CowSwap: The Future DEX Form of Intent?

TechFlow Selected TechFlow Selected

CowSwap: The Future DEX Form of Intent?

What are the differences between CoWSwap, UniswapX, and 1inch Fusion?

Author: xiaoyu

Dan, with all respect. The game was changed long ago by @1inch when they first did high-quality aggregation and @CoWSwap when they pioneered the solver model.

It’s good stuff, but you are not really the first or the second.

—— @Curve Finance

UniswapX launched with a bang—and controversy. The most pointed accusation? That UniswapX copied CoWSwap and 1inch. Curve’s official Twitter account commented: “The rules of the game were changed long ago—first by 1inch with high-quality aggregation, then by CoWSwap as the pioneer of the solver model. UniswapX is solid, but it’s truly neither the first nor the second.”

CoWSwap responded with a post asserting its status as the pioneer of intent-based trading. So what exactly is CoWSwap? How does it differ from UniswapX? And why do market voices accuse UniswapX of "copying" CoWSwap rather than 1inch Fusion?

We’ll dissect CoWSwap—from its origins and mechanisms to performance data and nine key product differences with UniswapX and 1inch Fusion—with the precision of a master butcher breaking down a cow, aiming to answer what CoWSwap truly is, how it performs, and whether the “copying” allegations hold water.

DeFi Users’ Thief: MEV Attacks

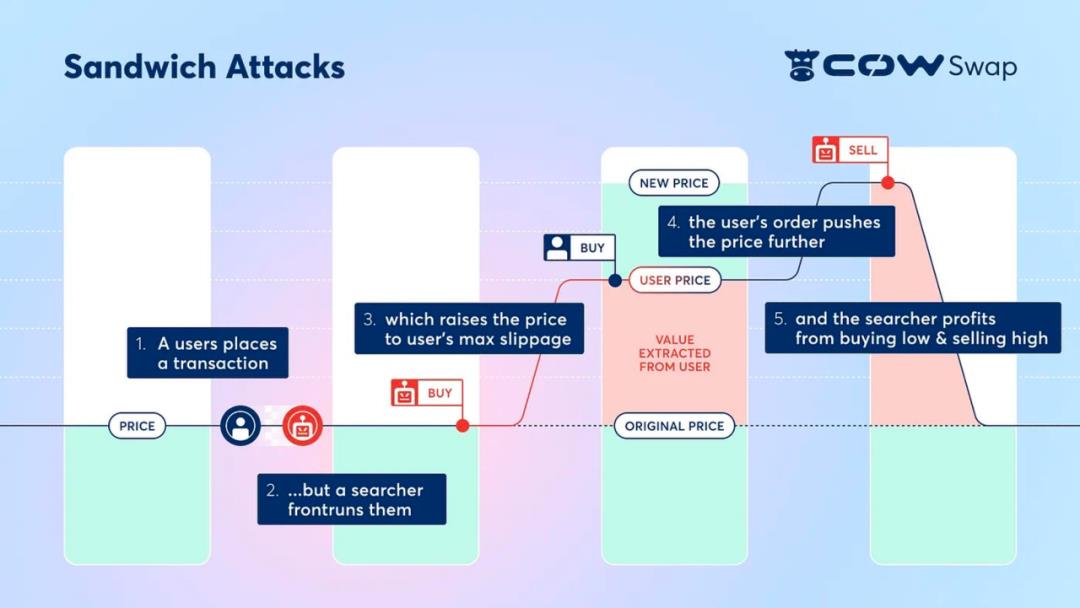

DeFi users have long been victims of MEV attacks—such as front-running, back-running, and sandwich attacks. The CoWSwap protocol offers MEV protection, aiming to reduce users’ MEV-related losses. Before diving in, let’s briefly understand what MEV attacks are.

Imagine this: finally, you spot an ideal trading opportunity! You open Uniswap, wait for the transaction to confirm, only to find that the tokens received are significantly fewer than expected. Checking the block explorer, you discover someone bought before you, inflated the price, and sold right after—profiting at your expense. Yes, you’ve just fallen victim to an MEV attack.

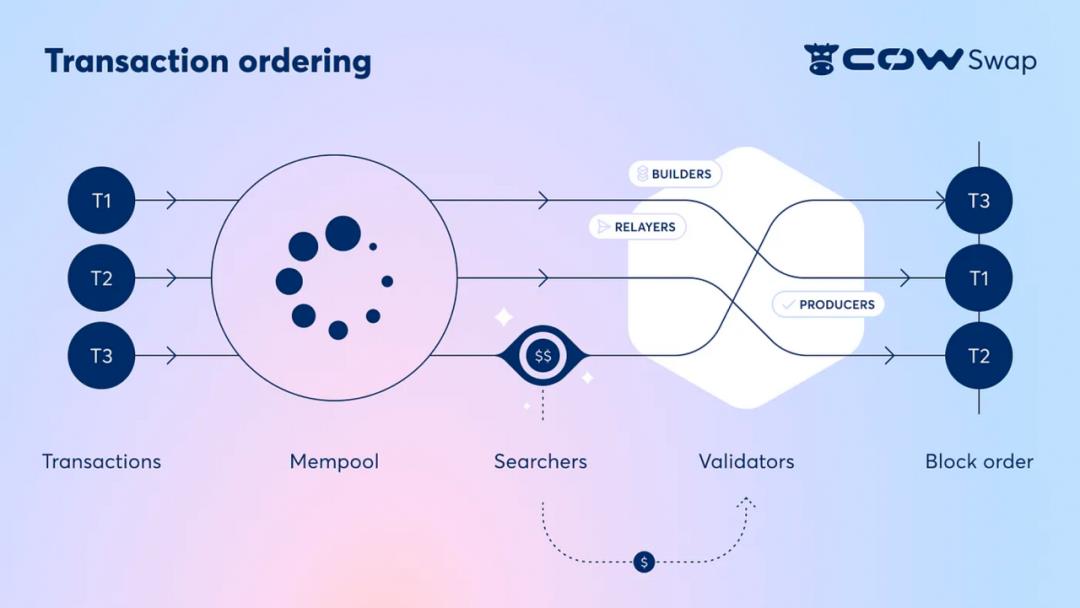

MEV attacks occur due to the "asynchrony" between submitting a transaction and its on-chain confirmation. When a user submits a transaction on Ethereum, it doesn’t immediately get added to the next block. Instead, it first enters the "mempool"—a pool of all pending transactions. Validators then pick transactions from the mempool and include them in the next block during block construction. Since the mempool is public, searchers can pay validators to reorder transactions in ways that extract value from regular users.

Image source: CoWSwap Docs

Guide Through the Dark Forest: CoWSwap’s MEV Protection

Better than the best price.

—— CoWSwap

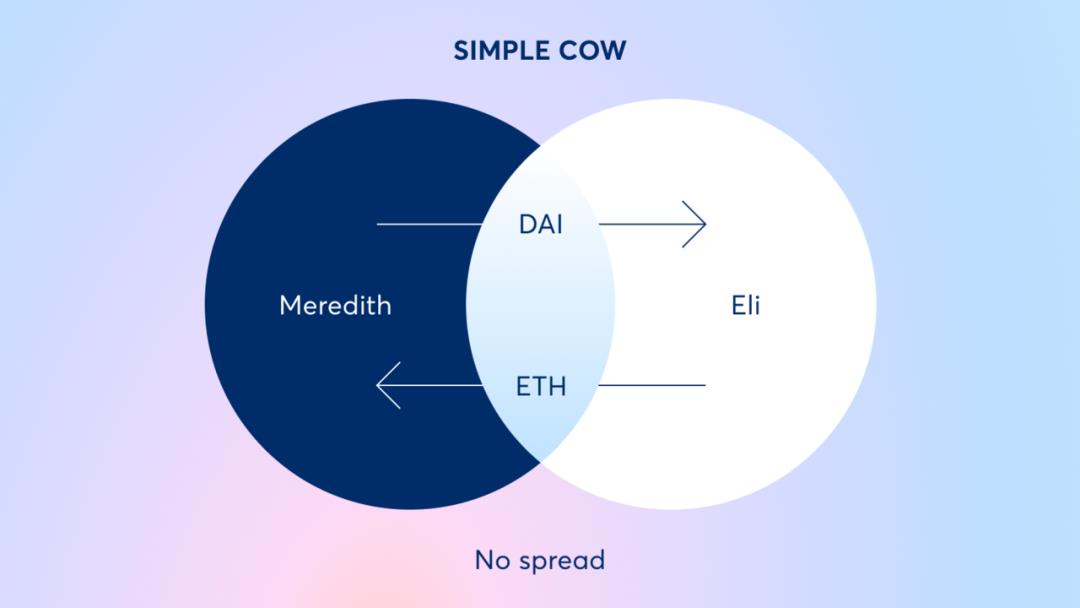

Despite its name sounding like it’s related to cows, “CoW” here stands for “Coincidence of Wants”—a special method of trade matching. Specifically, “coincidence of wants” refers to an economic phenomenon where two parties each hold something the other needs, enabling direct exchange without requiring a medium like money.

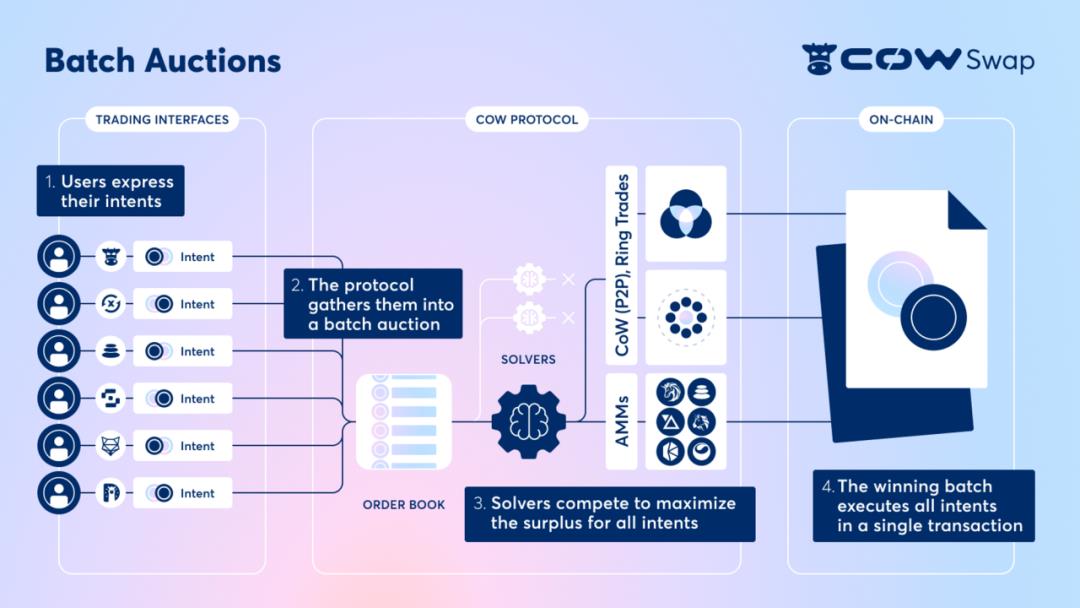

In the CoWSwap protocol, users don’t submit trades via a traditional transaction. Instead, they send a signed order (or trade intent) specifying the maximum and minimum output they’re willing to accept within a certain timeframe. Users don’t care—and needn’t care—about how the trade is executed. These off-chain signed orders are then sent to solvers, who compete to find the optimal execution path when the order becomes active. The top-ranked solver gains the right to execute the batch. This also means that the solver bears the gas cost, and users incur no gas fees if the trade fails (e.g., if no valid execution path meeting the promised price is found before the deadline).

CoWSwap’s MEV protection can be summarized in three key aspects:

1. Batch Auctions

A “coincidence of wants” occurs when two (or more) traders directly swap cryptocurrencies without relying on on-chain liquidity. When such matches happen, bundling orders into a single batch improves efficiency: it eliminates LP fees and gas costs, avoids slippage through off-chain P2P swaps, and prevents potential MEV attacks on-chain.

Leupold, CoWSwap’s tech lead, explains: Due to the “Cambrian explosion” of various tokens in DeFi, market liquidity is highly fragmented. Market makers must step in to provide liquidity across diverse token pairs. If coincidences of wants can be identified every block, fragmented liquidity spaces can be reaggregated.

2. Off-Chain Solving

Since third parties handle users’ trade orders, the visibility of the mempool is hidden, shifting all MEV risks onto these third parties. If a solver finds a better execution path, the order executes at a better price; otherwise, it settles at the worst-case quoted price. All transaction management risks and complexities are handled by professional solvers.

Users only need to express their “trade intent,” without worrying about execution details. Inexperienced users who don’t know how to boost their priority in the public mempool are protected by CoWSwap’s mechanism—no longer needing to fear walking through the “dark forest.”

3. Uniform Clearing Price

If two people trade the same asset within the same batch, the protocol enforces a single clearing price for that batch. Both trades settle at the “exact same price,” eliminating first-come-first-served dynamics. On typical DEXs, even within one block, multiple trades on the same pair receive different prices depending on execution order. But CoWSwap mandates a uniform clearing price, making reordering meaningless. According to Leupold, this approach eliminates “various forms of MEV.”

CoWSwap’s architecture is quite novel. Even before the concept of intents gained traction, it already largely aligned with the core principles of intent-based DEX design. Industry research reports have praised this architecture highly. Yet clearly, CoWSwap isn’t a mainstream name—when people think of aggregators, 1inch comes to mind first. Why is that?

We summarize CoWSwap’s drawbacks in three points:

1. Unsuitable for Illiquid Tokens

Theoretically, this mechanism could offer users better pricing, but may also lead to losses. For actively traded tokens, orders are likely to find “coincidences of wants” within batches, optimizing prices. However, for illiquid tokens (say ETH), solvers might execute trades at maximum slippage, potentially worse than slippage from a single liquidity source.

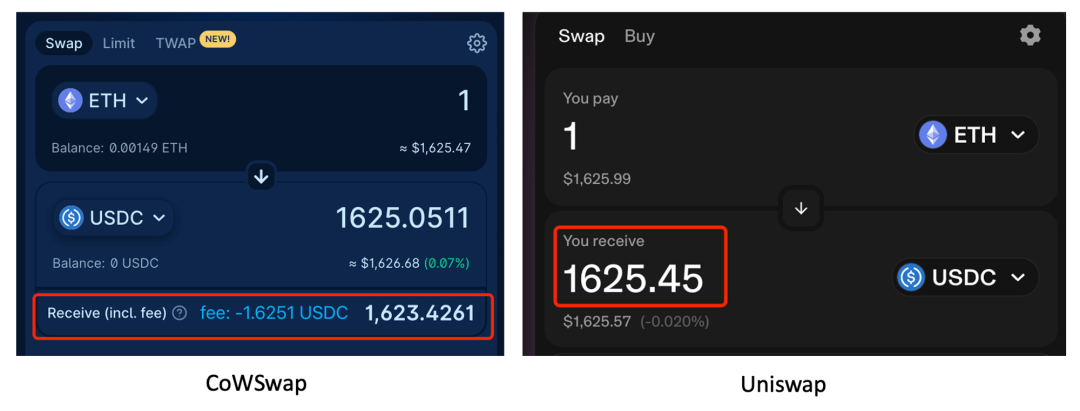

2. Additional Protocol Fees

For small trades with ample liquidity, CoW’s protocol fees may result in net losses for users.

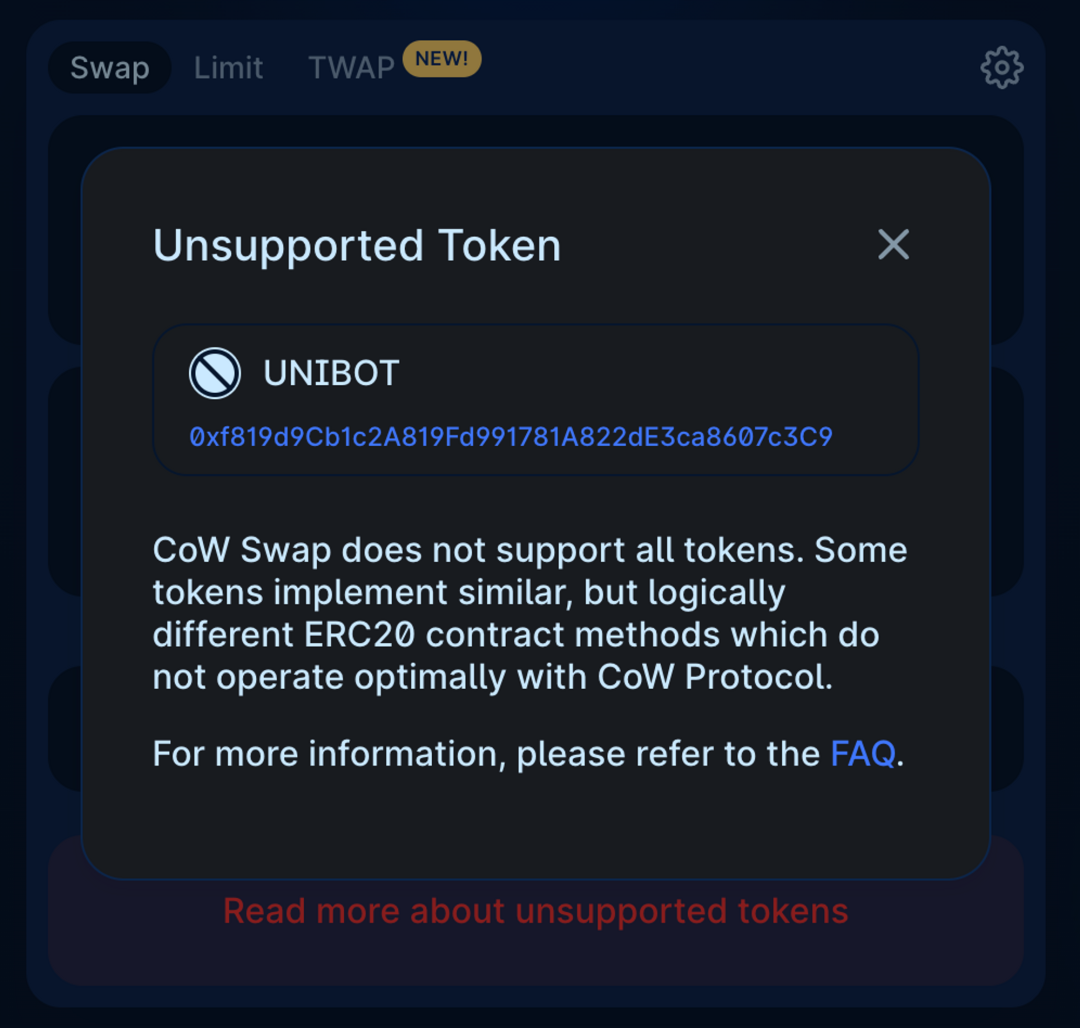

3. Not Supporting All Tokens

CoWSwap does not support swapping all tokens—it only supports ERC-20 standard tokens. Moreover, some tokens, though implementing standard ERC-20 interfaces, return less than the specified amount upon transfer due to custom logic (e.g., fee-on-transfer tokens). This breaks CoWSwap’s settlement logic—for example, $Unibot cannot be traded on CoWSwap.

Data Reveals Truth: Examining CoWSwap’s Market Performance

Ideals are often beautiful, but reality is harsh. Only through data can we truly assess CoWSwap’s market performance. Aligning with its strengths, we’ll examine CoWSwap’s performance from angles including MEV resistance, trading volume, and market share.

1. MEV Resistance

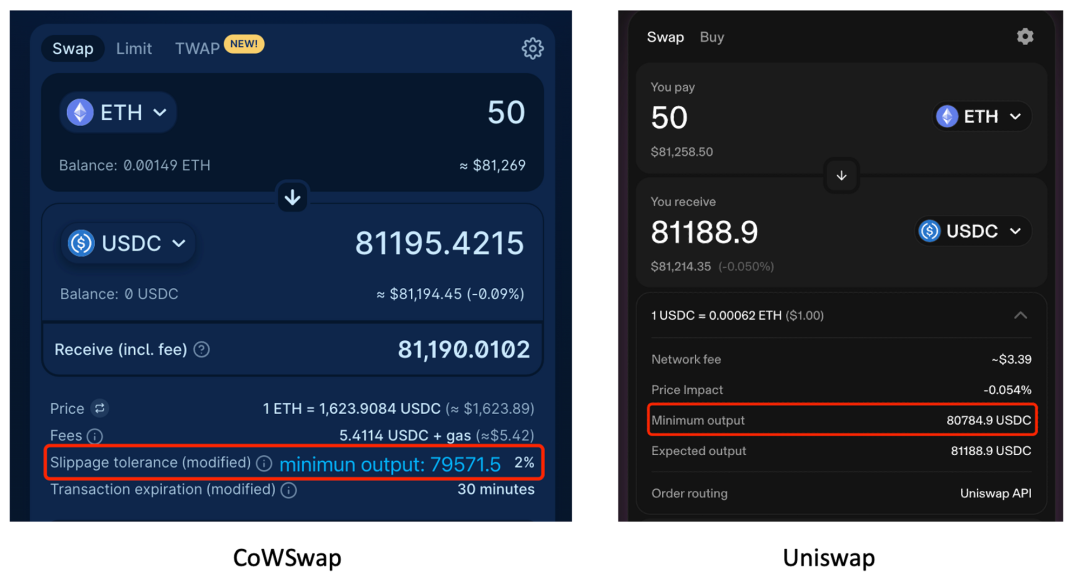

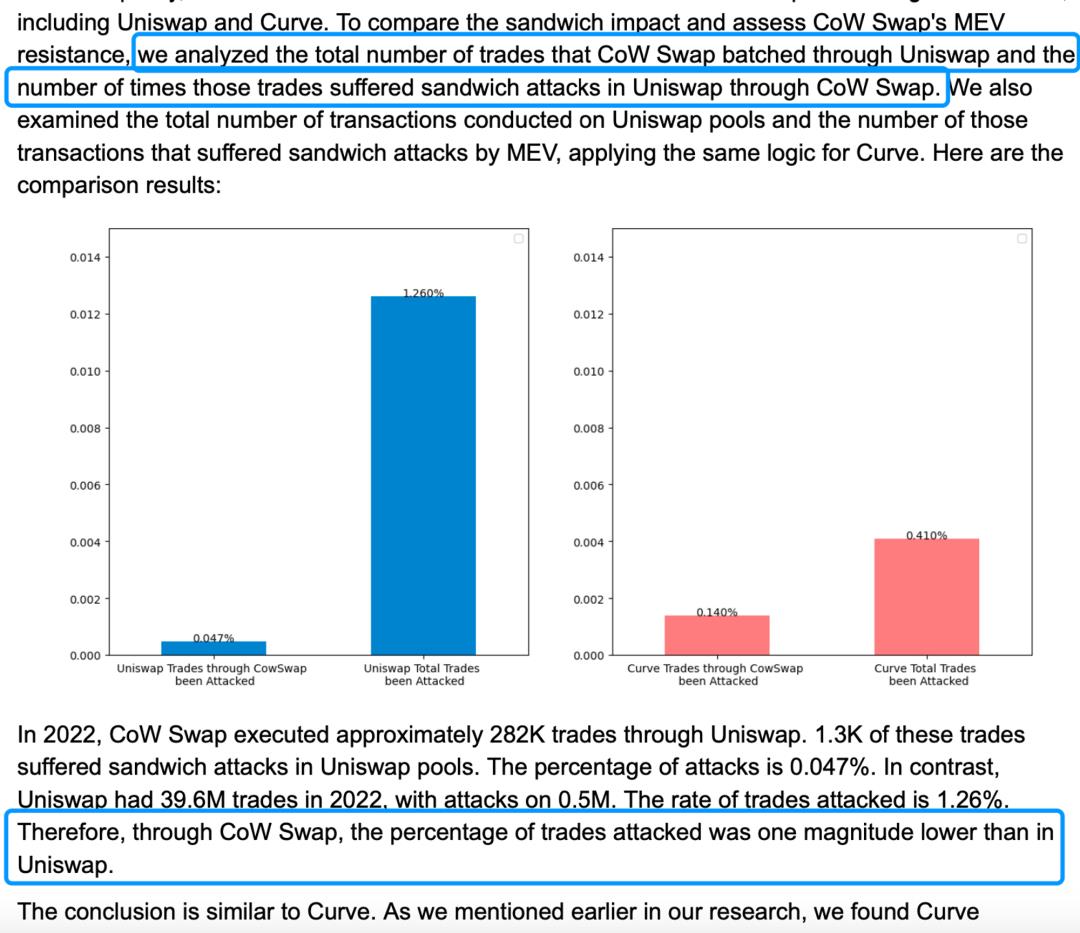

Compared to sandwich attacks on Uniswap and Curve, the number of attacked trades routed through CoWSwap is drastically lower. Compared to 1inch and Matcha, CoWSwap had the fewest sandwich attacks and lowest proportion of affected trading volume in 2022.

Source: Research report by on-chain MEV analysis team @EigenPhi

2. Trading Volume and Market Share

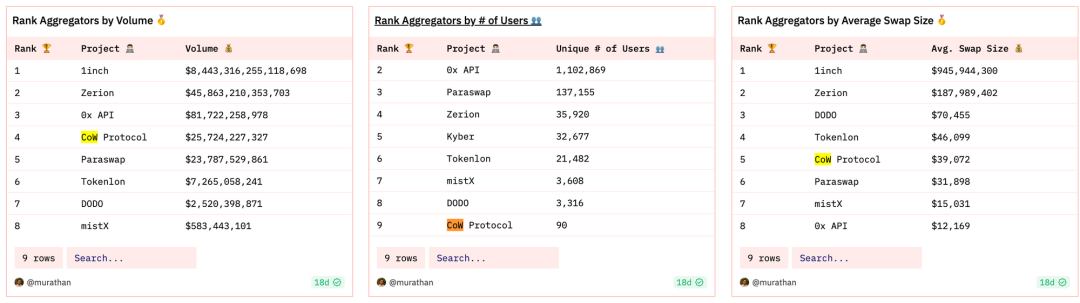

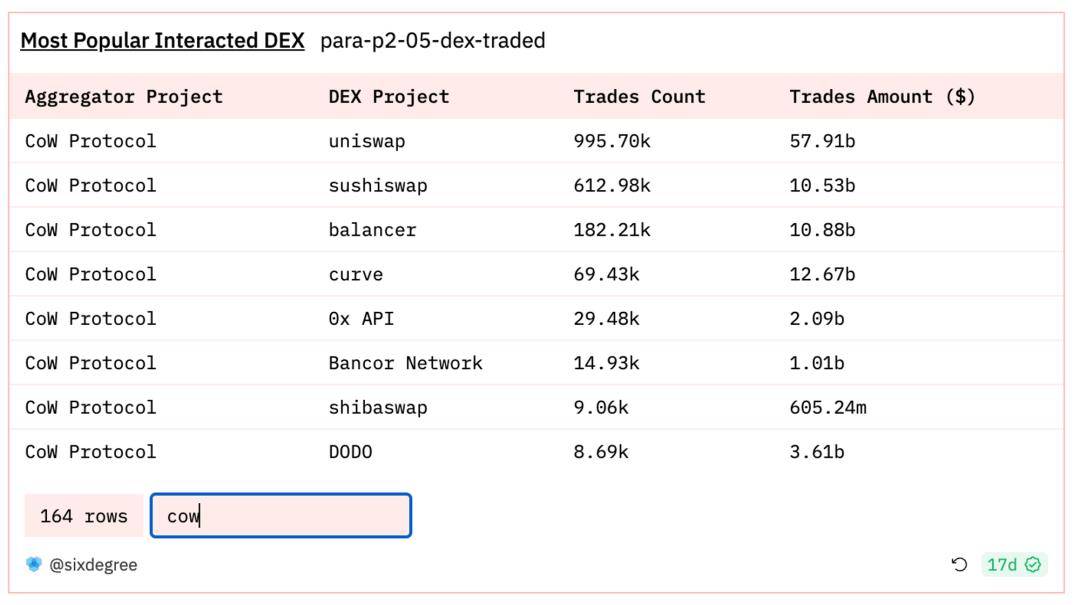

Horizontal comparison across the aggregator sector: CoWSwap ranks fourth in trading volume, ninth in user count, and fifth in average trade size. 1inch leads in all metrics.

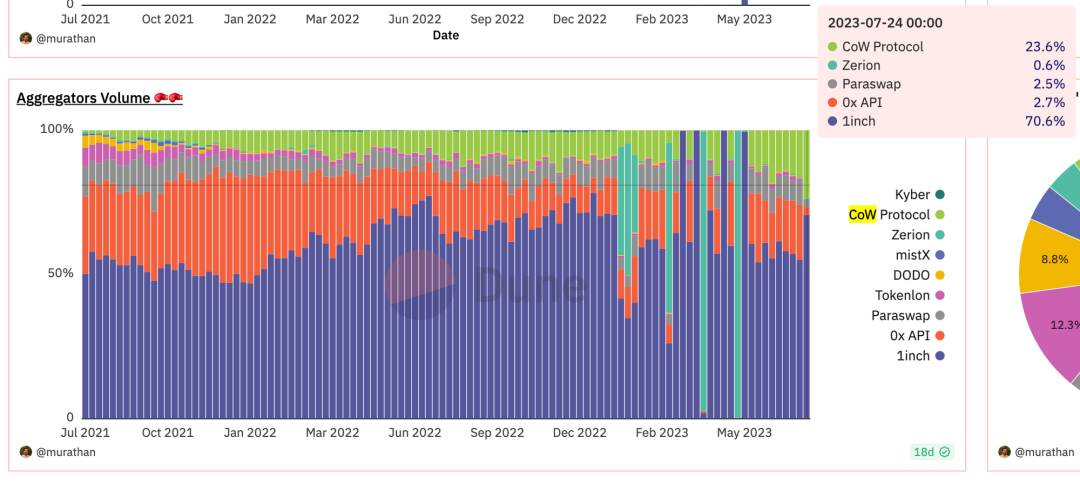

Comparing aggregator market shares: 1inch dominates with broad user adoption (~70% share), followed by CoWSwap (~10%), then 0xAPI, Matcha, and Paraswap. CoWSwap’s market share shows an upward trend.

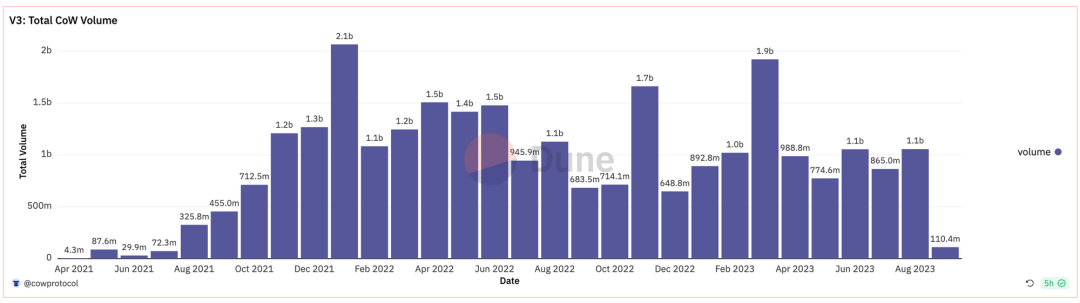

CoWSwap’s monthly trading volume fluctuates significantly. As of September 1, total trading volume reached $27.4B.

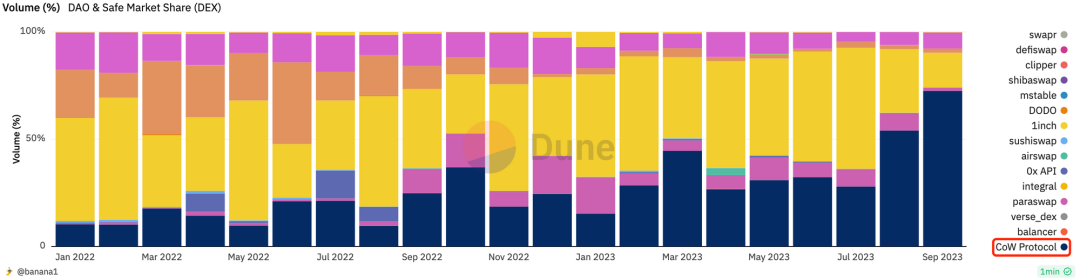

3. DAO Adoption

One-third of DAOs conduct trades on CoWSwap. Because DAOs frequently require large, MEV-resistant trades, platforms meeting special order needs—like limit orders, TWAP, and Milkman—are favored. (On July 10, AAVEDAO used Milkman to monitor slippage when swapping 326.88 wETH and $1,397,184 worth of $BAL into B-80BAL-20WETH.) This ratio continues to grow—in August, CoWSwap accounted for over half (54%) of such activity.

4. Balancer Incentives

On March 24, Balancer proposed [BIP-295] offering ~50–75% fee discounts to CoWSwap solvers. CoW-routed trades on Balancer rank third, behind only Uniswap and Curve.

The “Copying” Controversy

“CoW Swap is the first DEX Aggregator offering some protection against MEV”

—— CoWSwap About

CoWSwap originated as Gnosis Protocol V1, launched in 2020—the first DEX to offer ring trades via batch auctions. UniswapX and 1inch Fusion adopt architectures similar to CoWSwap: signed orders → outsourcing trade execution to third parties → competitively incentivizing third parties to return MEV to users. When UniswapX launched, accusations of copying CoWSwap flooded in. 1inch Fusion was jokingly dubbed a “modded version” of CoWSwap upon release.

Today, we explore the differences among the three, summarized across nine dimensions.

1. Third-Party Names

UniswapX: filler

CoWSwap: solver

1inch Fusion: resolver

Same role: providing execution solutions for users’ signed orders and packaging them into a single transaction for inclusion in a block.

2. Execution Process

UniswapX: The winning filler has exclusive execution rights for a period, followed by a Dutch auction if unclaimed.

CoWSwap: All solvers submit solutions to the Driver, which ranks them. After bidding closes, the top-ranked solver is notified and executes the batch.

1inch Fusion: Resolver count increases over time while price decays.

Critics argue 1inch Fusion starts with only one resolver in the first minute, leading resolvers to “wait for lower prices before executing”—increasing user waiting times.

3. Batch Formation

“Leopold contends that CoW Swap’s design still offers better pricing because it batches trades rather than processes them individually like UniswapX. Batching many different trade requests together provides better MEV resistance, he said.”

—— CoWSwap CTO

CoWSwap: Bundles all pending on-chain orders into a single batch for Dutch auction, enabling combined order matching (CoW).

UniswapX: Fillers independently pick up one or more orders via API for processing.

Due to order complexity, CoWSwap must bundle all pending orders into one batch—but finding an optimal solution within one block time is uncertain, and sometimes impossible.

4. Degree of Order Parameterization

UniswapX: Users enjoy greater freedom (and potential complexity) in defining parameters, including decay functions and initial Dutch auction prices.

CoWSwap and 1inch Fusion: Users only need to specify token pair and slippage tolerance. CoWSwap additionally allows setting order duration.

5. Different Third-Party Liquidity Sources

UniswapX: Allows any liquidity accessible to fillers—including private liquidity sources.

CoWSwap: Uses both CoW matches and external liquidity sources.

1inch Fusion: Typically served by large market makers.

CoWSwap focuses on finding counterparty matches simultaneously, while 1inch’s market maker resolvers can choose direct execution. UniswapX could allow professional market makers to participate, potentially solving 1inch’s criticized “resolver waits for lower price” issue and capturing market share.

6. Degree of Decentralization

UniswapX: Fully permissionless—anyone can access pending orders via API and compete with other fillers by sending solutions to Reactor (unless user specifies a filler).

CoWSwap: Must either create a $1M USDC/COW pool to get whitelisted, or be approved by Cow DAO based on DAO criteria.

1inch Fusion: Top ten addresses selected based on $1INCH staking amount weighted by staking duration. Requires registration, KYC, and maintaining sufficient balance to cover order costs.

Note: CoWSwap is currently in Phase 1 (project team authorization); Phase 2 requires staking and DAO voting; Phase 3 will allow anyone to become a solver.

7. Quotation Sources

UniswapX: Allows fillers to quote (RFQ), meaning fillers can set the initial Dutch auction price.

CoWSwap, 1inch Fusion: Use API-based quoting.

8. UniswapX Uses RFQ and May Adopt Reputation System

UniswapX: Allows users to designate a specific filler to execute orders within a time window (followed by Dutch auction), incentivizing fillers to quote via RFQ. To prevent abuse of exclusive rights, a reputation or penalty system may be introduced.

CoWSwap: Weekly rewards go to the solver with the highest order fulfillment rate from the previous week.

9. UniswapX Introduces Cross-Chain Aggregation (Not Yet Implemented)

UniswapX: Can extend to support cross-chain trading, merging swap and bridge actions into one seamless operation—users can exchange assets on the source chain for desired assets on the target chain without directly interacting with bridges.

CoWSwap, 1inch Fusion: Still under discussion.

Final Thoughts

Overall, CoWSwap is a project worth watching. Outsourcing order execution to third-party solvers shares philosophical similarities with L2 scaling: execute off-chain, settle and verify on-chain. CoWSwap cleverly enables trades to function like a vast barter economy, solving liquidity fragmentation—only tapping on-chain liquidity when peer-to-peer matching falls short.

One requirement of intent-based systems is allowing anyone to act as a solver, driving efficiency through competition. CoWSwap’s architecture aligns well with this principle. By delegating transaction risk and complexity to professional solvers, users are shielded from the dangers of the “dark forest.” This mirrors DODO V3’s philosophy, where liquidity providers entrust capital to professional market-making teams instead of managing strategies themselves.

CoWSwap has achieved notable success in combating MEV, and its market share is growing under the intent narrative. Yet it faces challenges for mass adoption, including protocol fees and lack of support for certain tokens. As a pioneer of the solver model, UniswapX and 1inch Fusion feel more like innovations built upon its foundation—1inch releasing resolvers sequentially and integrating professional market makers; Uniswap enabling RFQ with designated fillers instead of simultaneous submissions. We look forward to CoWSwap’s framework inspiring further innovation in decentralized aggregator space, and hope to see CoWSwap achieve sustained and outstanding growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News