A Deep Dive into Stader: Will LSD + Real Yield Drive a Surge in Token Value?

TechFlow Selected TechFlow Selected

A Deep Dive into Stader: Will LSD + Real Yield Drive a Surge in Token Value?

Everything seemed so flourishing.

Written by: Riddler

Compiled by: TechFlow

LSDs are a new primitive in crypto. This also gives $SD fundamental support through a combination of catalyst + narrative.

TL;DR

Stader is a liquid staking protocol born from Terra.

It now exists across 6 blockchains and plans to expand to even more. Progressive decentralization is also part of its governance roadmap.

$SD Token Overview

- Price: $0.78

- Market Cap: $79 million

- Circulating Supply: 10 million

- Total Supply: 150 million $SD

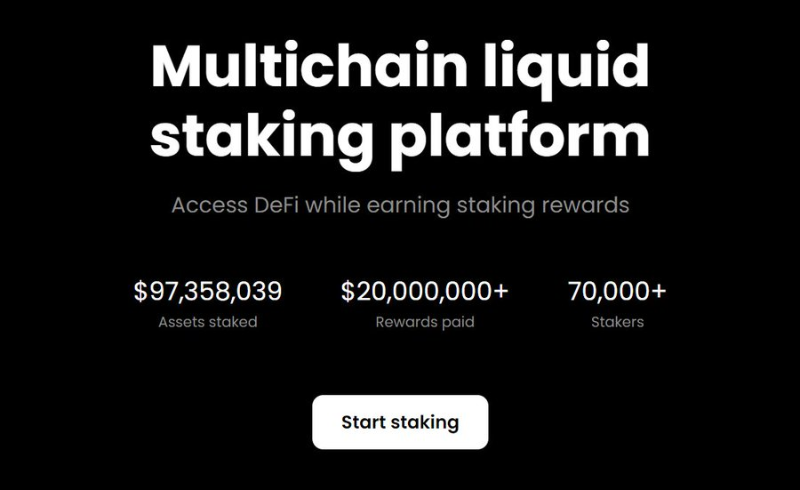

- TVL: $126 million

$SD went through a tough period following the $LUNA collapse, but has recently staged a comeback by introducing new utility for the token.

Cross-chain staking presents several challenges:

-

It quickly becomes complicated, leading users to prefer staying on a single chain or delegating their staking to someone competent.

-

Delegation also transfers your voting rights to the delegate, undermining decentralization.

Stader offers a convenient liquid staking solution that addresses both issues—without adding complexity and while maintaining strong APRs.

Since its founding during the Terra era, Stader has undergone multiple audits, initially with CertiK and Zinstitute. Today, HalbornSecurity, Peckshield, and BlockSec serve as Stader’s primary auditing firms.

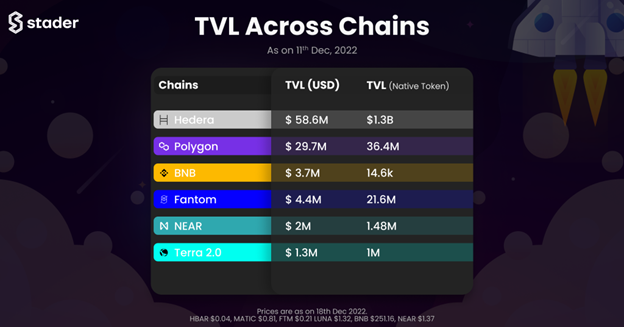

Currently, 6 chains are supported, with at least 3 more in development:

Hedera - Polygon - Binance - Fantom - NEAR - Terra.

Upcoming launches include $ETH - $AVAX - $SOL.

Across these current 6 chains, Stader’s total TVL has reached nearly $100 million, with over half staked on Hedera. Adding $ETH, $AVAX, and $SOL could significantly boost this number.

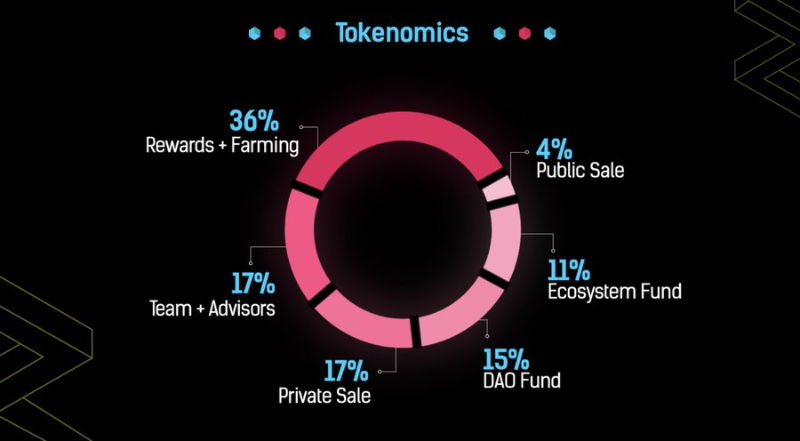

Tokenomics

On March 14th and 15th, $SD conducted a public sale on CoinList. The ICO price was 4.5 USDT, raising approximately $23 million. The maximum supply is capped at 150 million $SD.

Key Utilities of $SD Token

➡ Staking for passive income

➡ Stake $SD to earn a share of protocol revenue

➡ Governance within Stader.

After the Terra collapse, new plans have been developed to provide additional use cases for $SD.

Roadmap

Stader has many ambitious plans ahead. Let’s walk through them step by step.

Support for more chains—including the three mentioned above, plus Move-based chains such as Aptos and Sui—will open up massive opportunities for increasing TVL.

The next chain to launch will likely be $ETH, and there's a detailed plan outlining how everything will unfold. Stader is building strong partnerships with AAVE, Venus, Beefy, Quickswap, and others.

MaticX and $BNB vaults represent promising future directions, potentially delivering solid APRs for the liquid staking platform. $SD LPs and single-sided $SD staking are also coming soon, further enhancing these returns.

A series of new $SD utilities aim to progressively achieve decentralized governance, with hints that real yield mechanisms will follow in the future.

Real yield will mark the third act in an ongoing decentralization journey—governance being the first act.

Currently, SD is in Stage 2 of 3, having already introduced a governance council and voting snapshots.

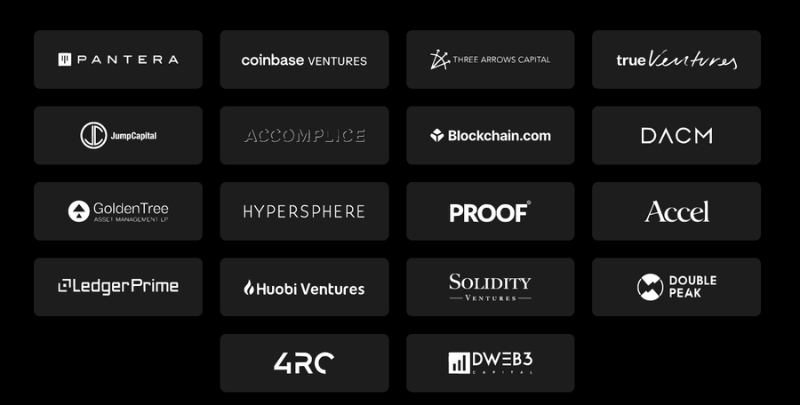

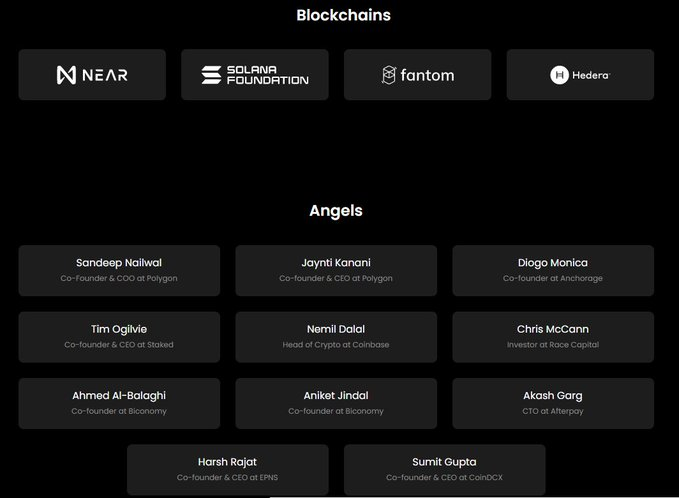

Backers and Partners

Stader has earned the trust of numerous backers and major CEXs including Bybit, OKX, Gate, Huobi Global, and others.

Many “angels” also support $SD, some of whom come from the Polygon team.

Thanks to such extensive preparation and planning, SD has bottomed out and rebounded—everything now looks bright and promising.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News