When searching for Alpha on-chain, which metrics should we pay attention to?

TechFlow Selected TechFlow Selected

When searching for Alpha on-chain, which metrics should we pay attention to?

The most valuable alpha often exists on-chain.

Written by: The DeFi Investor

Compiled by: TechFlow

The most valuable Alpha exists on-chain, so in this article, I’ll walk through several on-chain developments:

- Venture capitalists’ activity

- Unique contract deployments

- Liquidation levels

- Top balance changes

- CEX outflows

All of these can be analyzed using free tools.

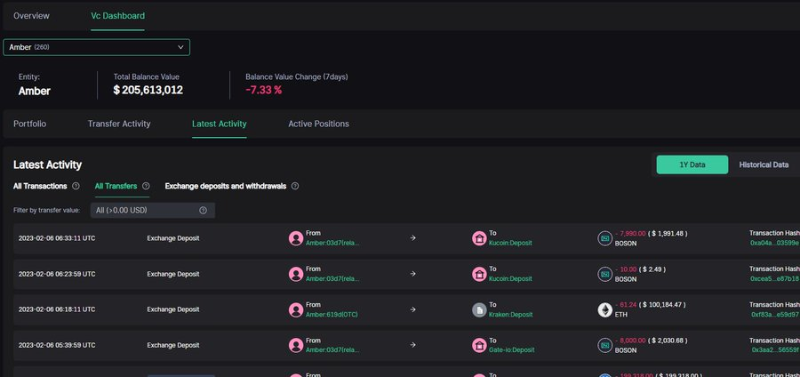

1. VC Activity

Some venture capitalists have access to insider information. Watchers’ VC Watch dashboard helps you analyze their on-chain activity in real time.

- What are they buying?

- What are they selling?

- Which dApps are they using?

I use the "Latest Activity" section to identify small-cap tokens being purchased by multiple VCs. You can filter their transactions by transfer amount (e.g., minimum $1 million). Since VCs conduct large-volume trades, this approach saves me time digging into their on-chain behavior.

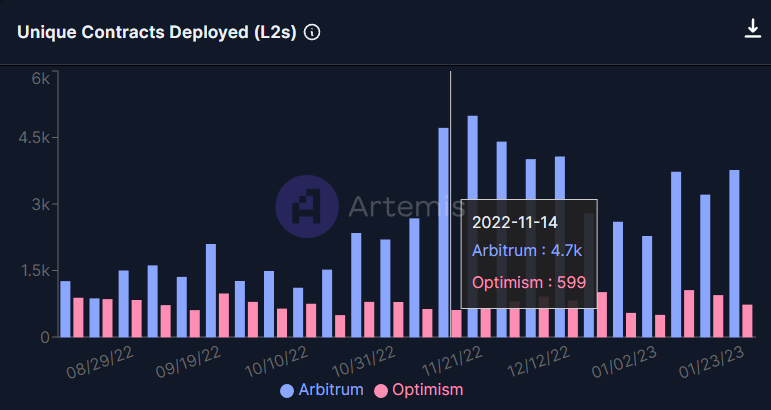

2. Unique Contract Deployments

Where is innovation happening?

The number of unique contracts deployed on Artemis can give you an answer. For example, Arbitrum saw a peak in developer activity on November 14, 2022. Since then, many Arbitrum-related tokens have outperformed the market.

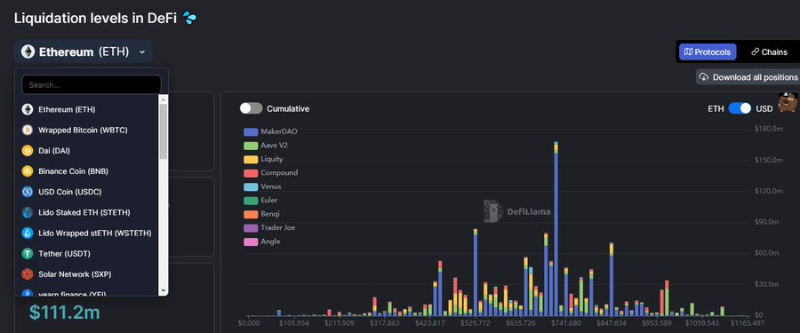

3. Liquidation Levels

Many sudden price drops are triggered by large-scale liquidations.

Monitoring DeFi liquidation levels can warn you about potential price declines. Fortunately, DeFillama offers a dedicated dashboard for liquidations.

Use case: When ETH’s price approaches a major liquidation level, I place my limit buy order far below that level. If ETH drops to that point, a large sell-off is likely.

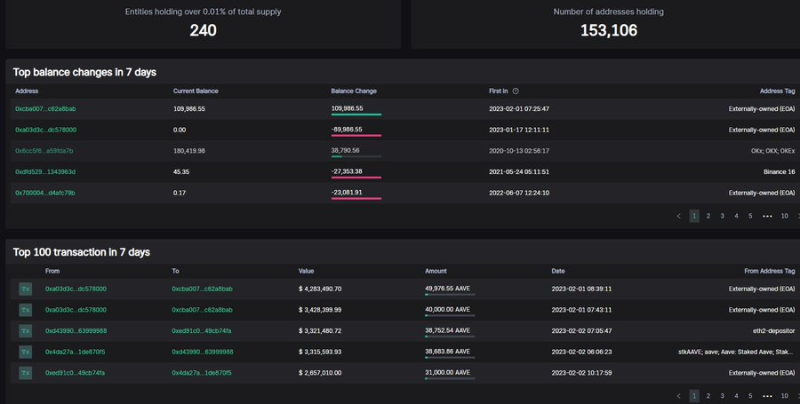

4. Balance Changes

Before buying a token, I ask myself: What are the whales doing? Are they accumulating or selling?

Watchers allows you to check top balance changes across thousands of tokens over the past 7 days.

-

If whales withdraw tokens from CEXs to their own wallets or buy on DEXs, it's a bullish signal.

-

If whales deposit large amounts of a certain token to CEXs, it's typically bearish.

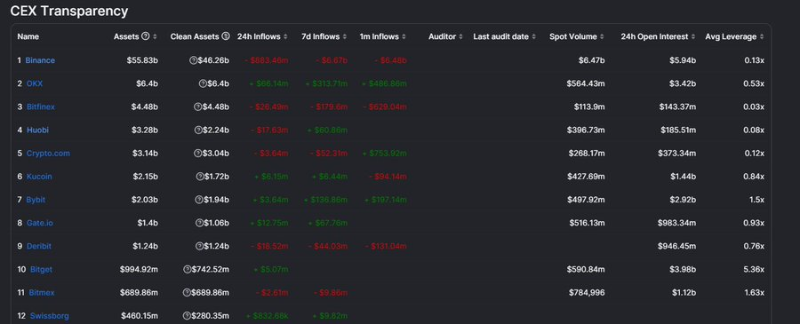

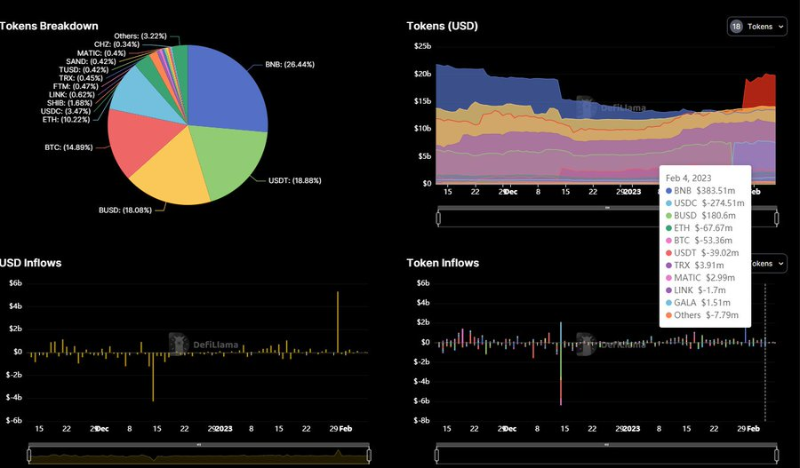

5. CEX Outflows

Large outflows from CEXs may indicate two things:

-

Whales are accumulating tokens long-term and moving them to self-custody—potentially a bullish sign.

-

A bank run is occurring (in which case, consider withdrawing your assets).

DeFiLlama’s CEX Transparency Dashboard shows inflows and outflows across CEXs. By clicking on any exchange in the list, you can also view top token inflows, helping you understand which tokens whales are likely to sell.

In summary, on-chain data is highly useful and can provide you with an edge. However, do not make investment decisions purely based on the on-chain activity of certain wallets—after all, even some of the largest venture capital firms went bankrupt last year.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News