EthCC Talk Recap: How Should the "Rollup-as-a-Service" Model Increase Profitability?

TechFlow Selected TechFlow Selected

EthCC Talk Recap: How Should the "Rollup-as-a-Service" Model Increase Profitability?

How to profit from RaaS solutions?

Author: Ken

Translation: TechFlow

This article reviews YQ, CEO of AltLayer, speaking at EthCC, focusing on the economics of RaaS—specifically the operator profit formula for providers and how to improve operational profitability.

In his structured presentation, YQ began by explaining why we need RaaS, then introduced the types and economics of RaaS to help users better understand Rollups-as-a-Service.

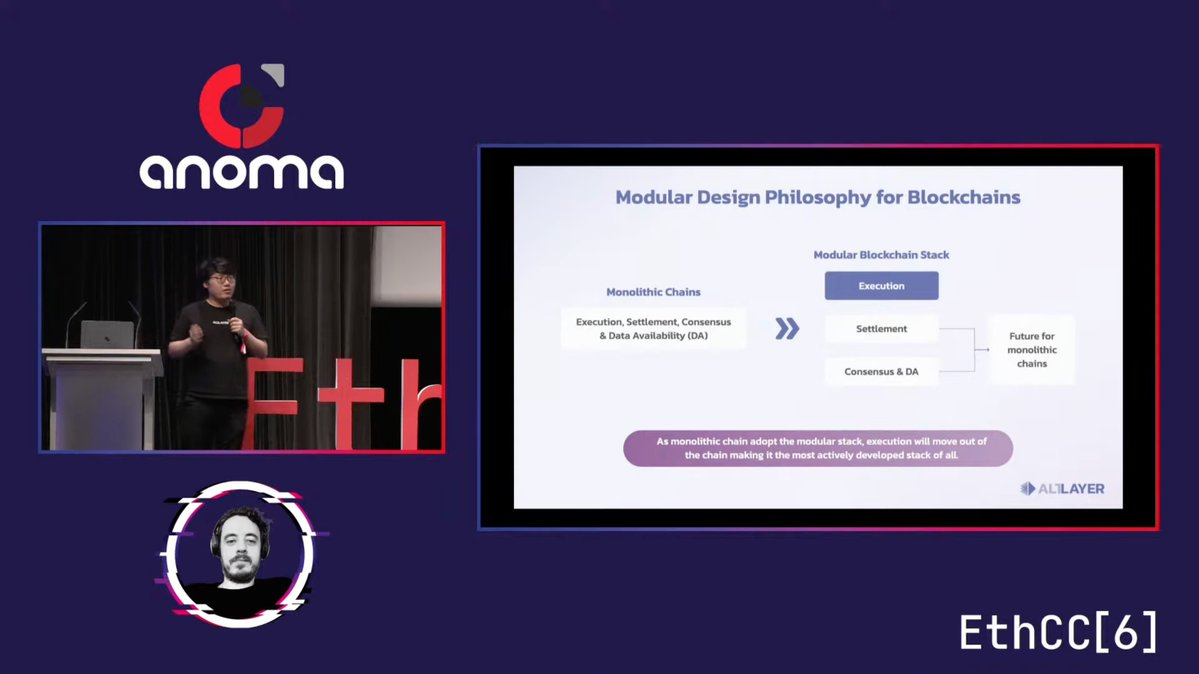

Today, the paradigm has shifted from monolithic to modular, with the entire stack being broken down into distinct layers.

Clearly, Ethereum is also moving toward a rollup-centric approach, where execution will be offloaded to rollups and Ethereum will, in the long term, become a Data Availability (DA) layer.

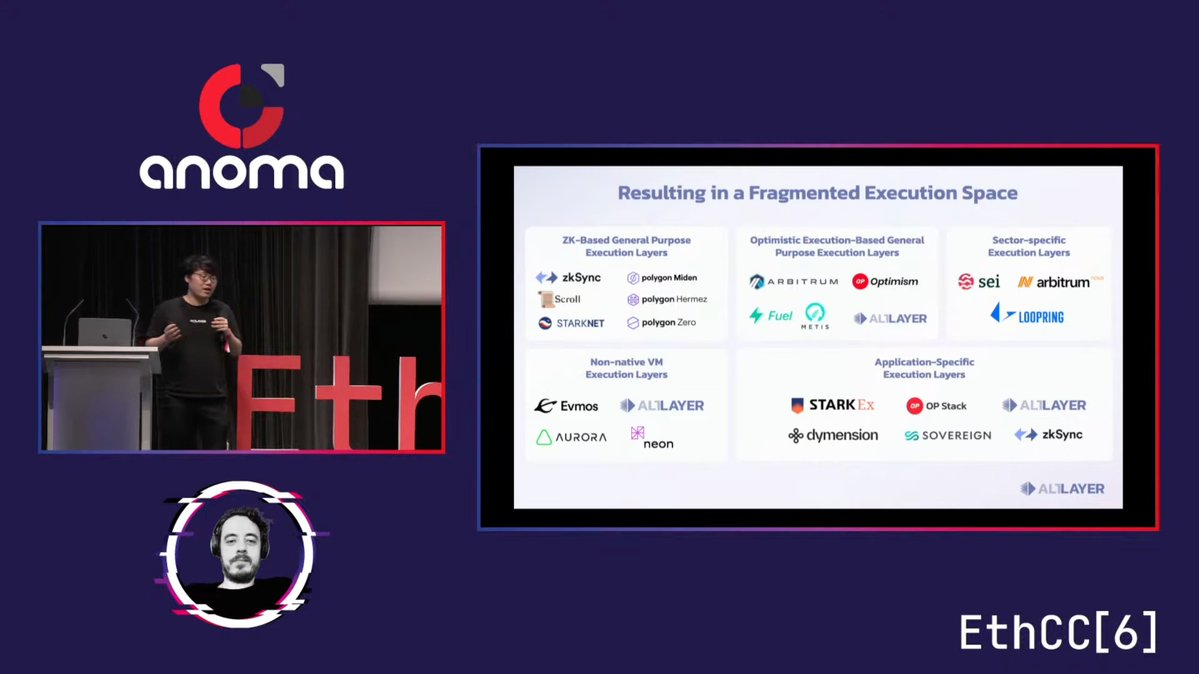

Currently, the execution layer landscape has significantly expanded.

There are several types of execution layers, such as Optimistic and zero-knowledge-based general-purpose rollups.

At the same time, there are application-specific rollups serving various dApp domains like gaming, non-fungible tokens (NFTs), social, etc.

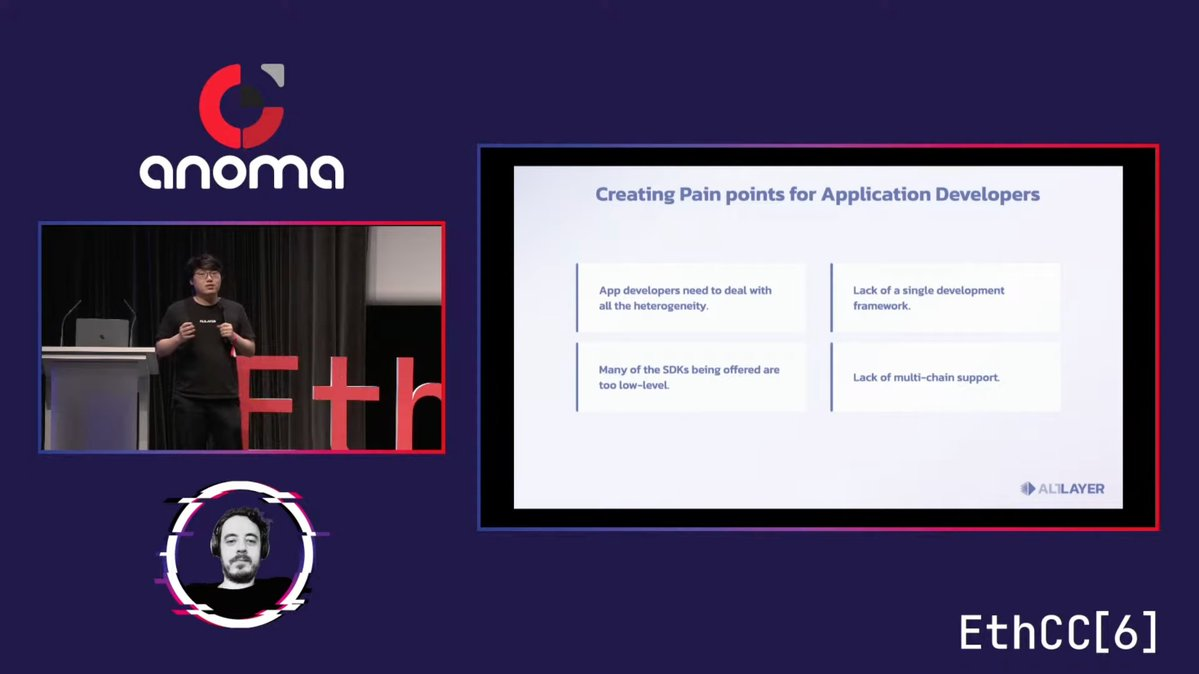

However, too many execution layers can cause confusion for developers.

Additionally, integrating software development kits (SDKs) into existing tech stacks and attaching Layer 2 (L2) solutions to Layer 1 (L1) presents challenges for developers.

This is exactly why we need RaaS providers.

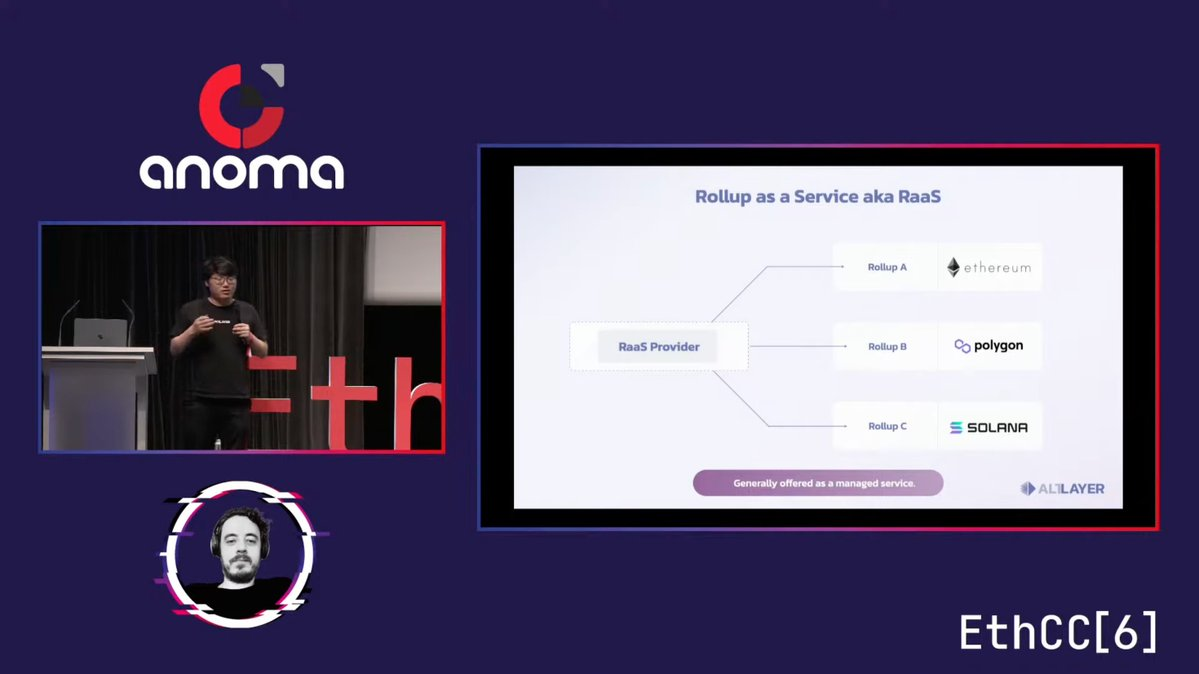

We can think of RaaS providers as Software-as-a-Service (SaaS) companies, as they integrate SDKs and different technology stacks into their offerings.

If a developer wants to launch a rollup on Ethereum, they can use RaaS to quickly create one and publish data back to Ethereum.

We see that the RaaS ecosystem is also quite broad, including providers offering SDKs, shared sequencers, and no-code tools for launching rollups.

Nowadays, using no-code dashboards, developers or users can launch a rollup within minutes—a significant improvement compared to 6–7 years ago.

RaaS brings many benefits such as flexibility, low cost, and rapid deployment. As previously mentioned, dApps can create fully customized rollups in minutes.

Web2 developers unfamiliar with blockchain and Solidity can also confidently build using these no-code frameworks.

RaaS can be compared to AWS in the crypto industry, allowing developers to rapidly create L2s without worrying about underlying infrastructure details.

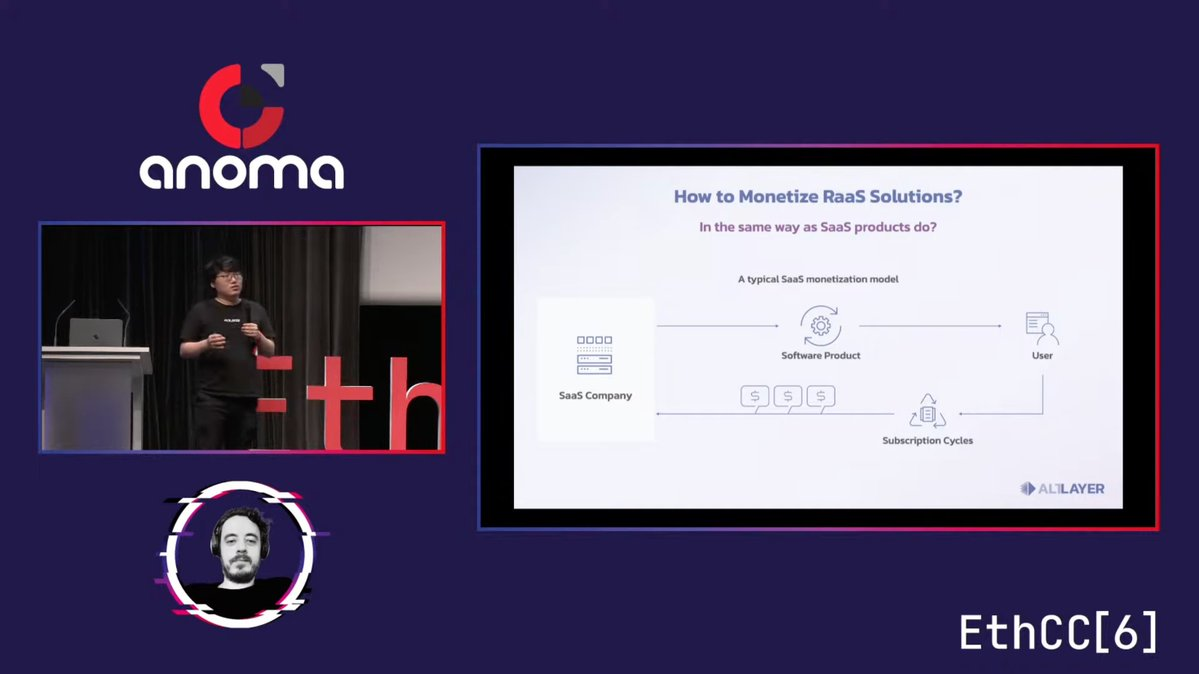

But how do you monetize a RaaS solution?

One idea is to adopt a SaaS model, where the provider charges developers directly when creating an L2, similar to AWS or GitHub.

The SaaS model is straightforward and benefits from mature payment solutions such as Stripe and cryptocurrency payments via Coinbase.

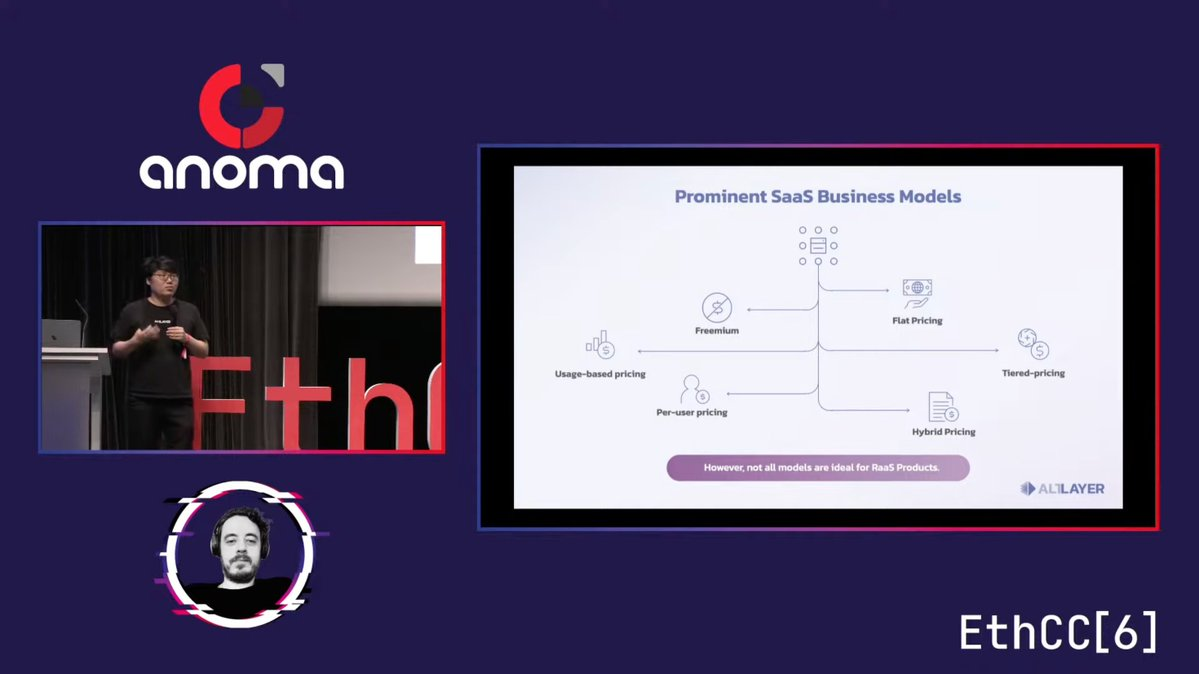

We could also implement tiered pricing, combining free and paid models, giving developers and users free credits initially and charging based on actual usage afterward.

Although the SaaS model is simple and advantageous, applying it to RaaS in crypto may involve some complexities.

Therefore, to better understand the economics of RaaS, we will analyze the steps, costs, and revenues associated with rollups and RaaS.

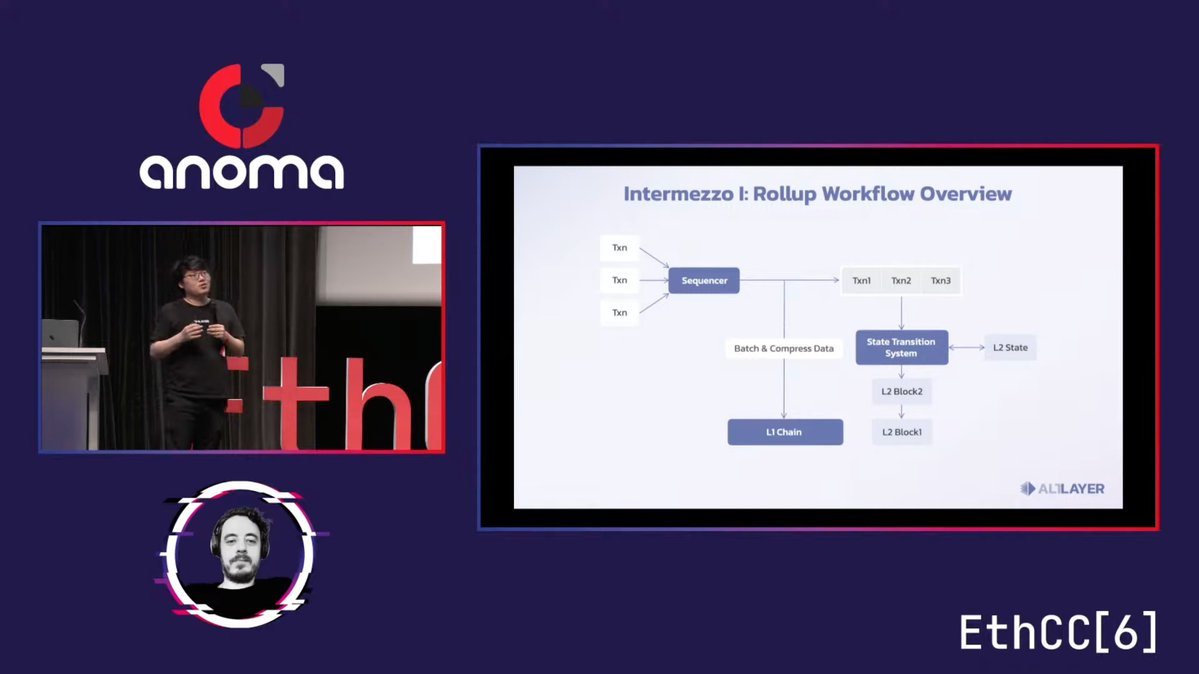

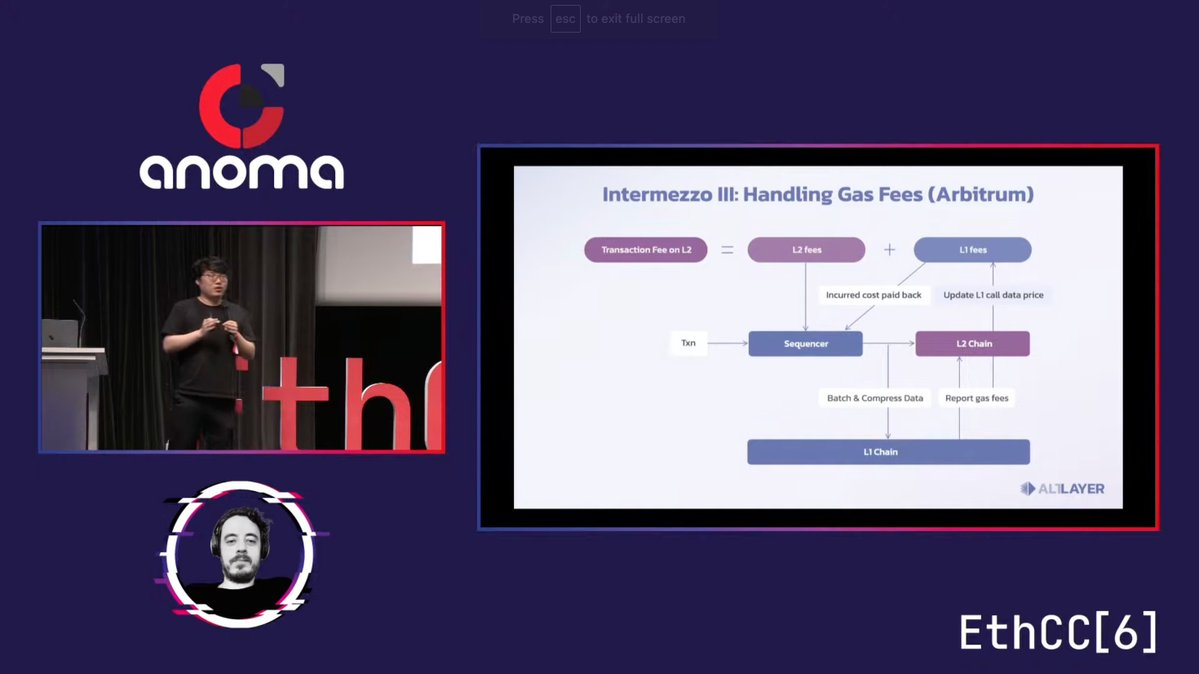

Starting with the rollup workflow: a sequencer aggregates user transactions, executes them, bundles blocks, and submits data to Layer 1 (L1).

Typically, on L1 there is also a fraud or validity proof mechanism, involving a smart contract that verifies proofs and challenges the sequencer if needed.

As experienced with Optimism, Arbitrum, and others, fees vary significantly depending on the timing of transaction execution.

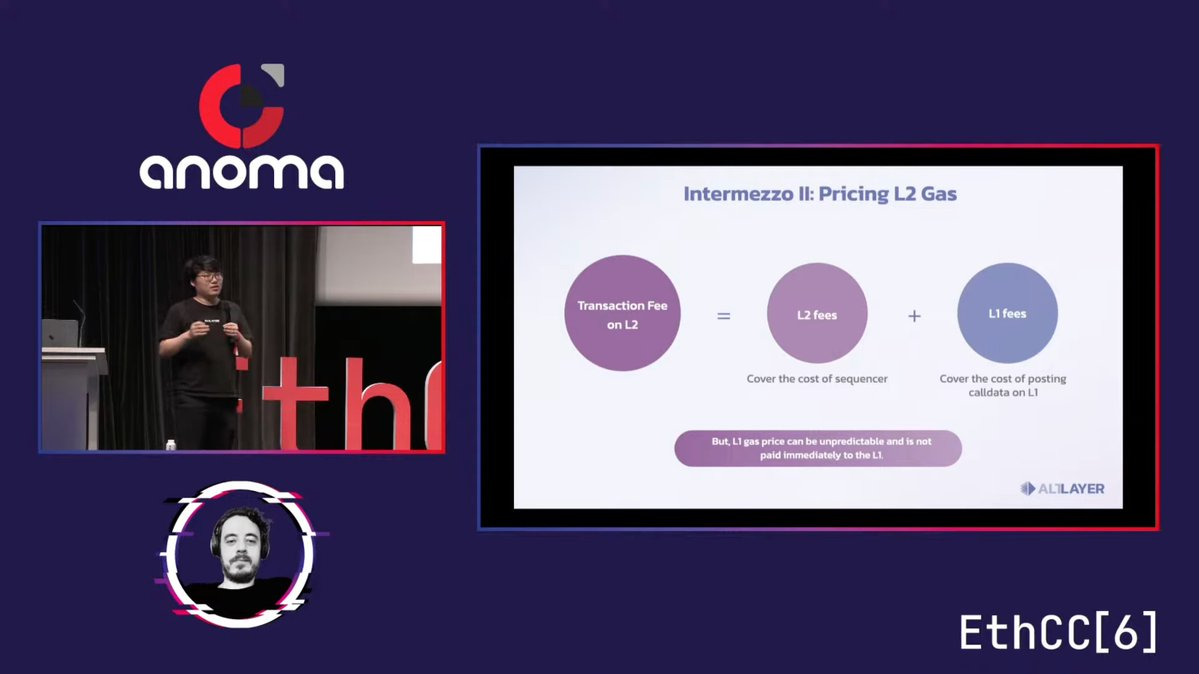

Fees aren't fixed because we pay not only for L2 processing but also for the sequencer publishing data to L1.

To clarify, L2 fees are relatively stable because large volumes of transactions are processed off-chain.

However, since data is periodically published to L1, the cost depends on the number of transactions processed during that period. With high transaction volume, average fees are lower; with low volume, fees are higher.

For most L2 solutions, additional fees are charged during data publication due to uncertainty in L1 gas costs.

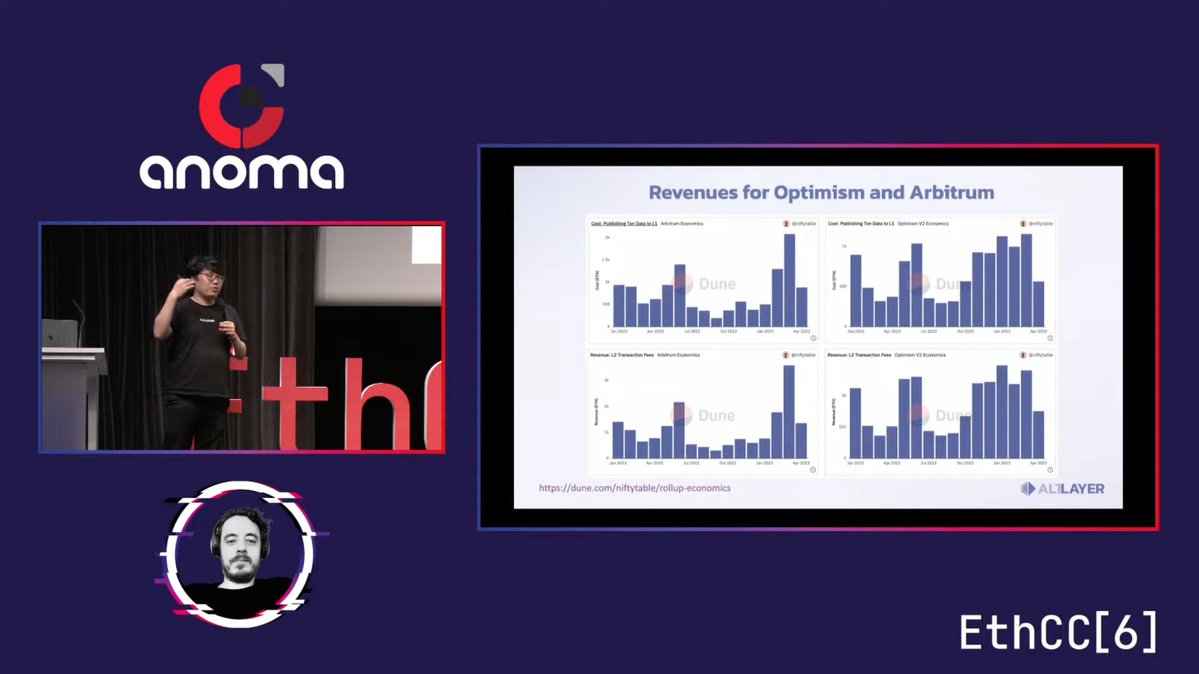

Data shows that both Optimism and Arbitrum have earned millions by collecting user fees minus the cost of storing data on Ethereum.

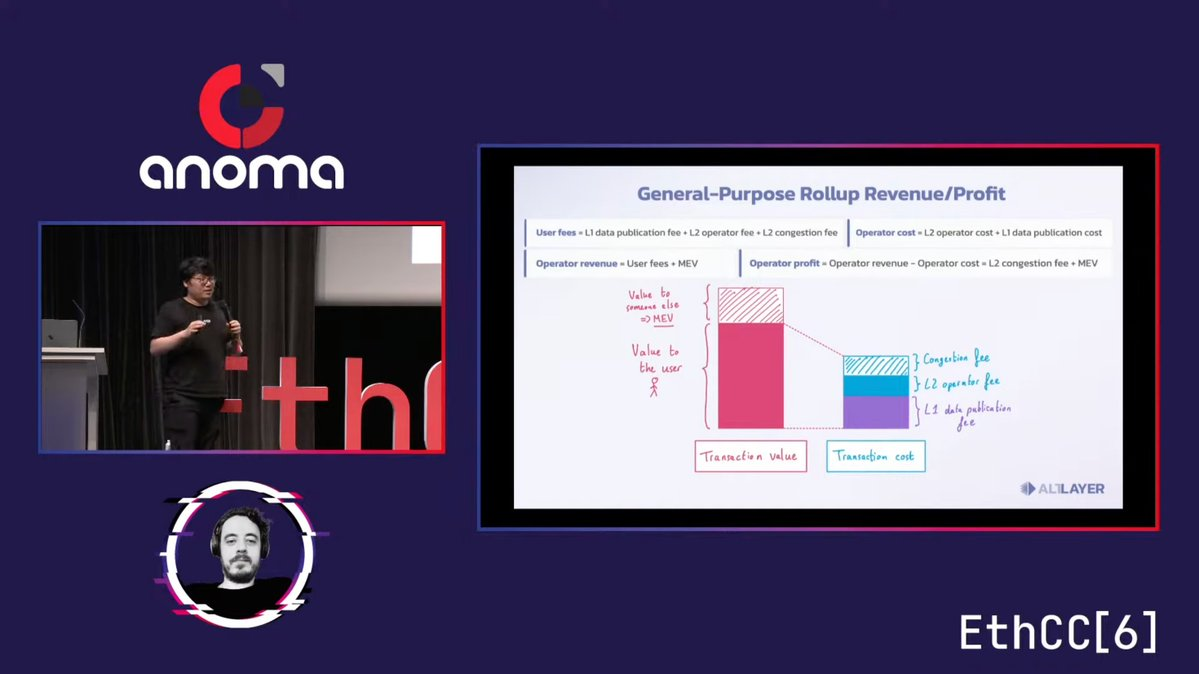

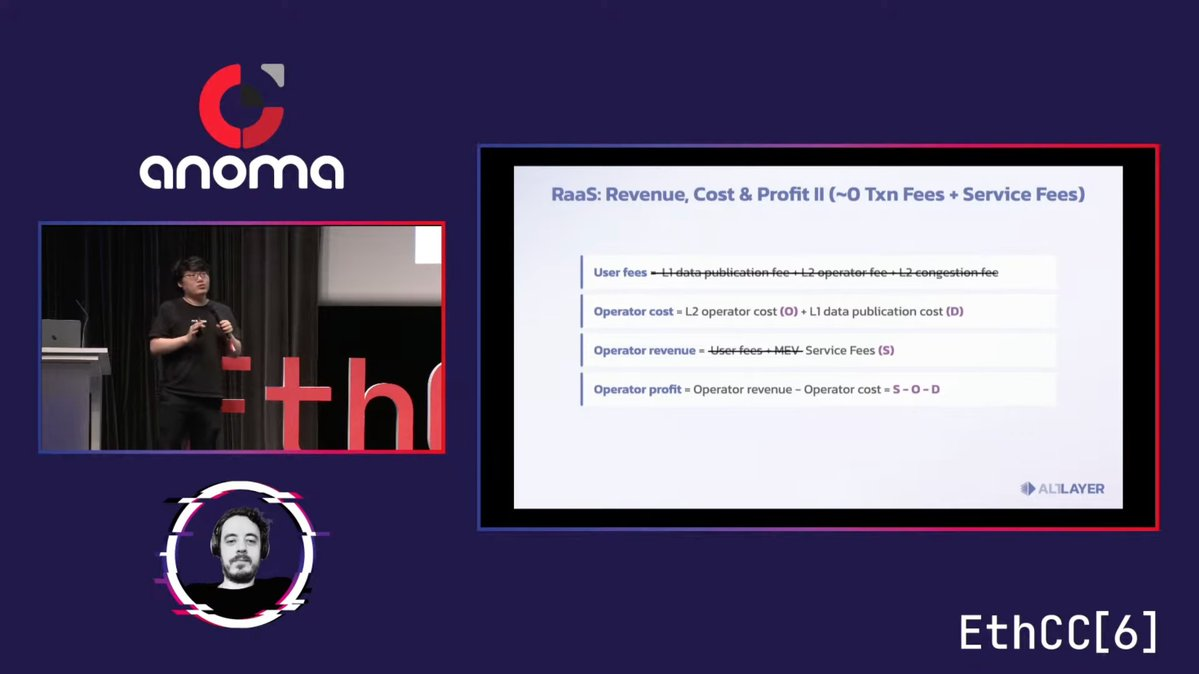

Delving deeper into the economic model of rollups, here is the profit breakdown for a general-purpose rollup:

-

User Fees: L1 data publishing fee + L2 operator fee + L2 congestion fee (during high traffic);

-

Operator Costs: L2 operator fee + L1 data publishing fee;

-

Operator Revenue: User fees + MEV (Miner Extractable Value);

-

Operator Profit: L2 congestion fee + MEV.

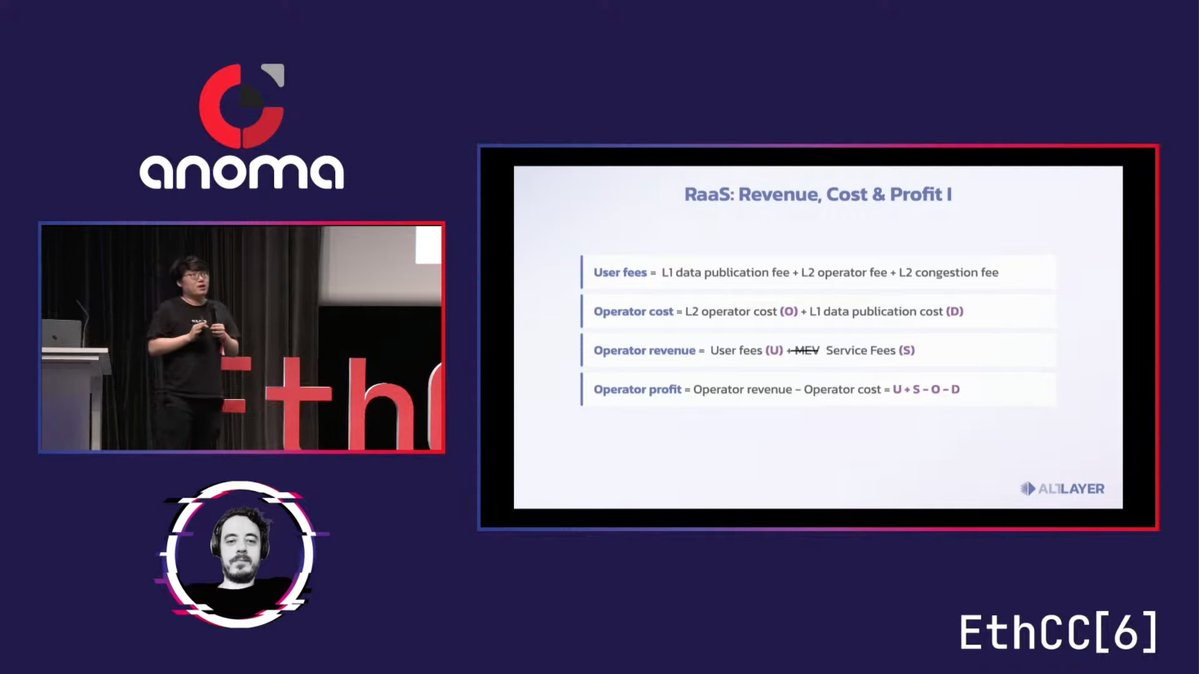

As a RaaS (Rollup-as-a-Service) provider, if we offer similar services to run a general-purpose L2, our revenue, costs, and profits would be largely comparable.

In practice, there are subtle differences in operator revenue, as we can charge clients (e.g., gaming and NFT projects) service fees.

However, most dApps prefer owning their own chains—application-specific rollups with zero gas fees—to deliver a seamless user experience.

Thus, RaaS providers cannot collect user fees or capture MEV (due to first-come-first-served priority), resulting in significantly lower overall profits compared to providing general-purpose L2s.

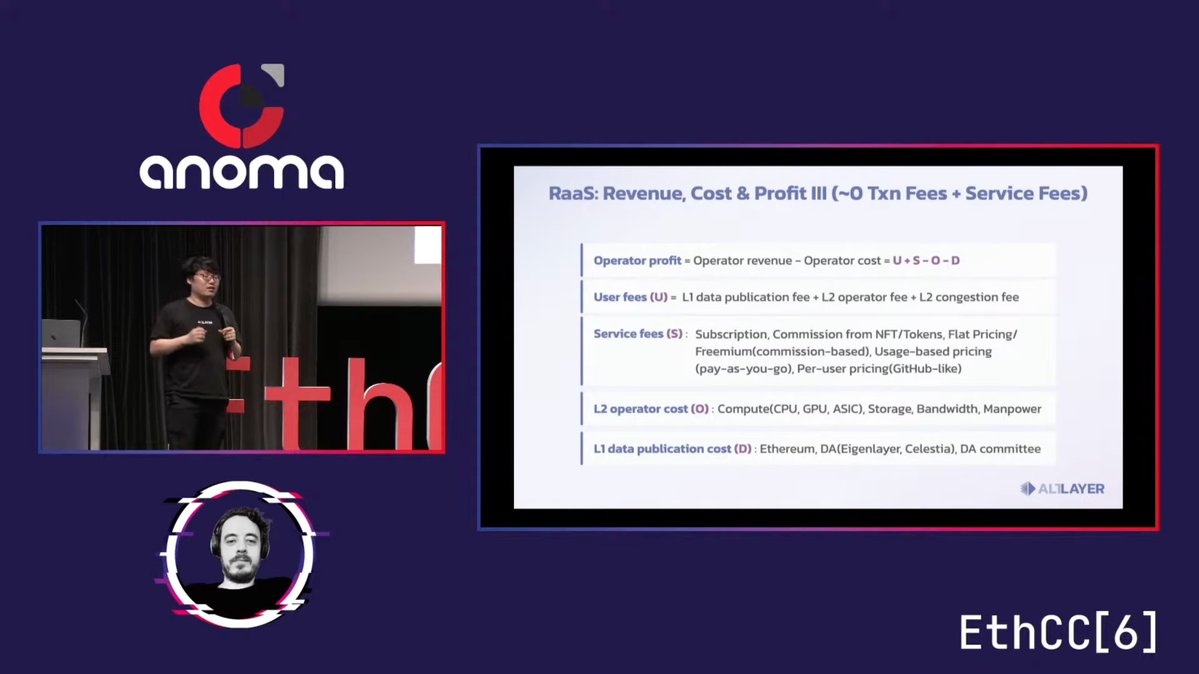

Therefore, the operator profit formula for RaaS providers is as follows:

-

General L2: U+S-O-D

-

Application-Specific: S-O-D

U = User fees; S = Service fees; O = L2 operating costs; D = L1 data publishing costs.

We can try to increase operator profit by increasing U and S (via SaaS model adoption) and reducing O and D (through cost-effective alternatives such as @eigenlayer and @CelestiaOrg for DA).

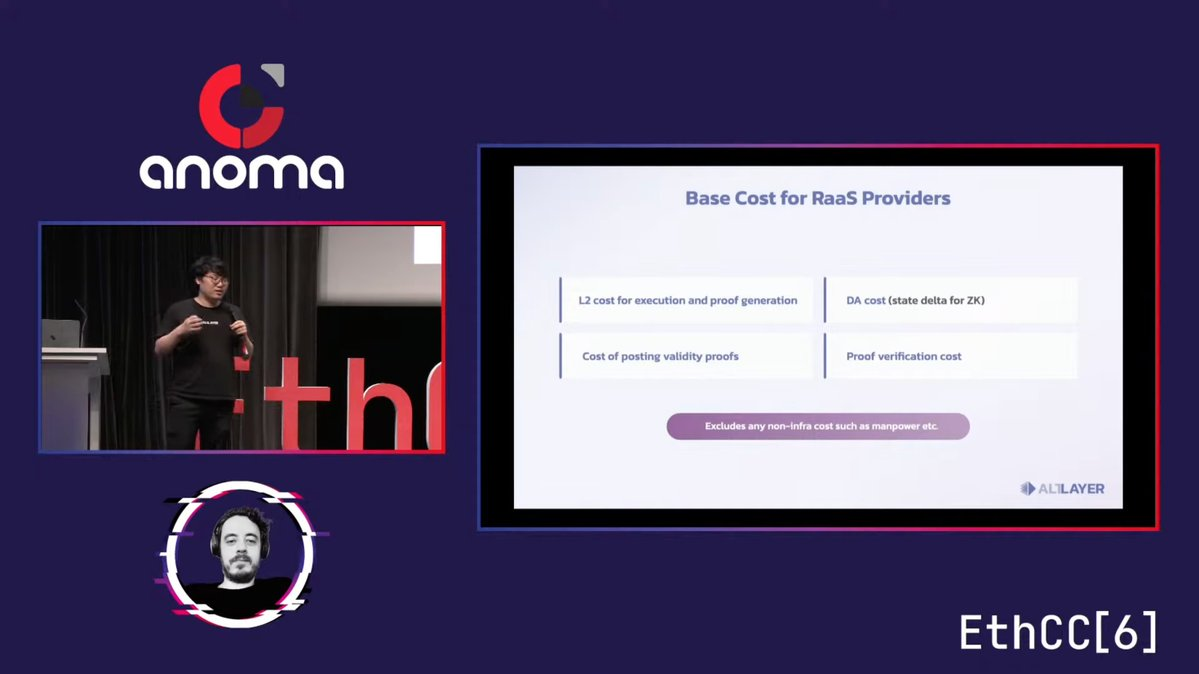

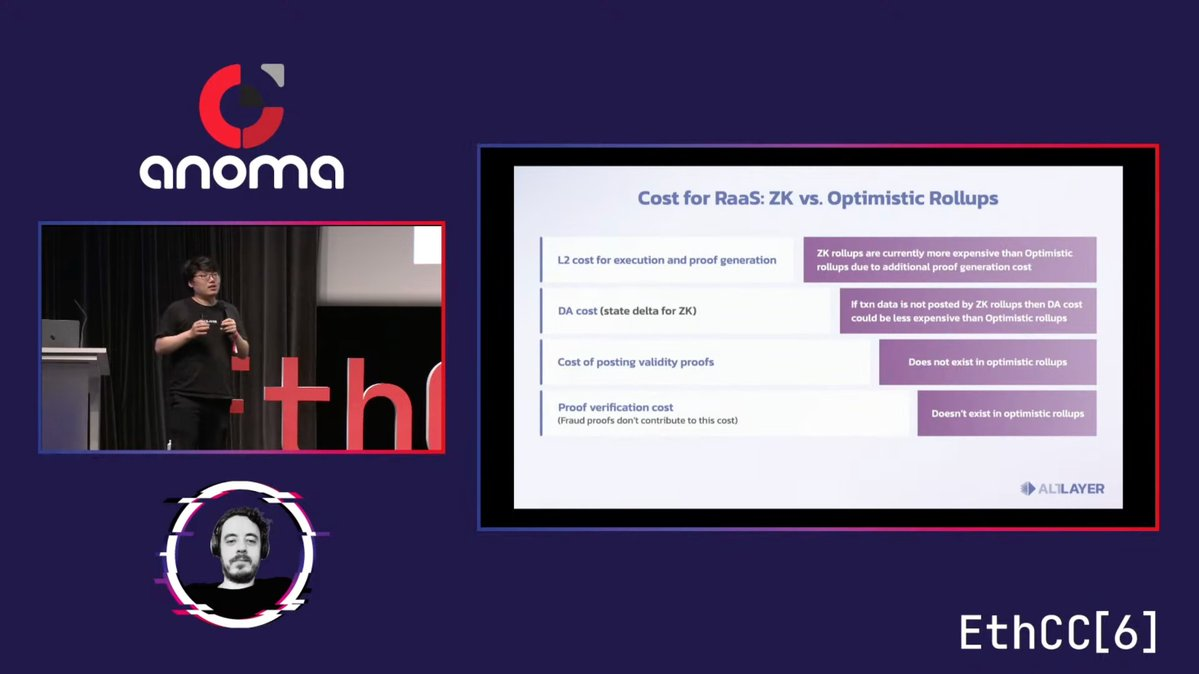

After discussing the economic model of RaaS, YQ shared insights based on his experience regarding RaaS provider costs.

RaaS costs primarily stem from L2 operations—typically sequencers and validators—as well as DA (data availability) costs.

According to his findings, the Optimistic approach is significantly cheaper than zero-knowledge proofs, as it does not require expensive machines to generate proofs.

However, this comes with trade-offs: ORUs (Optimistic Rollups) have longer challenge periods and require more careful handling of data publication.

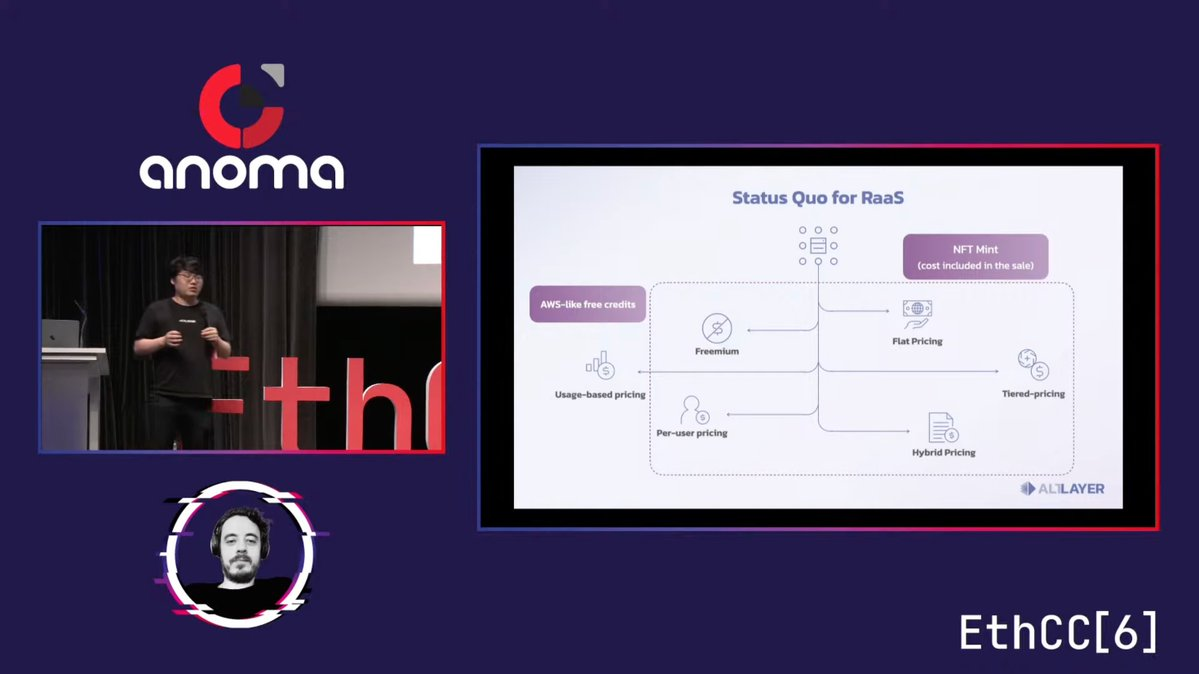

In the current state of RaaS, various pricing plans exist—such as flat-rate, tiered, and other models—often closely tied to specific use cases like NFT minting and gaming.

Additionally, free credits may be offered to partners.

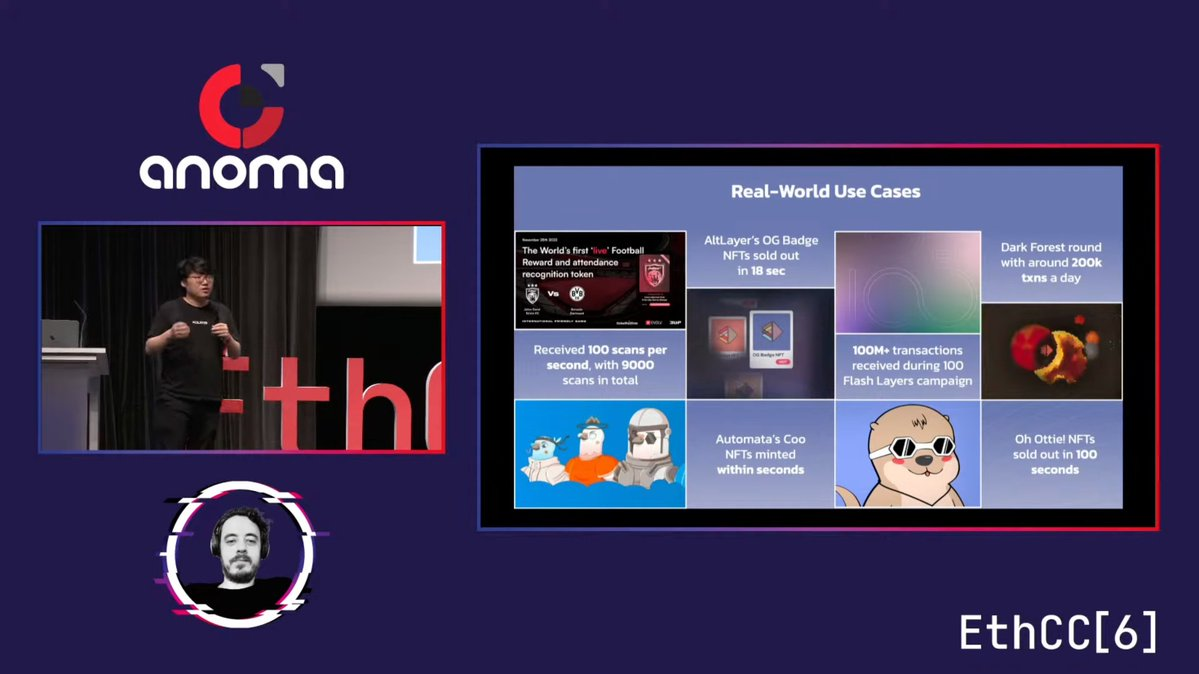

Regarding real-world use cases for RaaS, AltLayer has been under development for nearly two years. During this time, numerous projects have used AltLayer to launch rollups supporting NFT campaigns, NFT ticket sales for football matches, and events like the Darkforest competition. In these cases, a SaaS payment model was adopted.

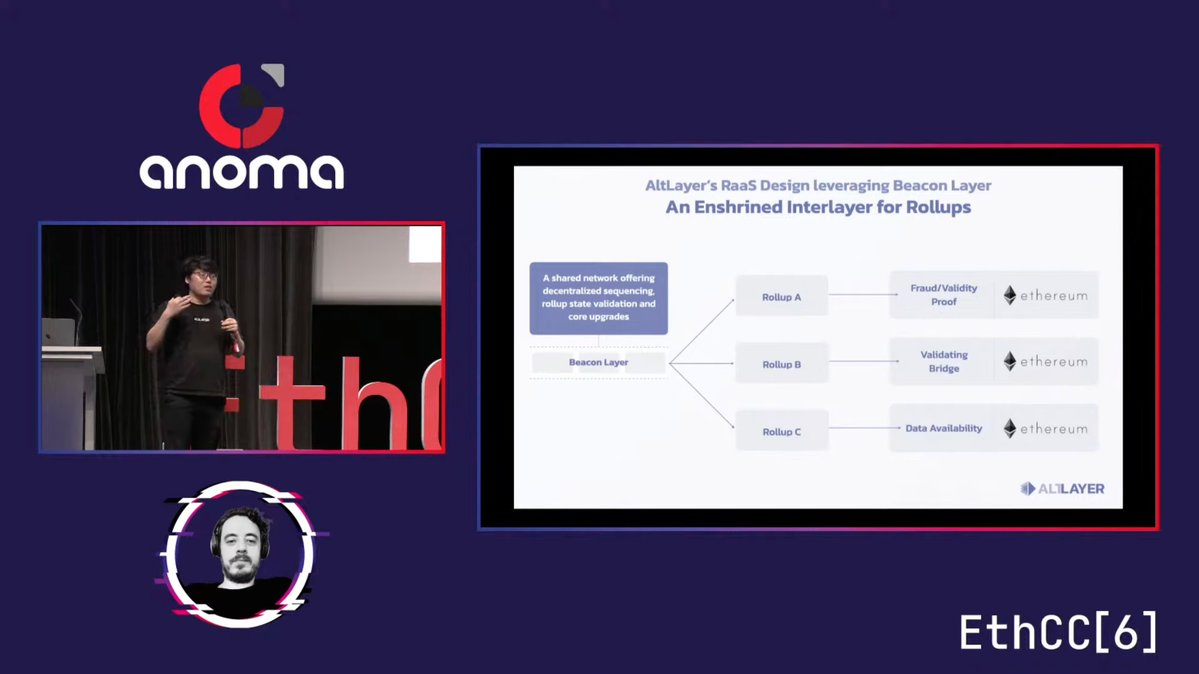

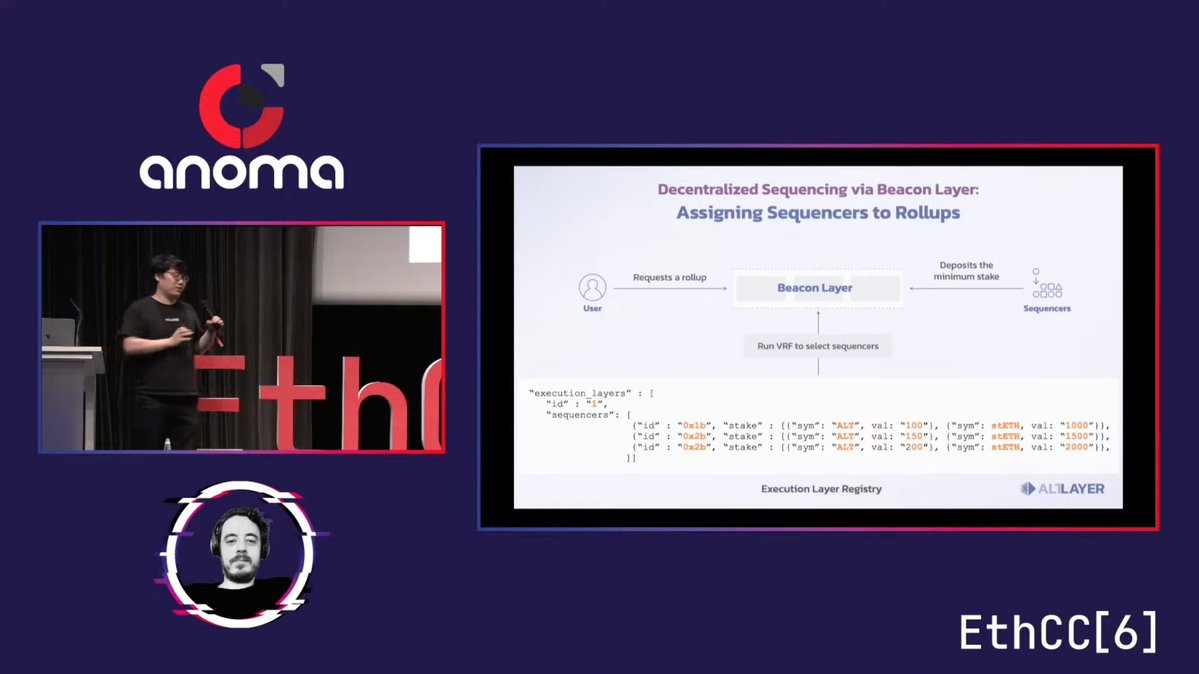

YQ also introduced Beacon Layer, which distinguishes AltLayer from traditional Web2 SaaS and brings decentralization into the RaaS space.

Think of it as an orchestration layer: when a user requests to launch a rollup, Beacon Layer assigns dedicated operators.

The first version of AltLayer’s RaaS Launchpad allowed users to launch rollups in a centralized manner.

However, going forward, through Beacon Layer, it will become decentralized—anyone can join the network as a sequencer and have the opportunity to be selected to serve dedicated rollups.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News