L1 blockchain competition weakens, L2 blockchains will become the next competitive focus

TechFlow Selected TechFlow Selected

L1 blockchain competition weakens, L2 blockchains will become the next competitive focus

Let the bullet fly for a while, and see how high-performance vertical L2s progress after six months or a year.

Author: Zixi.eth

In the next cycle, we may no longer see a battle among Layer 1 blockchains; instead, it could be replaced by a competition among Layer 2 solutions.

I am highly optimistic about General L2s and vertical-specific L2s.

Here's my analysis:

All Layer 1 blockchains face the trilemma problem—namely, they cannot simultaneously achieve decentralization, scalability, and security. From 2018–2020 and 2021–2023, every L1 attempted to solve this issue, but in reality, no one managed to fulfill all three aspects at once; trade-offs were inevitable.

When people realized that the direction of L1 development had hit a wall, Israel created the first Layer 2 solution: Starkware. In an L2 setup, project teams operate their own nodes and build their own “chain.” Multiple transactions are batched together into a single transaction, which is then submitted to the L2’s smart contract on the L1 chain. This contract executes the transaction on L1, after which the mainnet confirms the L2 transaction. This enables fast and cheap operations while still inheriting the security and decentralization of the underlying L1.

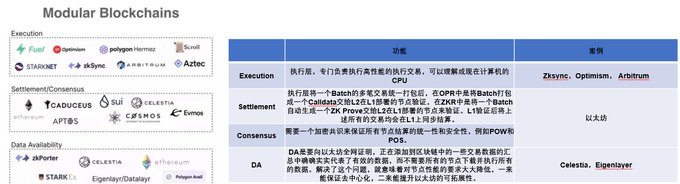

In 2022, Celestia introduced the concept of modular blockchains, proposing that blockchains should be divided into four layers: Execution, Settlement, Consensus, and Data Availability (DA). Among these, Execution and DA are the most critical components, handling the topmost layer (transaction execution) and the foundational layer (archiving transactions), respectively.

Let’s rewind to 2017–2018. At that time, popular investment targets were Ethereum fork chains. The boom needs no explanation—but why did they gain such traction? It was closely tied to the emergence of new asset types like ERC20 tokens and fundraising models such as IEOs and IDOs. Anyone could permissionlessly issue new assets for market subscription, which sparked the bull market. The profitable investments back then were L1 chains (Ethereum forks) and various platforms for trading these new assets.

From 2020 to 2021, investment targets expanded beyond Ethereum competitors to include DeFi and GameFi dApps. Additionally, NFTs emerged as a significant entry point for user traffic. The winners during this period were again L1 chains (Ethereum competitors) and diverse asset trading platforms—including not only centralized and decentralized exchanges (CEXs/DEXs), but also NFT marketplaces and derivative exchanges, which began growing rapidly in scale and influence.

Now consider an interesting observation—credit goes to Boss Tang for this insight. Looking back at the L1s that succeeded in the previous cycle, their valuations during final private funding rounds before listing might have seemed high at the time. Yet, after going through a full bull-bear market cycle, today’s valuations make those earlier prices look incredibly cheap. However, this statement suffers from survivorship bias.

Why were L1s so profitable in the last cycle? Because: 1. People genuinely wanted different approaches to solving Ethereum’s scalability issues; 2. Innovations in consensus mechanisms; 3. A strong desire to create independent ecosystems; 4. Pandemic-driven monetary easing led capital to flow into sectors with the grandest narratives; 5. Ethereum’s ecosystem wasn’t yet dominant enough to deter competition.

From the perspective of General L1s—I define them as large, all-encompassing chains with the most ambitious narratives—each aimed to become an "Ethereum killer" and build its own ecosystem. Even investing in the final round, or even in pre-public sale stages, yielded returns of over 2x when compared to current valuations. If you could exit at peak valuation (and actually manage to sell post-unlock), the multiples were substantial, making this the optimal strategy.

Looking at L1-as-a-Service models, this appears to be an even broader and more comprehensive narrative than traditional L1s. However, problems arise: 1. It demands even greater capability in ecosystem building from the team; 2. Token value capture is weak (e.g., Cosmos’ token is essentially vaporware, and Polkadot’s slot auctions have long been criticized). Still, investors could earn solid returns—over 2x even entering in the final rounds—but the overall ceiling is relatively lower.

Regarding vertical-specific L1s/L2s, they represent a more niche approach. From ceilings and scalability perspectives, they generally underperform the above options. But they didn’t succeed earlier due to: 1. Lack of modular thinking; 2. They were fundamentally still building another L1, requiring reinvention of VMs, liquidity, users, and developer adoption; 3. Performance remained poor, unable to support enterprise-grade finance or mass consumer adoption. Yet when the trend shifts, the potential upside will be extremely evident.

However, in the next cycle, I believe things may change—for example, EthStorage and xxxx (teasing a bit)—one solves data storage issues on Ethereum, while the other pushes execution performance to the extreme, enabling consumer-facing applications and high-performance derivatives/spots exchanges for enterprises. Is the lack of mass adoption so far due to blockchain being inherently unsuitable for it?

Not necessarily. Especially from a financial standpoint, blockchain—or distributed technology—is highly suitable for mass adoption in trading. If we can build a very fast execution layer—a high-performance vertical Layer 2—web2 developers, particularly Chinese development teams, could potentially pioneer entirely new paradigms atop it.

The past two cycles have proven Ethereum’s unshakable dominance. Will another public chain war reoccur in this cycle? I don’t think so. Reasons include: 1. Developer base (~30k); 2. User base (~300k–400k DAU); 3. Capital depth (~$30B TVL); 4. Sufficient iteration and upgrades—we’ve already validated directions like Rollups, modularity, and DA over the past three years. Therefore, the next cycle’s battleground will shift to Layer 2s.

Currently, most L2s remain general-purpose, meaning they’re still neither cheap nor fast enough. There’s ample room for improvement, and their ecosystems haven’t grown significantly yet. Presently, L2 performance doesn’t significantly outpace competing L1s. Take Gravity, for instance, a B2B financial application.

CeDeFi on-chain derivatives are naturally suited for institutional clients, but limited by Starknet’s current performance—even if deployed as an app-specific chain—it still can’t achieve on-chain matching from cost and speed perspectives (currently only off-chain matching with on-chain settlement is feasible), thus failing to achieve full transparency and trustlessness. If Gravity were migrated to xxx, it would become a high-performance, fully transparent B2B on-chain derivatives exchange.

Can we take an alternative path—temporarily sacrificing some degree of decentralization—to build a highly performant L2 that differentiates itself from current General L1s? Such an L2 might not be ideal for DeFi, but would excel for consumer applications (like gaming or e-commerce) and certain enterprise financial products (such as orderbook-based on-chain exchanges). This could lay the groundwork for potential mass adoption.

Currently, these specialized vertical Layer 2s, by charting a unique course, may provide superior infrastructure for mass-adoption-ready dApps. But this may require advancements in hardware storage, parallelized MEV handling, data structures, and more. Let’s wait and see—observe the progress of high-performance vertical L2s over the next six to twelve months, and assess whether they can enable mass adoption in either consumer or financial domains within the next two to three years.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News