FactorDAO: Camelot's new project, a no-code asset management platform with modular investment strategies

TechFlow Selected TechFlow Selected

FactorDAO: Camelot's new project, a no-code asset management platform with modular investment strategies

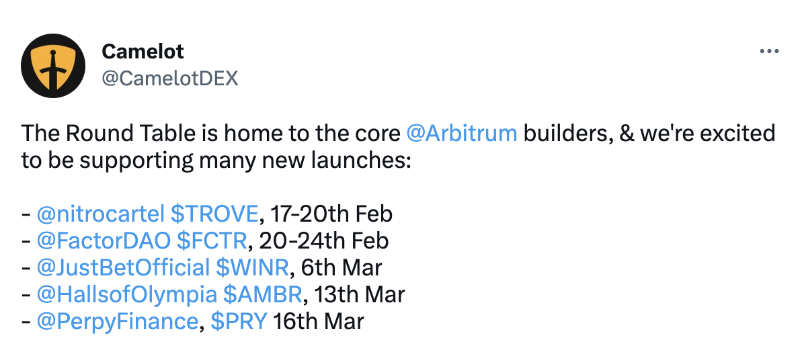

Camelot is set to launch its third initial offering project, FactorDAO ($FCTR), on February 20, following $NEU and $TROVE.

Written by: Morty

According to official information, Camelot will launch its third new project—FactorDAO ($FCTR)—on February 20, following $NEU and $TROVE.

Understanding FactorDAO

First, what does FactorDAO do?

In simple terms, FactorDAO is a no-code asset management platform that allows Builders and fund managers to create innovative products, investment strategies, and vaults, attract LPs from investors, and earn revenue.

These products/strategies/vaults include:

1. Indices composed of a basket of crypto assets (thematic indices);

2. Yield-capturing strategies aggregating returns from different DeFi protocols;

3. Hedging strategies for managing risk exposure on investor assets;

Ultimately, FactorDAO is essentially a middleware built on Arbitrum connecting investors (LPs) and fund managers. Fund managers can offer professional investment strategies to users, who earn returns through these strategies while the managers take a cut (with fee structures determined by each manager). Investors can choose among strategies based on performance and style metrics provided via FactorDAO’s dashboard, selecting the asset management strategy best suited to their investment preferences.

The key advantage of such protocols lies in their decentralized architecture. Being deployed on blockchain ensures transparency, flexibility, and composability. The CeFi collapses of 2022 left a deep impression, and decentralized asset management protocols have the potential to address these issues.

However, precisely because it operates on-chain, there are inherent smart contract risks (though CeFi also faces risks like hacking or founder exit scams)—which is why "DYOR" remains essential with every investment.

Now that we've covered the general picture of FactorDAO, let's dive into some specific features worth noting:

Thematic Indices Composed of Basketed Token Assets

Similar to the ALP product set to be launched by Arbitrove—the second Camelot launchpad project—fund managers can build indices using FactorDAO. Thematic indices are fully collateralized by various assets (FTs, NFTs, RWA) on Arbitrum and support both active and passive strategies (e.g., staking GMX tokens in GMX), as well as shorting operations within FactorDAO Yield Pools. After purchasing index shares, investors receive index tokens minted by FactorDAO.

Yield Pools

Creators of Yield Pools can deploy permissionless, non-custodial lending pools. Any yield-generating token can be deposited, and each token pool undergoes risk isolation.

Investors can deposit and borrow assets across various Yield Pools on the platform. To borrow, investors must post collateral according to each pool’s predetermined collateral factor, which determines the ratio between eligible collateral assets and borrowed assets.

Flexibility

The flexibility stems from FactorDAO vaults using the ERC4626 token standard, modified for greater scalability to enable more complex strategy execution.

Additionally, thanks to this innovative token standard, FactorDAO simplifies the initiation, settlement, and trading of decentralized derivatives.

Through FactorDAO, fund managers can easily construct hedging positions, delta-neutral strategies, CDS (credit default swaps), and other advanced strategies.

Another aspect of flexibility is that FactorDAO offers two types of vaults for fund managers: permissionless vaults and permissioned vaults. Participation in permissioned vaults requires whitelisting or KYC/AML verification.

Composability

Leveraging DeFi composability, FactorDAO has opportunities to integrate with other DeFi protocols, providing fund managers access to broader asset classes and financial services.

Other DeFi protocols can also build new products atop FactorDAO vaults—creating vaults backed by protocol-related assets to drive their own ecosystems. In turn, FactorDAO could earn additional fee revenue.

This creates a dynamic similar to Curve Wars: DeFi protocols can buy $FCTR and lock it as ve, gaining governance rights to direct emissions and rewards directly into vaults tied to their protocols.

DAO Structure

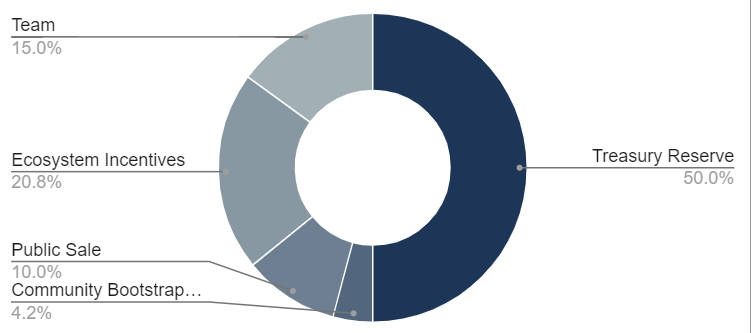

To gain governance rights, $FCTR must be converted into $veFCTR; the longer the lock-up period, the more $veFCTR one receives. The 20.8% of $FCTR allocated to the ecosystem fund will be used for events, hackathons, and growth incentives, with $veFCTR holders voting on how these funds are managed.

FactorDAO consists of a main DAO and multiple sub-DAOs responsible for distinct functions, including:

Treasury management sub-DAO

Product development sub-DAO

Marketing and user education sub-DAO

Protocol data analytics sub-DAO

Coordination sub-DAO overseeing inter-sub-DAO collaboration

Voting weight calculations differ between the main DAO and sub-DAOs. The main DAO uses one-token-one-vote (OTOV), whereas sub-DAOs use Quadratic Voting (QV)—a collective decision-making mechanism where voters not only allocate votes but express the intensity of their preferences. This aims to resolve common majority-rule problems like voting paradoxes, vote dumping, and tactical voting. Sub-DAOs adopt QV to reduce whale influence over governance outcomes.

Modularity and No-Code

The final notable feature is FactorDAO’s no-code interface and modular strategy framework. The no-code design is friendly to fund managers and DeFi teams, while community-driven strategy modules streamline strategy creation—benefiting both users and managers.

$FCTR Tokenomics

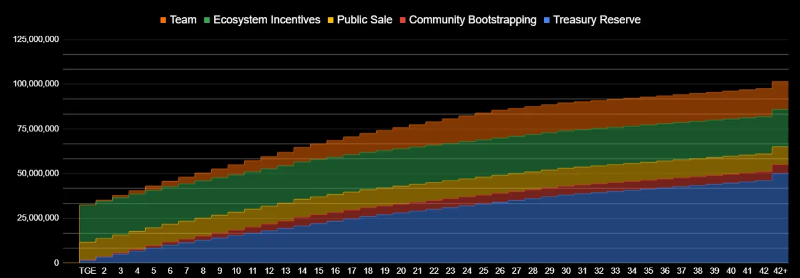

As shown in the image, here is the clear $FCTR token distribution:

15% to team

20.8% to ecosystem fund

4.2% to early investors (0.05u)

50% to treasury reserve

10% for public sale (0.1u)

Below is the $FCTR emission schedule: $FCTR will reach full circulating supply after 3.5 years. Team and early investor tokens (0.05u) will begin linear unlocking one month after the public sale.

$FCTR Utility

FactorDAO adopts the ve token model. By locking $FCTR into $veFCTR, users gain the following rights:

Revenue sharing: Entitled to 50% of FactorDAO protocol fees (the remaining 50% goes to the DAO).

Governance: Gain governance rights (proposal and voting power) to decide vault token emissions and FactorDAO’s fee structure.

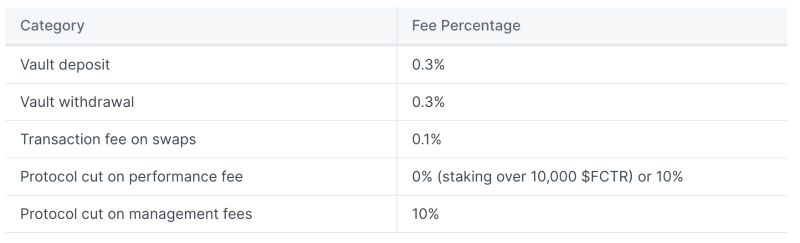

How Does FactorDAO Generate Fees?

FactorDAO’s primary protocol income comes from transaction fees. Additionally, the DAO takes a 10% cut from fund managers’ fees (management and performance fees).

However, this fee is waived if the fund manager stakes more than 10,000 $FCTR (the official documentation isn’t entirely clear here, but I interpret this as locking $FCTR into $veFCTR).

Camelot Launch Rules ("Mango Auction" / Value Discovery Model)

Start: February 20, 2023, 18:00 UTC

End: February 24, 2023, 18:00 UTC

Blockchain: Arbitrum

Currency: $USDC

Initial $FCTR price: $0.10 per $FCTR

Allocation: 10,000,000 $FCTR (10% of total supply)

Total max supply: 100,000,000 $FCTR

Minimum/maximum allocation: None

Hard cap: None

Vesting: None, 100% unlocked

Final Thoughts

In the DeFi world, asset management platforms are nothing new. However, traditional pain points include “a scarcity of truly skilled fund managers” and “limited investment strategy diversity.” FactorDAO significantly addresses both issues. It modifies the standard ERC4626 vault token to enhance strategic scalability. Community-driven strategy modules and a no-code interface lower the barrier to entry for fund managers. Notably, fund managers set their own management and performance fee rates—higher potential returns incentivize skilled managers to build strategies within FactorDAO’s ecosystem.

References:

https://docs.factor.fi/introducing-factor/key-differentiators

https://foresightnews.pro/article/detail/25481

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News