Top 10 Predictions for DeFi and the Crypto World: SBTs, RWA Adoption, the Metaverse Returning to Focus...

TechFlow Selected TechFlow Selected

Top 10 Predictions for DeFi and the Crypto World: SBTs, RWA Adoption, the Metaverse Returning to Focus...

Top 10 predictions on DeFi and cryptocurrency for 2023 from crypto Twitter KOLs.

Written by: Ignas

Compiled by: TechFlow

Without further ado, let’s dive straight into my top 10 predictions for DeFi and crypto in 2023:

1. DeFi options narrative will gain massive attention when volatility returns

Here's why: Robinhood generated $363 million in net revenue from fees in 2021 ($52 million from stocks, $48 million from crypto, and $163 million from options).

For DeFi options to take off, UI/UX needs improvement and must be mobile-friendly.

Due to their complexity, there is significant knowledge asymmetry in options trading. This means whoever delivers a "DeFi Robinhood" could unlock massive revenue.

I’m watching $RBN, $DPX, $LYRA, $HEGIC, $PREMIA... but we’re not there yet!

2. The "modular blockchain" narrative

Modularity is the ultimate scalability solution for blockchains. Celestia, Mantle, and EigenLayer will become hot topics, though Cosmos, Polkadot, and Ethereum will also benefit.

Valuations of these new tokens will be high.

3. $ETH will outperform $BTC

Bitcoin’s narrative is tied to money printing, but money printing is currently on pause.

Ethereum’s performance depends on:

- Growth of L2/L3 networks

- Pure yield + EigenLayer re-staking

- DeFi and NFT activity

But the outperformance hasn't happened yet.

4. Increased adoption of Soulbound tokens

SBTs were introduced seven months ago by V. Buterin et al. to bring Web3 into real-world economics.

SBTs represent your real identity on-chain and are non-transferable.

Figure out how to speculate with SBTs, and you’ll succeed.

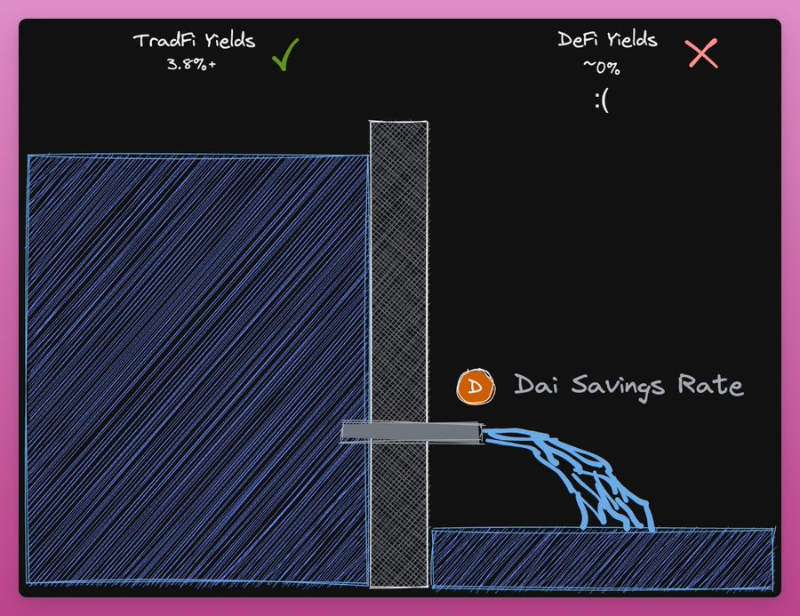

5. Real-world assets boosting DeFi yields

For example, Maker is discussing a DAI savings rate, so part of TradFi yields will flow to $DAI holders. More protocols will adopt TradFi/RWA to offer higher yields.

6. Fierce competition among DEXs will drive business model diversification

Most DEXs started as Uni V2 forks across different chains.

In 2022, they added new features and expanded onto other chains—PancakeSwap to Ethereum, Trader Joe to BNB Chain, etc.

With the rise of DEX aggregators, capital efficiency in spot markets becomes critical for survival.

To succeed, DEXs will launch new features beyond trading to diversify and differentiate themselves. Also, the Uni V3 license expires in April, so we’ll see V3 forks—and perhaps even Uniswap V4.

7. Renewed interest in metaverse/VR

Reports suggest Apple is launching "Reality Pro," a VR headset that could reignite the decentralized metaverse dream in crypto. Crypto projects launching successfully on App Store/VR platforms may achieve major success.

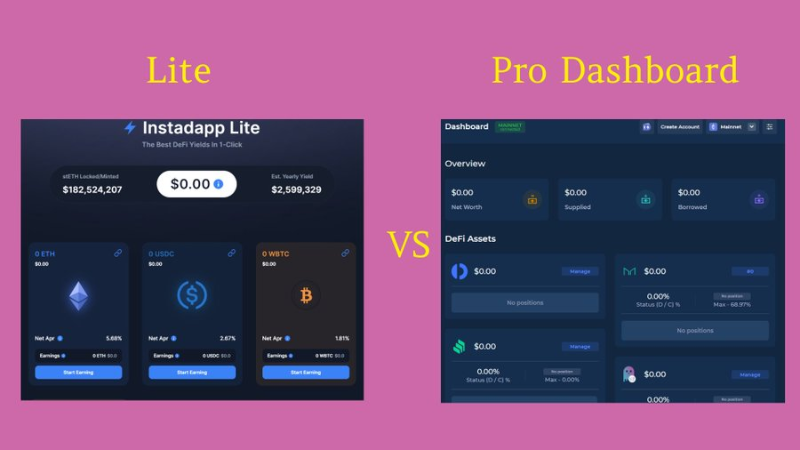

8. Growth of simplified versions of DeFi

DeFi has become increasingly complex and unwelcoming to new users. To attract newcomers, protocols will introduce one-click simplified versions of their core functions.

Examples include Instadapp Lite and Oasis Earn.

9. At least one more major Web2 company will integrate NFTs

Reddit succeeded in showing how NFTs can go mainstream. Other Web2 companies will quietly introduce them, possibly without users even realizing they're using NFTs.

Teams like Polygon are making this happen.

10. Arrival of next-generation hardware wallets

2022 taught people the importance of self-custody—but it’s still not easy.

Ledger Stax and Keystone have made improvements, and other wallets are coming too—but I hope to see seedless recovery, better dApp integration, and vastly improved user experience.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News