Binance IEO from an ROI Perspective: The Best Choice for Stable Returns in a Bear Market?

TechFlow Selected TechFlow Selected

Binance IEO from an ROI Perspective: The Best Choice for Stable Returns in a Bear Market?

During the last bear market, Binance's IEO (Launchpad) was one of the best options for ordinary people to hedge against risks. Can this be repeated in the current bear market?

Author | Bob

Publisher | Baicai Blockchain

As of now, cryptocurrencies led by Bitcoin and Ethereum have become one of the best investment assets in 2023, with gains exceeding 60%. However, viewed over a longer timeframe, the crypto market remains in a bear market, with frequent capital flows and shifting trends that struggle to build sustained momentum. Ecosystems such as Layer 2, BRC20, and Meme tokens have each experienced only short-lived surface-level booms.

How can ordinary investors achieve higher and more stable returns during this bear market? This has become a pressing concern. Recently, Binance CEO CZ shared a comment on Twitter saying "When launchpad," drawing public attention back to IEOs.

Image source: Twitter

During the previous bear market, Binance's IEO platform (Launchpad) was one of the best options for retail investors to hedge against risk. Can history repeat itself in this downturn? We will take an in-depth look at Binance Launchpad.

Has Binance Launchpad’s Project Selection Changed?

Binance Launchpad has long been known for its strict and confidential project selection process. Beyond publicly stated rules, few know the exact criteria used to select projects. Therefore, our analysis here is based solely on available public data—what advantages must a project possess to be selected by Binance?

From a timeline perspective, STEPN ($GMT) is a project that cannot be overlooked in the history of Binance Launchpad.

Binance Launchpad Timeline

GMT is one of the most successful projects in Binance Launchpad’s history, achieving a peak price increase of over 38,100% and reaching nearly 5 million global Web3 users. STEPN changed lifestyles for many users, integrating Web3 into daily life. For the broader Web3 space, STEPN even pioneered the X2E trend—going far beyond P2E—and inspired countless imitators.

After GMT, Binance significantly slowed down its Launchpad pace, pausing IEOs for nine months before restarting. Looking back at these recent IEOs, what do they have in common?

Hooked Protocol ($HOOK) was the first new IEO after GMT—a Web3 infrastructure integrating Learn-to-Earn, aiming to build a gateway into Web3.

Its first product, Wild Cash, is a Quiz-to-Earn app. Before joining Binance Launchpad, Wild Cash already had 4 million downloads globally and ranked #1 in Indonesia and Nigeria on Google Play’s games chart. It was also the third most active application by daily addresses on BNB Chain.

Space ID ($ID) was Binance’s first IEO project of 2023—a decentralized domain name service protocol building a universal naming network. Space ID launched the ".bnb" domain on BNB Chain and, prior to the IEO, had 225,000 users registering 418,000 domains. In the decentralized domain space, it ranks second only to ENS (Ethereum Name Service).

Open Campus ($EDU) is a decentralized Web3 education content platform and Binance’s most recent IEO. Open Campus aims to create a fairer education system using blockchain, allowing educators to turn their content into NFTs and earn revenue through sales. Tiny Tap is the first application built on Open Campus.

Founded in 2012, Tiny Tap is an Israeli UGC educational gaming platform focused on interactive learning content for children. Publicly disclosed figures show Tiny Tap generated $7.6 million in revenue in 2022, with cumulative revenue from 2019–2022 reaching $17.6 million. The platform currently hosts 230,000 interactive lessons and serves 120,000 paying users. Tiny Tap consistently ranks among the top ten highest-grossing children’s apps on the U.S. App Store.

Analyzing post-GMT IEO projects reveals a clear trend: Binance Launchpad now favors projects that already have live products with proven success in their respective fields. In terms of sector focus, Binance still appears to follow the STEPN playbook, showing preference for projects featuring Earn mechanics.

Of course, this pattern may not hold for future IEOs. Notably, before relaunching Launchpad, CZ stated that Binance would focus on education, compliance, and product/service sectors in 2023. Thus, prioritizing areas like education and compliance might be a smarter strategy going forward.

Image source: Twitter

Can Binance Launchpad Help Projects Scale from 1 to 10?

In the crypto space, Binance holds significant influence and access to industry resources. Binance Launchpad is one way Binance leverages this influence and resource advantage, which explains why so many projects seek inclusion. Once a project reaches a certain scale and product maturity, Binance can help it rapidly accumulate momentum and transition from 1 to 10. As analyzed earlier, this explains Binance’s current preference for projects with strong, competitive products.

It’s hard to know exactly what changes occurred within Binance Launchpad during the nine-month gap after GMT’s IEO. But judging from subsequent IEO data, Binance appears to be turning the STEPN model into a replicable template to accelerate project growth and iteration.

According to Similarweb traffic data, after launching on Binance Launchpad, Hooked Protocol’s total app installations reached 10 million—an increase of approximately 6 million—with Google Play downloads surpassing 5 million. The app successfully expanded into markets such as Vietnam, Turkey, and Pakistan.

Google Play, Wild Cash download count

Driven by Binance Launchpad, Wild Cash achieved 150% growth within just a few months. According to its roadmap, Hooked Protocol plans to launch additional Web3 applications, including an AI-powered learning chatbot called Hooked Academy Sensei, a news aggregation app named Wild News, and a wallet using MPC technology called Hooked Wallet.

Dune Analytics, BNB Chain Top 15 Daily Active Apps

After completing its IEO, Space ID saw an 89.95% increase in ".bnb" domain registrations and a 158.2% rise in user numbers. Additionally, it successfully launched ".arb" domain services on the Arbitrum network.

Image source: Space ID

Open Campus differs somewhat. As a Web3 UGC education-focused project, it did not see massive user growth after its Launchpad listing. Instead, it attracted greater investor attention to the sector. Top-tier investors including Sequoia China, Kingsway Capital, Liberty City Ventures, and Polygon invested $8.5 million into Open Campus to support enterprise development and accelerate expansion in the edtech industry. According to official announcements, Open Campus is preparing to launch a $10 million Educator Fund to support teachers and creators.

Image: BlockBeats News

The transformations seen in Hooked Protocol, Space ID, and Open Campus after joining Binance Launchpad demonstrate that Launchpad is more than just a profit vehicle for users. It actively empowers the ecosystem, helping projects scale from 1 to 10 and creating a win-win-win scenario for the platform, project teams, and users.

Is the ROI from Binance Launchpad Stable for Investors?

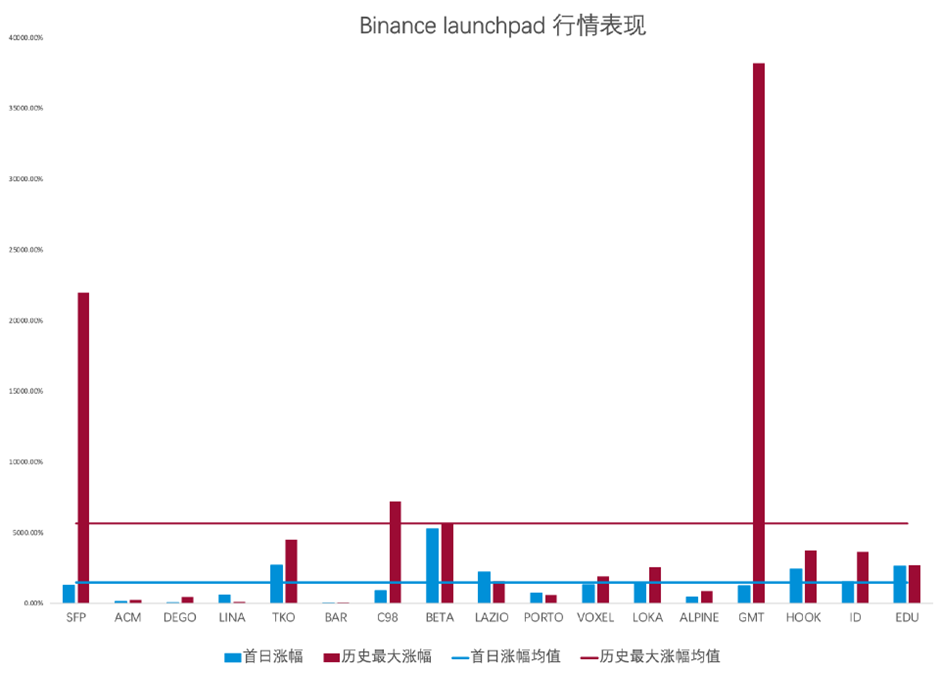

For users, the key concern with participating in IEOs is return on investment (ROI). To assess this, we compiled data on first-day price increases and all-time high returns for Binance Launchpad projects since 2021.

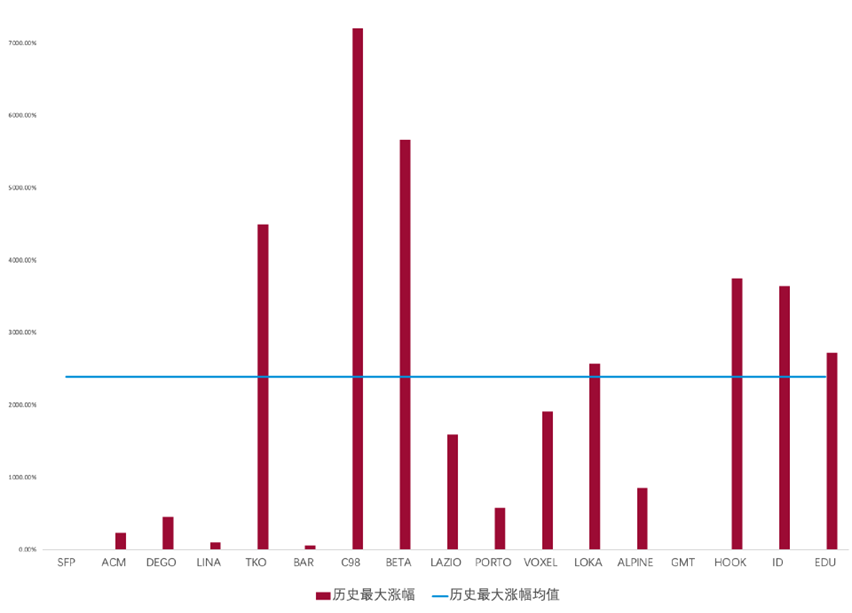

Since 2021, Binance Launchpad has conducted 17 IEOs, with an average first-day gain of about 1,466% and an average all-time peak return of approximately 5,644%. The variance of historical maximum returns across these 17 IEOs is calculated at 9,702.79.

The data shows large variations in peak returns among pre-GMT IEOs. After excluding two extreme outliers—$SFP and $GMT—the average peak return drops to 2,386%, and the variance falls sharply to 481.68.

This reduced variance indicates that peak returns from Binance Launchpad are becoming more stable ($HOOK: 37x, $ID: 36x, $EDU: 28x).

Data suggests that while the probability of outsized returns has decreased, average returns have increased—likely due to the stronger fundamentals and overall quality of recently listed projects compared to earlier ones.

On a macro level, the cryptocurrency market remains in a bearish, volatile phase where capital favors projects with solid fundamentals. For most investors, Binance Launchpad remains one of the few investment avenues capable of delivering consistently high profits during bear markets. Stabilizing returns may also reflect intensified on-chain competition and limited inflow of external capital.

Based on multi-dimensional analysis, we can conclude that the quality of Binance Launchpad projects has improved significantly, leading to more consistent and stable investment returns. This trend stems from both macroeconomic conditions and Binance’s evolving preferences in project selection.

Of course, considering the ongoing bear market, comparing current projects directly to the extraordinary success of GMT may be unfair. Nevertheless, based on available data, Binance Launchpad remains one of the highest-return investment opportunities in the entire crypto market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News