The Renaissance of BTC Assets: Why We Should Pay More Attention to the RGB Protocol?

TechFlow Selected TechFlow Selected

The Renaissance of BTC Assets: Why We Should Pay More Attention to the RGB Protocol?

Leading the revival narrative of BTC, BRC-20 might be the first, but likely won't be the last.

出品:TechFlow Research

撰文:0xmin & David

Ordinals and BRC-20 have successfully sparked a trend of "issuing assets on Bitcoin," but clearly, they may not be the last.

If issuing assets on Bitcoin becomes a new narrative, is there a more feasible and user-friendly approach that minimizes the burden on Bitcoin's mainnet?

Thus, a long-dormant protocol has recently re-emerged into discussion—"RGB," a protocol capable of creating and managing digital assets on the Bitcoin network, often mentioned alongside Layer 2 concepts like the Lightning Network.

What exactly is the RGB protocol? Can it truly bring about a renaissance for BTC-based asset issuance?

The Early Days of RGB: Focusing on BTC Asset Issuance

The idea of issuing assets on the Bitcoin network is not new.

The origins of the RGB protocol trace back to 2018, when members of the Bitcoin community such as Giacomo Zucco, Peter Todd, and Alekos Filini began exploring new methods for creating and managing assets on Bitcoin. Their goal was to design a protocol that could leverage Bitcoin’s security and decentralization while supporting more complex functionalities such as asset issuance and smart contracts.

To achieve this, they explored ways to integrate asset and state information with Bitcoin’s UTXO model, eventually proposing a new protocol called RGB. Its core idea is to combine asset issuance, ownership, and state updates via client-side validation with Bitcoin’s UTXO model, rather than relying on full Bitcoin nodes like BRC-20 does today.

As for why it’s called "RGB," you might immediately think of the primary colors red, green, and blue. In fact, the initial research direction of the RGB protocol was “colored coins,” hence the color-related naming. Although the current RGB protocol has little relation to colored coins, the name stuck.

As seen in its GitHub repository, RGB aims to provide scalable private smart contracts for Bitcoin and the Lightning Network, enabling asset issuance within the Bitcoin ecosystem.

However, due to Ethereum’s rise and Bitcoin being increasingly viewed as a store of value and market indicator, efforts to issue assets and create contracts on Bitcoin remained lukewarm.

It wasn’t until the recent surge in popularity of BRC-20 that the topic of Bitcoin-based asset issuance resurfaced. Compared to BRC-20’s on-chain inscription system, RGB adopts an off-chain processing logic similar to that of the Lightning Network.

Using UTXOs to Bind Asset States

The implementation of RGB isn't hard to understand—the key lies in Bitcoin’s own accounting method—UTXO.

Due to space constraints, we won’t go into a full explanation of UTXO, but only briefly define it: instead of recording the final state of Bitcoin transactions, it records transaction events and processes.

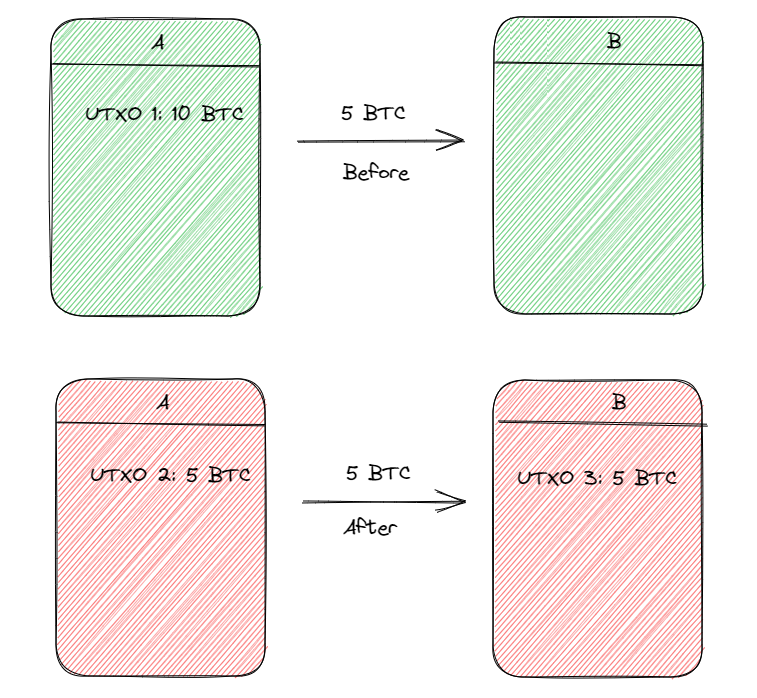

A simple example: A has 10 BTC and sends 5 BTC to B, leaving A with 5 BTC. This can be described using UTXO as follows:

-

UTXO 1: A owns 10 BTC

-

UTXO 2: A has 5 BTC remaining

-

UTXO 3: B receives 5 BTC

As shown, UTXO records changes in transaction states on the Bitcoin chain. After the transaction, A has 5 BTC left—a different state from previously owning 10 BTC. Correspondingly, UTXO1 is effectively split into two new states: 5 BTC returned as change (UTXO2) and 5 BTC transferred to another party (UTXO3).

With this principle understood, RGB essentially binds off-chain asset issuance to on-chain UTXO changes:

Since UTXOs can confirm transaction events at specific points in time on Bitcoin, we can use these transactional changes to represent changes in other states.

For example, if I issue an asset elsewhere, I can link it to UTXO1 on the Bitcoin network. If I transfer that asset to someone else, this "transfer" action can be mapped to UTXO2 on the Bitcoin network…

Because UTXOs are fixed and consensus-verified, as long as I can prove this binding is reliable, then state changes of other assets corresponding to UTXO changes on Bitcoin should also be recognized by consensus.

More fundamentally, the RGB protocol leverages the security of Bitcoin’s mainnet UTXOs to backstop the security of off-chain asset issuance or contract logic.

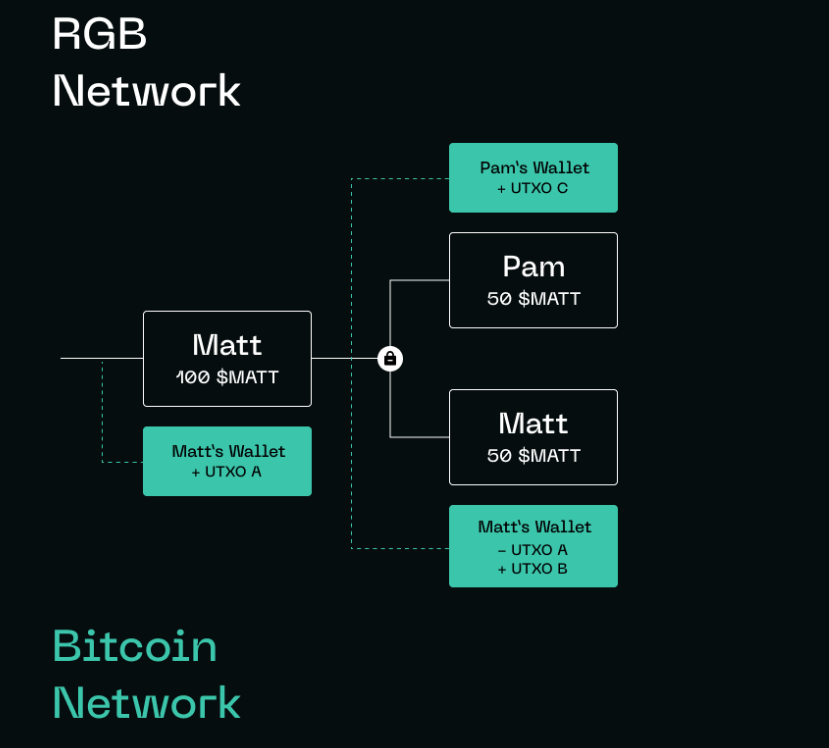

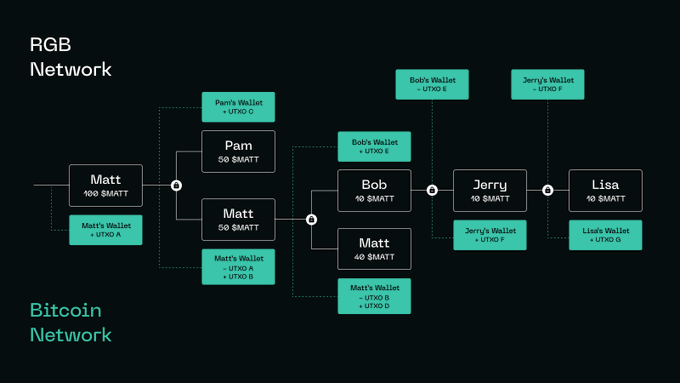

If this still feels abstract, consider an example provided by Twitter user @trustmachinesco:

-

Matt issues 100 $MATT tokens to himself on the RGB network;

-

On the Bitcoin network, Matt’s act of “issuing tokens” corresponds to his currently held Bitcoin UTXO A;

-

Matt transfers 50 $MATT tokens to Pam;

-

On the Bitcoin network, Matt’s “token transfer” corresponds to a new UTXO B, while UTXO A from step 2 is destroyed;

-

On the Bitcoin network, Pam’s “receiving tokens” corresponds to a new UTXO C, representing her current Bitcoin holdings;

-

Likewise, when Pam transfers tokens, her original UTXO C is destroyed, generating a new UTXO D…

If the $MATT token continues changing hands, each transfer will correspond to identifiable UTXOs on Bitcoin’s mainnet, where each transaction destroys the previous UTXO and generates a new one.

Through this process, we can see how asset creation, transfer, and verification in the RGB protocol are linked to Bitcoin’s UTXOs. This linkage enables RGB assets to be securely, decentralizedly, and privately transferred over the Bitcoin network.

One-Time Seals and Commitments

The above outlines a simplified technical overview of RGB. In practice, ensuring that off-chain assets issued via RGB correctly map to on-chain UTXOs requires additional supporting technologies.

-

Client-side validation: In the RGB protocol, transaction validation and data storage occur on the client side (e.g., wallet software), not on the blockchain. This keeps transaction data off-chain, enhancing privacy. Client-side validation also reduces on-chain data storage demands, improving scalability.

This is a major difference between RGB and BRC-20. Since transaction data resides off-chain, RGB can theoretically significantly reduce current network congestion and high fees.

-

Single-Use Seals: A technique ensuring asset ownership cannot be tampered with. A single-use seal is a cryptographic signature that locks the state of an asset. When an asset is transferred, the old seal is invalidated and a new one created. Any attempt to alter ownership would be detectable because the seal state wouldn’t match.

This corresponds directly to the destruction and creation of UTXOs described earlier. The old seal represents the old UTXO; the new seal points to the new UTXO.

-

Commitments: To tie assets to the Bitcoin network, RGB uses commitments—a cryptographic proof linking an asset to a specific Bitcoin transaction. These commitments are embedded into Bitcoin transaction outputs (UTXOs), allowing assets to be transferred over Bitcoin’s network.

-

Anchoring: To connect client-side validation with the Bitcoin network, RGB employs anchoring—the process of combining single-use seals and commitments. When an asset is transferred, the new seal, commitment, and transaction data are anchored onto the Bitcoin network, ensuring system-wide security and consistency.

Here is a more realistic workflow of the RGB protocol:

-

An asset issuer creates a new asset on the client side and generates a single-use seal and commitment.

-

The issuer anchors the new asset to the Bitcoin network by embedding the commitment into a Bitcoin transaction output (UTXO).

-

The recipient verifies the asset’s validity by checking the commitment and validating the single-use seal.

-

During transfer, the old seal is destroyed, and the new seal, commitment, and transaction data are anchored to the Bitcoin network.

Through this mechanism, RGB enables asset issuance, transfer, and verification on the Bitcoin network while preserving privacy, scalability, and decentralization.

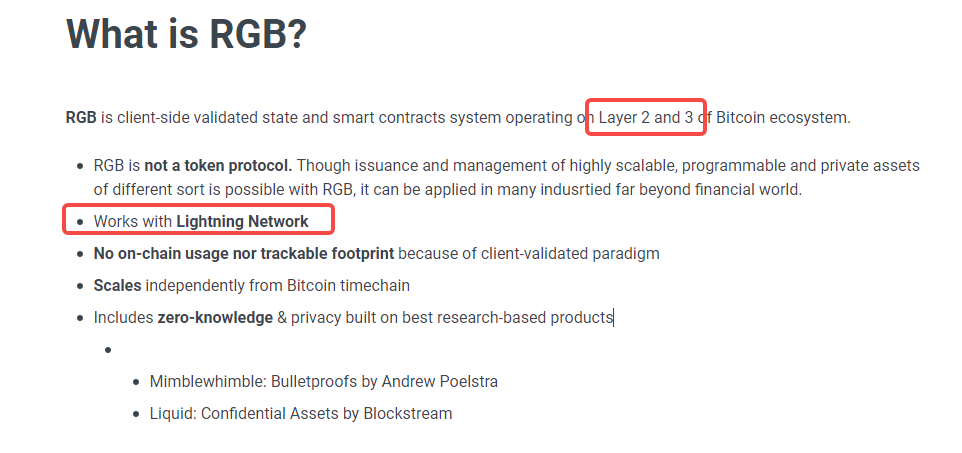

Moreover, RGB integrates well with the Lightning Network. According to its official documentation, RGB describes itself as an L2 or L3 solution. When the Lightning Network exists, RGB can operate as an L3 layer, enabling fast off-chain exchanges of both Bitcoin and RGB tokens, thus achieving more efficient transactions and asset management.

In our view, both RGB and the Lightning Network are Layer 2 protocols on Bitcoin, focusing respectively on digital asset issuance/management and fast value transfer. They can support and complement each other, contributing to a more efficient and scalable Bitcoin ecosystem.

The Future

RGB’s resurgence from obscurity owes much to the wave of asset issuance driven by BRC-20.

Without making value judgments or debating significance, what we can observe is that after the first speculative wave, more opportunities quietly emerge, pushing the ecosystem forward amid the noise.

We now see that in its recently released v0.1 version, RGB has unlocked the final remaining features required for smart contract functionality. Against the backdrop of BRC-20 burdening the network, RGB’s foundational groundwork may foster other BTC-based protocols and applications.

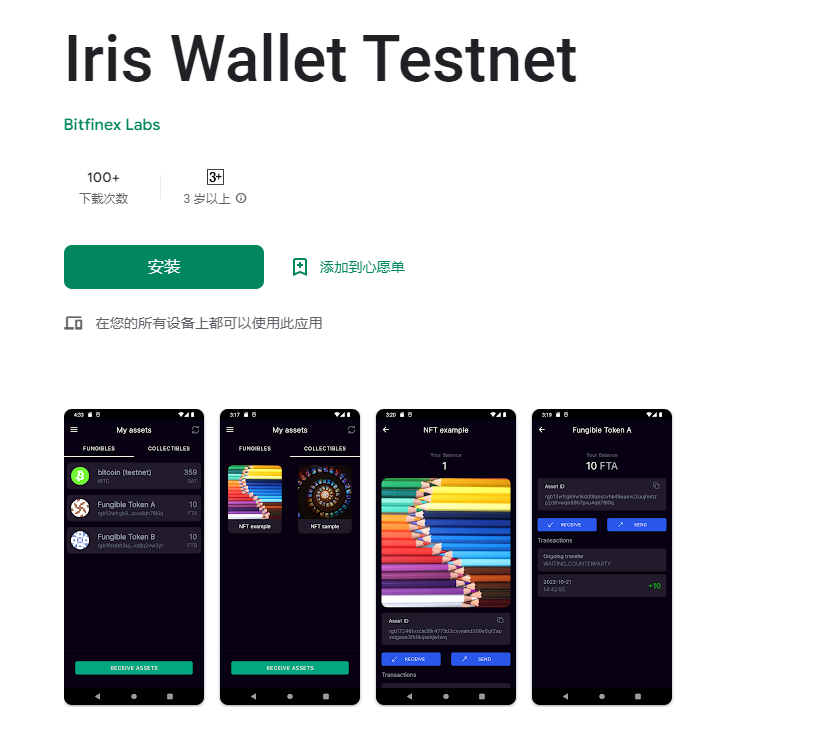

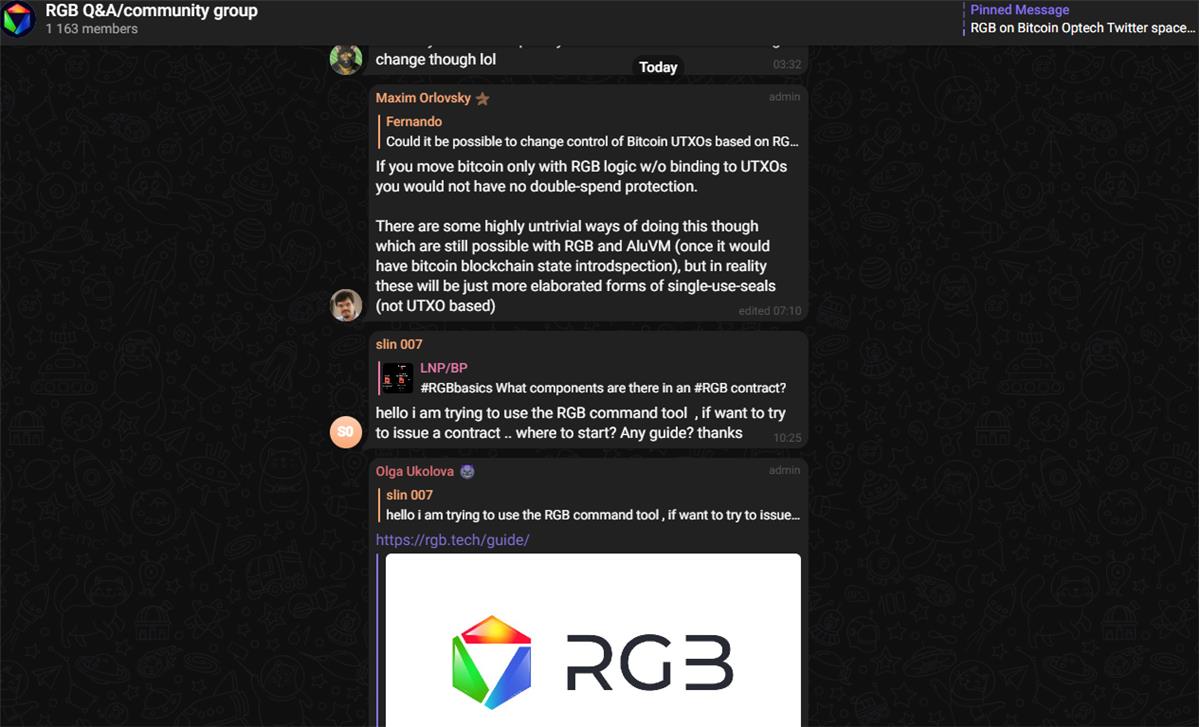

Additionally, RGB has launched wallets capable of sending and receiving BTC-network-based assets, including support for NFT functionalities. During our research, we found RGB’s Telegram discussion groups remain active, with developers actively engaging in technical discussions and problem-solving.

Leading the narrative of BTC’s revival, BRC-20 may be the first, but likely won’t be the last.

Leading the narrative of BTC’s revival, BRC-20 may be the first, but likely won’t be the last.

Speculation benefits some and introduces new technical challenges; solving these challenges often spawns new narratives, reviving early protocols like RGB, potentially igniting the next wave of hype.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News