How Can Camelot, the Real Yield Protocol, Win the Arbitrum DEX War?

TechFlow Selected TechFlow Selected

How Can Camelot, the Real Yield Protocol, Win the Arbitrum DEX War?

The Genesis Pool and $GRAIL public sale are live on Camelot DEX on Arbitrum.

Written by: Small Cap Scientist

Translated by: TechFlow

The Genesis Pools and public sale of $GRAIL are live on Camelot DEX on Arbitrum.

Strong partnerships, game-changing $GRAIL tokenomics, and an NFT-based liquidity program are among the reasons why it could win the Arbitrum DEX wars—making it worth a deep dive.

Given the direction DeFi is heading, Uniswap and SushiSwap will likely maintain cross-chain liquidity for most top trading pairs like USDC/ETH or ETH/WBTC.

Therefore, targeting incentives toward native pairs on Arbitrum while leveraging those major pairs elsewhere makes more sense for deeper liquidity.

The team is taking a unique approach by focusing on Arbitrum-native projects and strategic partnerships.

User-provided liquidity tends to be non-sticky as it chases the highest APR. In contrast, projects need long-term LPs that concentrate liquidity on a single DEX.

With this in mind, Camelot has decided to heavily incentivize its partners to maintain liquidity on its platform.

To date, partners have included GMX, Umami, JonesDAO, Buffer Finance, Sperax, Spell, GMD, and Nitro.

Protocols like GMX may market-make on Camelot and potentially shift their liquidity there—an important distinction setting Camelot apart from other DEX launches. The team even shares some advisors with GMX.

The JonesDAO team is also collaborating with Camelot and promoting it across social media.

This is a massive win for these protocols, as they gain access to shares of Camelot DEX, can use $GRAIL to incentivize LPs, and pool deeper liquidity than leading DEXs.

As these projects collaborate and incentivize liquidity, it turns into a competition between protocols to attract sustained liquidity. Ultimately, users benefit most through deep and stable liquidity.

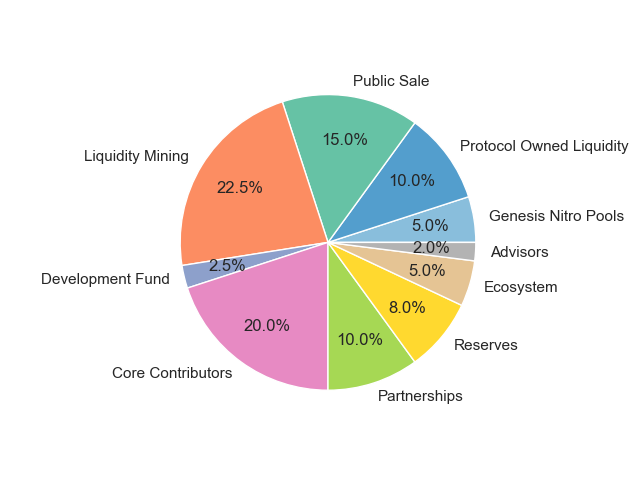

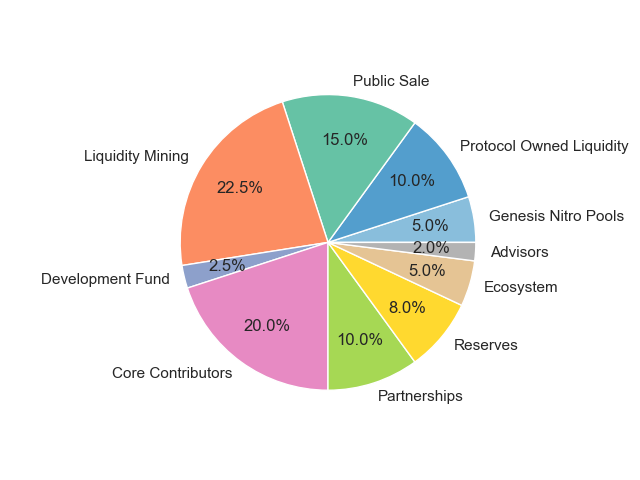

Approximately 25% of the total supply is allocated to partners (10%), reserves (8%), ecosystem (5%), and development fund (2.5%).

This means they're aggressively incentivizing current partners to adopt Camelot as their primary DEX, while also reserving allocations for future partners.

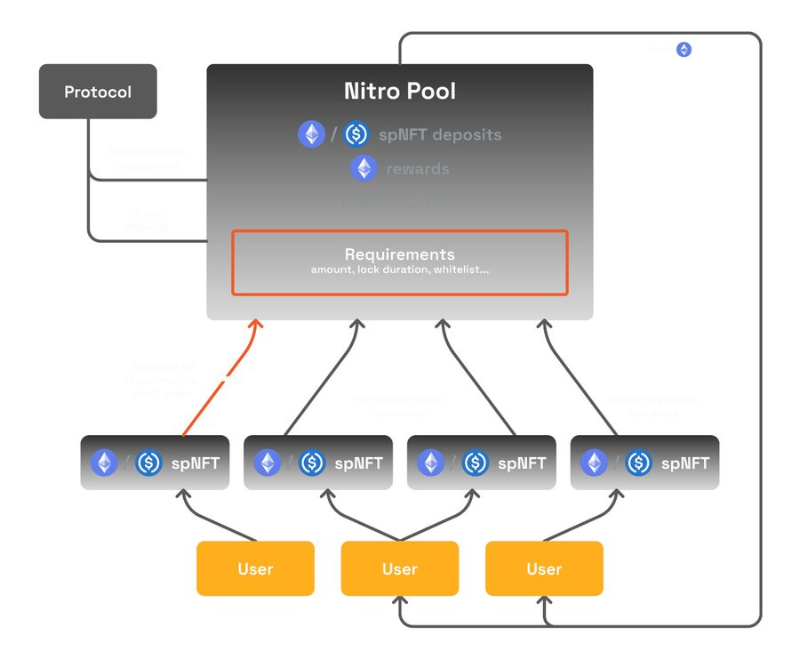

A standout feature for partners is Camelot’s Nitro Pools.

Their spNFTs allow projects to set parameters such as minimum LP amount, time locks, or whitelists to selectively reward LPs. This offers endless customization for targeted liquidity incentives.

Here's an example:

$JONES could use a Nitro Pool to say: “Any user who deposits into JONES/ETH pair with at least $500 LP, locked for 6 months, and whitelisted by the team.” Then allocate 50,000 JONES to the pool.

Rewards = Loyalty + Long-term holders.

Ideally, in the future, you’ll be able to use your long-term spNFT position as collateral for borrowing.

On the roadmap, this unlocks a full layer of incentivization for long-term project liquidity. Your LP position might even qualify for 0% interest loans.

A less-discussed Camelot feature is dynamic and directional fees applied per trading pair.

This allows fee differentiation based on trade direction—for example, charging 0.01% when buying cmUMAMI and 2% when selling. This helps stabilize volatility during extreme events.

Dynamic fees enable systems based on individual pair volatility—something typically managed at the exchange level. This shows how deeply focused the system is on developing new features for partner projects.

What excites me most is their tokenomics.

I’ve been waiting for a DEX to implement a dual-token system. Their $GRAIL / $xGRAIL model isn’t exactly what I envisioned, but it captures many of the same benefits.

$GRAIL is liquid, while $xGRAIL is the DEX’s vesting and profit-sharing token.

Example: You earn 100% APR in the $JONES-$ETH LP, with 60% paid in liquid $GRAIL and 40% in $xGRAIL.

This aligns LPs with the protocol’s long-term success.

$xGRAIL is a non-transferable token that allows stakers to earn a share of protocol fees (paid in ETH/USDC LP), participate in governance, or boost LP yields.

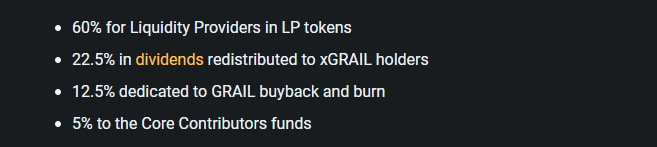

22.5% of swap fees are distributed to $xGRAIL stakers, so both users and partner projects benefit as DEX volume grows.

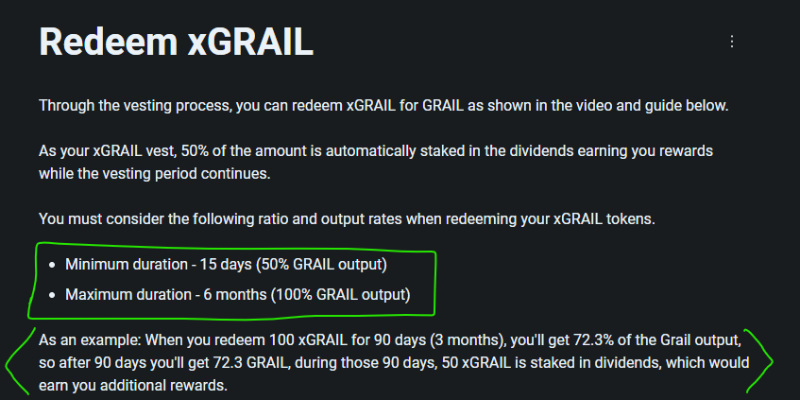

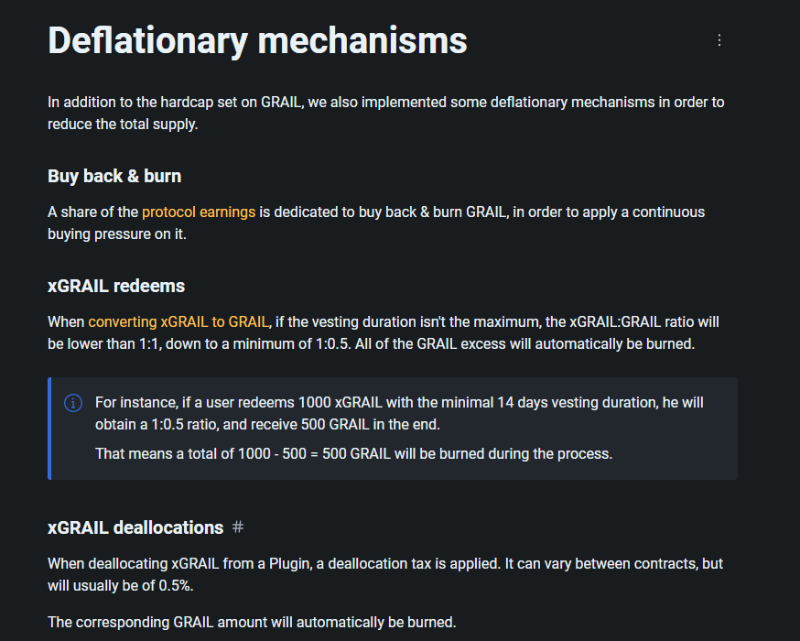

You can redeem $GRAIL from $xGRAIL, but achieving a 1:1 ratio requires time.

The shortest vesting period is 15 days at a 0.5:1 ratio. The longest is 6 months for a full 1:1 redemption.

This keeps circulating $GRAIL supply low while offering user flexibility.

Camelot also implements deflationary mechanics by using 12.5% of swap fees to buy back and burn $GRAIL, along with $xGRAIL redemption fees.

This helps counter inflation and makes their model more similar to $ETH—over time, increasing volume could reduce the total supply of the protocol’s tokens.

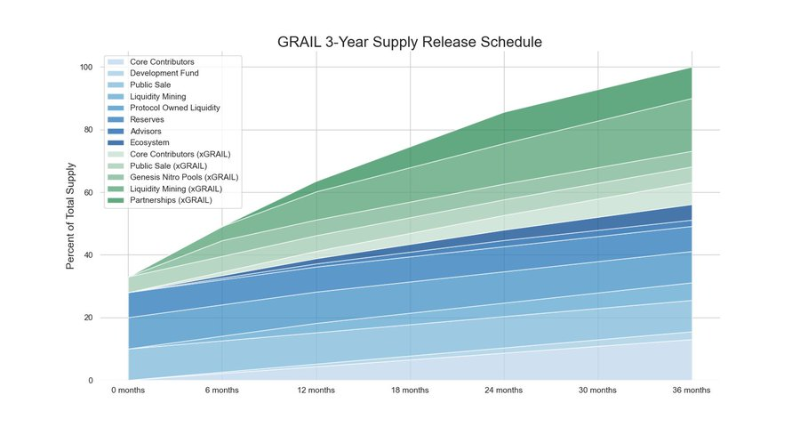

Token distribution highlights that most dilution comes from $xGRAIL emissions in the first year, while $GRAIL (blue) increases by only about 50%.

Note that redemptions (inflationary for GRAIL) or burns (deflationary) cannot be fully predicted.

At launch, approximately 35,000 out of the total 100,000 supply of $GRAIL + $xGRAIL will be in circulation.

Notable user allocations:

-

10k PooL ($GRAIL);

-

15k public sale (10k $GRAIL + 5k $xGRAIL);

-

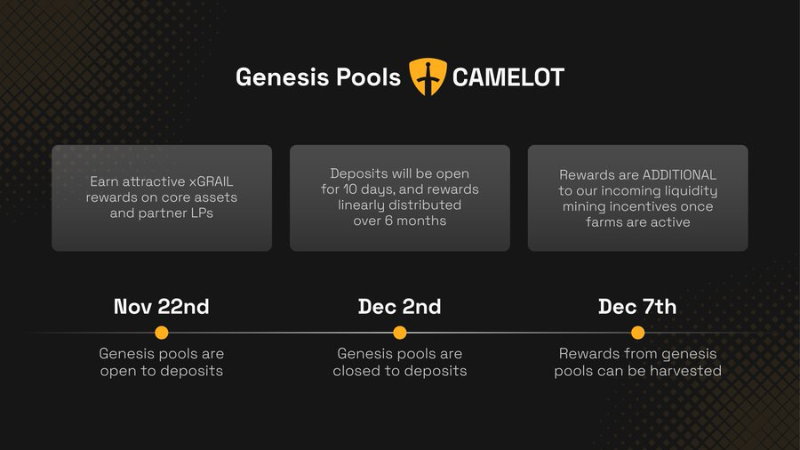

5k Genesis Nitro Pools ($xGRAIL distributed over 6 months).

Genesis Farms offer a free way to provide liquidity and earn $xGRAIL with vesting periods over 6 months.

These deposits will close within days and start earning immediately without requiring locked capital.

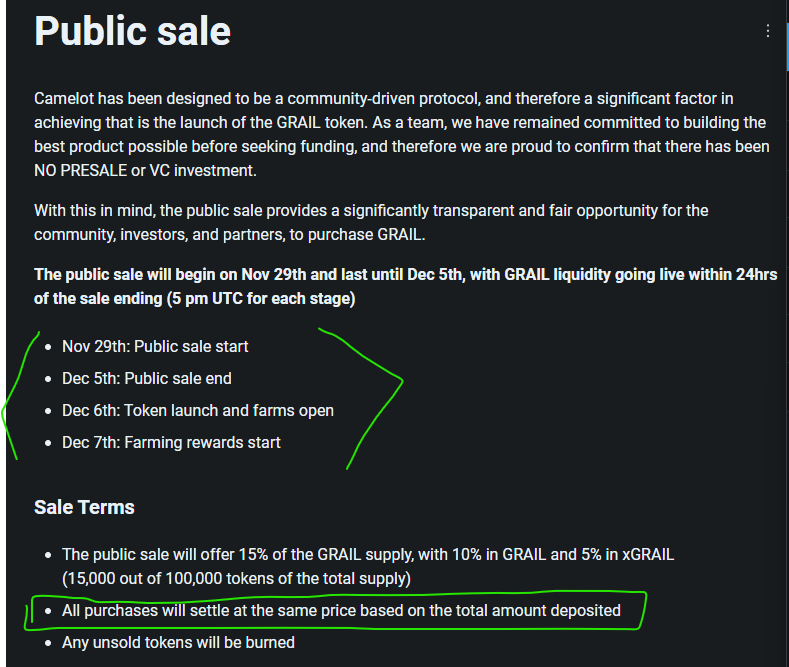

The public sale is ongoing until December 5th, representing 15% of the total $GRAIL supply.

All purchases settle at the same FDV, so there’s ample time to participate.

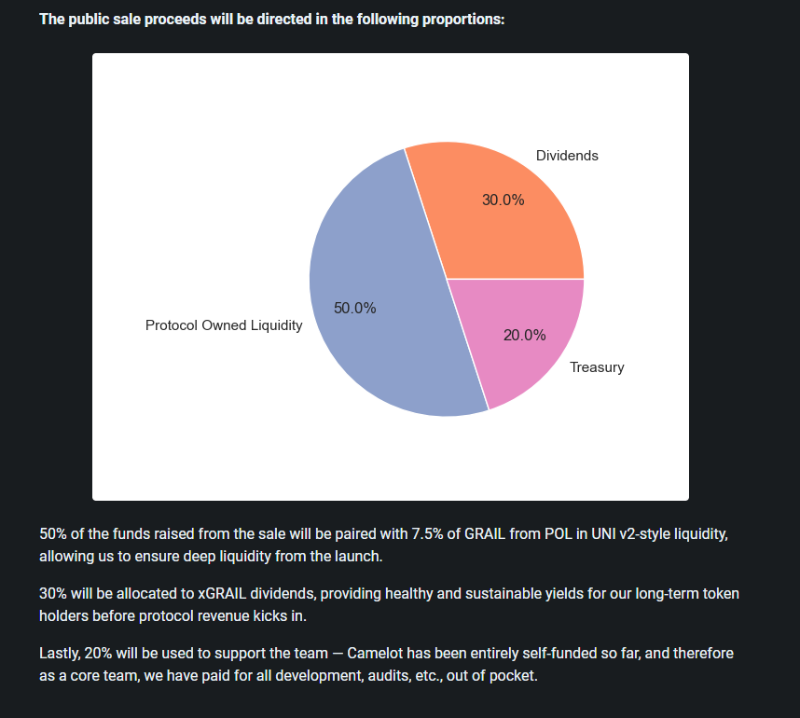

30% of proceeds will bootstrap $xGRAIL yield—a rebate-like mechanism for public sale buyers, making higher FDV better for Genesis Farmers.

50% of public sale revenue will fund the launch of the GRAIL PoL (Proof of Liquidity).

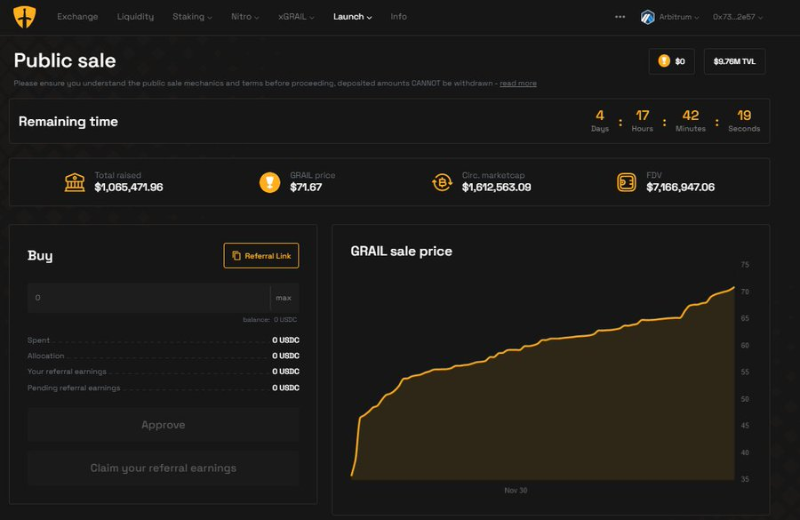

Camelot’s public sale has already raised $1 million, implying an FDV of around $7 million with nearly 5 days remaining. I expect it to finish significantly higher.

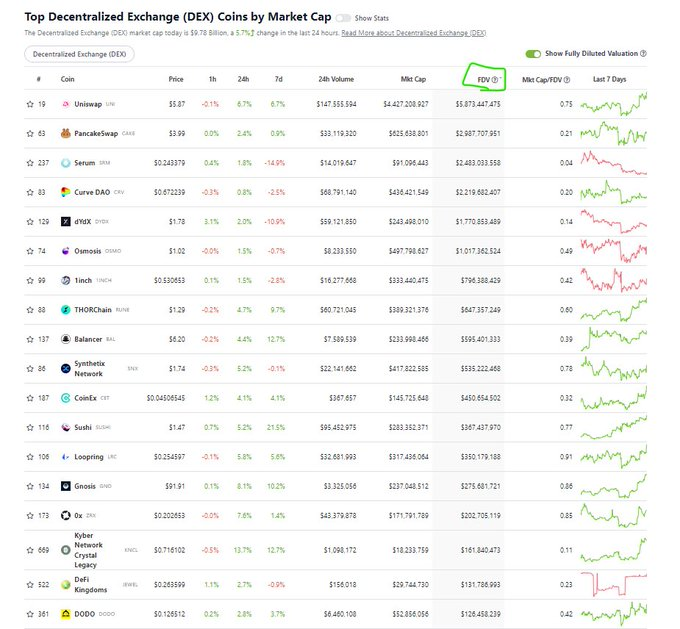

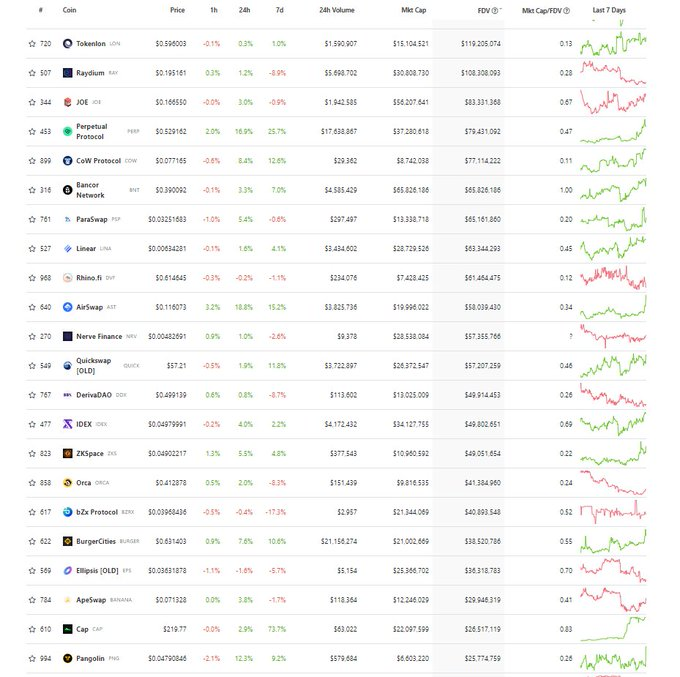

Comparing their FDV to other top DEX platforms, there’s significant room for growth:

-

$OSMO: $1 billion;

-

$JOE: $85 million;

-

$JEWEL: $131 million;

-

$BOO: $19 million;

Notably, Arbitrum itself also has substantial growth potential compared to most sidechains or other L2s.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News