Rodeo Finance: A Sustainable Leveraged Ecosystem

TechFlow Selected TechFlow Selected

Rodeo Finance: A Sustainable Leveraged Ecosystem

This article will delve into Rodeo's liquidity leverage mining and explore how it differs from other similar DeFi platforms.

Written by: Emperor Osmo

Compiled by: TechFlow

Rodeo Finance is a DeFi platform aiming to build a sustainable leveraged ecosystem that enables users to earn real yields through passive and leveraged strategies.

Since its launch, Rodeo has become a notable project within the Arbitrum community. In this article, researcher Emperor dives deep into Rodeo's liquidity leverage mining and how it differentiates itself from other similar DeFi platforms.

Rodeo Finance aims to create a sustainable leveraged ecosystem. It allows users to borrow and lend while earning passive income via various real yield strategies.

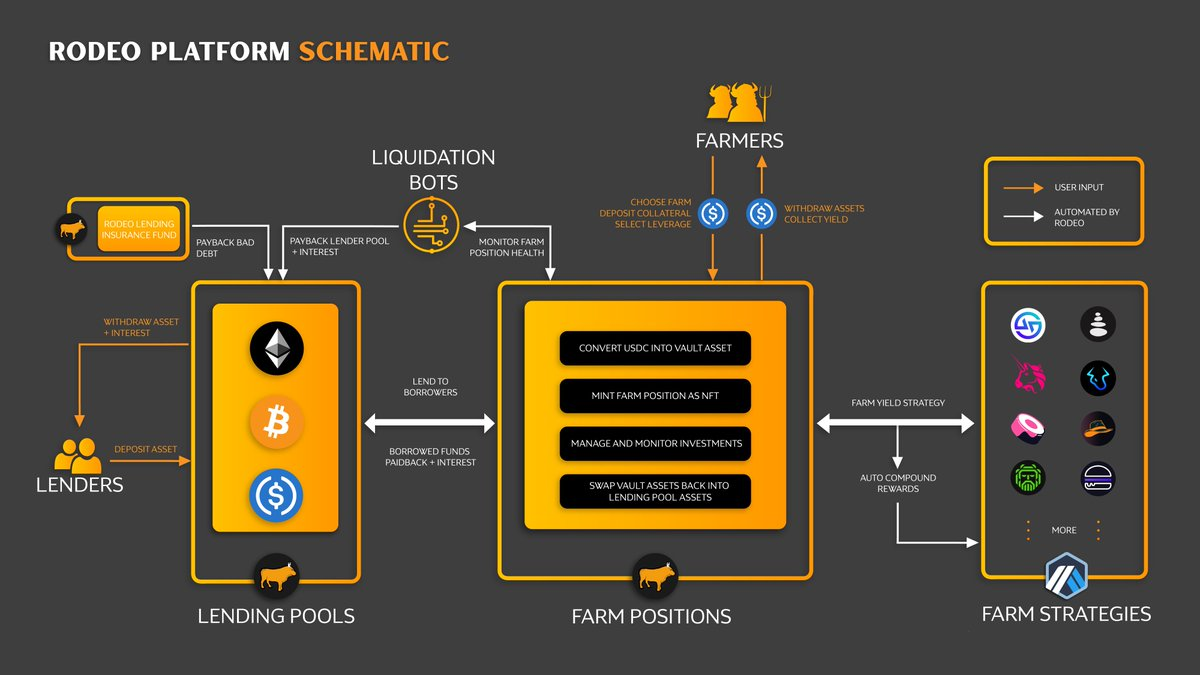

First, it’s important to understand that Rodeo Finance operates on two fronts designed to form a virtuous cycle:

- Passive liquidity providers (lenders);

- Leveraged speculators.

In Rodeo, lenders can deposit their tokens to generate passive income and serve as counterparties for speculators seeking leveraged gains. Lenders receive “RIB” tokens as collateral, which accrue interest through automatic compounding. On the other hand, speculators in Rodeo Finance aim to borrow against deposited assets.

Users can simply choose their preferred liquidity pool, deposit $USDC, and select their desired leverage—up to 10x—to amplify potential returns.

"With great leverage comes great responsibility."

Like any lending protocol, minimizing bad debt is crucial. To address this, Rodeo Finance employs two types of liquidation mechanisms:

- Soft liquidations (partial position liquidation);

- Full liquidations.

This is an interesting and mutually beneficial approach to debt clearance. Rodeo Finance maintains security of lent assets while allowing users to retain part of their funds.

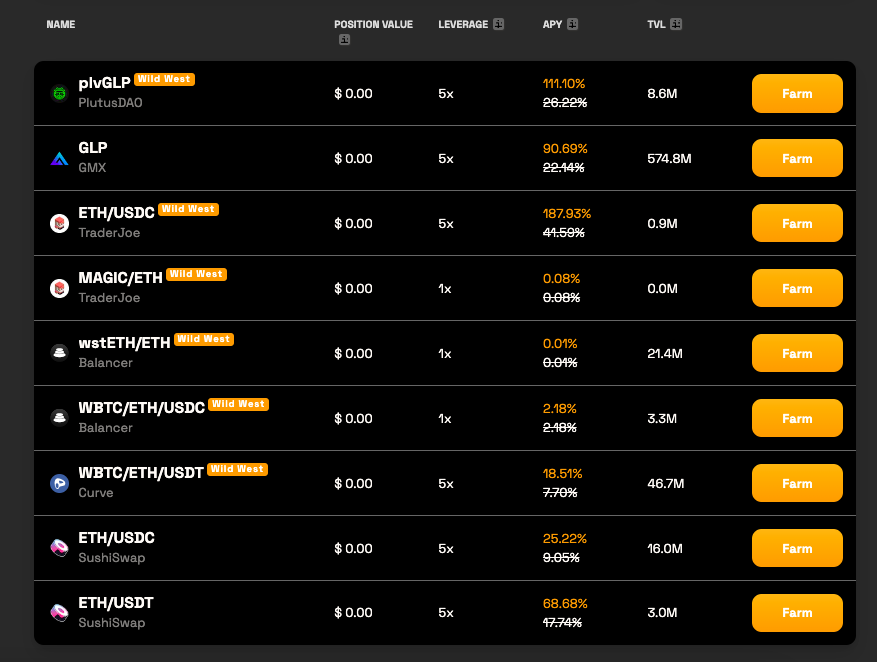

Rodeo is building a decentralized ecosystem that delivers real yield while enabling users to maintain passive income strategies. By choosing to deploy on Arbitrum, it offers one of the best liquidity strategies available to date.

Since the launch of Rodeo V1, there has been significant excitement about what lies ahead:

- More strategies;

- Greater incentives;

- Launch of the $RDO token;

- Airdrop.

Rodeo's Corral, the initial launch of leveraged yield farming, has already attracted strong interest from the Arbitrum community—drawing over 1,000 users and more than $800,000 in TVL so far. Implementing more incentivized strategies will elevate this further.

The Rodeo Stampede will culminate with the rollout of their new $RDO token. This will primarily target passive liquidity farmers to sustain a competitive and long-term viable ecosystem.

Rodeo Rocket Vaults are essentially automated risk-managed vaults.

They allow users to hedge some risks in liquidity pools by introducing both short and long positions to minimize volatility.

Rodeo Lasso is Rodeo Finance’s first DAO governance model. The DAO will oversee key initiatives such as farm integrations, new asset listings, and the overall direction of the protocol.

In Rodeo V2, sustainability will be paramount—meaning unsustainable high APRs will no longer be the goal. Instead, it will foster a long-term flywheel effect beneficial to both users and investors. The Rodeo Wagon Wheel (dynamic liquidity leverage) represents this flywheel mechanism.

Rodeo Silos will allow users to earn $RDO rewards through liquidity pools—effectively issuing xRDO tokens, which initially can be used to purchase additional leverage.

Rodeo Finance will implement a ve(3,3)-like model to reward participants for long-term liquidity commitments to the protocol. The goal is to reduce friction while maintaining capital efficiency for liquidity.

Rodeo Saloon will host the “main” pools that handle the majority of trading activity. Leveraging Balancer’s linear boosted pool technology, Saloon will offer composability for Rodeo’s ribAssets, resulting in higher APRs.

Last but not least, they have announced an upcoming $RDO token airdrop. This decision is particularly significant given that many features require the native token to incentivize liquidity, bribe emissions, and reward the community.

Rodeo Finance is positioning itself as an automated yield machine focused on creating a symbiotic ecosystem that benefits both users and the protocol.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News