Web3 "Pinduoduo" Guide: How to Earn While Pinging with SBT?

TechFlow Selected TechFlow Selected

Web3 "Pinduoduo" Guide: How to Earn While Pinging with SBT?

Only with a surge in user growth will the market avoid merely slow recovery, making viral marketing strategies for Web3 particularly crucial.

Author: Byte, DeepGo Web3 Builder

If the cryptocurrency market enters a major bull run in 2023, it will require substantial liquidity driven by new users. However, Web3 currently lacks breakout applications capable of attracting mainstream adoption, and user retention from previous trends like DeFi, NFTs, and GameFi remains low. Only with explosive user growth can the market avoid a slow recovery—making viral marketing strategies in Web3 critically important.

Drawing on insights from internet product development and crypto market research, this article aims to offer a fresh perspective on how Web3 applications can achieve broader adoption through innovative pathways.

When Users Come Together

In the Web2 space, Pinduoduo stands out as a company embodying decentralized thinking akin to Web3 principles. Huang Zheng, founder of Pinduoduo, once published an intriguing article in 2017 titled "Reversing Capitalism," which presents the following core idea:

The traditional "capitalist model" follows a linear path: Factory (M) → Supply Chain (S) → Large Merchant (B) → Small Retailer (b) → Consumer (C), where goods pass through multiple intermediaries before reaching end users. Reversing this process creates C2M—"consumers and manufacturers meet directly, eliminating middlemen." This is essentially what Pinduoduo achieved.

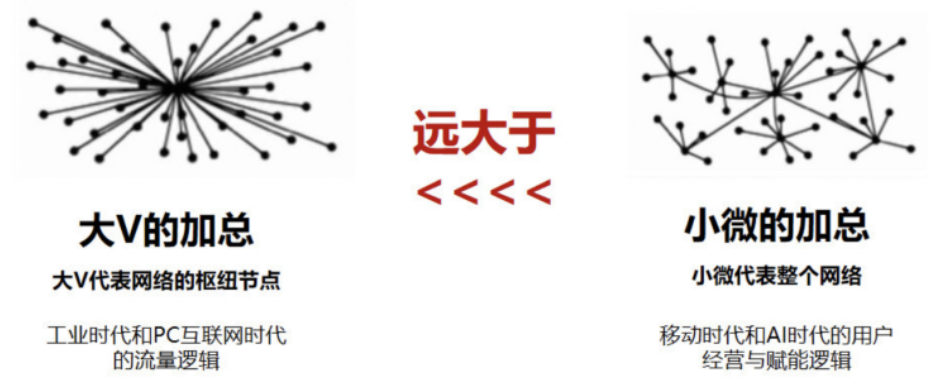

This approach mirrors decentralization in Web2 and offers valuable inspiration—not for combining Web3 with e-commerce per se, but for applying group-buying logic to Web3 social interactions. By aggregating user data and traffic during collective actions ("group buys"), users become sellers rather than buyers, monetizing their own data. When united, users gain pricing power over their data, while advertisers naturally become demand-side participants—achieving higher ad efficiency than traditional Web2 models.

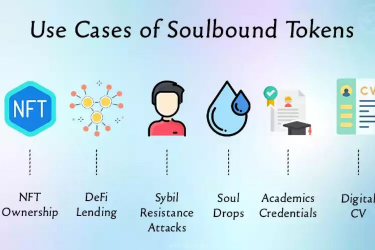

So how do we generate meaningful data continuously? Our answer: content sharing—the most effective use case for SBTs (Soulbound Tokens). Content sharing is a mature, high-frequency, low-barrier social behavior in Web2, inherently tied to social currency and identity expression, making it ideal for building organic social relationships.

Data Monetization Model

How can vast amounts of content be effectively curated, organized, and delivered to target audiences? This is the domain of curation markets. In Web2, platforms rely on algorithms for this task; in the DeepGo network protocol, curators—users who share and filter content—take on this role. Let's examine the key actors within this mechanism:

-

Demand Side: Advertisers seeking customers pay fees to access datasets.

-

Curator: The organizer who selects and shares content, initiates SBT badge minting events, and receives 30% of data revenue.

-

Participant: Readers joining the SBT minting event split 50% of data revenue equally. Other readers may freely consume content without participating or earning rewards.

-

Treasury: A protocol-owned pool belonging to the entire social network, receiving 20% of data revenue.

Within this system, the demand side funds the ecosystem, curators organize activities, and participants jointly mint SBT badges to build on-chain reputations. Revenue and cost flows are illustrated below:

Revenue originates from the demand side, raising a critical question: Why would marketers pay to access data? To scale, these aren't just crypto-native entities like exchanges or projects—they must include traditional advertisers.

According to public internet reports, average customer acquisition costs via Web2 channels are around $20. For advertisers to shift budgets to DeepGo, they need significantly better targeting efficiency and ROI—acquiring more precise customers at lower cost.

Take the paper "Decentralized Society: Finding Web3’s Soul" as an example. A curator launches an SBT badge minting event based on reading and learning about the paper. Suppose the data access price is set at $1 per record. If an advertiser believes readers of this paper align well with their product, they’d be willing to pay—as long as actual conversion rates exceed 5%, marketing ROI on DeepGo surpasses traditional methods.

Group-Buying Scenario Analysis

Assume a curator launches an activity to mint SBT badges on Polygon and covers gas fees for the first 400 participants. With an average fee of ~$0.05 per mint, total curation cost is ~$20. Below are revenue projections under different scenarios.

Optimistic Estimate

Total participants: 1,000. First 400 have gas fees covered; remaining 600 self-pay. Demand side pays $1 per data access.

-

Demand Side Cost: $1,000.

-

Curator Earnings: $1,000 × 30% – $20 = $280. ROI = 280 / 20 = 14x.

-

Each Participant: $1 × 50% = $0.50, plus potential token airdrops. First 400 incur no minting cost; latter 600 pay ~$0.05 each.

Neutral Estimate

Total participants: 400. Curator covers all gas fees. Demand side pays $1 per data access.

-

Demand Side Cost: $400.

-

Curator Earnings: $400 × 30% – $20 = $100. ROI = 100 / 20 = 5x.

-

Each Participant: $1 × 50% = $0.50, plus possible airdrops.

Pessimistic Estimate

Total participants: 100. Curator covers all gas fees. No demand-side payment for data access. Both curator and participants only mint SBT badges without immediate earnings.

-

Demand Side Cost: $0.

-

Curator Earnings: -$0.05 × 100 = -$5, i.e., a $5 loss.

-

Each Participant: $0, though may still receive future airdrops.

From a pure revenue standpoint, even in the worst-case scenario, the cost to the curator is limited to covering $0.05 per participant in gas fees. Meanwhile, both curators and participants gain value: they obtain exclusive SBT badges that contribute to long-term reputation building and unlock future opportunities such as airdrops. Crucially, anyone can act as a curator—permissionless and open-ended—so long as they weigh curation costs against potential returns.

Even if no immediate monetization occurs, the process itself fosters engagement and recognition of content value. Over time, repeated curation builds trust and quality signals, laying the foundation for sustainable user retention.

Product Insights

-

Pinduoduo

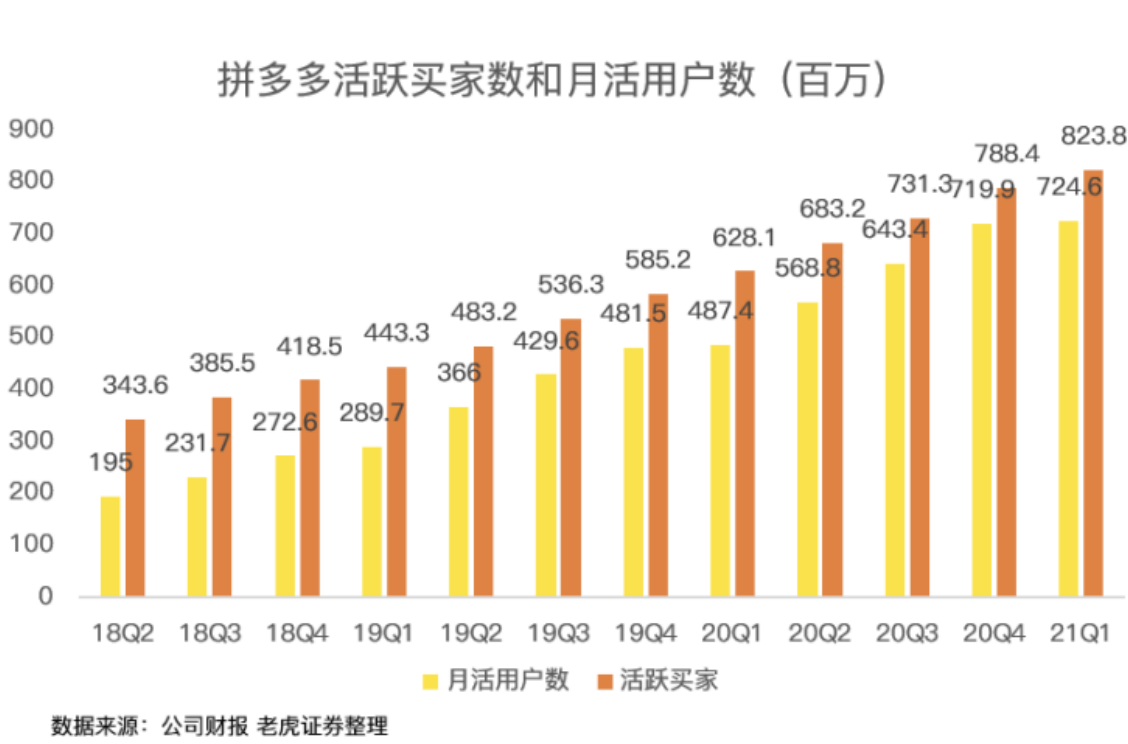

Pinduoduo reached a $100 billion market cap faster than any other company, achieving rapid monthly active user growth. Beyond its reputation for cheap goods, what truly sets it apart? Though the "invite friends to cut prices" mechanic might seem tacky, it strongly appeals to cost-conscious users, fueling continuous user acquisition.

Founder vision is a company’s primary competitive advantage. By redefining production relationships, Pinduoduo made a leap forward in internet economics. While other e-commerce players remained stuck in the "user searches for products" paradigm, Pinduoduo perfected a blend of decentralization, gamification, social psychology, and economic incentives.

-

Phaver

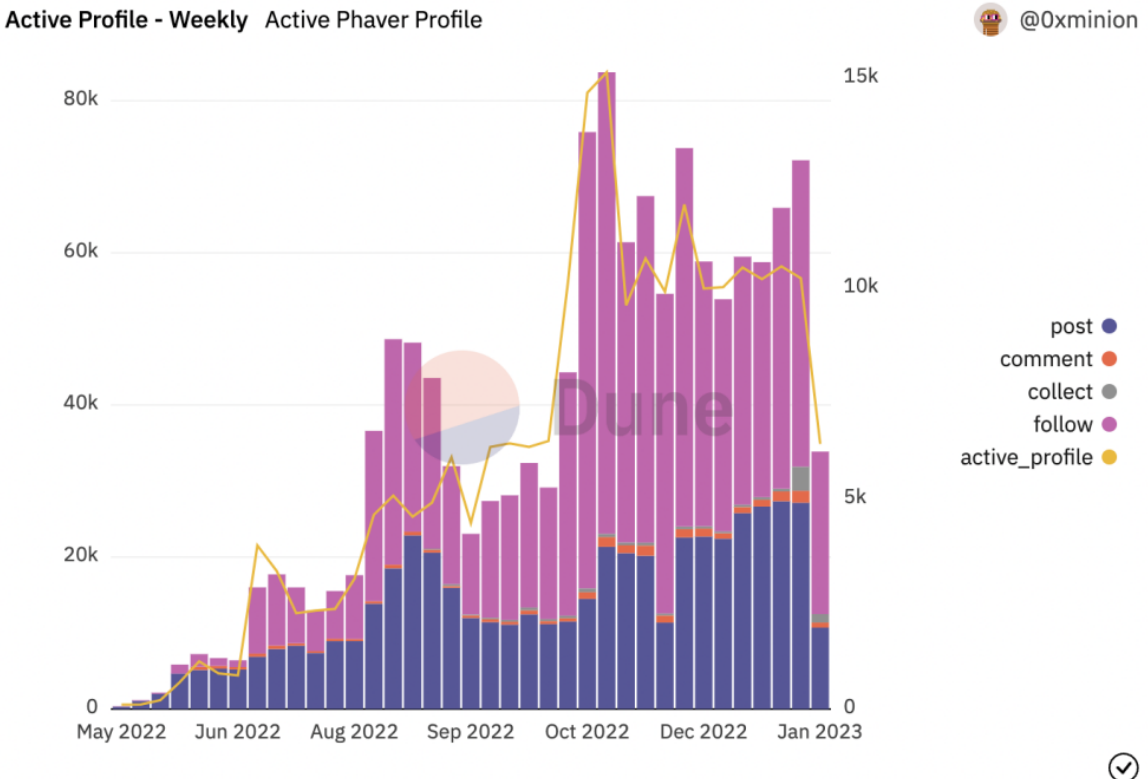

Users can support creators and content using real tokens, and all community contributors are rewarded. Through a staking-based voting mechanism, creators are incentivized to produce high-quality content consistently, helping the community surface the best information streams.

Based on on-chain data and user experience, content-centric use cases represent a natural entry point for Web3 apps—capable of driving explosive growth and high engagement. Since the early days of the information internet, fast access to quality information has always been a frequent, essential need.

-

Galxe

Galxe provides NFT-based marketing infrastructure, allowing projects to issue digital credentials that track user participation. It has already attracted 800,000 users and secured investments from several prominent institutions.

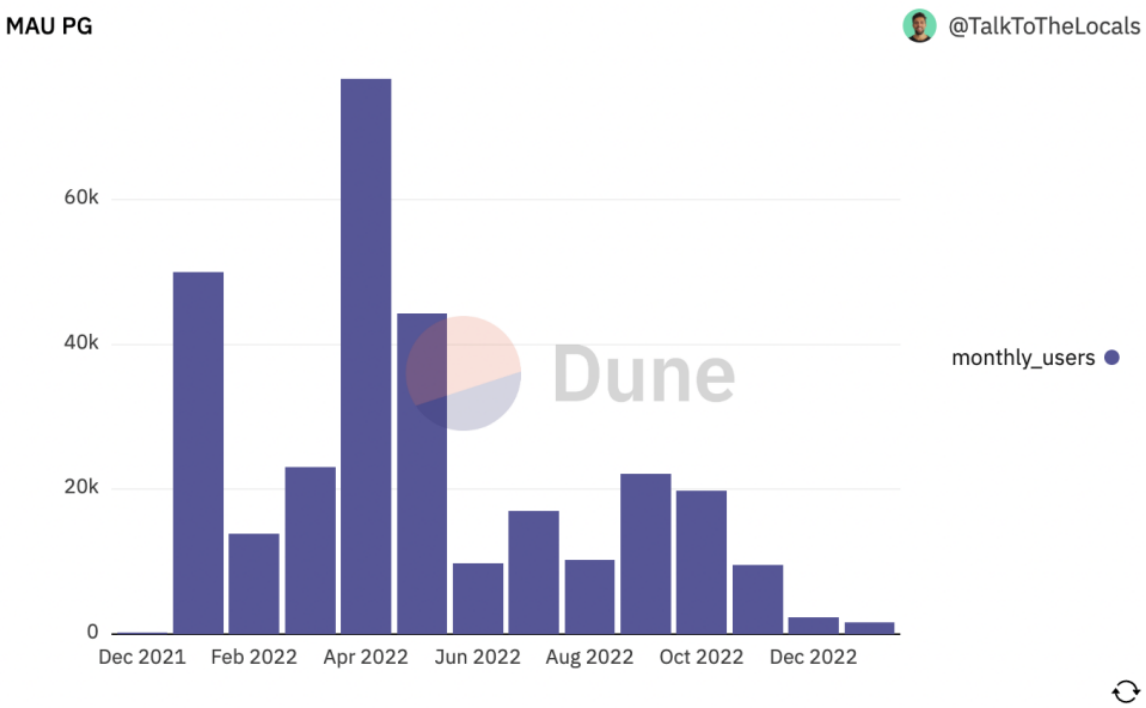

The above MAU figures reflect only Galxe’s activity on Polygon, excluding BSC, Ethereum, and other chains. Still, one trend is clear: user engagement has been steadily declining. Galxe’s curation model heavily depends on project-led campaigns—if projects stop issuing NFT tasks, existing users become inactive, resulting in poor retention.

Conclusion

GameFi in 2021 was a bull-market spectacle, but many games failed to retain users, and their economies devolved into Ponzi schemes. In contrast, DeepGo’s Web3 social framework aims to cultivate a healthy, self-sustaining curation market. Inspired by platform economies, we seek to replace centralized platforms with transparent protocols, returning data ownership to users.

More precisely, DeepGo enables low-barrier, self-interested collective collaboration. Sharing content becomes a form of self-tagging. Group participation is the easiest form of social interaction—one anyone can join. Collectively minting SBTs creates structured datasets; once authorized, advertisers can pay to access these labeled audiences, reversing traditional marketing dynamics.

Unlike models dependent on single suppliers (e.g., project teams), curation in DeepGo is permissionless—anyone can become a content "agent." Through sustained curation and a stable incentive model, high-quality content rises to the top, enabling strong user retention. And if group activities promise significant profits, viral, exponential growth becomes inevitable—positioning DeepGo as a leading Web3 content marketing solution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News