Top1 The Exclusive Curse of Token Listings: Binance New Token Investment Return Analysis

TechFlow Selected TechFlow Selected

Top1 The Exclusive Curse of Token Listings: Binance New Token Investment Return Analysis

Excessive investment due to listing effects, delayed launch timing (due to greater caution), and liquidity advantages becoming dumping destinations are all unique to Binance.

Author: Loki

According to Binance listing announcements, during the 13-month period from April 29, 2022, to June 4, 2023, Binance launched spot trading for a total of 20 new tokens. These include six newly issued tokens (OP, APT, ID, ARB, EDU, SUI), which had been listed on no more than three other exchanges within three months prior, and 14 established tokens (each already listed on at least one other exchange for over three months).

Based on this data, we can calculate three return metrics:

1) Return from listing day (closing price) to present

2) Return from listing day (closing price) to seven days after listing (closing price)

3) Return from seven days after listing (closing price) to present

Binance Listing Performance Comparison

The average holding return across the 20 projects since listing is -22.3%, while BTC’s average return over the same period was +7.9%. This indicates significantly weaker performance compared to BTC. Only three tokens—ID, RPL, and LDO—outperformed BTC during this time; the remaining 17 underperformed. The highest outperformance came from RPL (leading BTC by 26%), while the largest underperformance was OSMO (trailing BTC by 96.6%).

Considering that listings on Binance may trigger temporary price spikes, with listing-day prices potentially reflecting local highs, we use T+7 (seven days post-listing) as the baseline. Using this metric, the average return across the 20 projects improves to -11.3%. The number of projects outperforming BTC increases to six, showing notable improvement—but still lags behind BTC’s average return of +9.4%.

This suggests that the so-called “listing effect” has somewhat dragged down the overall holding returns of new Binance-listed tokens. However, even if investors wait until T+7 to buy in, they still face a relatively high probability of loss.

Next, let's assume a short-term speculative strategy: buying at closing price on the listing day and selling seven days later. Unfortunately, this approach yields an average return of -11.8%, worse than BTC’s -1.6%. Out of 20 such trades, only five generate profits, and only six outperform BTC—the majority result in losses and underperformance.

One thing we can confirm is that the 14 established tokens listed by Binance are fundamentally sound and have already been tested by the market. They cover popular sectors such as Layer 2 and Shanghai Upgrade narratives and objectively qualify as "high-quality tokens." Assuming neither project fundamentals nor Binance’s token selection standards are flawed, three primary explanations become more plausible:

(1) Late listing timing

This issue is particularly evident in trending themes such as MEME coins or ETH Merge-related concepts. For example, Binance listed Floki and Pepe in May 2023—by which time both were nearly universally available across all major exchanges. Similarly, LQTY, OSMO, and RPL were listed somewhat late. This lag reflects Binance’s relative slowness in capturing emerging, bottom-up industry trends.

(2) Binance’s liquidity advantage turns it into a dumping ground

According to TokenInsight data, Binance accounted for 58.98% of global spot trading volume in 2022—6.44 times that of OKX, the second-largest exchange. With the largest user base and trading volume, being listed on Binance brings significant investor attention. However, this very liquidity advantage makes it an attractive destination for large holders to offload positions, impacting both price and volume negatively post-listing.

(3) The “listing effect” pre-emptively exhausts upside potential

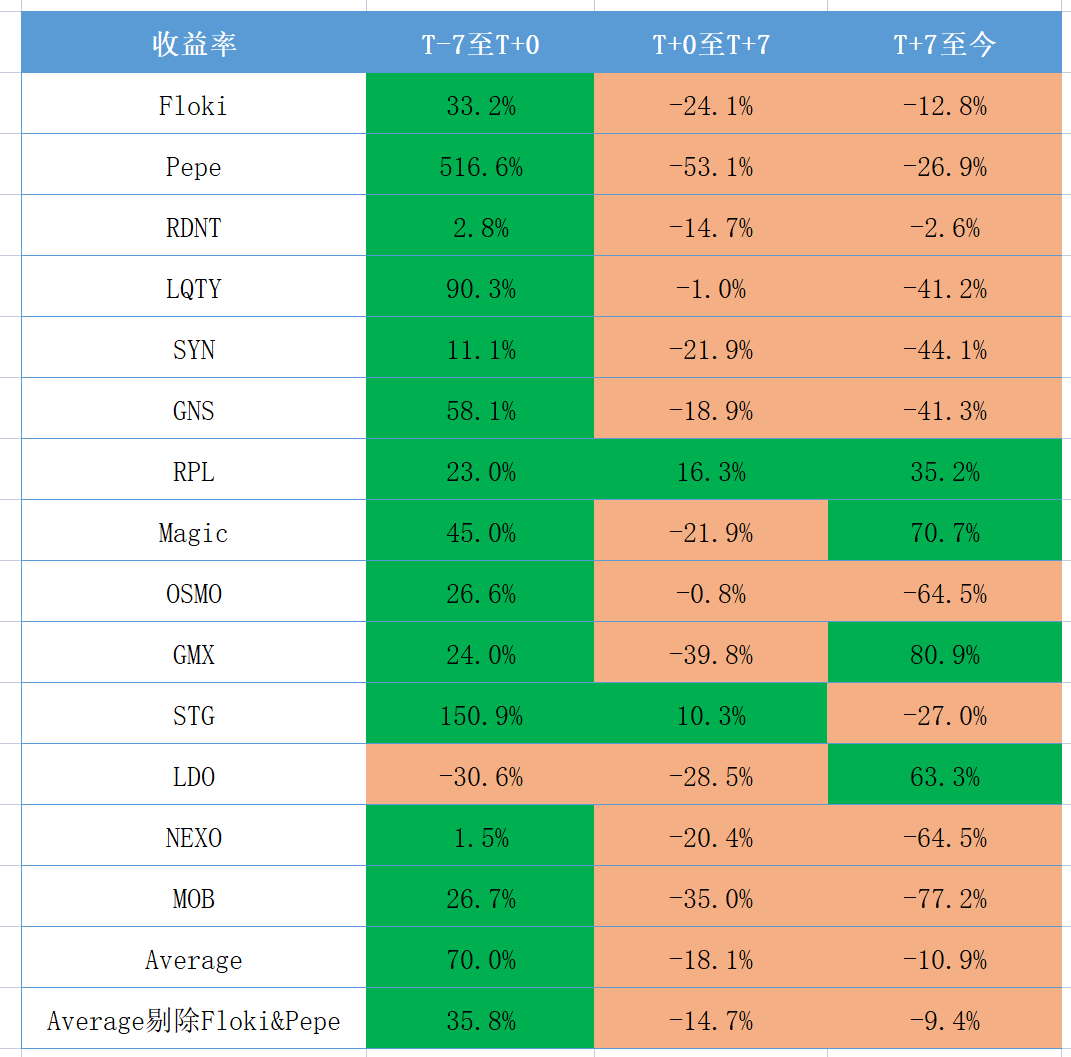

As previously analyzed, the first seven days after listing saw an average decline of -11.3% across the 20 tokens, significantly dragging down investor returns. When excluding the six newly issued tokens, the average return for the remaining 14 established tokens drops further to -18.1%, indicating an even starker underperformance.

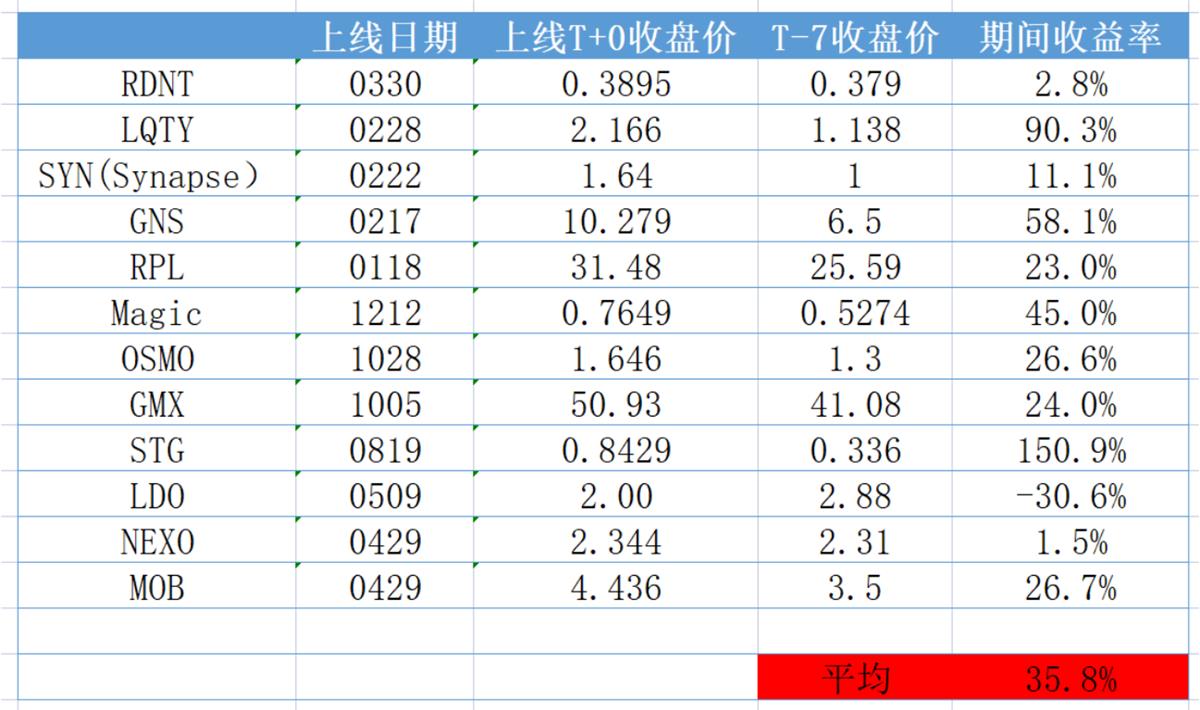

Building on this, let’s look further back—because the “listing effect” impacts not only post-listing performance but also pulls forward much of the anticipated gains to before the listing. We selected the 14 established tokens and calculated their returns from seven days before listing to the listing day (excluding two MEME coins and six newly issued tokens due to their extreme pre-listing rallies, which would distort the data; additionally, MEME coin listings are driven more by market hype than fundamentals):

The results show a pronounced “listing effect” on Binance: apart from LDO, all 13 other tokens experienced clear price increases, averaging +35.8% in the week leading up to listing. (LDO’s flat performance coincided with a BTC drop from 39K to 29K.) Even after subtracting the -22.3% average return since listing, investors could still realize a net gain of 13.5% if they sold just before listing.

Listing Effect: The Curse of Being #1

From the above analysis, we conclude that the main reason for poor post-listing performance of new Binance tokens is the “listing effect,” which prematurely consumes future growth potential. This explains the disconnect between Binance and its users’ experiences:

From Binance’s perspective, it follows a reasonable process to list fundamentally strong tokens. Had investment decisions been made prior to Binance’s listing announcement—or at the moment Binance internally decided to list these tokens—even extended over longer market cycles, investors could achieve above-average returns.

From the user’s perspective, however, buying a newly listed token on Binance often leads to losses. The root cause lies in the “listing effect”: a 35% pre-listing rally erodes the token’s intrinsic upward momentum. This represents irrational or excessive speculation. The problem then becomes simple: if you start 35% behind, how can a newly listed Binance token possibly deliver alpha?

Indeed, issues like speculative overpricing due to the “listing effect,” delayed listing timelines (due to greater caution), and becoming a dumping ground thanks to superior liquidity are unique challenges faced by Binance. Beyond these, controversies around IEOs, layoffs (or “staff optimization”), and investments by Binance Labs also persist. Yet no one cares whether the executive of the 10th-ranked exchange has a close friend benefiting from insider info, nor does anyone pay attention when the 50th-ranked exchange lays off staff. These are curses reserved exclusively for the industry’s #1 player.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News