How to comprehensively and professionally evaluate a project's fundamentals?

TechFlow Selected TechFlow Selected

How to comprehensively and professionally evaluate a project's fundamentals?

Fundamental analysis is one of the factors that contribute to investment success.

Written by: ZERO IKA

Translated by: TechFlow

Fundamental analysis is one of the factors that makes investment successful. Everyone tells you to DYOR, but no one tells you how. Here, I’ll show you how to conduct professional DYOR from scratch and increase your chances of achieving solid returns.

Idea

The first thing I do is examine the idea behind the project.

Does it solve a real problem? Success belongs to those who solve problems.

Think about Ethereum’s gas fees. L2s have gained traction because they solve this issue.

Is it innovative?

If a project simply copies others’ technology and ideas, how likely is it to succeed?

Humans are drawn to new solutions and quickly grow tired of clones.

Market Saturation

Assume a project looks promising, but the space is crowded with competitors. Its chance of breaking through becomes slim.

That’s why I prefer sectors with superior technology and fewer competitors.

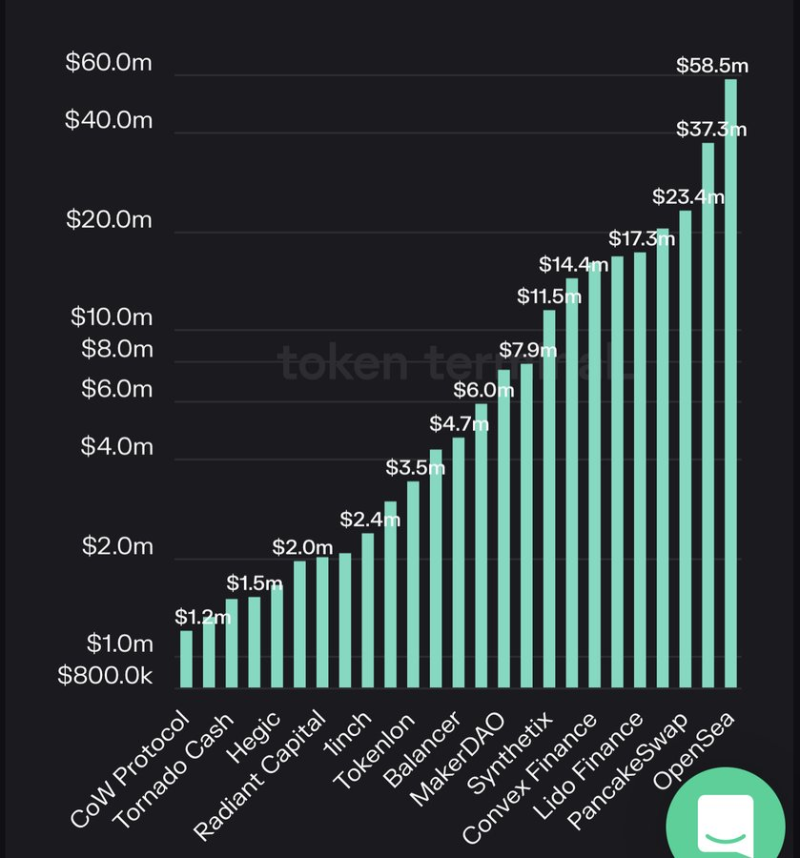

Revenue

Crypto projects are businesses first. To survive and succeed, they must generate revenue.

You need to determine whether the project is sustainable or just another Ponzi scheme. I use Token Terminal’s "Revenue" page to compare projects. Revenue mainly comes from:

• Fees

• Paid licenses

• Product sales

Team

An excellent team is essential if you want to increase your odds of success. Would you invest in a project run by scammers? To evaluate the team, I:

- Visit the official website to view team members

- Use LinkedIn + Cypher Hunter to scan their past experience

- Check Twitter to see if they’re active and regularly update the community

I always avoid teams that:

- Have a history of bad behavior

- Lack experience

- Rarely update the community

- Refuse to accept criticism

Community

A strong community is key to understanding how much trust people place in a project. It also helps attract new potential holders. We can assess community engagement by browsing chat logs on Telegram and Twitter.

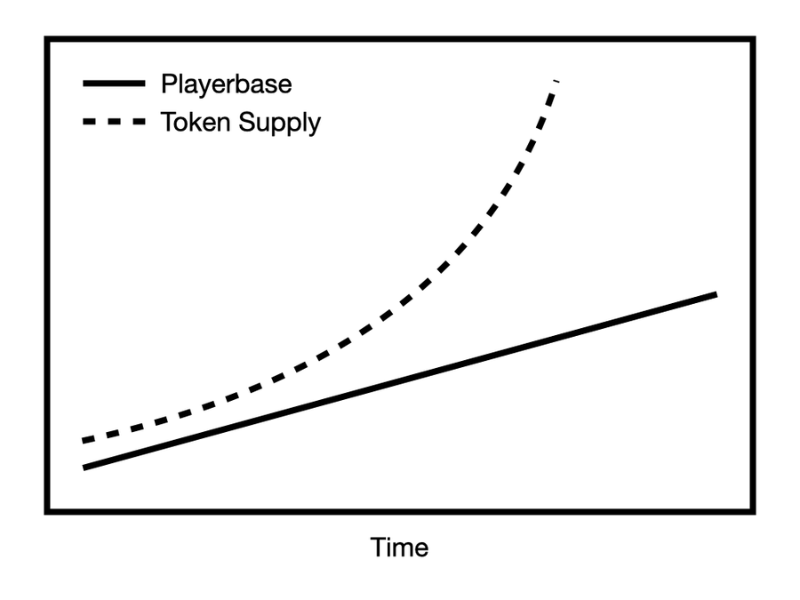

Token + Tokenomics

This is a critical factor. When you buy a token, you're not buying stock. Without sound tokenomics, even a great project cannot guarantee success.

Many gaming projects saw massive pumps initially but crashed over time. People play, earn tokens, then cash out.

Without proper incentives and with ever-increasing token supply, prices will be suppressed over time. That’s why tokenomics matter regardless of the project type.

Tools I use to analyze tokenomic metrics:

• Check supply: Coingecko + CoinMarket Cap

• Vesting schedule: Token Unlocks + Vest Lab

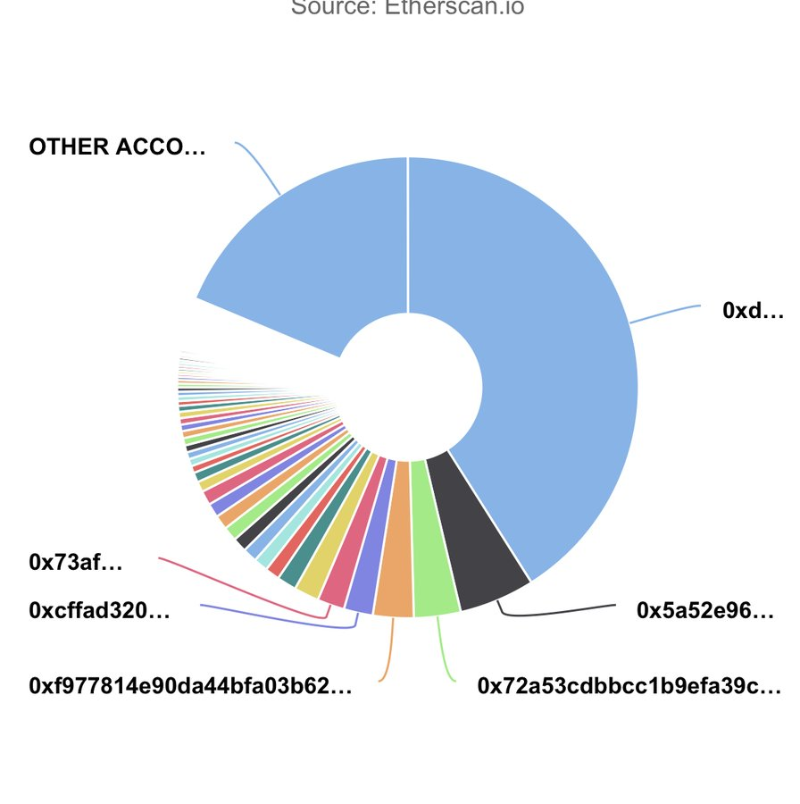

• Token distribution: Whitepaper + Etherscan | Holders section | Token holder chart.

Unfair token distribution is often a red flag. Whales holding large amounts may dump, triggering major sell-offs. For example, if 41% of $SHIB supply is concentrated in one wallet, what happens if that holder sells? The price would suffer massive impact. That’s why this metric matters.

TVL

TVL (Total Value Locked) is a good measure of a DeFi ecosystem’s health. It includes all tokens deposited into features offered by DeFi protocols—staking, lending, liquidity pools, etc.

This is a key metric. Without TVL, there’s little interest in the ecosystem, making price appreciation difficult.

How to check it?

Simply use DeFiLlama to track capital inflows into the project. You can also use DappRadar to identify the most popular Dapps within an ecosystem.

Liquidity

Liquidity is a metric primarily composed of three parts:

- Exchanges listing the token: Fewer exchanges → lower liquidity → fewer opportunities for people to buy

- Sufficient liquidity to support trading activity

- Potential for listing on major exchanges

“I don’t know where to find liquidity metrics”—Coingecko has everything:

• Trading volume

• Exchanges

Product

For a project to succeed, it must add value to the world—and to do so, it needs to offer products or services people like or want to use.

I always try (when possible) to test a crypto project’s product.

Dex, Cex, platforms, games, blockchains…

If I don’t like a product, I almost certainly won’t invest in it. Also, I don’t rely on others’ opinions—only things I’ve personally verified feel trustworthy.

Risk/Reward

How much return do you need to feel satisfied with your investment? Set psychological targets that are realistic.

Mid/low market cap tokens are riskier, but they offer greater upside potential compared to high-cap tokens. If you choose a high-market-cap token, don’t expect ×50 or ×100 returns.

Price

I always check the token price before buying, no matter how revolutionary the project seems. I:

- Buy during accumulation phase

- Sell during uptrend/distribution phase

- Do nothing during downtrend

The concept is simple, but requires discipline to execute.

A few additional insights:

-

Alpha comes with higher risk. I allocate budgets based on risk level. For low-cap tokens, I set a maximum of 5%; for mid-cap, up to 15–20% depending on sector rotation. But never go all-in—risk management is crucial.

-

You’ll never find a perfect project.Every project has strengths and weaknesses—centralization, lack of utility, marketing, etc. Your goal should be to evaluate them and pick investments with relatively smaller downsides.

-

Security is critical for DeFi protocols. How many times have we heard about DeFi exploits? If you’re evaluating a DeFi protocol, prioritize its security. Tools like Defi Safety can help—they rate protocols based on security.

-

No marketing, no market. You might have the best tech and team, but without visibility, it’s hard to gain attention. Make sure to check whether the project runs marketing campaigns. Note: most projects launch these during bull markets for hype.

-

Always monitor team progress—especially adherence to timelines and roadmaps. Delays happen, but repeated postponements and excuse-making are red flags.

-

Once you identify a promising project and buy your initial position, don’t forget about it. Keep up with the latest developments, roadmap progress, and announcements.

In summary, fundamental analysis is key to assessing a project’s potential strengths and weaknesses.

When evaluating a project, ensure alignment across all the following aspects:

• Team

• Revenue

• Product

• Community

• Future prospects

• Marketing

• Tokenomics

• Return on investment

• Liquidity

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News