Data Insights: Current Market Phase Assessment and Trend Analysis

TechFlow Selected TechFlow Selected

Data Insights: Current Market Phase Assessment and Trend Analysis

This article aims to analyze from a data perspective where we currently stand in the cryptocurrency cycle, which assets smart money is buying, and the narratives driving the market.

Written by: ONCHAIN WIZARD

Compiled by: TechFlow

In this article, crypto analyst ONCHAIN WIZARD aims to analyze from a data-driven perspective our current position within the cryptocurrency cycle, which assets smart money is buying, and what narratives are driving the market.

Where are we in the cycle? Below are my views/explanations.

First, I believe there are now many signs pointing toward a short-term bottom forming, including:

-

BTC has largely shrugged off recent lawsuits against Coinbase and Binance, including Binance US halting USD withdrawals. BTC and ETH only dropped around 6%, still trading well above their one-year lows.

-

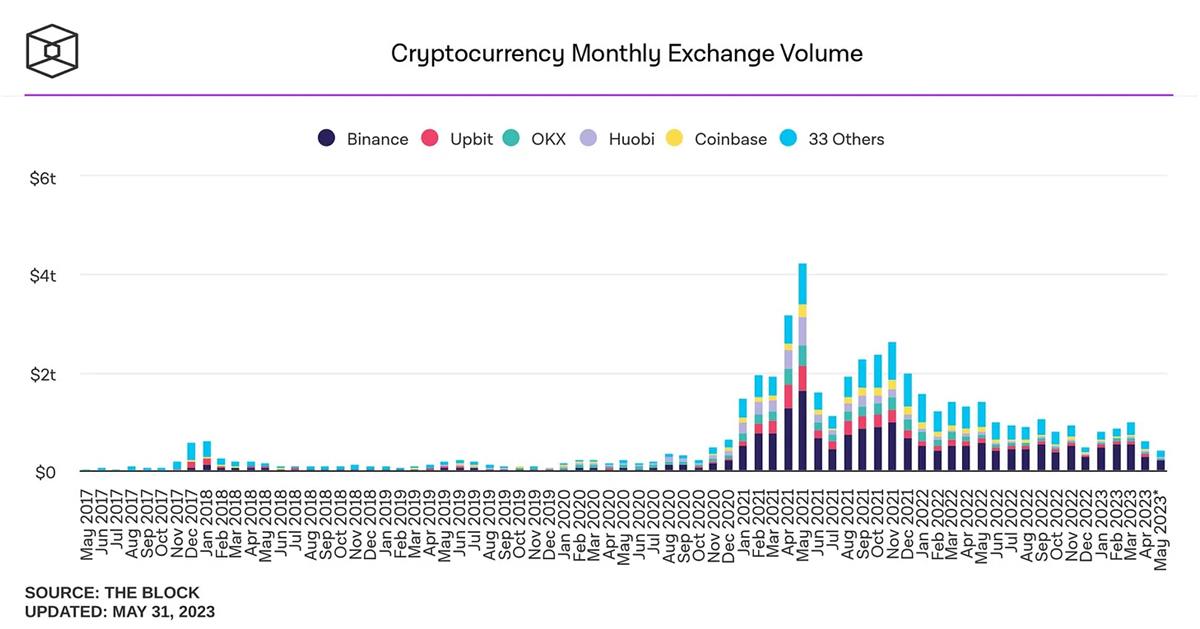

Monthly spot exchange trading volume recently hit a one-year low at just $423 billion.

-

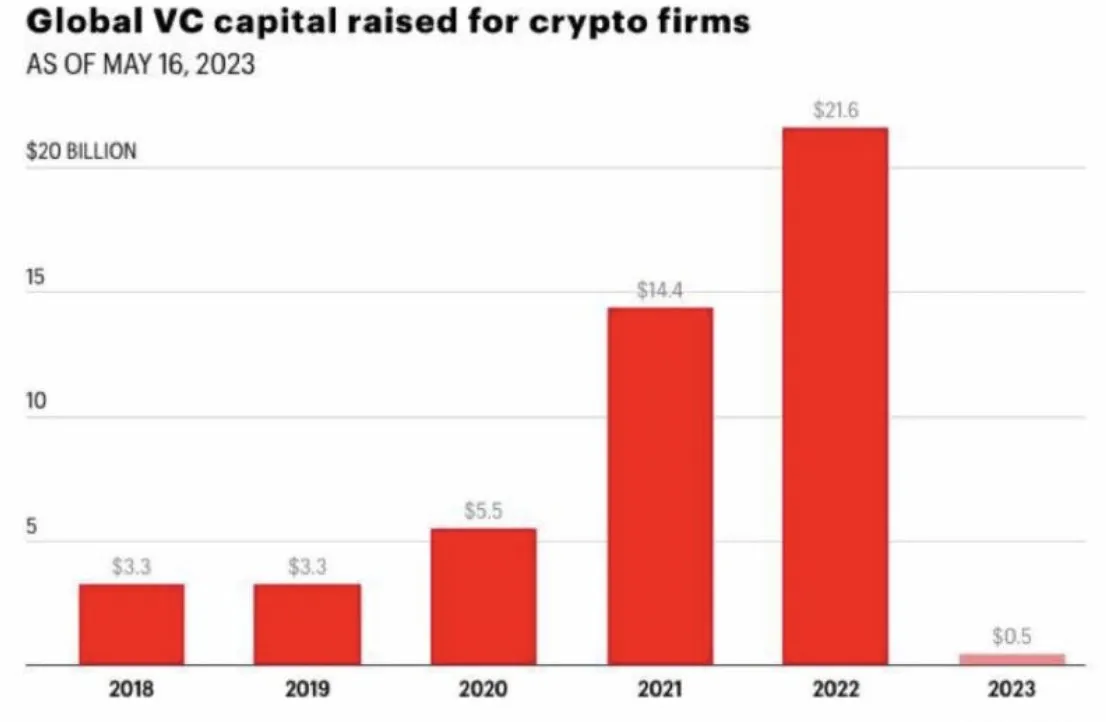

Venture capital interest is also fading.

-

From overall sentiment on crypto Twitter, I sense that some people are questioning whether to remain in this space, while others are simply bored with price action, lack of volatility, and absence of major narratives.

-

Artificial intelligence is diverting people's attention away from crypto.

Meanwhile, smart money continues deploying their stablecoins, with stablecoin holdings dropping to pre-Luna levels:

Overall, since FTX/LUNA, crypto sentiment has never felt more negative. With unfavorable macro liquidity conditions expected to ease by year-end, I personally believe we're likely within about 10% of a short-term BTC bottom.

What narratives are driving the market:

-

Meme coins —— Memes still dominate DEX trading volume (though losing momentum), led by PEPE. Andrew Kang recently claimed PEPE is nearing its bottom; if it rebounds, it could bring renewed momentum to the broader meme sector.

-

LSDfi —— This could be the biggest fundamental narrative of this summer. Current data summary: approximately $18 billion worth of ETH deposits are staked (representing less than 10% of total supply). We’re now seeing projects like LBR and USH emerge—essentially acting as second-layer solutions for liquid staking assets—and these are likely to become the hottest narrative of the summer.

-

Trading tools——As meme coins attract significant attention on DEXs, there’s growing interest in bots that assist with trading these tokens. The largest Telegram bot generates $4 million monthly revenue. Following successes like UNIBOT—which generated over $100K in realized gains for some smart money traders—I view this as a smaller yet notable narrative worth tracking and exploring for innovative new projects.

-

Small-cap tokens on Arbitrum——The final narrative is the quiet success of some of the latest projects launched on Arbitrum, including GHA, WAR, and CHOKE.

What is smart money buying:

The chainEDGE Smart Money Dashboard has observed some significant inflows, specifically:

Major cryptocurrencies + derivatives (ETH, ETH staking derivatives, BTC). Over the past month, we’ve seen net inflows exceeding $75 million into this category, with relatively little stablecoin deployment. This indicates that smart money is primarily rotating already-deployed tokens into major assets while deploying only small amounts of stablecoins. Overall, this is a bullish signal for the broader market.

Top inflows in the meme sector include Psyop, RFD, MRF, and BIAO. In the last 24 hours, main inflows were PEPE and HarryPotterObamaSonic10Inu.

Projects with the largest inflows over the past month include MKR, CAKE, 0X, LBR, and USH.

Summary

Despite weak market sentiment, I lean bullish based on smart money accumulation in the market, signs of an "emotional bottom," and hopes for a turnaround in macro conditions later this year. LSDfi will be a key narrative this summer. If you're seeking opportunities, I suggest watching for launches of related new projects to consider building your portfolio (of course, not guaranteed). The market hasn't panicked excessively over SEC lawsuits either—that's another encouraging sign.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News