UniswapX: Opening the Gateway to the Uniswap V4 DeFi Testground

TechFlow Selected TechFlow Selected

UniswapX: Opening the Gateway to the Uniswap V4 DeFi Testground

With the emergence of Uniswap V4, Uniswap is poised to shed criticism for straying from its core mission and become a key infrastructure supporting various applications.

Author: Yilan, LD Capital

The recently launched UniswapX is currently in opt-in beta, and it's expected to serve as a fully cross-chain routing solution, bringing structural impacts to existing aggregators and cross-chain bridge sectors. The market believes the most direct impact will be siphoning trading volume from fee-competitive markets such as aggregators (e.g., 1inch, Cowswap). After UniswapX’s release, 1inch saw a significant price drop.

UniswapX is essentially a non-custodial trading protocol based on Dutch auctions. It allows third-party Filler entities to execute trades (acting as takers), where Fillers can be on-chain or off-chain liquidity providers such as market makers, MEV searchers, or DEXs. Competition among Fillers occurs via Dutch auctions—specifically through parametric pricing that sets initial order prices. The starting price in the Dutch auction is determined by RFQ (Request-for-Quote), an off-chain quotation system that polls certain Fillers (market makers are incentivized to use private transaction relays to route orders to on-chain liquidity pools). To further incentivize the Filler network to offer the best prices, UniswapX allows an order to designate a specific Filler with exclusive rights to fill it for a short period before opening the Dutch auction to all other Fillers. This RFQ + Dutch auction model has already been implemented earlier by Cowswap’s Coincidence of Wants, and 1inch Fusion integrated professional market makers with off-chain order matching last year. By adopting a similar integration approach combined with future V4 composability, UniswapX expands the market’s diversity of choices.

Optimizations and problems solved by UniswapX:

(1) Internalization of MEV revenue—partially subsidized to swappers (via better execution prices), and partially captured by Fillers, effectively returning profits to users;

(2) Off-chain transaction signing, which is retail-user friendly. Fillers perform comprehensive calculations balancing gas optimization and actual exchange outcomes, leveraging this complexity to deliver optimal results. Users avoid paying multiple gas fees across many pools, don't need native gas tokens to trade, and incur no gas costs if transactions fail;

(3) Meets cross-chain trading demands.

Criticisms:

(1) For tokens with single-path routes, regular mode may already offer the best price at the largest pool; using UniswapX might result in redundant charges and not necessarily save money;

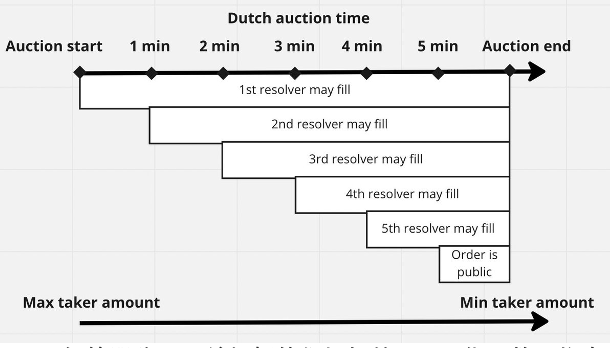

(2) Inherent latency within the Dutch auction process (see diagram below) could lead to losses due to market volatility or encourage Fillers to wait for lower prices before executing (UniswapX aims to address this via a reputation system);

(3) The Filler RFQ model is relatively less decentralized.

Dutch Auction Flowchart

I. How UniswapX Helps Users Save Gas and Achieve Better Prices (though not always cheaper in every scenario)

UniswapX and 1inch Fusion operate similarly in optimizing user transaction costs, but UniswapX is more permissionless and does not have 1inch’s whitelisting mechanism.

From a user perspective, 1inch Fusion appears like a normal swap, but technically, Fusion implements limit-order-style execution, where the exchange rate is filled by third parties called "Solvers" (similar to Fillers in UniswapX). The order’s exchange rate gradually decreases (via Dutch auction) until a Solver finds it profitable to fill. Multiple Solvers compete to fill the order, ensuring completion before the rate drops below minimum profitability. Here are some ways Solvers capture profit:

-

Continuously decreasing exchange rates during the Dutch auction;

-

Gas savings when filling matched orders;

-

Gas savings from batched fills.

UniswapX Fillers also profit through these methods. Additionally, competition between Fillers—and against Uniswap v1, v2, v3, and eventually v4—drives better prices for users.

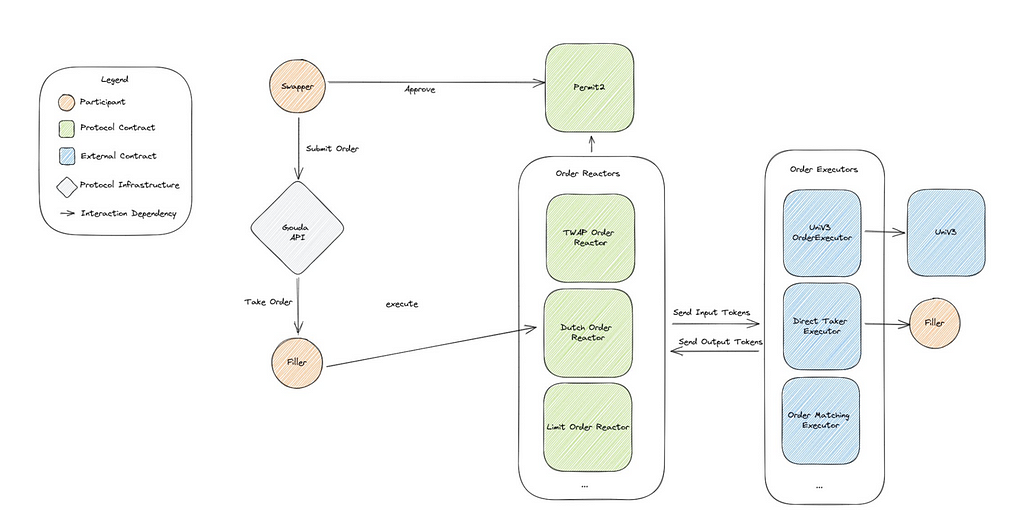

UniswapX Transaction Flowchart

In this process, transactions are submitted to the Reactor Contract and paid for by the Filler. If a transaction fails, the Filler bears the gas loss. Although gas costs are ultimately reflected in the user’s final price, users no longer need large amounts of gas tokens—only minimal gas is required for initial authorization. Price competition, reduced MEV leakage, and lower gas collectively translate into better execution prices for users.

II. How MEV Protection Is Achieved

By introducing a permissionless Filler network, where Fillers choose various Reactors for settlement and execute trades via batch auctions and mempool privacy, UniswapX provides a degree of MEV protection, making users beneficiaries of MEV revenue.

First, a brief explanation of how MEV occurs: MEV (Maximal Extractable Value) refers to the maximum value extractable by miners or other actors by reordering, front-running, or selectively including/excluding transactions in a block. MEV arises from blockchain transaction sequencing and consensus mechanisms.

Take CoW Swap as an example: CoW Swap uses several protocols to match orders and prevent sandwich attacks. Some 2022 MEV protection data from CoW Swap shows: approximately 1.9K sandwich attacks targeted CoW Swap transactions. Compared to 239K total trades, this represents only about 0.8% of CoW Swap’s volume. Sandwich attacks extracted roughly $1.3M from CoW Swap Solvers. Compared to CoW Swap’s total fee revenue of $8.55M, this accounts for only ~1.5%. Through CoW Swap, the percentage of attacked trades is an order of magnitude lower than on Uniswap or Curve. Additionally, the proportion of batch value under attack relative to total volume was only 0.7%, again an order of magnitude lower than other DEXs.

Currently, the most heavily attacked contracts are Uniswap V3 and V2. UniswapX is designed to solve this issue. Given better pricing mechanisms and resources, users will naturally prefer them—over time, more trading volume is expected to shift from older Uniswap versions to UniswapX.

In UniswapX usage, traders first sign a permit to authorize token transfers, requiring a small gas fee. Then, they sign transaction parameters (input/output token types and amounts) and authorize the Reactor Contract to spend their tokens. Fillers compete to win orders, and the winning Filler submits a batch transaction to the Reactor Contract. The Reactor Contract calls the Executor Contract to execute the trade. The Executor Contract receives output tokens from the Filler and sends them to the trader. The Reactor Contract verifies that execution matches the submitted parameters before settling.

In this process, traders transact directly with Fillers, removing opportunities for attackers to perform MEV arbitrage. Even if MEV attacks occur (as Fillers may themselves be MEV searchers), the gains are shared with traders to some extent.

Within UniswapX, prices decay over time via auction. As long as someone finds it profitable to include the transaction, they’ll submit it before the tolerance floor is reached—thus completing the order profitably. Arbitrageurs no longer need to front-run the target asset as before. This system ensures orders are filled at the first profitable opportunity—an inherent MEV protection. For instance, if multiple trades exist off-chain simultaneously, a submitter can discover and execute them all together—submitting early in the cycle. In price auctions, earlier bidding means higher prices and less value leakage.

III. Cross-Chain Transaction Support

The UniswapX protocol can be extended to support cross-chain trading, allowing traders to exchange assets held on a source chain for desired assets on a target chain. Off-chain signed orders resolve not only pool complexity but also bridge complexity—both handled seamlessly by the same service provider or submitter.

UniswapX enables the following cross-chain features:

(1) Fast swaps – As long as there’s a message-passing bridge between two blockchains, UniswapX can enable fast asset swaps across any two chains;

(2) Simplified operations – Swaps and bridging are merged into a single operation, eliminating the need for users to interact directly with bridges, manage gas tokens across chains, or wait for settlement delays;

(3) Fast exits – UniswapX enables near-instant withdrawals from Layer 2 back to its parent chain;

(4) Native asset swaps – Traders can receive native or canonical assets on the target chain instead of bridged tokens. For example, ETH on Ethereum Mainnet can be directly swapped for AVAX on Avalanche;

(5) Minimized passive bridge risk – Traders bear no bridge-related risks when swapping native assets; only Fillers assume bridge risk when rebalancing across chains via bridges.

Simplified version of cross-chain UniswapX protocol:

Traders sign an off-chain order containing standard single-chain parameters plus additional fields:

(1) Settlement oracle: A unidirectional oracle proving event occurrence on a target chain. This could be a canonical bridge between L1 and L2, a light-client bridge, or a third-party bridge.

(2) Filling deadline: The order must be filled on the target chain before this deadline.

(3) Filler bond amount and asset: Collateral the Filler must deposit on the source chain.

(4) Proof deadline: Time by which the Filler must provide proof of fill on the source chain.

The trader’s order is broadcast across the Filler network. Fillers compete to execute it, submitting the order along with the trader’s funds and their own bond to the Reactor Contract on the source chain. The Filler fulfills the order by transferring the required asset to the trader on the target chain. The target chain’s Reactor Contract records the filled order before the deadline and uses the settlement oracle to relay confirmation back to the source chain’s Reactor Contract. Upon verification, the trader’s assets and the Filler’s bond are released to the Filler on the source chain. If the Filler fails to fulfill within the proof deadline, the trader recovers both their input assets and the Filler’s bond from the source chain Reactor Contract.

An Optimistic cross-chain protocol can mitigate issues where settlement oracles may be slow or expensive. In this model, the Filler completes the order on the target chain. If no one challenges the fill within the challenge period, the Filler receives the trader’s funds and their own bond on the source chain. Anyone can challenge the fill via the source chain Reactor Contract before the challenge window closes. If the Filler provides valid proof within the proof deadline, they claim the challenger’s bond. If not, the Filler’s bond is distributed to the challenger and trader, and the trader’s funds are refunded on the source chain.

Hayden Adams believes that in the future, most assets will reside on their native chains—their most secure or canonical chains—rather than being bridged. That is, if a submitter performs a cross-chain swap, they receive tokens on the token’s native chain. Thus, bridge usage is minimized. Rather than viewing bridges as asset transporters, in this model, bridges merely transmit final messages. Data packets aren’t even needed unless the submitter lies. This is “minimal viable bridging,” where users only bear bridge risk during cross-chain transactions. Once the swapper receives output tokens and the submitter receives input tokens, neither party faces further bridge risk.

Therefore, UniswapX minimizes the need for bridging and abstracts it away—for example, the system supports any possible bridge. Think of it as a bridge aggregator: submitters can use any bridge, but each transaction specifies a particular cross-chain bridge (“settlement oracle”), which can be any bridge, another system, multisig, governance, centralized systems, or even trust in the submitter.

IV. Differences Between UniswapX and 1inch Fusion

UniswapX allows Fillers to accept and submit orders permissionlessly, making it more open compared to 1inch’s whitelisted model.

1inch Fusion's Solvers receive order flow based on the amount of 1inch tokens they stake. This means only one Solver can match trades during the first minute of an auction. Even afterward, competition remains limited. To fill an order, a Solver must be whitelisted and hold sufficient balance to cover fees. Whitelisting involves:

(1) Accumulating enough Unicorn Power to rank among the top ten registered Solvers. Two ways to increase Unicorn Power:

· Staking more 1inch tokens or extending the lock-up period.

· Attracting more representatives to delegate their Unicorn Power to the Solver via farming.

(2) Registering as a Solver in the whitelist and delegation system, setting a working address.

(3) Depositing 1inch tokens into FeeBank to pay for transaction resolution costs.

The ranking of the top ten stakers on the whitelist is determined by their “Unicorn Power.” Stakers lock 1inch tokens in a staking contract to receive st1inch tokens. Lock-up periods range from 1 month to 2 years. st1inch grants “Unicorn Power,” which increases non-linearly based on duration:

-

Locking for 2 years: Each 1inch token locked grants 1 Unicorn Power.

-

Locking for 1.5 years: Each 1inch token locked grants 0.47 Unicorn Power.

-

Locking for 1 year: Each 1inch token locked grants 0.22 Unicorn Power.

-

Locking for 0.5 years: Each 1inch token locked grants 0.1 Unicorn Power.

-

Expired locks: Each 1inch token locked grants only 0.05 Unicorn Power.

UniswapX adopts a permissionless access model, using a reputation system to reduce malicious behavior by Fillers. It grants priority execution rights to the best bidders and employs a reputation system to prevent Fillers from waiting for lower prices before executing. The RFQ system could benefit from integrated reputation or penalty mechanisms to restrict abuse of exclusive rights, ensuring a smooth user experience.

Other aspects are largely similar.

V. Revenue Growth Outlook

UniswapX charges a 0.05% transaction fee. Based on current daily volumes—$35M for 1inch and $22M for Cowswap—even capturing half of these platforms’ volume would generate an additional $25M * 0.05% = $12.5K per day. Compared to Uniswap’s current daily revenue of nearly $1M, this represents only a 1.25% increase—not significant.

Conclusion

In terms of marginal revenue growth, UniswapX won’t fundamentally change Uniswap’s income in the short term; its greater impact is on competing protocols in the sector. Uniswap’s expansion into wallets, NFT markets, and aggregators—strategies that squeeze other protocols in existing markets—has not been widely accepted by the market. UniswapX is just one of the protocols we can expect to be empowered by V4. With the arrival of Uniswap V4 and its commitment to building a better ecosystem, Uniswap has the potential to overcome criticism of straying from its core mission and evolve into a critical infrastructure platform supporting diverse applications. Its diversified initiatives will gradually establish it as a major experimental hub that the market cannot afford to ignore.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News