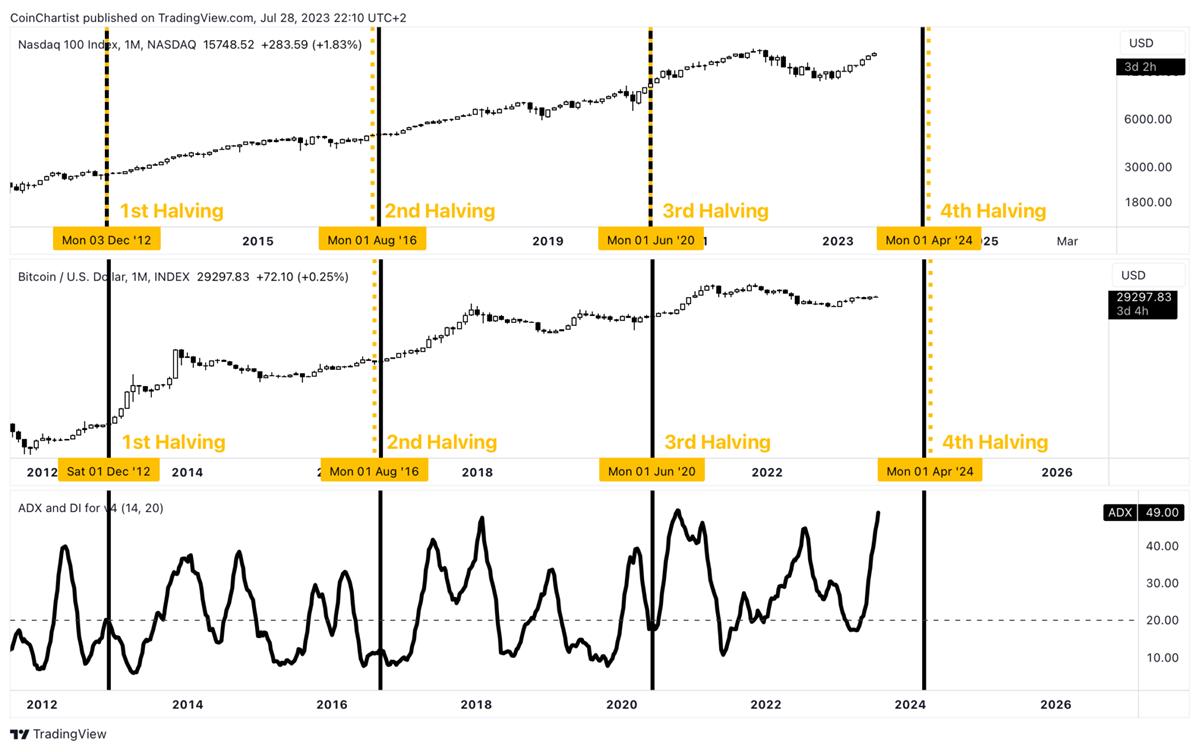

To many, the Bitcoin halving seems like a surefire trigger for price increases. Yet correlation does not imply causation.

Looking at past Bitcoin halvings, U.S. stocks have also risen almost simultaneously. Surely we can't claim Bitcoin halvings caused the stock market rally—or reframe it as "stock market growth drove Bitcoin’s rise."

Price is determined by both supply and demand. After three Bitcoin halvings, the impact of halving on supply has diminished. In 2024, the block reward will drop from 6.25 BTC to 3.125 BTC.

Thus, what truly drives Bitcoin’s price is demand—specifically, whether new external capital will flow in.

Reflecting on the bull run following the 2020 halving, the causes people recall aren’t necessarily the halving itself, but rather the "pandemic" and "the Fed’s massive monetary easing." Amid extremely loose liquidity, U.S. stocks soared, large amounts of money poured into Grayscale Bitcoin Trust, which continuously bought Bitcoin. Then Tesla invested in Bitcoin, fueling market frenzy.

Therefore, the real key to a crypto bull market lies in where the money comes from.

Does this mean the Bitcoin halving is unimportant? Not quite. The halving still holds strong narrative and anticipatory value.

In a crypto market where fundamentals are nearly nonexistent, price movements are often driven by narratives and positive expectations. Experience shows such narrative value can be powerful.

When everyone believes the "Bitcoin halving" will bring a bull market, they rush to buy—and that collective action can actually create the bull market.

This is what Soros called "reflexivity."

Stock markets work similarly—they are voting machines. In the short term, stock prices are determined not by company performance but by how many people are buying. The more buyers there are, the higher the price climbs. So when buying a stock, most people are actually thinking: will others think this stock is good too? Will they also buy it?

Financial markets are the result of a collective battle of perceptions—I think about what you think, and you think about what I think.

Under reflexivity, asset prices never equal intrinsic value. They mostly float in an inflated state; as prices rise, people perceive the asset as stronger, prompting even more buying.

This cycle repeats until the bubble bursts. The same dynamic applies during downturns. This ensures prices perpetually swing like a pendulum around value—from one extreme to another.

Therefore, from a macro-industry perspective, a real bull market may only emerge when the majority truly believe the "Bitcoin halving" will bring one.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News