Prisma Finance: Unlocking the Vast Potential of Liquid Staking Tokens

TechFlow Selected TechFlow Selected

Prisma Finance: Unlocking the Vast Potential of Liquid Staking Tokens

Through Prisma, users can use liquid staking tokens as collateral to mint fully over-collateralized stablecoins (acUSD).

Author: Prisma Finance

Translation: TechFlow

Introduction: Prisma Finance is a new DeFi-native protocol focused on unlocking the full potential of Ethereum liquid staking tokens (LSTs). With Prisma, users can use LSTs as collateral to mint an over-collateralized stablecoin (acUSD). This stablecoin will be incentivized on Curve and Convex Finance, providing users with additional yields from trading fees, CRV, CVX, and PRISMA.

Prisma's codebase is based on Liquity and fully immutable, aiming to build a robust protocol and a truly decentralized stablecoin. Its flexible collateral parameters appeal to users who wish to fully leverage their liquid staking tokens. The Prisma DAO will manage parameters, emissions, and protocol fees. The project has received support from leading founders and institutions in the industry, including Curve Finance, Convex Finance, and FRAX Finance.

Overview

Prisma is a new DeFi protocol focused on unlocking the full potential of Ethereum liquid staking tokens (LSTs).

Prisma allows users to mint a stablecoin (acUSD) that is fully backed by liquid staking tokens. This stablecoin will be incentivized on Curve and Convex Finance, creating an efficient capital flywheel where users earn trading fees, CRV, CVX, and PRISMA on top of their Ethereum staking rewards.

Prisma’s codebase is fully immutable and built on Liquity to create a strong protocol and a truly decentralized stablecoin. Its favorable and flexible collateral parameters make it attractive for users seeking to maximize the utility of their LSTs without exposure to risks associated with other stablecoins. The Prisma DAO will govern parameters, emissions, and protocol fees.

Supporters

Prisma is supported by the founders of Curve Finance, Convex Finance, FRAX Finance, Conic Finance, Tetranode, Llama Airforce, Michael B. from LlamaNodes, Coingecko’s founder, Ivan from Amplice and GearBox, OKX Ventures, DeFiDad, MrBlock, Impossible Finance, 0xMaki, GBV, Agnostic Fund, the founder of Swell Network, Magnus from Dialectic Fund, Carlos from BITKRAFT, Adam Cochran, Eden, Research Director at The Block, Kinnif from Fisher8, Tascha from Stella, Ankr’s founder, Sam from NodeGuardians, MCEG, Eric Chen and Mirza from Injective, and many others.

Current State

The market for Ethereum liquid staking tokens (LSTs) has grown rapidly in recent years, reaching a market cap of $18 billion—about 10% of Ethereum’s total market value. According to DeFiLlama, it has recently become the largest DeFi category by TVL and represents the biggest potential market within DeFi.

Utility

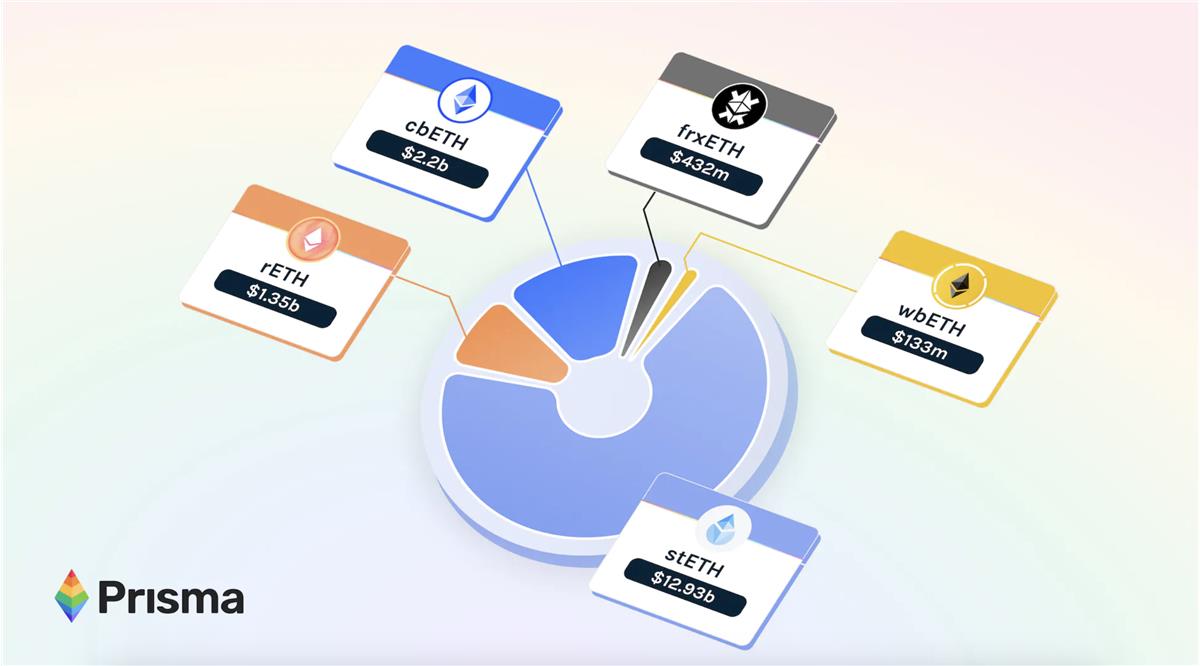

Prisma enables users to mint its native over-collateralized stablecoin (acUSD) using any of the following LSTs, offering unprecedented capital efficiency for holders of liquid staked ETH tokens. Loans backed by LSTs are automatically repaid with help from Ethereum staking rewards.

By adding Curve pools, users can stake their stablecoins and earn additional rewards in the form of CRV and CVX, which the protocol will heavily incentivize through participation in the Curve wars.

Liquity and Prisma

Prisma’s codebase is based on Liquity. We strive to honor their philosophy, believing it embodies the best qualities of DeFi: immutability, robustness, and decentralization. At the same time, we aim to make Prisma unique by introducing flexibility around collateral types and parameters at the governance level. Through veTokenomics, holders of PRISMA will have greater control over the protocol.

PRISMA: Token and Governance

PRISMA uses a veToken model to govern several aspects of the protocol:

-

Stability Pool;

-

Pool parameters for new collateral types;

-

Protocol fees;

-

Emissions (and which collaterals should receive them).

Governance participants can also incentivize acUSD minting or adjust minting and borrowing fees on their chosen collateral, aiming to encourage LST protocols to participate in Prisma’s governance. vePRISMA holders can additionally choose to allocate PRISMA emissions to any LP token.

Assets

Prisma will support the following assets:

-

wstETH (Lido);

-

cbETH (Coinbase);

-

rETH (Rocket Pool);

-

sfrxETH (Frax Ether);

-

WBETH (Binance).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News