Arbitrove: An index yield product for the Arbitrum ecosystem,即将 to be launched on Camelot

TechFlow Selected TechFlow Selected

Arbitrove: An index yield product for the Arbitrum ecosystem,即将 to be launched on Camelot

A Comprehensive Overview of $TROVE即将 to be Launched on Camelot

Original: Vorpaxis

Compiled by: TechFlow

A comprehensive overview of $TROVE, soon to be launched on Camelot.

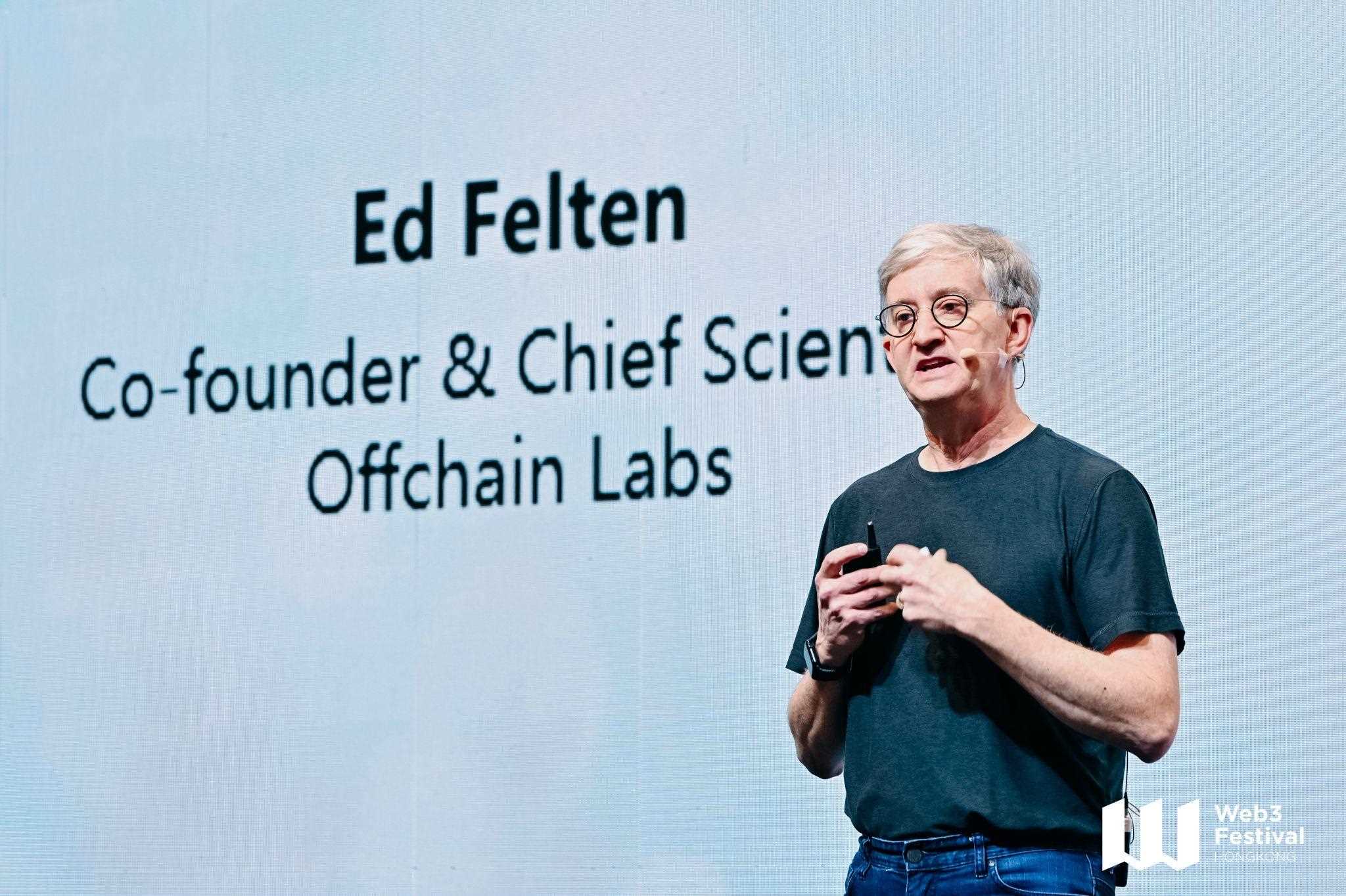

Project: Nitro Cartel

Category: DAO

Blockchain: Arbitrum

Date: February 17, 2023

Overview

Nitro Cartel is a decentralized autonomous organization (DAO) aiming to drive adoption and TVL across the entire Arbitrum ecosystem. They are developing two products to achieve this goal—“Arbitrove” and “Hyperplane Bridge.”

-

Arbitrove is an asset index for Arbitrum with yield-generating strategies. Its first launched index is called ALP.

-

Hyperplane Bridge is currently planned for future protocol development—the idea being an incentivized cross-chain bridge solution to attract more new users to Arbitrum.

The Nitro Cartel DAO is governed by holders of Passport NFTs, which were launched in December 2022.

Nitro Cartel Passport

The Nitro Cartel Passport was created to fund the project's initial launch and treasury. These funds will allow developers to pay for audits of future products such as Arbitrove.

Passport holders can influence the protocol’s direction through governance. To reward early supporters, Passport holders will receive token airdrops from future products (e.g., $TROVE).

Minting Details:

-

Total supply of 1,000; team can mint up to 200 NFTs

-

Price: 0.4 ETH

-

Date: December 4, 2022

-

Team-held Passports are permanently locked but may claim yields generated from holding Passports

Minting Results:

-

Only 509 NFTs minted

-

390 NFTs listed on OpenSea

-

Current floor price (as of 23:00 on February 14): 3.65 ETH

The DAO treasury wallet is a multisig requiring 4 out of 7 signers to execute transactions. The signers are:

-

Nitro Cartel team members (4)

-

JonesDAO (Nach211)

-

Camelot DEX (Myrddin)

-

Vesta (Floflo1904)

Multisig address: 0x72f9b18f1091b1F8A0981Afe44aD0123Ae32524A

Arbitrove

Arbitrove is the first major product released by Nitro Cartel, designed to provide users with an easy way to access Arbitrum protocols.

In the long term, Arbitrove plans to launch various indices—potentially yield-generating assets, novel protocols, NFTs, or even subcategories like GameFi and liquid staking derivatives.

The first index launched by Arbitrove is called ALP, which will cover blue-chip assets on Arbitrum, such as $GMX, $GNS, and yield strategies around tokens like $GRAIL, $JONES, $MAGIC, and others.

Full list below:

Composition of ALP

ALP operates based on minting and redemption mechanics. Currently, users can mint ALP using ETH, with a 0.5% fee charged on both minting and redemption. The protocol then acquires assets and executes yield-generating strategies, automatically rebalancing as needed.

The DAO aims to boost overall liquidity on Arbitrum by allocating some assets into liquidity pools on DEXs. Nitro Cartel has also partnered with Vesta, and ALP may eventually be used as collateral for borrowing.

$TROVE

$TROVE is the liquidity and governance token for the Arbitrove product. Holders of $TROVE will influence the product’s direction through decentralized governance. A public sale is coming soon, with key details as follows:

-

Time: February 17, 2023, 14:00 UTC – February 20, 2023, 14:00 UTC

-

Location: Camelot Launchpad

-

Required token: ETH

-

Starting price: 0.0025 USD

-

Supply: 200,000,000

-

Initial FDV: $2.5 million

-

Hard cap: Up to $2.5 million raised ($0.0125 per $TROVE, $12.5 million fully diluted)

-

Vesting: None

-

Per-wallet limit: No restrictions

-

All investors will receive the same price—the final price at the end of the sale

Trove also features a vesting form called esTROVE, which is non-transferable. However, it may earn protocol revenue through staking. The Nitro Cartel DAO will vote on this proposal in March. esTROVE can be redeemed into TROVE (linearly over one year, starting September 2023), but redeemed tokens will not be eligible for yield rewards.

$TROVE Tokenomics

The total supply of TROVE is 1,000,000,000. However, some of these will initially be issued as esTROVE and will not be immediately tradable.

Liquidity distribution will be:

-

200 million — LaunchPad sale

-

10 million — Airdrop to xGRAIL holders

-

90 million — Treasury (60 million allocated for protocol-owned liquidity)

-

220 million — Liquidity incentives (to be distributed over 8 years)

The remaining tokens (330 million to Passport holders, 150 million to the team) will be distributed as esTROVE. These tokens are illiquid, have a 6-month cliff (though they can be staked for yield), followed by a 1-year linear redemption period.

Additional Details

30% of the ETH raised will be paired with TROVE to provide liquidity on Camelot. The remaining 70% will fund growth for Nitro Cartel, Arbitrove, and future products.

Hyperplane Bridge

There is limited information available about this product. They note it may be delayed in favor of other products depending on community feedback.

Their intended goals for this product appear to be:

-

Deploy a bridging solution to Arbitrum using LayerZero technology.

-

Ensure low cost and a very simple user experience.

-

Provide native token incentives for users bridging to Arbitrum.

-

Achieve synergy with other products (e.g., a bridge + automatic purchase of ALP).

-

Be community-owned and DAO-governed.

Currently, they are proceeding cautiously, as cross-chain bridges carry high security risks, and they want to ensure they use the best available technology.

Team

The team is anonymous, but some details are provided in their documentation:

-

4 core developers.

-

3 team members focused on growth and business development.

They come from diverse backgrounds. Some details include:

-

Machine learning engineer from FAANG companies;

-

Systems engineer from major financial institutions;

-

Former founder of a top-tier NFT project;

-

Blockchain analyst from a prestigious university;

Conclusion

Nitro Cartel is set to launch its first index, ALP, on Arbitrove. This index will offer users an excellent way to gain diversified exposure to Arbitrum while generating yield.

The governance token for Arbitrove, $TROVE, will launch on Camelot on February 17.

Translator’s Note:

While we've seen tremendous DeFi innovation on Arbitrum—such as Rage Trade and Camelot—after the innovation wave, forking has increased again, with many protocols following suit by launching GLP-inspired delta-neutral strategy vaults.

Increased competition in a crowded sector means only a few will prevail—and ultimately, GMX itself may remain the sole winner.

If GMX is a shark with remoras attached, Arbitrove has the potential to become another shark. I also look forward to seeing more protocols built on top of ALP in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News