Fundamental Labs: Reviewing market fundamentals since 2016 to select sustainable development projects

TechFlow Selected TechFlow Selected

Fundamental Labs: Reviewing market fundamentals since 2016 to select sustainable development projects

The difference between bull and bear markets can be summed up in one word: "momentum."

By CoinDesk

Interviewee: Howard Yuan, Co-founder of Fundamental Labs

Translated by Zoe

The difference between bull and bear markets can be summed up in one word: "momentum."

In a bull market, the "momentum" behind rising asset prices is strong, influencing most investors' decisions. When an asset’s price rises rapidly, everyone wants to jump in—other considerations become irrelevant. But when a bear market arrives and periodic rallies come to an end, this momentum-driven “chasing gains” strategy quickly falls apart.

This is precisely the state of today's crypto market. The bear market has placed multiple pressures on new investors who have only held digital assets for a few years. Beyond panicking over declining portfolio values, they now face an even tougher challenge—how can individuals survive and grow during a prolonged market downturn? Everyone is scrambling for answers.

Fundamental Labs: Reviewing Market Fundamentals Since 2016

One of the best places to find these answers lies with veteran players who have lived through multiple crypto market cycles. As early supporters of innovations like ICOs, DeFi, and NFTs—key drivers of the crypto market in recent years—they’ve witnessed both explosive growth and painful collapses. Howard Yuan, co-founder of Fundamental Labs and an experienced Web3 venture investor, is one such seasoned player.

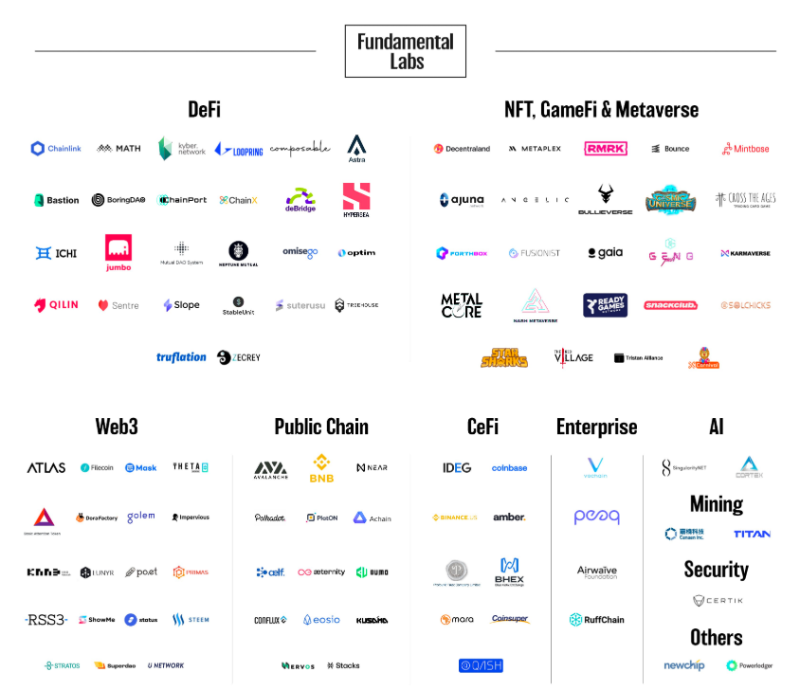

Since its founding in 2016, Fundamental Labs has been backing digital asset projects and is now raising its sixth fund. Guided by its core investment philosophy—“focusing on fundamental data is always the best way to make investment decisions”—Fundamental Labs has backed numerous high-quality crypto projects, including industry leaders like Coinbase, Binance, and Chainlink.

In a recent conversation with CoinDesk, Howard shared his fundamental-based perspective on why the recent bull run faded and offered valuable advice for navigating the current bear market.

Fundamental Warning Signs Behind the Crash

According to Howard and the Fundamental Labs team, if you conducted thorough fundamental analysis, warning signs were evident well before the crash—the collapse of certain companies accelerated the broader market downfall. However, due to obsession with bull market momentum, most investors overlooked these red flags.

The LUNA/UST collapse serves as a prime example. Howard pointed out that the collateral backing these digital assets was insufficient and easily detectable in public data, while their unrealistically high annual percentage yields (APY) also exposed underlying risks.

Crypto lending platform Celsius Network and hedge fund Three Arrows Capital (3AC), two other major points of failure during the crash, similarly suffered from weak fundamentals. Most notably, public data revealed their excessively high leverage ratios and lack of proper risk management practices.

Fundamental Labs and other Web3 funds that have existed for several years typically remain cautious about such entities. During this crypto subprime crisis, Fundamental Labs held no positions in LUNA/UST, Celsius, or 3AC. The firm believes that only by remaining clear-headed and disciplined in risk management at all times can one avoid catastrophic losses when the market turns bearish.

How Can Fundamental Analysis Provide Forward-Looking Guidance?

Fundamental analysis helps explain what went wrong in the past—but what about the future? Despite the current market gloom, Howard and the Fundamental Labs team are actively making new investments. They use key metrics and in-depth fundamental analysis to identify companies capable of sustainable growth.

Examples of noteworthy indicators:

On-chain metrics: The health of the blockchain underlying a digital asset is a critical indicator of its value. Howard emphasizes closely monitoring node count, number of active addresses, protocol revenue, and especially hash rate.

Financial metrics: The blockchain infrastructure must be financially sound. Key indicators include: fully diluted valuation (FDV), circulating market cap, total value locked (TVL), inflation rate, staking rewards, burn rate, and circulating supply.

Team and technical background: Beyond quantitative metrics, off-chain factors matter too—including founder background, technology stack, proven use cases, tokenomics design, product UX/UI, team expertise and track record, and clarity of project roadmap and milestones.

Community health: Venture investing blends qualitative and quantitative analysis across many dimensions. For instance, combining user growth and churn data provides insight—high growth with low churn is ideal. Qualitatively, assessing user and developer enthusiasm for the product and their vision for its future is crucial. Fundamental Labs cautions investors to distinguish genuine product commitment from marketing hype.

Finally, What Does a Project With Strong Fundamentals Look Like?

To give you a sense of which participants score highly on Fundamental Labs’ assessment framework, Bitcoin, Ethereum, and BSC show strong on-chain metrics indicating a high likelihood of healthy long-term development. Bitcoin’s computational power, measured by “hash rate,” appears particularly robust, while Ethereum remains the dominant Layer 1 blockchain focused on smart contract functionality. Meanwhile, Binance Chain has released a new technical roadmap, claiming over 2 million daily active users.

Bored Ape Yacht Club (BAYC) is another strong example, boasting a powerful community and a solid chance of weathering the bear market and achieving sustained success.

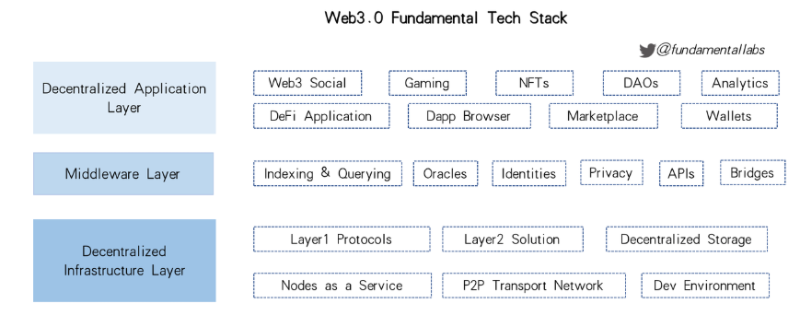

Of course, BTC, ETH, BNB, and BAYC are not emerging investments. Yet Fundamental Labs continues applying its analytical framework to evaluate startups of various sizes around the world. In particular, as Fundamental Labs enters its sixth fundraising round, it is actively seeking early-stage, fundamentally sound projects with strong growth potential but limited penetration into the Web3 ecosystem—such as SocialFi and GameFi. Toward this goal, Fundamental Labs has mapped out a foundational framework for the Web3 tech stack:

Following the 2021 bull market, widespread adoption of crypto applications pushed the industry to new heights—but also revealed new issues and demands within the infrastructure layer. Fundamental Labs remains committed to empowering foundational innovation across the Web3 stack and will continue actively investing in next-generation Web3 infrastructure and middleware.

Since its inception, Fundamental Labs has adhered to long-termism, consistently tracking industry developments and empowering projects at scale. To date, it has invested in over 100 projects. During the previous phase of explosive growth in application-layer projects, it made significant investments in Web3 initiatives such as SocialFi and GameFi. Now that the market has entered a bear phase, Fundamental Labs will continue focusing on fundamentals, identifying and supporting builders shaping the future of Web3.

If you're interested in gaining more detailed, fundamentals-driven investment insights from one of the most experienced venture firms in the space, subscribe to Fundamental Insights Weekly. For more information about the fund, visit Fundamental Labs' official website.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News