70 Days to LTC Halving: Market Indifference and Future Outlook Analysis

TechFlow Selected TechFlow Selected

70 Days to LTC Halving: Market Indifference and Future Outlook Analysis

Although Litecoin's halving event is approaching, market attention toward it appears to be relatively low.

Author: Alex

Compiled by: TechFlow

Although Litecoin's upcoming halving event is drawing near, market attention toward it appears to be low, raising concerns about its future. In this article, researcher Alex explores the psychology behind halving events, whether Litecoin still has a purpose, and how the market is reacting. Here’s the original piece:

I've been researching Litecoin and its upcoming halving event—approximately 70 days away—and so the focus of this article is: the psychology of halvings, and whether Litecoin still needs to exist.

First, some historical context:

Litecoin was created in 2011 based on Bitcoin, featuring faster block times and a different mining algorithm. Like Bitcoin, Litecoin halves its block reward every four years to reduce inflation and increase scarcity.

Why are halving events bullish?

First, because miners' rewards are cut in half, reducing structural sell pressure. Less selling = higher prices—it’s that simple.

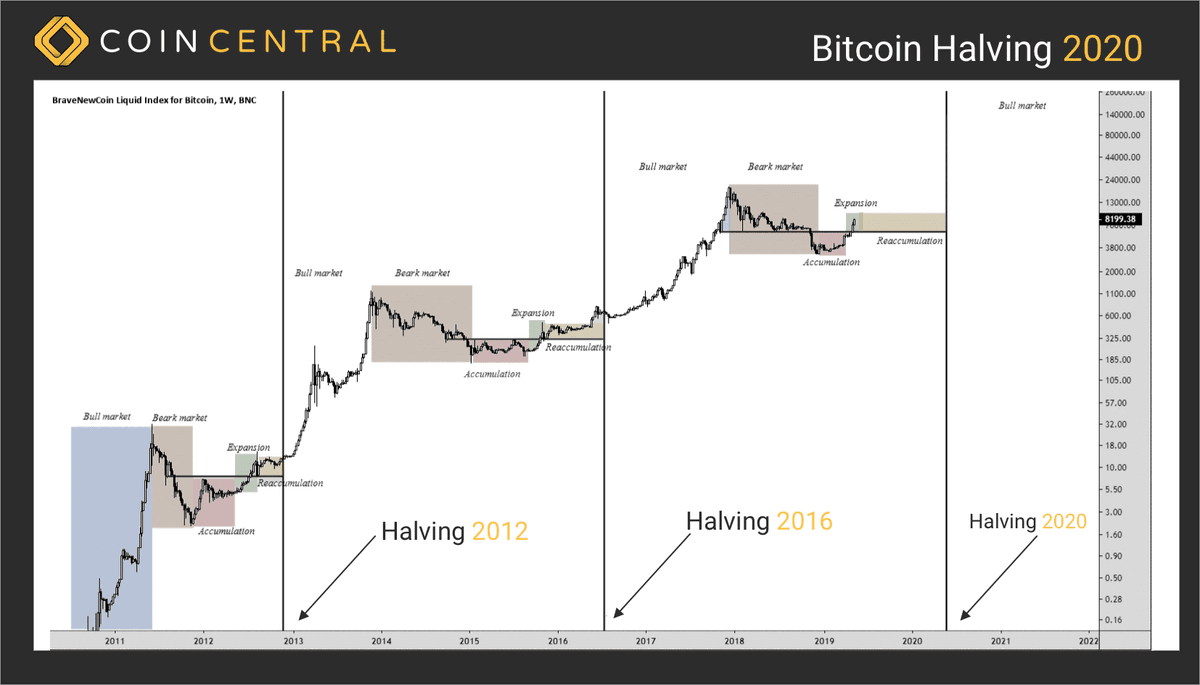

After three Bitcoin halvings, prices have followed a parabolic rise, leading most people to associate halvings with bullishness. The best narratives appeal to people across all levels of intelligence.

Are halving events guaranteed to be bullish?

Not necessarily.

Since halvings reduce mining rewards, they also reduce the diversity of participants who can profitably secure the network. Thus, all else being equal, each halving increases scarcity but weakens network security.

When people bid up prices ahead of a halving, they're effectively casting a vote of confidence that the network's security is worth protecting.

Now let’s look at Litecoin’s upcoming halving.

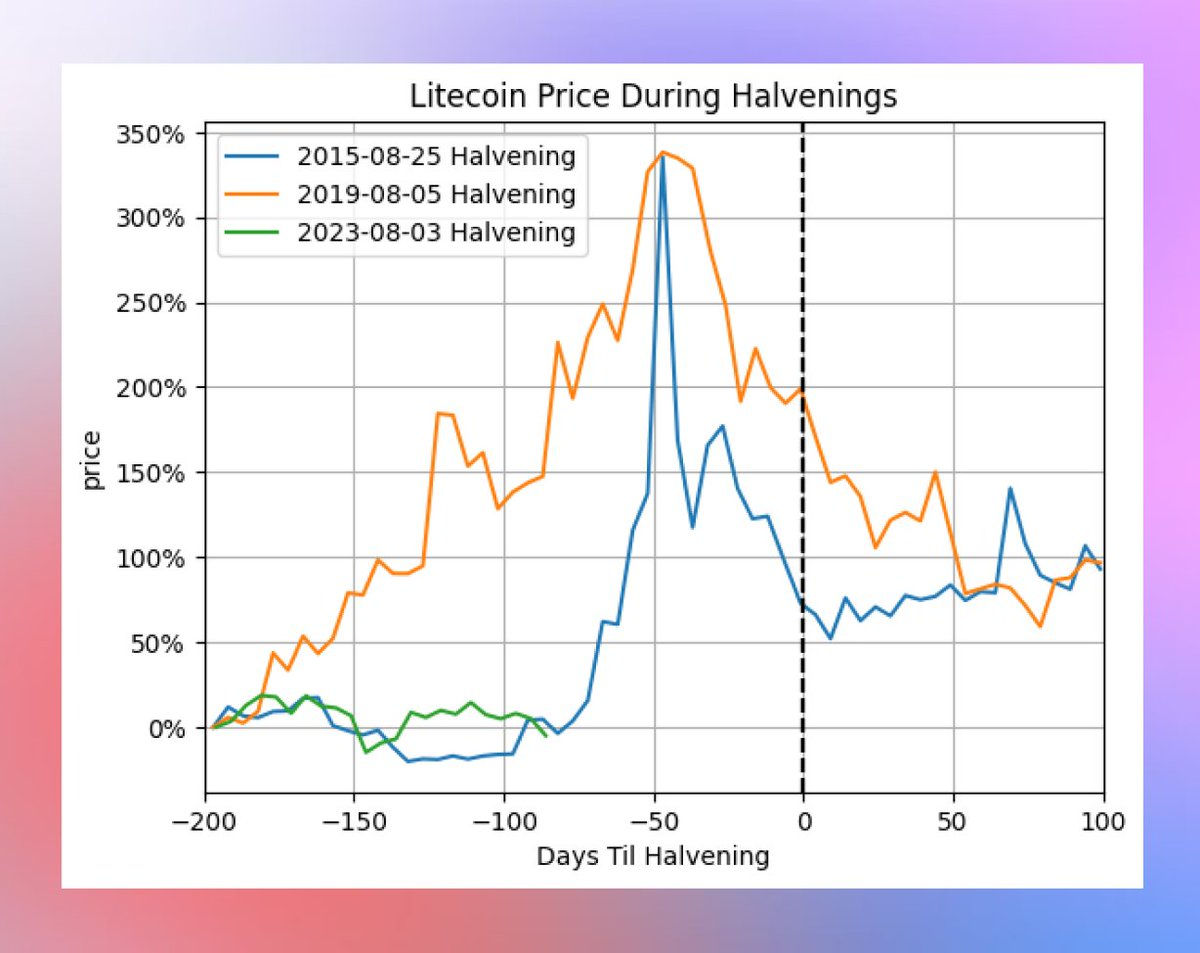

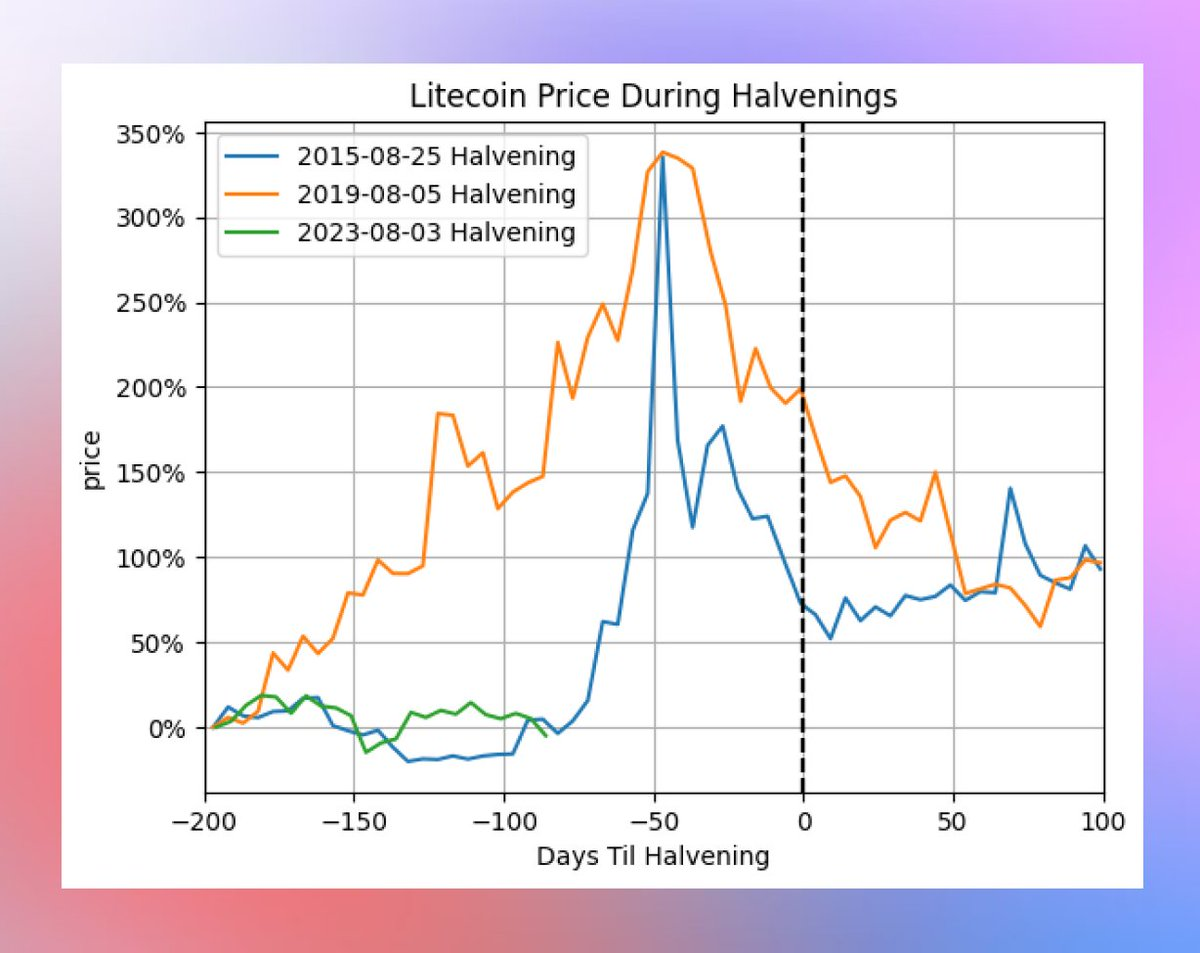

With less than 70 days until the halving, we haven’t yet seen strong market interest. In past Litecoin halvings, price peaks occurred around 50 days before the event.

We can't draw definitive conclusions from just two data points across vastly different tokens. But crypto’s irrationality never ceases—the apathy toward Litecoin’s halving might signal that its network security isn’t deemed worth saving. Since 2019, more innovative cryptocurrencies have emerged, leaving poor Litecoin behind.

But honestly, I don’t think Litecoin is ready to disappear just yet. Most people I’ve spoken to support the idea of a halving rally; there just hasn’t been a strong Schelling point for bulls to coordinate around.

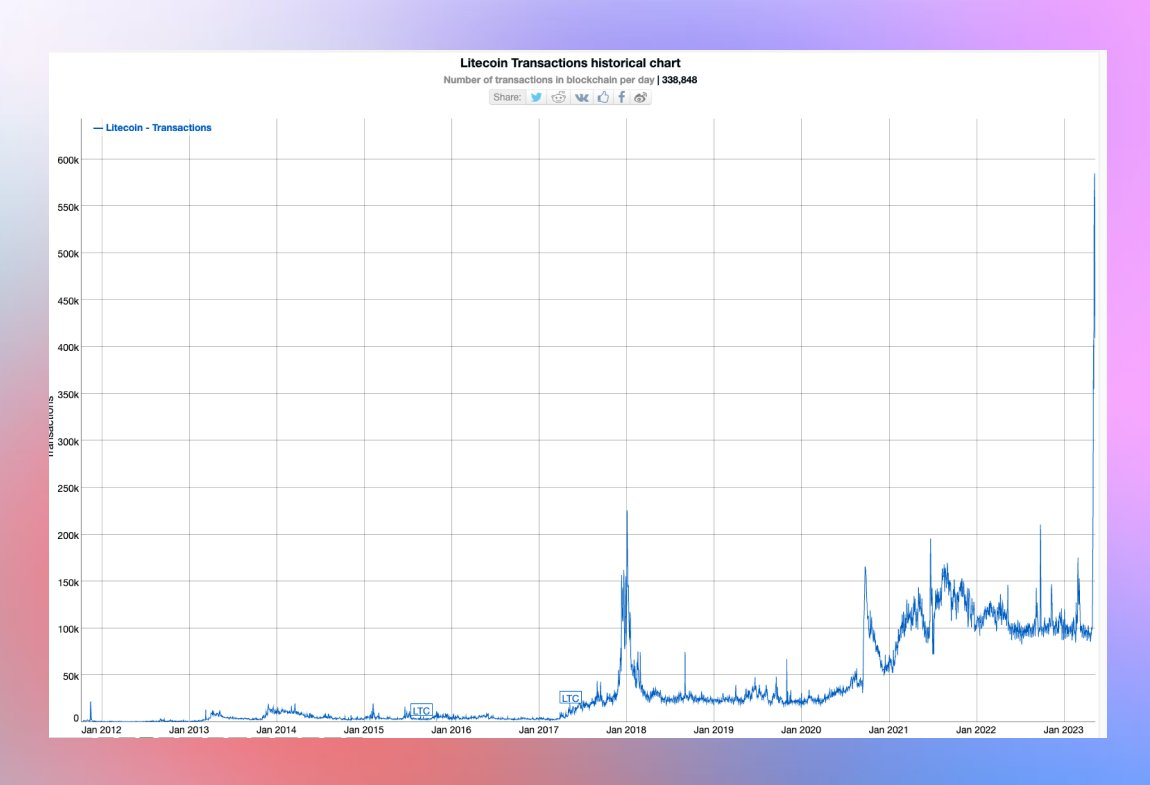

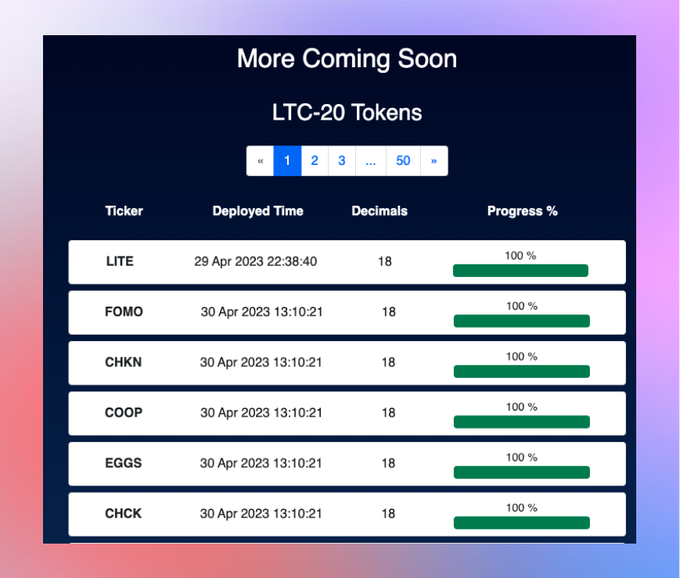

Meanwhile, since the launch of LTC-20 (a fork of the BRC-20 token standard on Bitcoin) on May 3, on-chain activity on Litecoin has been quietly growing. Transaction volume over the past week has surpassed any previous level.

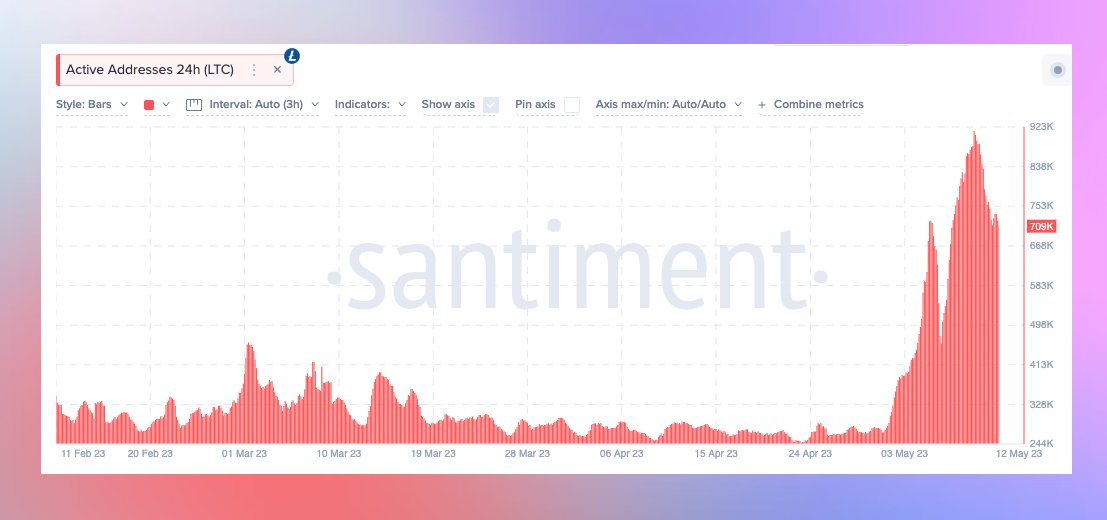

Last week, Litecoin also hit an all-time high in active addresses, and now hosts a variety of LTC-20 tokens for speculators to gamble on.

There is a disconnect between the on-chain excitement and price indifference.

It may not be the right time to take risks on altcoins, as they’ve been slaughtered over the past few weeks.

But this also means less competition from other narratives.

Now might not be the ideal moment, but I believe if the market decides to save Litecoin, the timing is getting close.

If nothing emerges within the next 100 days, I think that will be a good sign that other halving-related narratives are gradually losing their influence.

*Disclaimer: I hold a position hedged against Bitcoin, as I believe it offers a fairly attractive risk/reward profile. Not investment advice—please do your own research.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News