Tracking whales who made over 10x profits in Pendle—what’s their next move?

TechFlow Selected TechFlow Selected

Tracking whales who made over 10x profits in Pendle—what’s their next move?

Crypto analyst Finish has captured the next move of smart money through the Dune data dashboard.

Written by: Finish

Compiled by: TechFlow

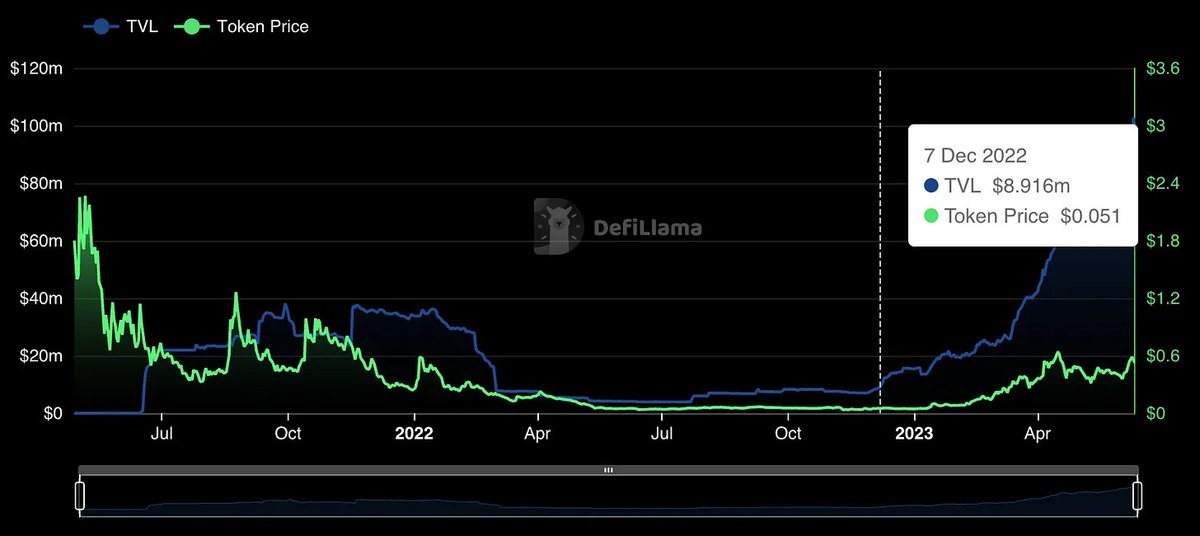

Smart money made over 1000% profit through Pendle. Crypto analyst Finish tracked these smart money moves using Dune analytics dashboards.

Last week, I spent a lot of time analyzing whale activity using various Dune dashboards and other tools. As I dug deeper into different wallets, I discovered some very interesting whales who achieved massive gains. How was this possible during the recent market downturn?

Through the dashboard, I found a whale who recently earned solid profits from $PENDLE.

He is no longer holding $PENDLE tokens but has converted all his $PENDLE into substantial profits. What’s more interesting, however, is what he did afterward—or when he might buy back $PENDLE. That’s exactly what I’m trying to find out.

Since then, the whale hasn’t done much—just staked some $ETH on Lido and sent some $cbETH received from Binance to Coinbase, which is definitely an interesting move. Additionally, he deposited the remaining ETH into Aave, although so far he hasn't borrowed anything.

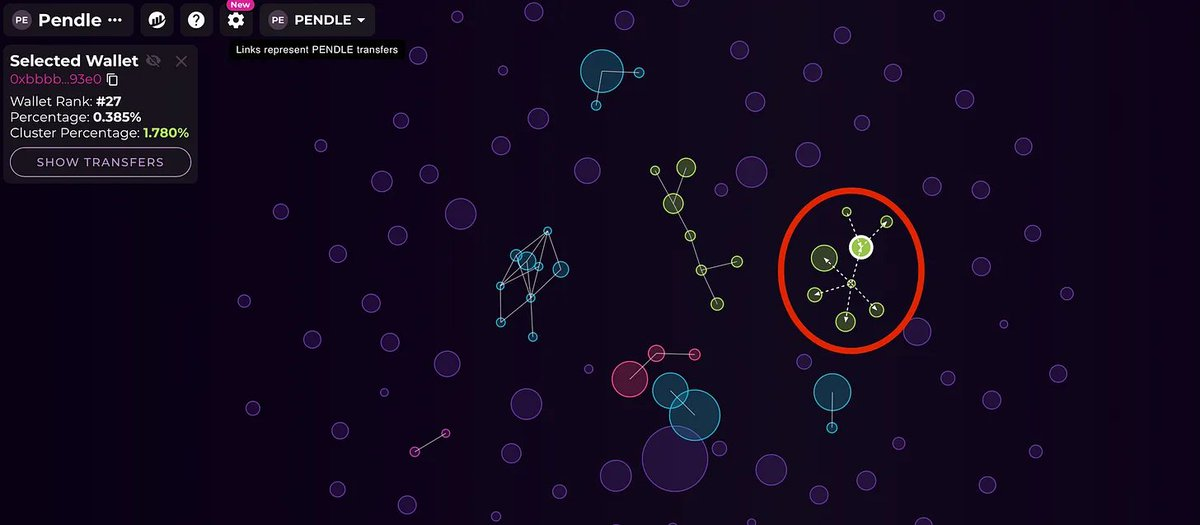

Now let’s look for the next smart money player. Using Bubblemaps, I discovered a second whale. It appears to be part of a whale cluster holding over 1% of the entire $PENDLE supply.

This group is particularly interesting because they haven’t traded much, yet are followed by many wallets on DeBank. The wallet I found had been accumulating $PENDLE throughout 2022—long before anyone was talking about it.

This whale is a true early adopter and still holds a significant portion of their position (892,000 $PENDLE, with 64,000 providing liquidity on SushiSwap). Currently, this whale isn’t making many transactions but transferred some $PENDLE to a friend on Arbitrum, making that wallet one of the largest $PENDLE holders on Arbitrum.

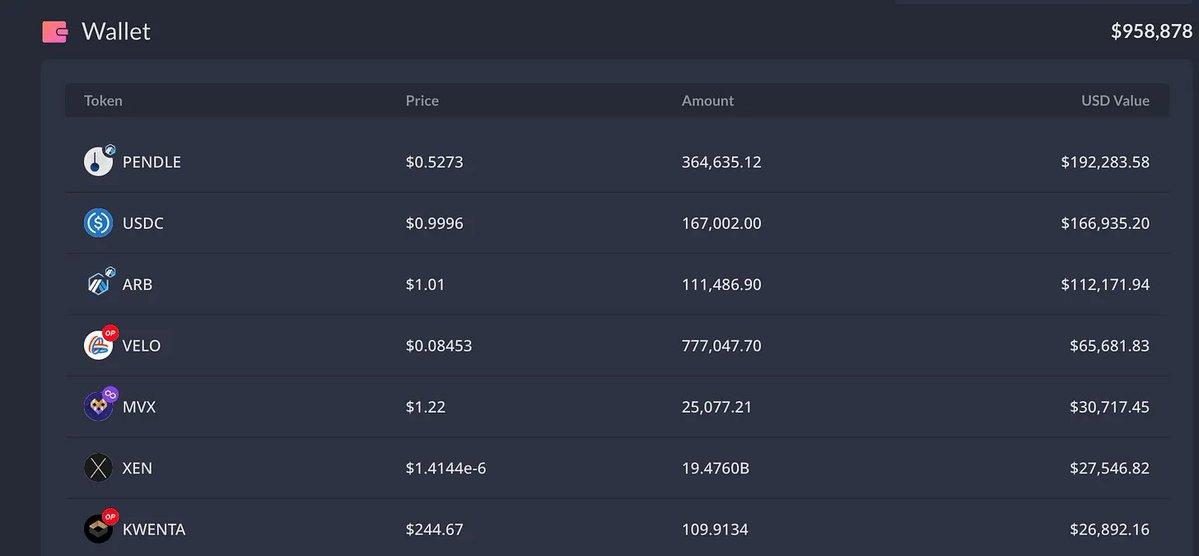

Let’s see what else this wallet is doing.

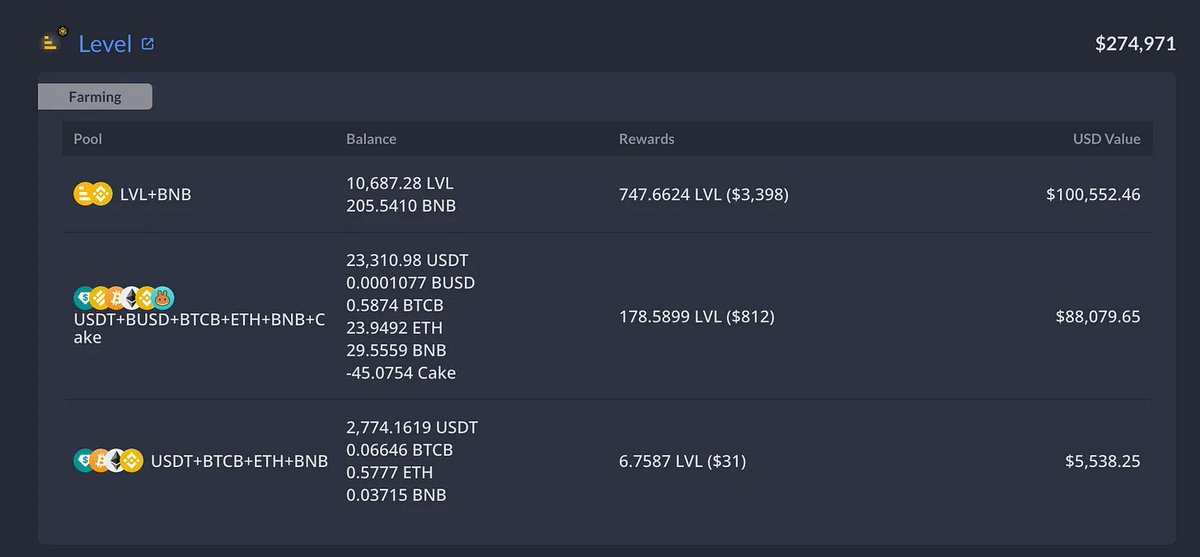

The wallet holds numerous altcoins along with some $USDC. Its largest positions are:

-

$PENDLE;

-

$ARB;

-

$VELO;

-

$KWENTA.

In addition, he appears to be a loyal user of Level Finance.

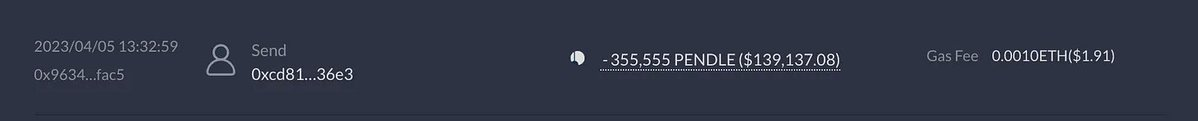

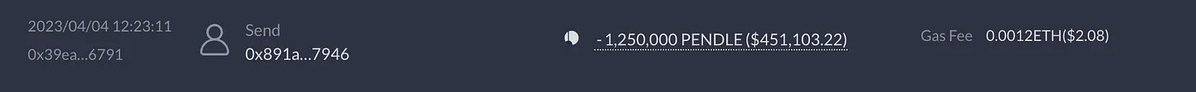

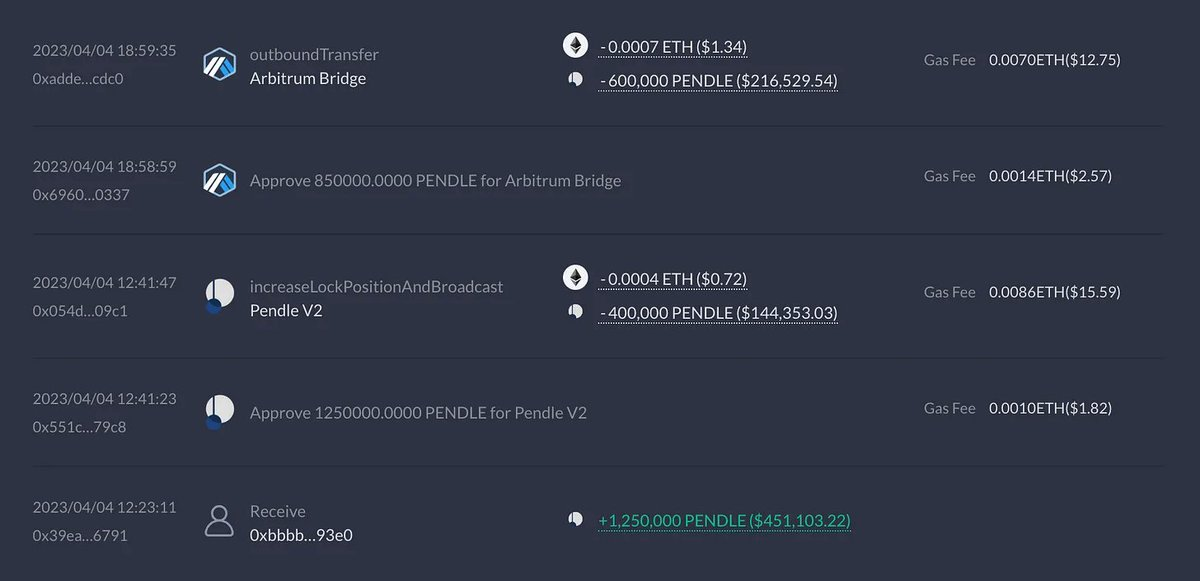

Now let’s move to the next friend of this whale. This wallet received a staggering 1.25 million $PENDLE from the whale. Let’s explore this wallet’s activities.

This whale locked $400,000 worth of $PENDLE as $vePENDLE. Another portion on Arbitrum is being sold weekly, generating steady returns.

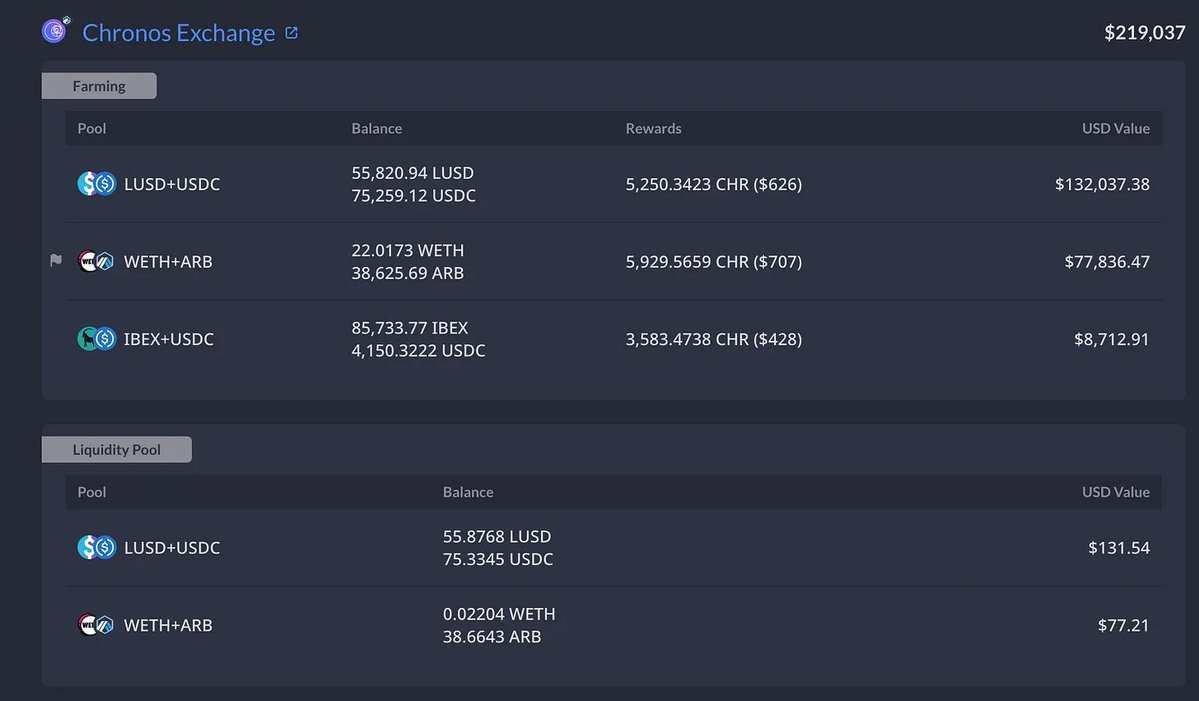

This whale is also a fan of Chronos, holding a large amount of LP tokens, though not much $CHR itself (around $250). The rewards from LP tokens exceed those from direct $CHR holdings.

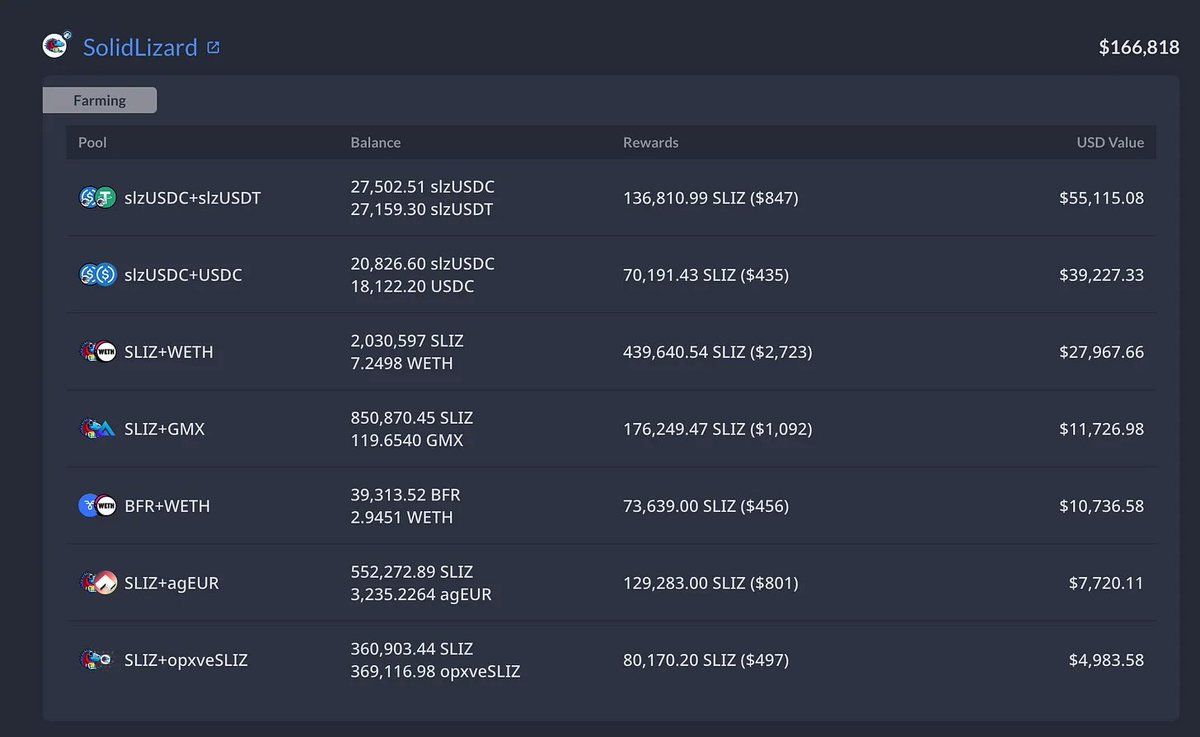

This whale has also heavily invested in SolidLizard. It’s not a popular DEX, but certainly worth investigating further.

In summary, whales have only sold a small fraction of their $PENDLE holdings. Most remain held, with some even locking tokens to boost LP APYs.

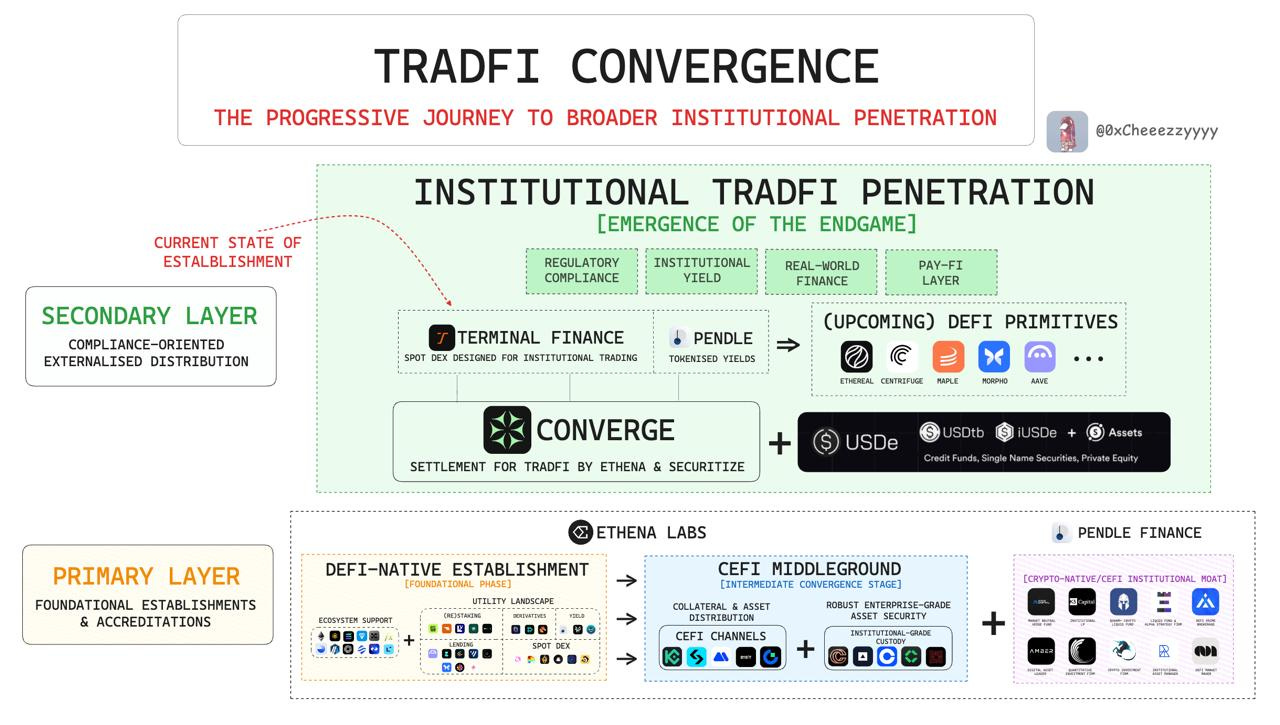

Other notable projects worth watching include Level, Chronos, and SolidLizard—all ve(3,3) model DEXs. I’ve also identified several projects investing in $Pendle that deserve attention.

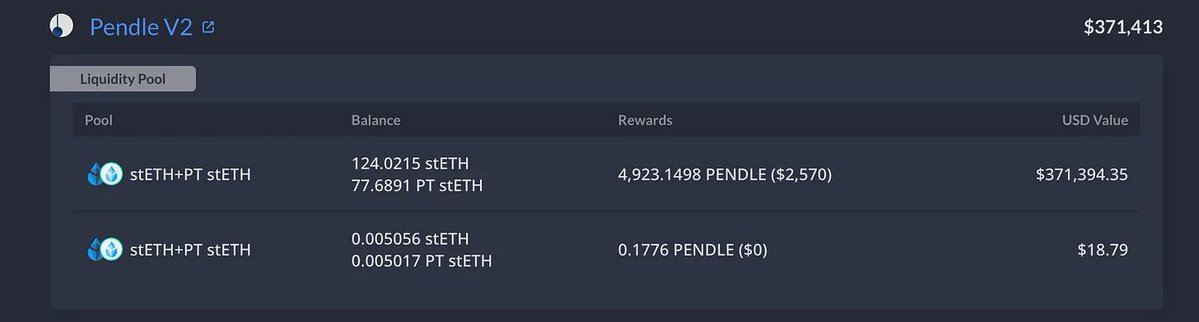

0xAcid has deposited 300 $ETH into Pendle pools and holds over $9 million worth of various LSDs.

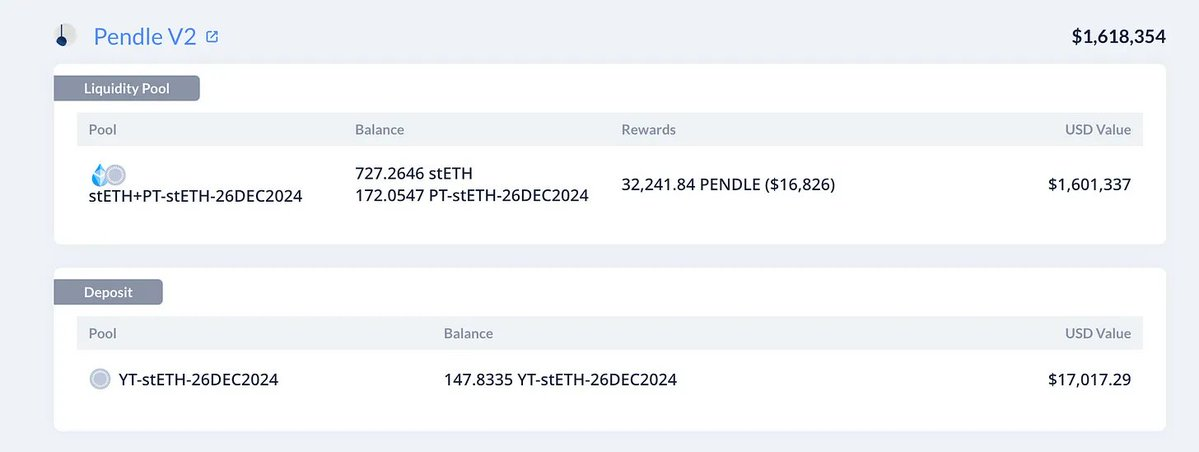

Kleros has been actively depositing into Pendle Pools, having already deposited over $1.6 million in LSDs.

Conclusion

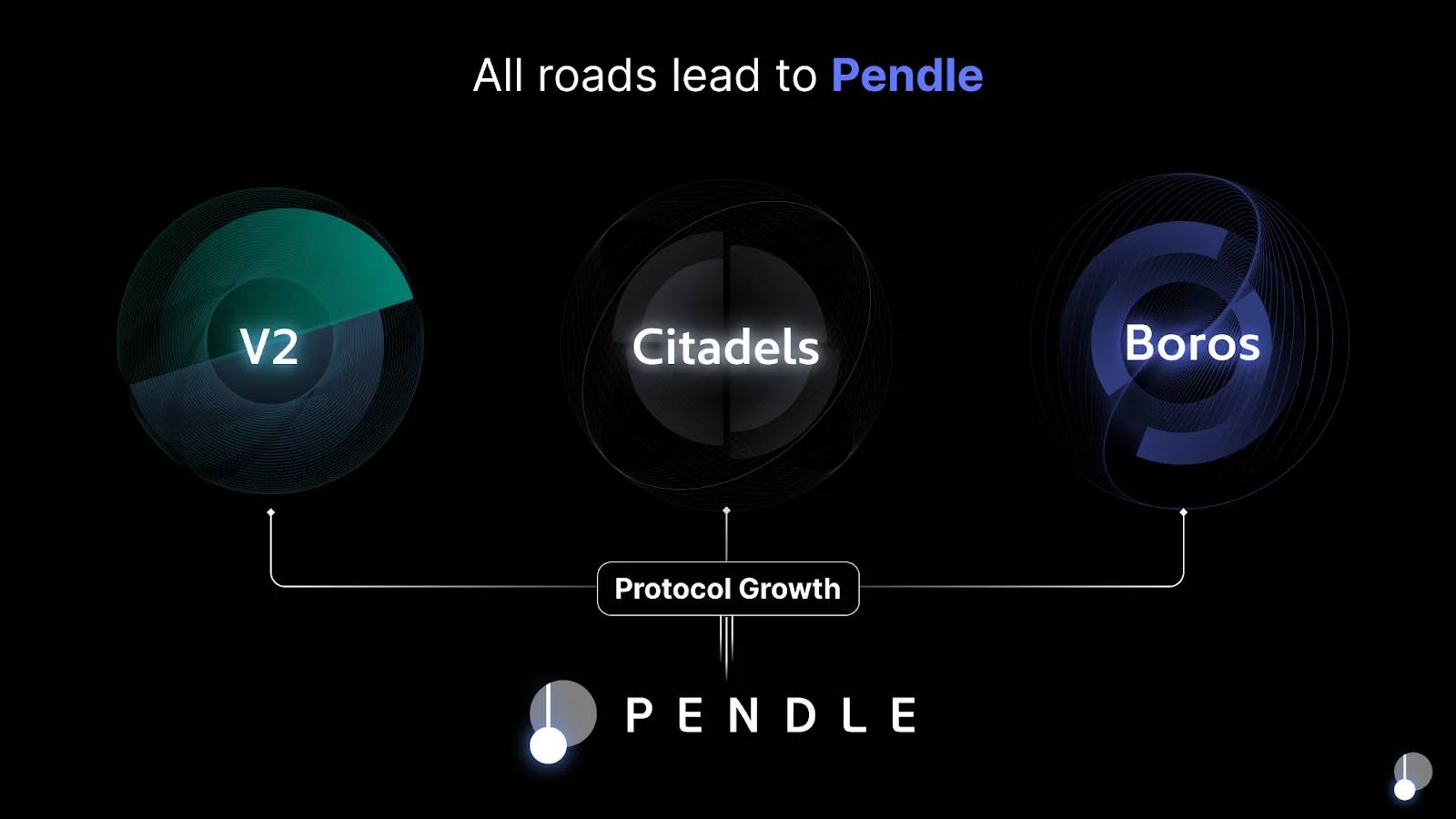

My biggest takeaway is that nearly all whales are firmly holding, and an increasing number of projects are joining the Pendle ecosystem—making me even more bullish on its long-term prospects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News