Deep Dive into stUSDT: Unveiling the Ambition to Become "Crypto Gold" and the Vision of the TRON Network

TechFlow Selected TechFlow Selected

Deep Dive into stUSDT: Unveiling the Ambition to Become "Crypto Gold" and the Vision of the TRON Network

Leveraging the crypto world's consensus on TRC-20, stUSDT is poised to become a key contender in the current RWA narrative.

RWA is increasingly drawing mainstream attention from both Web2 and Web3 communities. On July 3, stUSDT—the first RWA product in the TRON ecosystem—officially launched, marking another heavyweight addition to the RWA space. Thanks to TRON’s dominant USDT circulation volume and its nearly barrier-free accessibility, stUSDT was immediately dubbed the "Yu’ebao of Web3." Looking closer at stUSDT itself, it differs from existing tokenized stocks, real estate, or treasury bonds by choosing the most dominant stablecoin on-chain—TRC-20 USDT—as its underlying asset for mechanism design and operational execution.

stUSDT—An RWA Product Accessible to Everyone

Prior RWA implementations typically focused on bringing off-chain assets into DeFi—for example, Compound's founder’s new project Superstate offers Web3 high-net-worth individuals opportunities to invest in U.S. Treasuries. Similarly, MakerDAO’s treasury purchase program effectively channels on-chain capital into traditional financial markets.

In the broader context of crypto, we may now be approaching a new turning point. On one hand, the crypto industry continues to face intense scrutiny and crackdowns from Western regulators, who cite compliance concerns to target exchanges and classify major cryptocurrencies as securities. On the other hand, the RWA narrative has been gaining momentum—from Binance releasing an RWA report early this year, to old-money institutions like Citigroup entering the space, and the Hong Kong government issuing the world’s first tokenized green bond via Goldman Sachs.

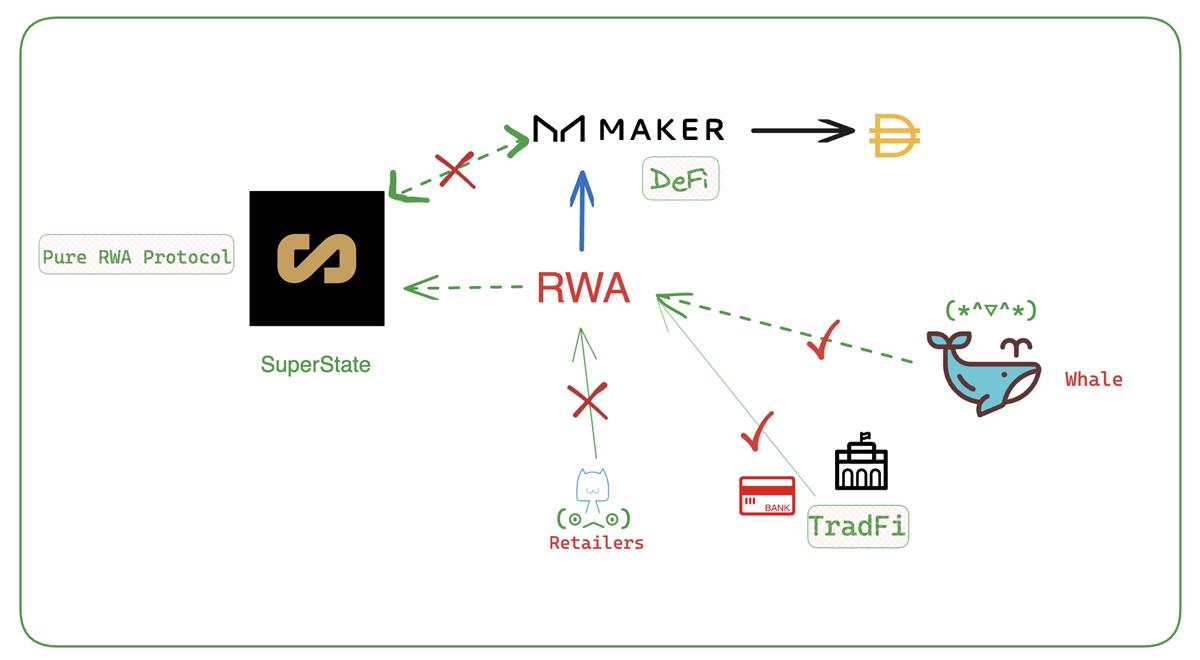

Suddenly, RWA is all the rage. However, current RWA efforts still face two core issues: one-way liquidity and unequal investment access.

-

Whether tokenizing traditional treasuries and securities for DeFi use, or using protocol treasuries to buy traditional financial products, these approaches only enable one-way liquidity and fail to bridge the gap between on-chain and off-chain systems;

-

Current RWA participants are mostly protocols, centralized institutions, or whales. Ordinary retail investors lack access, which contradicts the very spirit of DeFi and blockchain. Creating more inclusive liquidity has thus become an urgent priority.

RWA initiatives can currently be categorized into three broad types:

• DeFi: “New” RWA experiments from “old” projects like stablecoins and MKR;

• Tradi: Traditional institutions such as banks and governments—for example, BOC International’s securities issuance;

• Native RWA Protocols: Projects like Maple and Centrifuge.

Breakthrough requires returning to blockchain’s decentralized roots. If RWA continues down its current path, it risks being absorbed by TradFi under the banner of compliance. To prevent RWA from becoming a playground exclusively for whales and institutions, broader individual participation is essential. Only then can genuine consensus form and a healthy, liquid market emerge.

The way forward may lie in re-examining the essence and mainstream forms of RWA. What should the dominant RWA asset be today?

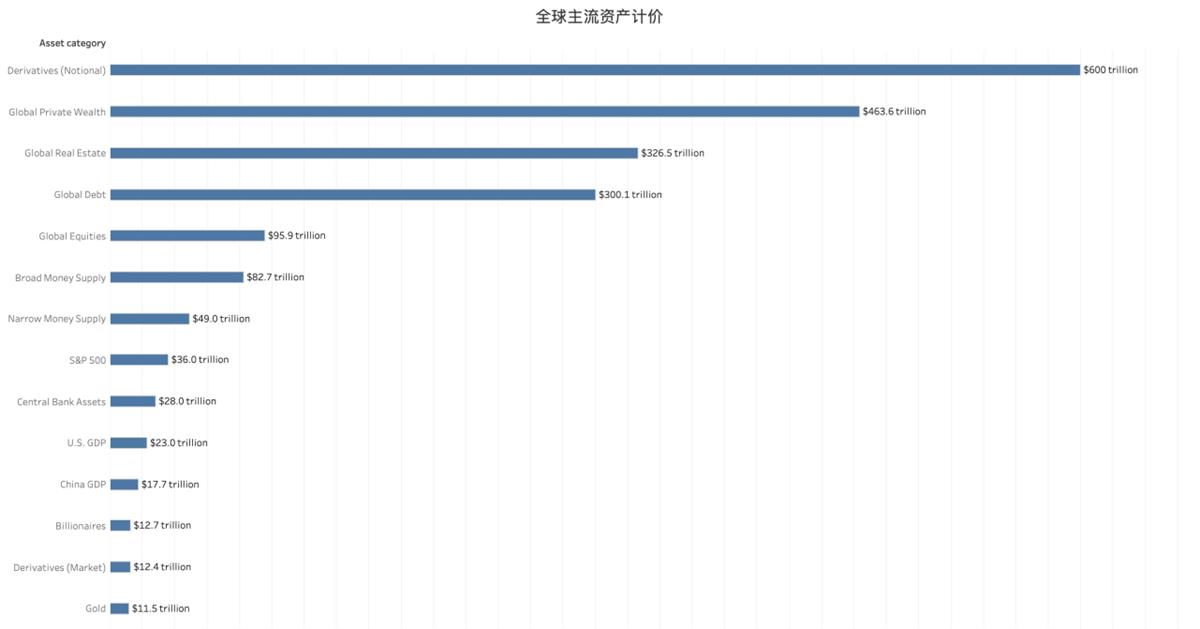

On the surface, it might seem to be U.S. Treasuries, stocks, securities, or even real estate—the world’s largest asset classes, each with market caps exceeding trillions of dollars. Yet the first three are already highly commoditized and suffer from excessive liquidity, even amid rising interest rates. Channeling crypto capital into them merely creates passive yield instruments that ultimately drain liquidity from the crypto ecosystem.

DeFi must have the courage to pursue more fundamental innovation.

Following USDC’s depegging crisis in March, increasing numbers of retail users have shifted toward USDT. Meanwhile, leading DeFi projects are launching their own stablecoins—such as Aave’s GHO, MakerDAO’s DAI, and Curve’s crvUSD. But fundamentally, these stablecoins still rely partly on USDC or USDT, merely increasing the proportion of on-chain collateral.

For instance, crvUSD includes WBTC and WETH among its collaterals, while DAI still holds a significant portion of fiat-backed stablecoins like USDC. In contrast, stUSDT treats USDT purely as a pricing reference, with daily operations conducted directly through stUSDT—this is the fundamental distinction.

In short, RWA products should originate from crypto-native assets rather than mimicking traditional finance. The logic of RWA still centers on assets—only assets possess the magic of reproduction.

Within crypto, beyond Bitcoin and Ethereum, the most significant asset class remains stablecoins—especially USDT, which functions as a de facto first-class citizen. Yet exploration around USDT has largely stagnated at simple staking yields, eventually becoming tools for accumulating tokens by ambitious actors.

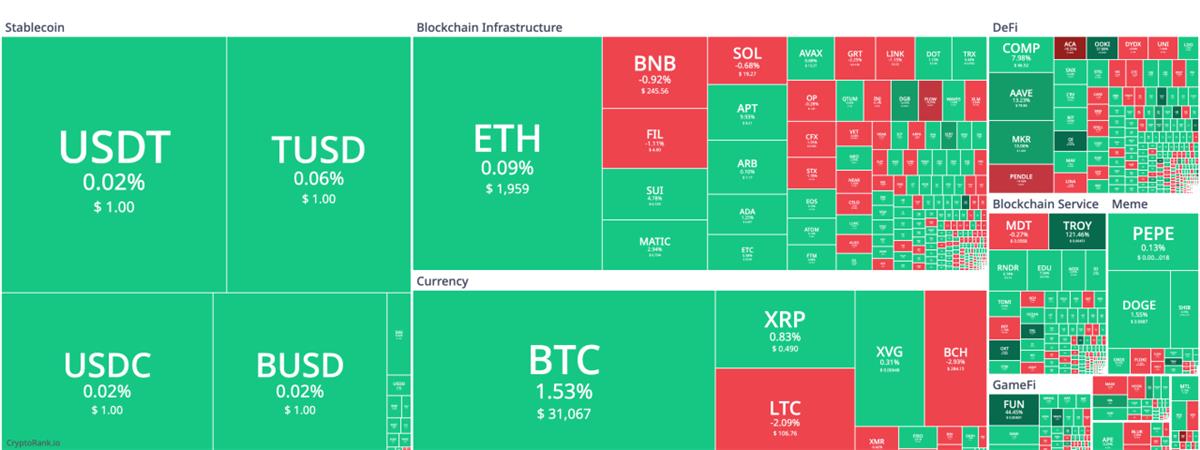

In terms of trading volume, the four major stablecoins—USDT, TUSD, USDC, and BUSD—form the market’s dominant players. With stUSDT entering the scene, there’s hope it could become a transformative force in RWA, potentially even serving as a pricing benchmark across TradFi and DeFi—becoming the first crypto equivalent akin to gold.

Stablecoins: The Silent Elephant in the RWA Room

For years, stablecoins have ranked among the top assets by market cap in crypto. Yet their role has largely been limited to onboarding/offboarding funds and serving as pricing and trading units across exchanges, DeFi protocols, and projects—sometimes used for basic yield staking or dual-token investments.

By comparison with fiat currencies, stablecoins exhibit extremely low capital efficiency. Whether looking at M0/M1/M2 classifications or the thriving stock and treasury markets, their valuation scales far exceed actual monetary supply.

Given this, current RWA shouldn’t fixate solely on tokenizing off-chain assets. Instead, we must reconsider the importance of liquidity itself and return to stablecoins. Using USDT as an example, two key problems become apparent:

-

USDT serves as a bridge between on-chain and off-chain systems, but minting and redemption are restricted to Tether Limited, creating inherent liquidity constraints;

-

Although Tether claims full fiat backing at a 1:1 ratio, the yield generated belongs solely to Tether—not shared with USDT holders. Yet in case of risk, holders bear the consequences directly, resulting in a clear imbalance of rights and responsibilities.

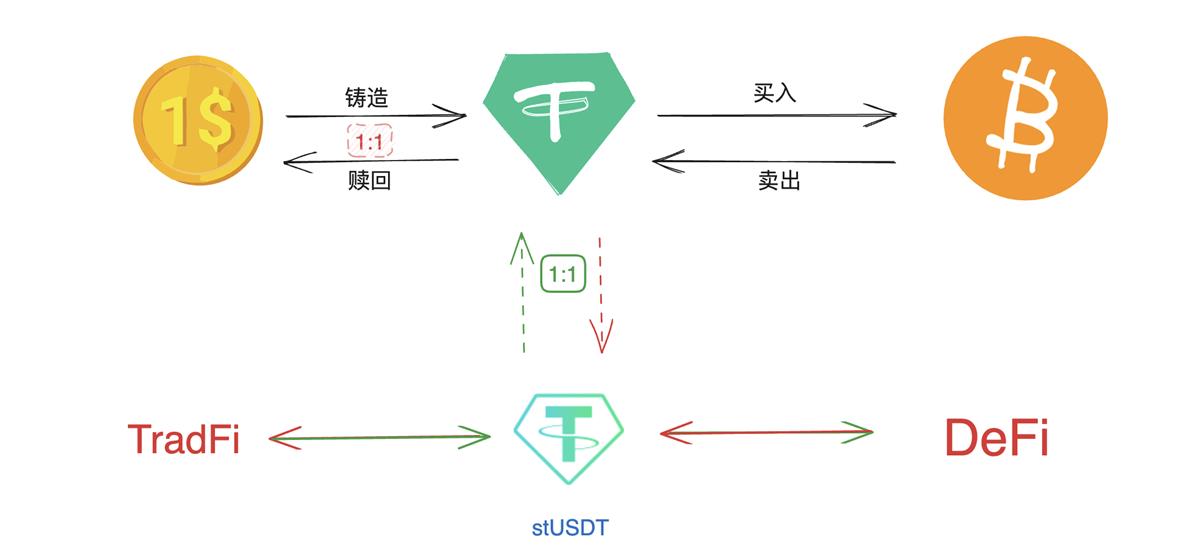

The launch of stUSDT addresses these issues head-on by enhancing USDT’s utility while employing smart contracts to maintain a true 1:1 collateralization ratio. stUSDT tokens are RWA certificates obtained by staking USDT, managed via on-chain contracts and an RWA DAO to ensure both capital efficiency and security. Users do not need to manually claim or adjust earnings—the Rebase mechanism automatically balances returns, ideally maintaining price stability over time.

However, it’s important to note that Rebase mechanisms in previous algorithmic stablecoin attempts failed during bank runs. Ultimately, few algorithmic issuers can match the liquidity depth of Ethereum or USDT. Even though stUSDT is backed by TRON’s substantial assets, it will still need to withstand market volatility tests.

At a macro level, stUSDT corrects the imbalance between USDT issuance and yield distribution. In the traditional USDT model, movement between USD and crypto—and vice versa—is mediated entirely by Tether Limited.

Tether ensures redeemability, which is its primary source of profit. stUSDT disrupts this dynamic. Its operational flow consists of four steps:

• Users stake USDT to receive stUSDT;

• stUSDT manages assets via smart contracts and deploys capital externally to generate yield;

• Yields are distributed automatically via smart contracts and the Rebase mechanism, allowing users to receive additional stUSDT without manual action;

• Users can convert stUSDT back to USDT.

On its launch day, over 22 million USDT were staked through the stUSDT platform—demonstrating strong protocol viability. Essentially, stUSDT acts as a complementary plug-in addressing existing USDT shortcomings:

-

Many Web3 users either dislike or cannot hold fiat assets like USD. stUSDT allows indirect exposure to dollar-denominated yields without requiring bank accounts;

-

Currently, USDT usage is limited, with most yield captured by Tether or OTC desks. Retail investors lack access to RWA-style returns from USDT, resulting in constrained liquidity. stUSDT maintains parity with USDT while enabling investment both on-chain and in off-chain instruments—such as high-yield U.S. Treasuries—allowing collective participation and expanding possibilities.

Through careful risk management and operational design, stUSDT decouples risk from yield.

Beyond smart contracts and Rebase mechanics, stUSDT’s operations will gradually transition to an RWA DAO, currently managed by JustLend DAO.

The indirect holding mechanism of stUSDT also enhances compliance. Theoretically, holding stUSDT constitutes only a convertible agreement with USDT, redeemable at any time. Yet through USDT, stUSDT holders gain access to broader investment opportunities. Crucially, investment decisions are made by the RWA DAO—not individual holders. In case of potential risks, backed by TRON’s multi-billion-dollar USDT liquidity pool, stUSDT can be instantly converted back to USDT.

Discovering a New Yield Engine for USDT

Looking back at DeFi, every bull market has been driven by an innovative engine. During the 2020 DeFi Summer, liquidity mining served as that catalyst—launching new farms continuously amplified returns, ultimately helping crypto reach a $2 trillion market cap.

Yet this model proved unsustainable—it relied on recycling existing capital without creating lasting value. In contrast, traditional finance features longer transitional phases. For instance, U.S. equities can deliver sustained multi-year gains, while Treasuries offer stable yields above 5%.

It’s foreseeable that the next bull market will favor stable, long-term returns, with LSD (Liquid Staking Derivatives) and RWA emerging as the most suitable products. Indeed, LSD falls under the broader RWA umbrella. Under RWA DAO governance, funds could be allocated to LSD markets. While Ethereum’s LSD risk is already low, it still doesn’t match the ultra-low risk profile of Treasuries—on-chain assets remain highly volatile.

Summarizing current RWA paradigms, they all grapple with the same questions: Where does yield come from? How is risk controlled? Drawing from leading native RWA protocols, we can categorize them into four paradigms:

•First Paradigm: Tokenized Real Estate—RealT

•Second Paradigm: Undercollateralized Lending—Maple

•Third Paradigm: NFT-based Real-World Assets—Centrifuge

•Fourth Paradigm: Tokenized Bills—ERC-3525

All of these models can be integrated within stUSDT’s framework. Under the RWA DAO structure, an Advisory Council (RWA Investment Committee) will oversee daily investment management, composed of experts from both TradFi and DeFi. Their involvement strengthens governance and enables capturing opportunities across both worlds, improving the protocol’s risk resilience.

Alongside traditional investors, smart contracts and DAO governance add greater flexibility. After generating returns, the RWA DAO will disclose data transparently and distribute profits automatically via smart contracts—ending the opaque "black box" nature of traditional investing.

Within the on-chain domain, stUSDT will leverage further opportunities in the TRON ecosystem. Take Sunswap, for example. SunSwap V3 improves capital efficiency through concentrated liquidity technology, allowing users to provide liquidity using token pairs, fee tiers, and price ranges—offering greater customization. This empowers LPs to precisely control fund allocation and enhance market-making capabilities. However, higher customization also means LPs must carefully assess market risks to avoid losses.

If the RWA DAO identifies profitable opportunities, it may participate in liquidity provision on SunSwap V3. Under DAO governance, adding or withdrawing liquidity becomes more agile, with all data publicly auditable on-chain—enabling swift responses to unexpected events.

Ultimately, stUSDT does not rely on Tether’s financial promises, but on the consensus surrounding TRC-20 USDT across the TRON network, with trust enforced by DAOs and smart contracts operating fully on-chain.

On launch day, stUSDT began generating Rewards, providing real-time snapshots detailing fund utilization. For example, on July 3, bank fees totaled $22,296.75, daily profit reached $2,403.43, and the daily Rebase amount was $2,163.09.

The RWA wind began blowing in 2017, but only now has large-scale implementation become truly feasible. stUSDT starts with the most mainstream stablecoin but goes beyond simple staking—aiming to maximize stUSDT liquidity while creating diverse use cases and unlocking Alpha and Beta returns for holders.

Returning to the two initial challenges facing RWA, stUSDT simultaneously bridges on-chain and traditional finance—enabling seamless yield flow—while maintaining permissionless access with no investment门槛, ensuring inclusivity.

The TRON blockchain, worth tens of billions of dollars, primarily hosts USDT assets supported by Tether’s funding commitments. stUSDT, as a re-staked derivative of USDT, is fully backed by USDT itself. Leveraging the crypto world’s consensus on TRC-20, stUSDT is poised to become a major contender in the evolving RWA narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News