In-depth Analysis of DeepGo's Ideological Origins and the Path to SocialFi

TechFlow Selected TechFlow Selected

In-depth Analysis of DeepGo's Ideological Origins and the Path to SocialFi

DeepGo is a highly flexible SocialFi product, like LEGO blocks, continuously connecting on-chain information.

Original Author: Zijie, Core Contributor of DeepGo SocialFi

DeepGo is a highly flexible SocialFi product, like LEGO blocks, continuously connecting on-chain information.

As Apple co-founder Steve Jobs once said: "you have to trust that the dots will somehow connect in your future." From "Smart Money Discovery" to "Tool for DAO Inspirations," DeepGo paints the SocialFi world like a vast canvas—connecting dots into lines, and lines into surfaces.

First, let’s share an introduction and review from an investor after internal testing:

Getting started with DeepGo is simple, but once you begin exploring, it's easy to become deeply engaged. After trying it out, I found the product both innovative and highly valuable, and I'd like to introduce and share it with others.

1. Onboarding Experience with DeepGo

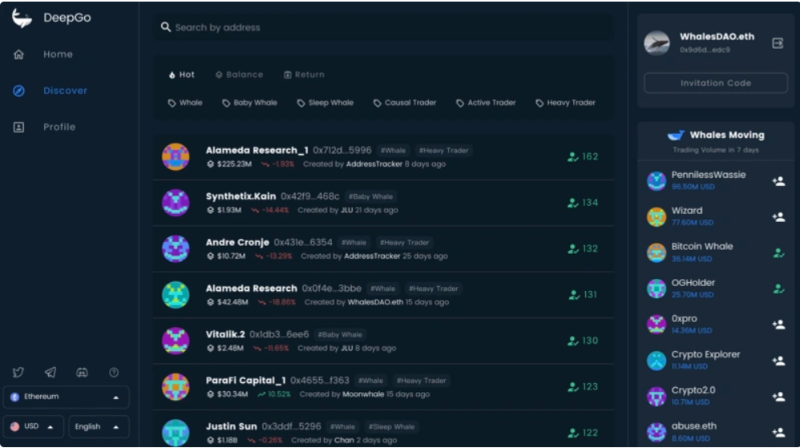

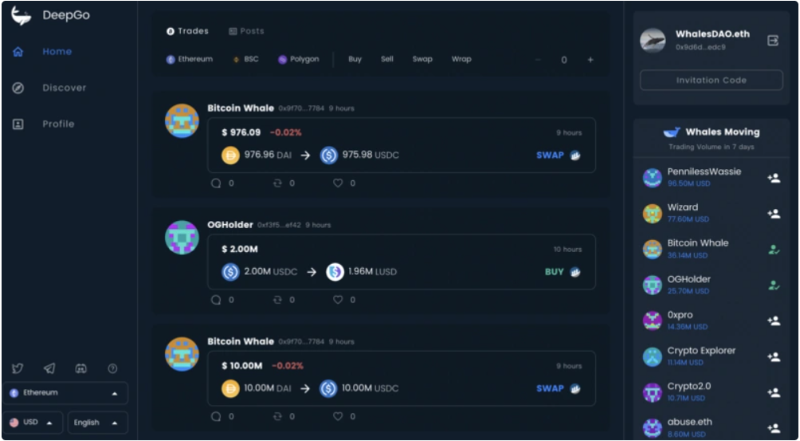

In terms of process, simply connect your wallet to log in. The system automatically creates your Profile and analyzes the performance and profit forecasts of your on-chain investment portfolio. Currently, login and registration require an invitation code; without one, users can only browse Profiles created by early adopters.

The DeepGo team made a smart decision by allowing users to create Profiles for other addresses. There are already many user-created Profiles for well-known funds and industry OGs. By following these whales, users receive targeted notifications about their trading activities. If you have insights or opinions on whale strategies or specific trades, you can comment and share them, engaging in discussions and learning with other investors.

Admiration for top performers is inherent to the industry. In the current market environment, everyone wants to know what the big players are doing. Blockchain data is authentic and tamper-proof, making whale activity alerts both valuable and practical. While some existing asset management platforms offer similar features, DeepGo stands out with its quantitative analysis and high-value visualizations.

2. DeepGo's Data Structure

Overall, DeepGo’s design reflects composability and structured thinking, curated through social interaction. DeepGo builds Profiles based on addresses, with core components including tokens, trade history, and post history. In this sense, a Profile represents a collection of a user’s on-chain reputation.

Currently, relationships between Profiles are loosely connected. Based on the main components, users can follow, repost, comment, and like each other’s content, creating significant social value.

3. Expandability

Through conversations with DeepGo’s designers, I learned that the current product primarily focuses on building social relationships and establishing reputations based on on-chain strategies—simple yet explosive in potential. In the future, it aims to build stronger connections for collaborative on-chain strategies, uniting creative strategy-driven investors as a social collaboration tool for DAOs. If “Address as a Service” is realized and trust-based reputations are established between Profiles, expansion into DAO-managed funds and liquidity protocols becomes highly feasible.

In early 2021, after three years in cryptocurrency quantitative investing, I began developing a consumer-facing investment analytics product named "DeepGo." The name was inspired by DeepMind, the team behind AlphaGo—the AI that mastered Go—reflecting our shared goal of enhancing collective intelligence through technology.

Initially, DeepGo was just a crypto quant strategy analysis tool. However, after extensive research into DeFi and discussions with investment institutions, our team evolved it into a composable SocialFi product.

The SocialFi sector is poised for takeoff, and DeepGo’s beta version has already entered closed testing. How did we enter this rabbit hole ahead of time? In this article, I’ll explore the motivations behind DeepGo and clarify its future path, divided into three parts:

-

Product Inspiration

-

Underlying Philosophy

-

Roadmap

Product Inspiration

Dune Analytics

Two years ago, while analyzing on-chain data for the stablecoin DAI, I first experienced Dune Analytics—and became hooked. Dune Analytics later faced competition from Nansen. As of December 2021, Nansen’s latest equity valuation reached $700 million, while Dune Analytics was valued at $1 billion. Personally, I believe Nansen is overvalued and Dune Analytics undervalued.

Both are excellent data analytics products providing investment strategy insights. However, on-chain data is inherently transparent. Nansen operates under a closed model, monetizing by offering Smart Money insights to subscribers—profiting mainly from information asymmetry. In contrast, Dune Analytics adopts an open approach, leveraging UGC (user-generated content), enabling users, projects, and communities to create valuable dashboards. Many projects now use Dune Analytics dashboards to display financial reports—for example, Redacted, a leading DeFi 3.0 project—validating Dune’s strong economic externalities.

Of course, Dune Analytics has room for improvement. Although it lowers barriers via modular design, lighter content would be more accessible to average users. Overall, Dune Analytics’ open model has gradually turned it into industry infrastructure. It’s only missing a token launch—and upon launching, its valuation could easily quintuple.

Notion

Notion has profoundly influenced DeepGo—it’s the most surprising Web2 product I’ve used in years. While note-taking and content creation aren’t novel concepts, Notion’s extreme flexibility made it a pioneering product. It received consistent praise across social media, largely because user freedom fosters immense satisfaction. Today, many users build personal websites using Notion—no coding required.

In October 2021, Notion surpassed 20 million users, with a valuation of $10 billion—five times higher than a year earlier. In many ways, Notion—with its flexible composability, open collaboration, and decentralized ethos—immerses participants in thematic teamwork, making it the closest existing product to a “metaverse.”

Many DAO communities use Notion for coordination and knowledge sharing, improving governance efficiency. For instance, members of the DeepGo community created WhalesDAO on Notion, enabling distributed research and investment based on on-chain data. Other notable examples include BanklessDAO. We can expect even more DAO communities to emerge on Notion in 2022, much like how Discord attracted crypto professionals through its decentralized design.

Underlying Philosophy

LEGO-Style Composability

DeFi’s greatest value lies in composability—the ability for innovations to compound. This manifests in two key ways:

-

When internal elements of a product are highly modular and composable, they greatly stimulate user creativity, thereby enhancing collective intelligence. A prime example is Furucombo, invested in by Multicoin Capital, where users combine various yield-generating protocols to build automated earning strategies.

-

When a product itself becomes a component within the broader ecosystem, it gains significant economic externalities. Open models create the widest moats. Examples include Mirror, the on-chain blog, and Dune Analytics—users focus solely on content creation, which then becomes ubiquitous, plug-and-play material for aggregators, projects, and communities.

During DeepGo’s design phase, we adhered to the principle of being a “Tool for DAO Inspirations,” maximizing composability through nesting minimal units.

-

Identity Unit: Profile identity. Building on-chain reputation around an address—blockchain addresses shouldn’t just be cold strings of characters but representations of individual reputation systems. Within the blockchain economy, a Profile serves as an identity unit. Through “Address as a Service,” every individual connects with other Profiles.

-

Social Unit: Post artifacts. Based on Profiles, users generate Posts. Since Profiles consist mainly of tokens and transactions, most user-generated Posts revolve around investment opportunities. Compared to other SocialFi platforms that emphasize general content, focusing on investment themes fosters more sustained user engagement.

-

Social Aggregation: Board panels. Initial user connections form through Posts, but to build impactful, strong ties, collective collaboration is essential. DeepGo’s Board panel draws inspiration from Notion’s team collaboration mode, treating social units as databases. Every creator can initiate a decentralized research DAO, forming high-quality circles with community followers.

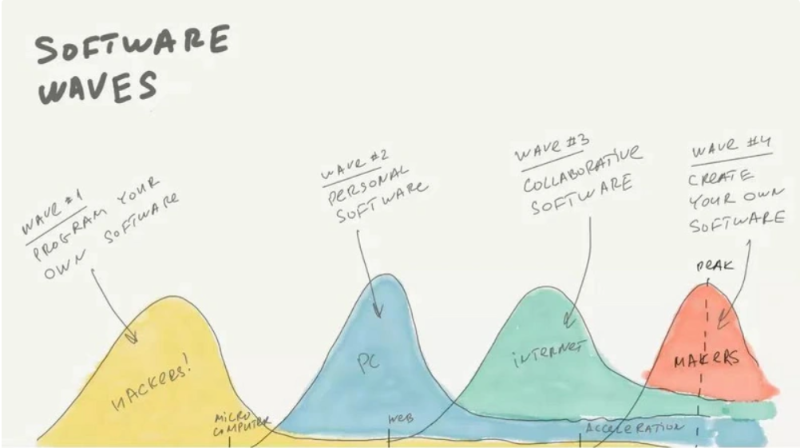

Software Waves

Looking back at software history, a clear trend emerges: decentralization and empowerment of individuals are central themes.

-

First Wave: Early microcomputers, primarily programmed by professional coders for personal use.

-

Second Wave: PC era, commercial personal software such as the Office suite.

-

Third Wave: Internet era, collaborative software such as Google Workspace.

-

Fourth Wave: Empowering individuals, enabling users to create personalized software, liberating productivity through organizational transformation—exemplified by Notion as a “post-Office” era product.

Here’s a bold prediction: Web3 products will represent the true fourth wave—not only continuing the trend of empowering individuals but also, when fully integrated with creator economies, enabling more ordinary people to benefit. This will spark the rise of individual intellectual economies, with the “Create to Earn” model becoming the core of future platforms.

Roadmap

From the evolution of Web2 social products, we know that surviving the “valley of death” gives social platforms natural moats—network effects amplify winner-take-all dynamics. But before overcoming this hurdle, many social products fade quickly. According to a prominent Silicon Valley VC, if a social product retains 20% of its users after six months, it may succeed—highlighting the critical importance of user retention.

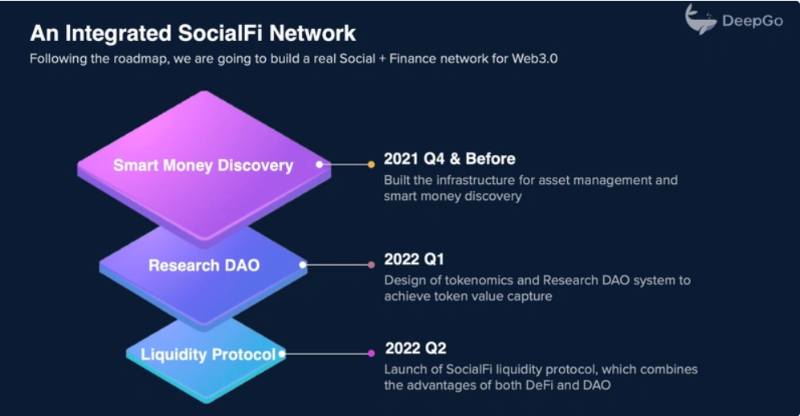

In designing DeepGo’s roadmap, we prioritized early user retention, focusing on seamless user journeys to complete the social loop. Later stages rely on growth engines to drive rapid scaling. Thus, we designed a three-layer progressive architecture, developed step-by-step according to timeline.

User Journey

After connecting their wallet, regular users can easily explore DeepGo’s Social world. Guided by the trigger-action-reward-investment cycle, users experience intuitive flow. Below are beta features already implemented:

-

Trigger: Discover on-chain whales, comparing them by popularity, assets, and returns. Well-known institutional and KOL Profiles are already available for exploration.

-

Action: Follow whales of interest to subscribe to their on-chain trades or insights, and engage via reposts, comments, and likes.

-

Variable Reward: During tracking or socializing, discover unexpected wealth-generating insights and gain high-value knowledge.

-

Investment: Engage in deep social interactions and join high-quality private DAO circles.

Growth Engine

In the current beta version, user retention among testers is high. Future upgrades will continue prioritizing user experience—each update tightly linked, all centered on building on-chain reputation. Once reputation is established, switching costs increase significantly, creating a wide moat that latecomers struggle to breach.

Q1 2022 – On-Chain Circles

During social interactions, users identify knowledgeable, professional investors. For deeper engagement, they move into more private on-chain circles. Here, DeepGo acts as a social research tool serving DAOs.

-

Trigger: Through on-chain trading-based social interactions, users recognize capable Profiles and seek deeper connections to uncover wealth opportunities early.

-

Action: Mint an NFT to join a professional investor’s DAO circle.

-

Variable Reward: Within the on-chain circle, enhance knowledge and skills through collective collaboration.

-

Investment: Time and effort.

On-chain circles go beyond Web2-style exclusive groups merely huddling together. Instead, they leverage on-chain reputation to enhance collective intelligence. Using Profile data provided in the current beta as a database, members can easily create investment strategies.

On-chain circles aren’t standalone projects—they’re pivotal pillars of the DeepGo SocialFi ecosystem, seamlessly integrating current on-chain social interactions with ultimate on-chain investments. They serve as social collaboration tools for various research DAOs, primarily used by communities, projects, and investors.

Q2 2022 – SocialFi Liquidity Services

From a quant investor’s perspective, blockchain’s most compelling applications lie in finance. Hence, our SocialFi emphasizes “Finance.” DeepGo’s ultimate form is DAO + DeFi—social features exist solely to build on-chain reputation, realizing “Address as a Service,” with the final goal of improving liquidity efficiency.

Current DeFi growth has stalled. Past liquidity solutions suffered from over-mining and lack of loyalty. By combining DeFi’s wealth-generation power with Social DAOs’ network effects, DeFi could enter a new “summer”—presenting massive opportunities for SocialFi.

Binance’s CZ once stated that SocialFi and GameFi are key industry drivers. The SocialFi赛道 holds great promise and has become a hot topic in the Web3 era, attracting bets from top global institutions. Yet, challenges remain even greater. Since 2017, many developers have attempted SocialFi, but most vanished quickly due to flawed token mechanisms, inefficient content curation, and—most importantly—insufficient foundational infrastructure and poor planning.

Product Moat

In Web2 internet investing, understanding a product’s moat is essential. As a promising Web3赛道, SocialFi demands thorough analysis. After studying numerous products, I conclude that the strongest moat in Web3 is decentralization. Decentralized products enjoy strong openness; when combined with robust token economics, they achieve unshakable competitive advantages.

DeepGo is a highly flexible SocialFi product, like LEGO blocks constantly linking on-chain information. As Apple co-founder Steve Jobs said: “you have to trust that the dots will somehow connect in your future.” From “Smart Money Discovery” to “Tool for DAO Inspirations,” DeepGo paints the SocialFi world like a vast canvas—connecting dots into lines, and lines into surfaces.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News