LTC Takes Center Stage on Wall Street: MEI Pharma's "Litecoin Treasury" Surges Over 80%

TechFlow Selected TechFlow Selected

LTC Takes Center Stage on Wall Street: MEI Pharma's "Litecoin Treasury" Surges Over 80%

"Litecoin Treasury" reignites the "altcoin micro-strategy" trend.

By kkk

On July 19, U.S. pharmaceutical company MEI Pharma (NASDAQ: MEIP) announced a strategic transformation, launching a dedicated Litecoin treasury strategy. Over $100 million in funding has already been committed to the initiative.

As part of the deal, the biotech firm will appoint Litecoin founder Charlie Lee to its board of directors. GSR will also secure a board seat and take on a key role in the company’s digital asset and treasury management advisory committee. Additionally, the Litecoin Foundation has invested in MEI Pharma, as the company's treasury strategy closely aligns with the foundation’s core mission of advancing global Litecoin adoption.

Following the announcement, MEIP shares surged 83.37% in Friday’s pre-market trading, extending the previous day’s 16.58% gain, briefly touching $9 before settling around $6.30. Trading volume for the day exceeded 13 million shares, far surpassing the previous three-month average of 26,000 shares per day. This shift not only reflects strong market optimism about the company’s blockchain-driven transformation but also marks the official launch of another “altcoin microstrategy” model—following ETH, SOL, and BNB—ushering in a new chapter of institutional allocation for Litecoin (LTC).

MEI Pharma Completes Strategic Shift: First Public Firm to Establish Litecoin Treasury

MEI Pharma, Inc. is a biopharmaceutical company focused on developing small-molecule drug compounds. Its core R&D pipeline includes Voruciclib, a CDK inhibitor for treating B-cell malignancies, and ME-344, a mitochondria-targeted anticancer agent. Founded on December 1, 2000, the company is headquartered in San Diego, California.

On July 19, 2025, MEI Pharma announced its integration with blockchain finance, initiating a private investment in public equity (PIPE) transaction and planning to include Litecoin (LTC) in its corporate treasury—becoming the first publicly traded biotech firm to adopt LTC as a primary reserve asset.

According to the announcement, the round is co-led by Titan Partners Group and cryptocurrency trading firm GSR. It involves issuing 29,239,767 shares of common stock or equivalent pre-funded warrants at $3.42 per share, raising approximately $100 million. The transaction is expected to close around July 22, 2025, subject to customary regulatory and closing conditions.

This fundraising effort represents more than just a capital raise—it signals a deep strategic pivot. The company stated it had systematically evaluated the sustainability of traditional biotech business models and decided to embrace blockchain and decentralized finance (DeFi). It plans to restructure its corporate treasury around Litecoin and establish long-term partnerships with the Litecoin Foundation and GSR.

Charlie Lee commented on the collaboration: "Since its creation in 2011, Litecoin has consistently upheld the principles of speed, security, and decentralization. It's exciting to see a public company like MEI embrace these values. This not only reflects growing institutional confidence in LTC but also lays the foundation for broader expansion into traditional capital markets."

Why Litecoin?

Litecoin is one of the earliest altcoins to enter the market, created in 2011 by former Google engineer Charlie Lee. Its core architecture is based on Bitcoin’s open-source code, enhanced with several key optimizations. Compared to Bitcoin, Litecoin generates blocks faster, uses the Scrypt proof-of-work (PoW) algorithm—more accessible to standard hardware mining—and features a total supply cap of 84 million coins, mirroring Bitcoin’s deflationary nature through halving events every 840,000 blocks.

As a pioneer among early altcoins, Litecoin has consistently prioritized on-chain transaction efficiency and scalability, offering low fees and fast processing times. In recent years, it has expanded into real-world payment use cases, including travel services, convenience stores, real estate agencies, and e-commerce platforms. In 2021, the Litecoin Foundation partnered with financial service providers to launch a Visa debit card, enabling users to instantly convert LTC to USD for everyday spending—further solidifying its utility.

Since founding Litecoin in 2011, Charlie Lee has remained the driving force behind the ecosystem. He has championed technological innovation and led major upgrades, including selective privacy feature integration and SegWit activation. His contributions to lightning network experimentation, mining pool coordination, and developer community building have laid a strong foundation for the long-term development of both Bitcoin and Litecoin networks.

His direct involvement in MEI Pharma’s Litecoin treasury initiative has once again boosted market confidence in the “Litecoin treasury” strategy. As emphasized by the Litecoin Foundation in its statement: "For 14 years, Litecoin has reliably provided millions of users with a stable, low-cost, and accessible network." This partnership with MEI marks not only the first time Litecoin has been integrated into the financial structure of a U.S. public company but also a strategically significant, institution-grade financial experiment led by its creator.

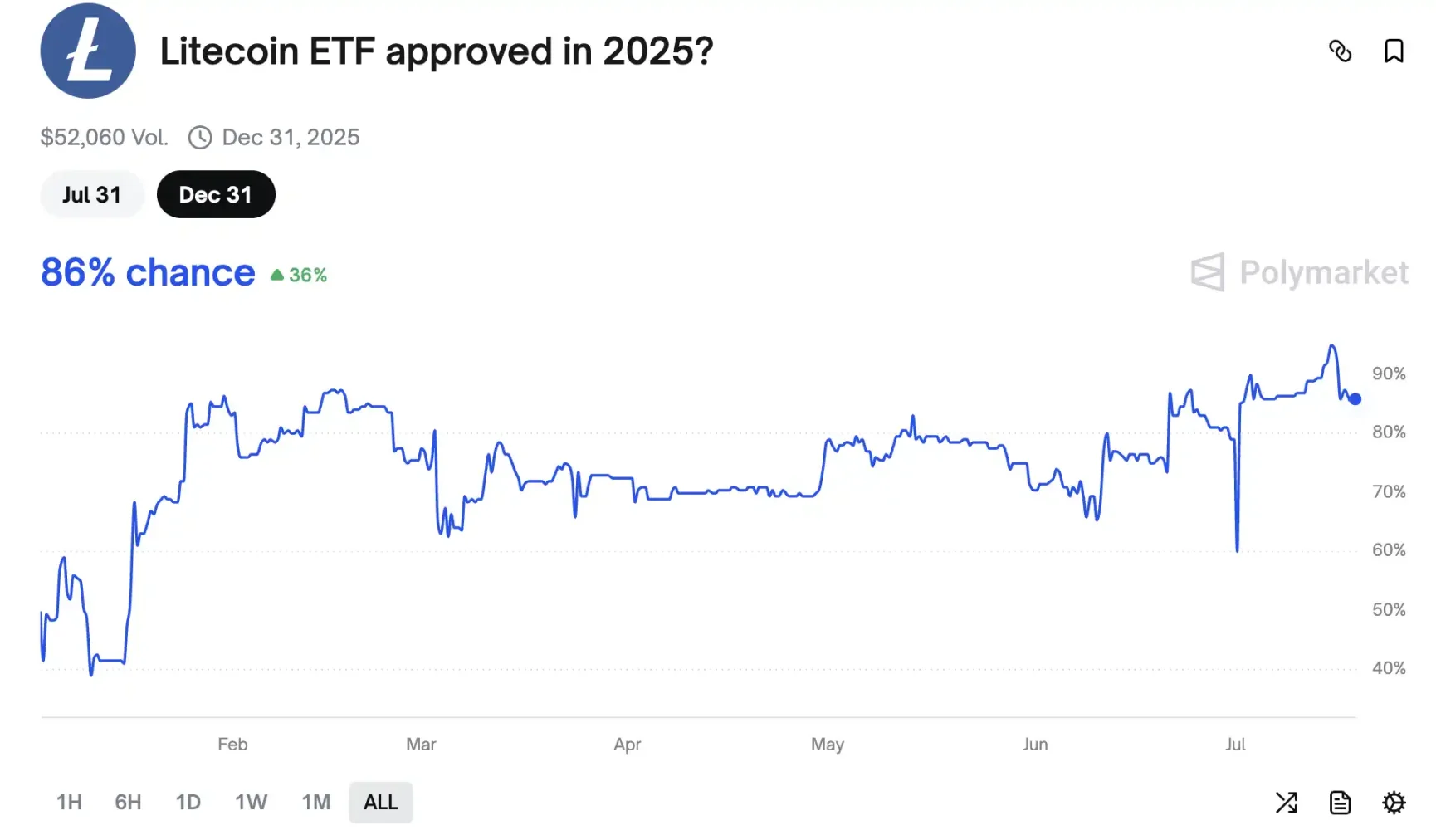

Meanwhile, institutional expectations for Litecoin are rising rapidly. According to data from decentralized prediction platform Polymarket, the probability of the U.S. Securities and Exchange Commission (SEC) approving a Litecoin spot ETF by the end of 2025 has reached 86%. This reflects investor optimism about Litecoin’s regulatory outlook and signals its gradual transition into the category of “mainstream assets” amid the ongoing compliance wave.

If a spot ETF is approved, Litecoin would join Bitcoin and Ethereum as a core holding in traditional financial portfolios, providing institutions with a compliant pathway for exposure. This would enhance LTC’s market liquidity and valuation anchoring while reinforcing its identity as a “payment-focused digital asset”—bridging the gap between on-chain ecosystems and Wall Street capital.

Conclusion

With MEI Pharma becoming the first public company to include LTC in its treasury, Litecoin officially joins the ranks of institutional accumulation—following Ethereum, BNB, and SOL in adopting the “microstrategy” model—marking the launch of another altcoin treasury pathway. On the day of the announcement, Litecoin broke out of its downward trend, surging over 6% within 24 hours, briefly reaching $106 before continuing upward to $115. This not only signifies a revaluation of LTC’s asset status but also strengthens the role of “altcoin microstrategies” as a key driver of capital inflows in the current bull market. With ETF prospects and accelerating institutional accumulation, the alt season is quietly beginning.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News