Litecoin's Frightful Night: The Dark Hand of the Crypto Market Fooled Everyone

TechFlow Selected TechFlow Selected

Litecoin's Frightful Night: The Dark Hand of the Crypto Market Fooled Everyone

A fake news story triggered a $200 million liquidation wave.

The crypto world never lacks surreal moments.

On September 13, news spread across global social networks that Walmart had announced support for Litecoin (LTC) as a payment method for online purchases.

The Litecoin Foundation’s official Twitter account shared the partnership announcement; international authoritative media including Bloomberg, Reuters, and CNBC reported it widely; in China, numerous leading media outlets also picked up the story.

Fueled by the positive news, LTC surged over 28% instantly, pulling other cryptocurrencies like Bitcoin upward with it.

Crypto investors became highly enthusiastic and rushed to buy in. However, just minutes later, the Litecoin Foundation deleted its tweet about the Walmart partnership, and Walmart issued a statement clarifying that the news was fake.

LTC plummeted immediately, reversing from a 28% gain to a 1% loss, dragging down the entire market. A series of door-shaped K-lines trapped leveraged and stranded investors tightly inside.

According to data from Bybt, within one hour after the news broke, total liquidations in the crypto market exceeded $200 million.

How did the hidden hand behind the scenes fabricate this false news and deceive most mainstream global media and investors?

Why did authoritative outlets like Bloomberg and Reuters fall victim in the crypto space?

Who will be held accountable for investors’ losses?

How Did the Fake News Spread?

Looking back at this fake news incident targeting the crypto market, one cannot overlook GlobeNewswire.

Among global news agencies, besides professional institutions like the Associated Press and Thomson Reuters, there exists a special category—commercial and financial wire services.

These can be considered "PR firms," whose core business involves charging companies to distribute press releases through global media channels, including news distribution and online public opinion monitoring. Major players in this field include PR Newswire, Business Wire, and in this case, GlobeNewswire.

Typically, when companies announce major news, they publish official PR releases via platforms like PR Newswire before global dissemination.

The幕后black hand exploited exactly this loophole to manipulate the market using fake news.

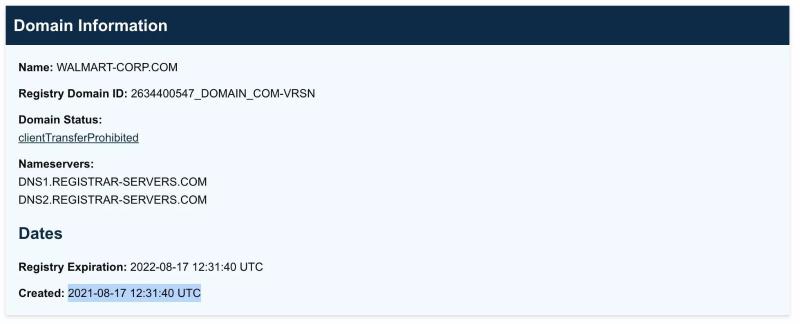

First, the perpetrator registered a domain name resembling Walmart—walmart-corp.com—in August, along with an associated email address.

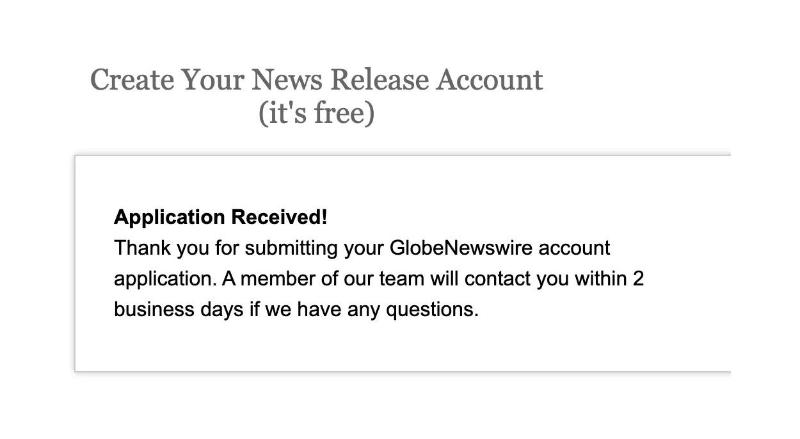

Then, they registered “WalMart Inc” on GlobeNewswire. Only four sets of information—company details, personal info, and contact information—are required, and staff review applications within two days.

This step was crucial—the black hand successfully deceived the backend reviewers using information tied to the fake domain and email, completing registration. Judging from the footer of the fake press release, the perpetrator likely impersonated Walmart CMO William White during registration.

On September 13, amid a day of continuous decline in the crypto market, the black hand launched their operation by publishing a PR release titled “Walmart Announces Partnership with Litecoin” on GlobeNewswire.

Notably, the article followed standard journalistic format, complete with fabricated “facts” and quotes attributed to key executives from both sides, making it extremely difficult to detect as fake content.

The news quickly spread—Bloomberg Terminal picked up the alert, and Reuters, CNBC, Yahoo Finance, Coindesk, and others ran front-page reports. Domestic media outlets widely republished the story.

They did not verify the claim with Walmart directly but simply cited the “false news” from GlobeNewswire.

More importantly, the Litecoin Foundation’s official Twitter account also shared the false press release, dispelling doubts among many investors.

Fueled by the bullish sentiment, the crypto market rallied, with LTC surging rapidly—up nearly 30%—and dragging Bitcoin, Ethereum, and other assets upward.

However, suspicions soon arose.

- First, no such update appeared in Walmart’s official website newsroom;

- Second, the entity “Walmart Inc” on GlobeNewswire had published only this single piece of news;

- Third, the email address used (walmart-corp.com) was registered in August…

Of course, Walmart itself was the most bewildered party. Upon seeing headlines claiming it accepted Litecoin payments, spokesperson Randy Hargrove urgently issued a denial.

He stated that Walmart had not formed any partnership with Litecoin and confirmed that the company had contacted GlobeNewswire to investigate how the false press release was published.

The Litecoin Foundation also deleted its tweet regarding the alleged partnership with Walmart.

Was the Litecoin Foundation Behind This Fake News Incident?

In an interview with Bloomberg, Litecoin founder Charlie Lee said he owns only about 20 Litecoins and has no motive to participate in schemes designed to inflate the cryptocurrency’s value.

He explained that the tweet announcing the Walmart partnership was a mistake made “due to excessive excitement,” calling the false post “an unfortunate reality.”

After Walmart’s denial, Reuters, CNBC, and others deleted their articles and issued corrections—but for investors who bought in during the surge, there was no way to undo their decisions.

Who Will Punish the Hidden Mastermind?

Who Will Punish the Hidden Mastermind?

For the mastermind who fabricated the fake news, the profit model is straightforward and clear.

Before releasing the false news, they accumulate long positions in LTC futures. When the fake news spreads and major media report it, LTC surges—allowing them to close their longs at a profit. Simultaneously, they open short positions at high prices, then wait for the correction. Once the truth emerges and LTC crashes, they profit from covering their shorts.

A double-sided harvest in one cycle.

To avoid exposure, the perpetrator used anonymous identity services provided by the Icelandic company “Withheld for privacy” when registering the domain.

Who Will Crack Down on Such Brazen Market Manipulation?

In traditional capital markets, whether in China or the U.S., spreading false or unverified material information constitutes securities market manipulation—a criminal offense.

In China, according to the 2020 Amendment to the Criminal Law (XI), those responsible for fabricating and disseminating false securities trading information or falsifying disclosures now face a maximum sentence increased from three years to ten years.

In the U.S., the Litecoin fake news incident has sparked outrage.

Nick Bilton, director of HBO’s hit series *FAKE FAMOUS*, tweeted that such market manipulation practices will inevitably draw severe regulatory crackdowns—it’s only a matter of time.

Caitlin Long, founder of Avanti Financial Group, tweeted: “Today, it’s not the SEC handling fraudsters—it’s the Department of Justice. As we speak, law enforcement is already requesting information from exchanges about who traded LTC.”

Beyond the mastermind, GlobeNewswire and the Litecoin Foundation are also hard to absolve of responsibility.

Currently, the false news has been removed. GlobeNewswire stated that it is strengthening verification procedures prior to publication and will fully cooperate with relevant authorities investigating the false announcement about the Walmart-Litecoin partnership.

They emphasized this was merely an “isolated incident, never seen before.”

The Litecoin Foundation also released a statement regarding the incident:

We feel compelled to comment on the recent false news regarding the Litecoin Foundation and Walmart announcing a partnership. This is untrue—the Litecoin Foundation has not formed any kind of partnership with Walmart.

This morning, a seemingly official fake press release was published on GlobeNewswire. Publishing partnerships in this manner is not our policy. The quotes attributed to the article were fabricated and do not come from Litecoin founder Charlie Lee.

Several media outlets, including Reuters, initially reported the story. In response, one of our social media team members acted too hastily by sharing it on the official Litecoin Twitter account—but it was quickly deleted. We have since taken steps to prevent future issues. Our marketing team continues responding to inquiries—this story is indeed false.

Manipulating Markets Through Media

In the relatively chaotic and disordered world of cryptocurrency, using information to influence markets is not uncommon—and to some extent, has become an accepted tactic.

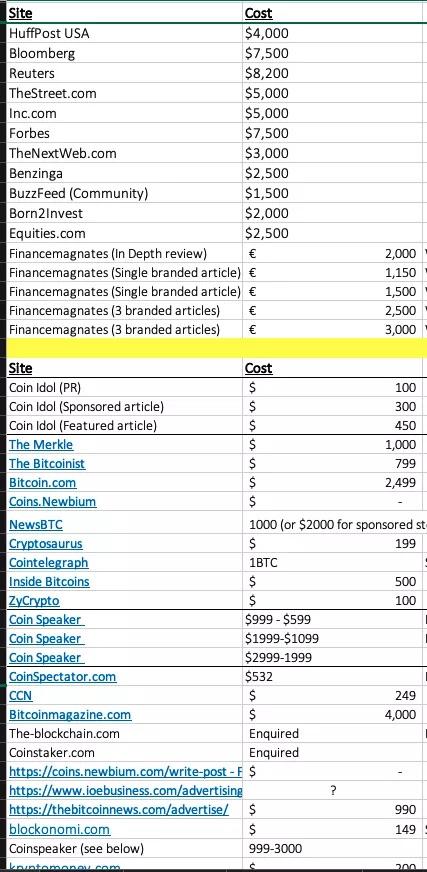

Crypto blogger “Two Comma Pauper” described his firsthand experience earlier this year in May, explaining how media hype can be weaponized to short the market.

He entered the crypto market in 2016 and founded a service firm engaged primarily in four areas:

Legal and regulatory services

Solidity development, helping build “shitcoins”

Marketing and PR, hyping up projects

OTC services

To short the market, the typical process goes like this:

Step 1: Pay several low-tier media outlets to publish bearish stories—without promoting them on their main channels, just posting them quietly online.

Step 2: Pay contributors at outlets like Bloomberg or Forbes to cite these articles in their own reporting. In his view, this is easy because:

(1) Writers are often financially desperate (“starving writer” meme is real)

(2) They constantly need fresh content

(3) Their income depends on traffic generated by their stories

Note: Some have questioned the pricing table provided by Pauper—the authenticity remains unverified.

Eventually, your desired narrative appears simultaneously on lower-tier sites and reputable platforms.

At this point, the “whale” pulls out their contact list and calls on friendly technical analysts to join in.

Content appears across websites—from NewsBTC to Reuters—all appearing legitimate.

These analysts share the stories (or variations) on Twitter, strategically amplifying emotionally charged keywords like “regulatory ban” or “hacker attack” to exploit human psychology.

Then, the “whale” deploys algorithmic dumping, choosing exchanges with weaker liquidity to execute large sell-offs, intensifying retail panic.

When retail investors dump en masse, they’re already waiting at the bottom with buy orders, scooping up bloodied coins.

In the dark forest of the crypto world, hunting rifles lie hidden everywhere.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News