The Future of ERC-4626: Bringing Exponential Liquidity and Capital Efficiency to DeFi

TechFlow Selected TechFlow Selected

The Future of ERC-4626: Bringing Exponential Liquidity and Capital Efficiency to DeFi

Undoubtedly, DeFi has made significant progress since Compound kicked off the DeFi Summer in 2020.

Author: ValHolla

Translation: TechFlow

Undoubtedly, DeFi has come a long way since Compound kicked off the DeFi Summer in 2020. But what's next? What practical services can DeFi offer users that TradFi cannot? Or does DeFi already have any products today capable of genuinely starting to capture market share from TradFi? I believe it does—and I believe that product is "Vaults".

In 2022, Vaults took the DeFi world by storm, so if you've been around in this ecosystem, you're likely already familiar with them. However, you might not yet be familiar with the ERC-4626 standard, which I believe will exponentially accelerate DeFi adoption and efficiency. Later, we’ll explore several protocols beginning to leverage these tokens for innovation. But first, let’s cover the basics of Vaults and the 4626 standard.

What Are Vaults?

Simply put, Vaults are smart contracts into which users deposit tokens, and then predefined strategies are executed to invest those deposits. Vaults represent a true zero-to-one innovation in decentralized finance, and if you ask me why they are the clearest example of DeFi’s added value, it’s because across all use cases, they are accessible, versatile, and transparent.

Accessible—Vaults are extremely easy to use.

Versatile—They are used for a wide variety of purposes. Currently, Vaults can collect options premiums, hedge leveraged futures positions, optimize lending yields, and much more.

Transparent—Anyone can view holdings and performance at any time, which truly sets them apart from TradFi. There is no real equivalent to Vaults in traditional finance; TradFi currently lacks anything that runs fully transparent asset management strategies with the same level of customization and ease of use.

Due to the backroom dealings seen at companies like Celsius, 3AC, and FTX, institutions remain extremely cautious about allocating capital to crypto. The benefit of DeFi is transparency, and Vaults build on that by adding accessibility and versatility. I wouldn’t be surprised if Vaults end up being the key bridge that finally brings TradFi participants into the space after the CeFi dust settles—and this is where the ERC-4626 standard may play a crucial role.

What Is ERC-4626?

Born as EIP-4626 at the end of 2021, ERC-4626 has recently gained massive momentum as more DeFi developers and users recognize the significant advantages it offers.

ERC-4626 takes the Vault creation process and standardizes it. This is critically important for user experience and leads directly to increased liquidity. If you’re a crypto veteran, you might remember the days before the ERC-20 standard on Ethereum, when tokens weren't interoperable. That made DeFi nearly impossible to exist, and the only way to buy or sell different cryptocurrencies was through centralized exchanges. The reason DeFi couldn’t exist was simple: to have enough liquidity to operate a financial system, some form of standardization (fungibility of assets) is required.

ERC-4626 Brings Fungibility to Vault Tokens

Simply put, this means that once you deposit tokens into a Vault, you receive a tokenized version representing your share of the entire Vault strategy—similar to an LP token for the Vault’s strategy.

For example, if you deposit USDC into xyzVault to earn yield, you receive xyzUSDC in return. Ideally, you could then sell xyzUSDC on a DEX or deposit it into another Vault.

When you want to exit, you must send your xyzUSDC back to xyzVault to redeem your original USDC plus earned interest, minus any fees.

ERC-4626 Brings Liquidity to Vault Tokens

Fungibility enables liquidity—that’s why standardization is so critical.

Right now, numerous DeFi protocols compete for relatively small pools of liquidity. On the positive side, we’re still early, and an open environment fosters competition, which drives innovation. However, the downside is that limited liquidity gets fragmented across many different applications that lack interoperability. This concept applies equally to Vaults.

Vaults are great because they allow people to invest in complex strategies without having to execute all the trades themselves. But if a Vault isn’t ERC-4626 compatible, using it locks up your capital and prevents it from being used elsewhere—defeating the core purpose of DeFi, where liquidity should flow freely.

ERC-4626 solves this problem. Returning to the xyzVault example, as long as you don’t redeem your xyzUSDC, the original USDC you deposited remains in xyzVault’s liquidity pool. If you deposit your xyzUSDC into a DEX, you also contribute liquidity to that DEX. Alternatively, you could lend your xyzUSDC to a money market protocol, thereby boosting their liquidity as well.

Let’s look at three projects leveraging the ERC-4626 standard.

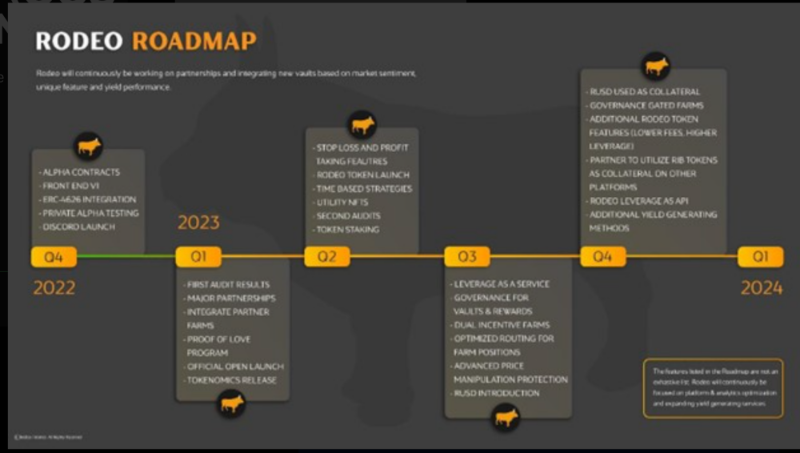

1: Rodeo Finance

Rodeo is positioning itself as the premier destination for yield farming on Arbitrum, and they’re doing so by harnessing the power of ERC-4626.

Rodeo’s Vaults allow you to invest in various LP yield strategies and go even further by enabling margin lending to boost your returns.

For instance, suppose you want to earn yield by providing $100 worth of USDC/WETH liquidity on Uniswap. Normally, you could only allocate up to $100 to that strategy, but Rodeo allows you to borrow up to 10x leverage on your deposit. Of course, the more leverage you use, the higher the risk—but it presents a compelling option for those seeking higher APY than “standard” LPing and who are comfortable taking on additional risk.

Two things set Rodeo apart: First, to invest in their strategies, you only need to deposit USDC. Rodeo takes all the USDC, purchases whatever LP tokens the strategy requires, and invests on your behalf. This saves you both time and gas fees that would otherwise be spent manually buying tokens and depositing them into liquidity pools. All you need is USDC.

Second, all of their Vaults use the ERC-4626 standard, making it easy to integrate new Vaults. For example, due to the risks associated with leverage, future Vaults on Rodeo might allow users to hedge their positions to avoid liquidation.

2023 should be an exciting year for Rodeo. As you can see, their roadmap includes numerous planned releases and improvements.

2: FactorDAO

Factor is a relatively new project aiming to become the liquidity hub on Arbitrum. Naturally, their approach centers on simplifying Vault creation, built around the ERC-4626 standard.

Factor offers a one-stop shop for creating various structured products, including yield strategies, derivatives, and LP positions. Essentially, if you want to create or invest in a custom asset management strategy, Factor is where you should consider.

As I mentioned earlier, nothing like this exists in TradFi: the ability for anyone to easily create a customized asset management strategy is a major advantage of DeFi. Additionally, through DeFi, you gain the transparency of public blockchains, allowing anyone to view every transaction and strategy within each Vault.

Once again, ERC-4626 plays a pivotal role here, as its composability enables strategies to be built atop other strategies. For example, you could create your own fund entirely composed of other ERC-4626 tokens, earning yield from diverse strategies—paving the way for more innovative products and systems on Arbitrum.

Factor is rapidly expanding its partner list across the Arbitrum ecosystem—including Plutus DAO, Buffer Finance, and Camelot—and for good reason: their offering creates win-win scenarios for all participants.

3: Fuji Finance

Fuji Finance is a cross-chain money market aggregator currently integrated with Ethereum, Polygon, Fantom, Arbitrum, and Optimism. With their upcoming V2 release, they plan to take ERC-4626 to the next level.

Leveraging Connext’s cross-chain infrastructure, Fuji will enable cross-chain pools based on—yes, you guessed it—the ERC-4626 standard. Thanks to ERC-4626, users will be able to lend and borrow multiple assets across different chains within a single transaction.

This further improves efficiency across the broader DeFi landscape. With Fuji’s new product, liquidity can capitalize on higher lending rates, lower borrowing costs, yield farming opportunities, and more across different chains. It also helps distribute liquidity across chains—for example, if a newer chain integrates with Fuji, they could incentivize Fuji users to lend and borrow on their chain while simultaneously accessing deeper liquidity on mature chains like Ethereum. In essence, there’s strong potential here to bring liquidity onto emerging chains.

Later this year, Fuji will expand beyond being just a money market aggregator to also becoming a strategy aggregator. Here again, standardization shines: lending Vaults and strategy Vaults will share the same underlying infrastructure—they’re all ERC-4626. This also means strategy Vaults can easily integrate lending Vault assets from Fuji, enabling the creation of more capital-efficient strategies across multiple chains.

Conclusion

Now, hopefully, you have a better understanding of how ERC-4626 creates exponential gains in usability and capital efficiency within DeFi. This will bring massive liquidity into DeFi. TradFi has no equivalent to Vaults, whose interoperability, customizability, and transparency are so clearly superior. The three protocols I’ve mentioned here are just a few of the many projects driving progress in this space. Given the adoption trends over recent months, I believe DeFi as a whole is on the verge of a major breakthrough.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News