Interpreting the Ideology of Web3: Cryptography, Distributed Storage, and Game Theory

TechFlow Selected TechFlow Selected

Interpreting the Ideology of Web3: Cryptography, Distributed Storage, and Game Theory

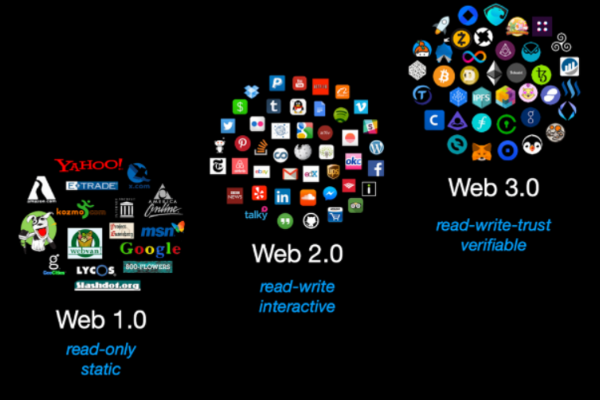

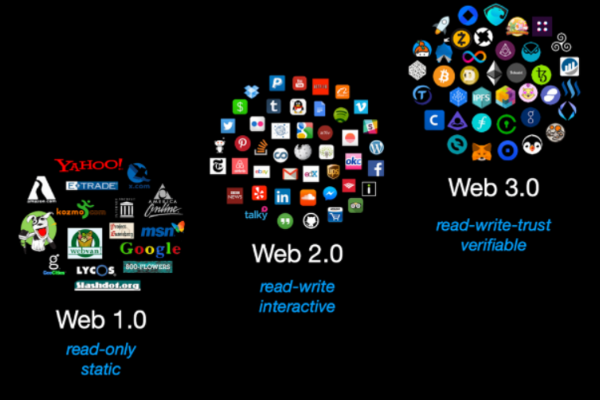

At its core, Web3 is an ideological revolution enabled by technological evolution.

By Fishylosopher, web3.com ventures

Authorized by TechFlow, translated and published by TechFlow volunteer Arena Wang.

In homage to the Socratic method.

The Evolution of the Web (Image source: Protocol Labs)

This article offers a "vertical" introduction to Web3 projects from an ideological perspective, outlining three foundational principles of Web3.

Preface

There are already countless articles explaining Web3—so why write another? Because as both a programmer and a philosopher, Web3 deeply fascinates me. At its core, it is a technological evolution that enables an ideological revolution.

The key technical foundation of Web3 is blockchain. Blockchain is to Web3 what the steam engine was to the Industrial Revolution—a foundational innovation that drives new mechanisms into existence. Fundamentally, blockchain is a publicly visible, append-only data structure. Its uniqueness lies in combining three distinct fields: cryptography, distributed systems, and game theory [1].

Each of these three fields contributes one foundational principle to the ideological evolution of Web3. Cryptography enables trustlessness, distributed systems enable permanence, and game theory enables spontaneity. In this article, I will use these three ideologies as a thread to connect numerous Web3 projects, linking technological innovation with philosophical implications.

Cryptography: Trustlessness

Long ago, “crypto” stood for “cryptography,” not “cryptocurrency.” In a double entendre sense, cryptography has been—and always will be—the key technology underpinning cryptocurrencies. Public-key cryptography (or asymmetric encryption) allows users to send data anonymously without revealing it.

Whether building decentralized or centralized financial systems, data encryption plays a crucial role. No one wants snoopers accessing or stealing their funds. Imagine discovering your bank takes no measures to protect personal financial information, allowing everyone to view every transaction you've ever made—that would be horrifying.

Data encryption becomes even more critical in decentralized financial systems like Bitcoin. There’s no central entity to sue in court. If your funds get hacked during a transaction, they’re gone—permanently. What bad luck! This is precisely why the Bitcoin protocol safeguards public-key encrypted transactions so rigorously.

For a transaction to be considered valid, users must provide a “digital signature”—a cryptographic hash created with their private key and verified using their public key [2]. Furthermore, the user’s wallet address—the destination for outgoing funds—is itself a hash of their public key. This adds an extra layer of authenticity, proving the signer owns the wallet. Even before a transaction, the public key remains hidden from outsiders. These small design choices in the Bitcoin protocol illustrate how blockchains operate on a foundation of trustlessness: trust the process, not people. After all, math is reliable—people aren’t.

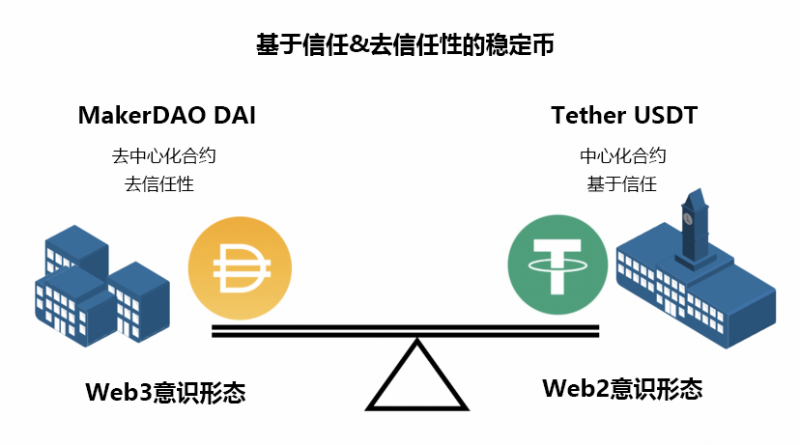

Trustlessness serves as a critical criterion to distinguish ideologically Web 2 projects from genuine Web3 projects. Consider two stablecoin projects: Tether’s USDT and MakerDAO’s DAI. Both aim to peg cryptocurrency to the U.S. dollar at a 1:1 ratio but achieve it through entirely different means.

Trust-based vs. Trustless Stablecoins (Source: author's illustration)

Tether’s model is simple: whenever I give Tether $1, they issue me 1 USDT, promising I can redeem 1 USDT for $1 anytime. The problem? I must trust that Tether won’t hand me worthless USDT tokens and abscond with my dollars [4]. Thus, Tether is ideologically a Web 2 project—it relies on my trust. I must believe Tether will safeguard my original dollars and not vanish overnight [5].

In contrast, MakerDAO’s DAI is ideologically a Web3 project and arguably one of the most successful decentralized initiatives.

DAI is maintained via MakerDAO’s over-collateralized lending protocol. To borrow 1,000 DAI from MakerDAO, I must lock up ETH worth more than $1,500 as collateral [6]. For the DAI stablecoin, these “over-collateralized loans” serve as solid backing.

When DAI’s price drops below $1, people buy it at a discount on exchanges to repay loans, reducing supply and pushing the price back up. Conversely, if DAI exceeds $1, users deposit more ETH to mint additional DAI. Rising DAI supply and ETH collateral issuance bring the price back down to $1 [7].

Users don’t need to trust a single centralized entity like Tether. Instead, they can verify whether the decentralized MakerDAO smart contract functions as intended. If desired, one could even copy the contract code into their own environment and run tests to confirm its behavior. This model maximizes transparency—a hallmark example of Web3 ideology [8].

More importantly, decentralization is a means, not an end; trustlessness is the goal. Decentralization alone does not constitute a “first principle.” When economies of scale exist, decentralization makes little sense. Consider garbage collection: imagine each of us driving weekly to a landfill instead of relying on centralized garbage trucks. That would create unnecessary inconvenience. Hence, decentralization isn’t a panacea.

Rather, decentralization only makes sense when the benefits of trustlessness, permanence, and spontaneity outweigh the lost economies of scale. Returning to trustlessness: in garbage collection, participants have minimal conflict of interest. No one cares what’s in your trash—it rarely contains your deepest secrets or most prized possessions. Therefore, trusting a centralized entity (like a municipal garbage service) carries low risk, and the economic gains from centralization far exceed the costs.

But in banking and financial transactions, the opposite holds true. Storing money in banks or safes offers negligible economies of scale. Meanwhile, many stand ready to steal your money. Thus, decentralized finance ensures that the advantages of a trustless network vastly outweigh the costs. This is why Bitcoin, as a blockchain project, makes perfect sense.

Distributed Systems: Permanence

At its core, scaling brings immense economic rewards—but also significant security risks. Single points of failure are fragile and threaten data permanence. Just as animals reproduce to increase DNA survival in uncertain environments, humans replicate data across multiple locations and nodes to make it resilient against bugs, hackers, and system failures. Compared to storing data on a single machine, decentralization achieves permanence by replicating identical data across multiple machines.

However, coordinating data across distributed systems is challenging [9]. How do you handle data corruption or malicious actors in a distributed network? Modern blockchains adopt the core concept of “Byzantine Fault Tolerance” (BFT), meaning the blockchain continues operating correctly as long as malicious nodes remain below one-third of total network nodes [10].

When a node proposes appending a block to the blockchain, it must collect signatures from at least two-thirds of validator nodes to be deemed valid. This signature-gathering process is called “consensus.” While blockchains implement consensus differently (e.g., Bitcoin’s PoW, Ethereum’s PoS, Solana’s PoH), they all fall under BFT. Crucially, as node count increases, BFT blockchains gain decentralized scale effects—making it harder for attackers to control enough nodes to compromise consensus.

With this, we’ve established how distributed systems in blockchains achieve “permanence.” Now we ask: what information should be stored on blockchains to ensure permanence?

Reusing our garbage analogy: you clearly don’t care if your trash disappears—in fact, you prefer it to. Yet you certainly don’t want your money vanishing overnight. Financial records (like the Bitcoin ledger) are thus obvious candidates for permanence. But it goes further. Religions, legends, sculptures, monuments—humans possess an innate drive to create permanence amid impermanence [11]. Personal websites, photo albums, gaming achievements—all digital memorabilia reflect this yearning for eternity. Such items may even matter more than money.

Currently, we store such data on hard drives or cloud backups—but these are fundamentally unreliable. What if the hard drive fails? What if Google or Dropbox gets hacked—or steals your data? These Web 2 solutions rely on trust. Companies can censor or delete your data at will. Web3 solutions powered by distributed consensus are fundamentally different. This is the promise of the “permaweb”: preserving your most precious digital assets indefinitely, free from censorship [12].

One of the most prominent permaweb projects is Arweave, which promises permanent, distributed storage for a small upfront fee. Though inspired by blockchain design, Arweave differs technically.

Fundamentally, blockchains are one-dimensional linked lists, where each block points only to the next. Arweave uses a “blockweave” structure, where each “block” can reference multiple prior blocks, forming a two-dimensional graph—akin to a file system tree on your computer [13]. This improves content retrieval efficiency. For consensus, Arweave employs “Proof of Access,” ensuring nodes randomly access data stored on the blockweave.

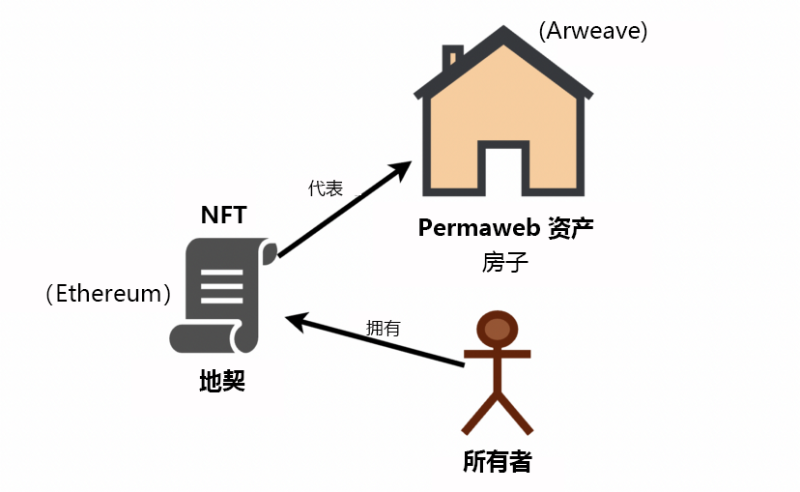

NFTs and the Permaweb (Source: author's illustration)

Unsurprisingly, Arweave and other decentralized permaweb protocols (like IPFS) naturally align with non-fungible tokens (NFTs) [14]. If permaweb assets on Arweave or IPFS are houses, NFTs are the deeds. Anyone browsing or passing by can see the “house.” But only the deed holder truly owns it. When selling, the owner transfers only the deed—not altering the house itself. Owning the NFT deed makes asset ownership and transfer practical and cryptographically secure.

Thus, NFTs are more than just “crypto baubles”—they serve practical roles as digital property deeds. However, a deed is only as valuable as the asset it represents. So let’s look beyond Bored Apes to explore other NFTs.

Game Theory: Spontaneity

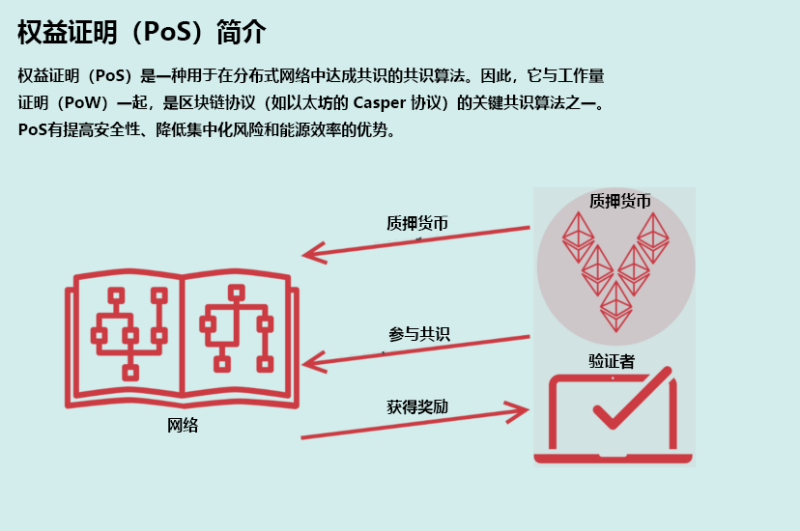

The third foundational principle of Web3 is spontaneity, enabled by game theory. People don’t become network nodes out of altruism or kindness—they do it for profit. This game-theoretic spontaneity manifests across Web3, most notably in the “Proof-of-Stake” (PoS) consensus models underpinning major blockchains like Ethereum, Polygon, and Binance Smart Chain (BSC) [15].

As shown, you stake a certain amount of tokens (e.g., 32 ETH on Ethereum) to become a validator and participate in consensus. If you behave honestly, you earn staking rewards (~10% APY). But if you act maliciously, your staked tokens (32 ETH) are slashed, and you lose all rewards. Thus, game theory strongly incentivizes active, loyal participation.

Introduction to PoS (Image source: https://fourweekmba.com/proof-of-stake/)

Another strong example of game-theoretic spontaneity is decentralized exchanges (DEXs) like Uniswap and Curve. They use smart contracts as crypto swap stations.

Where do DEXs get their liquidity? From volunteers—liquidity providers (LPs). LPs contribute their own crypto to trading pools. In return, they earn a share of transaction fees—effectively collecting interest from the pool [16].

Critically, unlike Web2 platforms like Google and Facebook imposing algorithms on users, no one forces you to stake on Ethereum or become a Uniswap LP. Participation is entirely voluntary—driven by the opportunity for substantial returns. Ideologically, Web3 communities are fully spontaneous. All community actions are fundamentally driven by game theory.

This game-theory-driven spontaneity extends beyond DeFi into the broader Web3 ecosystem, most visibly through decentralized autonomous organizations (DAOs). DAOs unite individuals around shared goals (e.g., ConstitutionDAO’s bid to purchase the U.S. Constitution) [17], enabling democratic voting via governance tokens, issuing tokens to track membership, and making collective decisions about resource use.

Unfortunately, truly decentralized, ideologically Web3 DAOs remain rare. Many projects merely issue governance tokens and claim DAO status. Yet if the founding company holds most tokens, the project remains centralized in practice—even with voting. Thus, despite a decentralized facade, these “pseudo-DAOs” remain ideologically Web 2.

Therefore, game-theoretic spontaneity provides another foundational criterion to distinguish Web 2 from Web 3 projects. The former features a single, centralized entity dictating user interaction; the latter enables users to democratically vote on collective decisions.

Conclusion

Web3 is still in its infancy, with much progress ahead. Yet we’re already glimpsing its revolutionary vision—an ideology built on trustlessness, permanence, and spontaneity.

Of course, Web3 faces structural challenges. What happens when a project’s company and community hold opposing views? Should the company override the community or relinquish control? How can blockchains bridge online and offline worlds? And a deeper question: are economic penalties (like slashing) sufficient deterrents? Do we need coercive enforcement? I’m confident future Web3 projects will offer better answers.

Yet one urgent, lingering question remains: What attitude should Web3 take toward Web2? How will centralized and decentralized internet coexist? Ideologically, Web3 projects are spontaneous. They depend on self-motivated participants, incentivized by game theory, actively maintaining decentralized communities. Without voting, participation, and commitment, DAOs dissolve or become de facto centralized entities. After all, democracy fails without voters. But everyone’s time, energy, and effort are limited—not everyone cares about community governance. Often, people may prefer others to decide for them—it’s easier. Much of Web2’s appeal lies in AI algorithms making choices on users’ behalf.

Therefore, I envision a world where Web2 and Web3 coexist.

In areas we genuinely care about—communities, art collections, online games—people can actively engage in Web3 DAOs and benefit directly. Elsewhere, we can use Web2 solutions and AI systems to make decisions on our behalf. Most importantly, Web3 gives us a choice—a viable alternative. We can take control in what matters most, rather than letting an authoritarian AI dictate every aspect of daily life. Remember: in Web3, we needn’t trust anyone. We can be certain our actions won’t be erased, and we define our own priorities.

The wind of freedom shall blow.

References

[1] Prof. Dan Boneh, Stanford’s CS 251: https://cs251.stanford.edu/

[2] https://river.com/learn/how-bitcoin-uses-cryptography/

[3] Bitcoin Whitepaper: https://bitcoin.org/bitcoin.pdf

[4] About Tether: https://www.forbes.com/advisor/investing/cryptocurrency/what-is-tether-usdt/

[5] More on Tether controversies: https://www.forbes.com/sites/seansteinsmith/2022/08/28/crypto-accounting-matters-and-tether-is-finally-moving-in-the-right-direction/?sh=16a1241b72e3

[6] Coindesk: https://www.youtube.com/watch?v=J9q8hkyy8oM

[7] https://ethereum.stackexchange.com/questions/89328/how-does-the-dai-peg-to-dollar/102052#102052

[8] Vitalik Buterin on MakerDAO’s significance: https://www.youtube.com/watch?v=XlYyj0WFi9Y

[9] State Machine Replication: https://en.wikipedia.org/wiki/State_machine_replication

[10] Byzantine Fault Tolerance: https://decrypt.co/resources/byzantine-fault-tolerance-what-is-it-explained

[11] A fascinating exploration of this theme is British philosopher John Gray’s book “The Immortalization Commission”

[12] Introduction to Permaweb: https://arweave.medium.com/welcome-to-the-permaweb-ce0e6c73ddfb#

[13] https://arweave.news/what-is-arweave-ar/

[14] https://docs.ipfs.tech/how-to/mint-nfts-with-ipfs/

[15] https://wiki.polygon.technology/docs/home/polygon-basics/what-is-proof-of-stake/

[16] Introduction to Uniswap: https://whiteboardcrypto.com/uniswap-v3/

[17] ConstitutionDAO: https://coinmarketcap.com/alexandria/article/constitutiondao

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News