Analysis of Internal and External Driving Forces in the Digital Asset Industry and Evolutionary Logic

TechFlow Selected TechFlow Selected

Analysis of Internal and External Driving Forces in the Digital Asset Industry and Evolutionary Logic

"Only openness and permissionless systems can better promote diverse innovation, create fairer infrastructure, and drive circulation and prosperity within the on-chain ecosystem."

"Only openness and permissionless access can better promote diverse innovation, bring about fairer infrastructure, and drive circulation and prosperity within the on-chain ecosystem."

The digital asset industry has evolved over more than a decade—from an experimental social movement led by a small group of tech enthusiasts and idealists, through multiple cycles of boom and bust—into today’s emerging sector that draws attention and participation from governments, institutions, universities, communities, and individuals worldwide. Throughout this journey, it has been shaped by constant tensions among idealism, skepticism, wealth creation, bubble bursts, financial innovation, and regulatory compliance. Combined with broader macroeconomic trends, technological advances, and shifting regulations, these forces have created a fragmented, competitive, and self-evolving market.

From the perspective of native crypto practitioners, this article aims to analyze the core drivers of industry growth and its self-iteration processes and directions, explore potential investment models and frameworks, and develop preliminary tools for investment return analysis—enabling more objective and rational predictions of returns while effectively managing extreme risks.

#Table of Contents

Part 1: Internal and External Drivers of Digital Asset Industry Development

1.1 External Drivers

1.1.1 Sovereign Currency Trust Crisis

1.1.2 Societal Demand for Open Financial Systems

1.1.3 Financial Product Innovation as Social Experimentation

1.2 Internal Drivers

1.2.1 Attraction to Idealists: The Declaration of Independence for IT Geeks and Financial Investors

1.2.2 Pursuit of an Ideal Society: Democracy, Openness, Autonomy, Consensus, Privacy

1.2.3 Human Nature's Fundamental Needs: Greed and Speculation

Part 2: Evolution Logic and Direction of the Digital Asset Industry

2.1 Performance and Efficiency Driven

2.2 Financial Assets and Model Driven

2.3 Liquidity and Narrative Driven

2.4 Security and Privacy Driven

Part 3: Core Risk Patterns in the Digital Asset Industry

3.1 Trust Risks

3.2 Liquidity Drying-Up Risks

3.3 Compliance and Regulatory Risks

Part 4: Pattern Summary and Initial Model Construction

#1 Internal and External Drivers of Digital Asset Industry Development

The digital asset industry is highly controversial—each market bottom brings criticism and mockery, yet the sector consistently demonstrates resilience, growing stronger in the next cycle and generating greater wealth effects that attract even more participants. What are the core internal and external driving forces enabling continuous self-iteration and development?

1.1 External Drivers

1.1.1 Sovereign Currency Trust Crisis

Since the 2008 financial crisis, central banks around the world have entered a new era of quantitative easing. Bitcoin emerged as an alternative asset designed to hedge against currency devaluation caused by excessive money printing. Despite early skepticism and wild price swings casting doubt on its viability as a store of value or transaction medium, Bitcoin gradually became the benchmark reference point in the industry thanks to growing miner participation and consensus formation. The emergence of stablecoins like USDT further reinforced the role of certain digital assets as value transfer instruments.

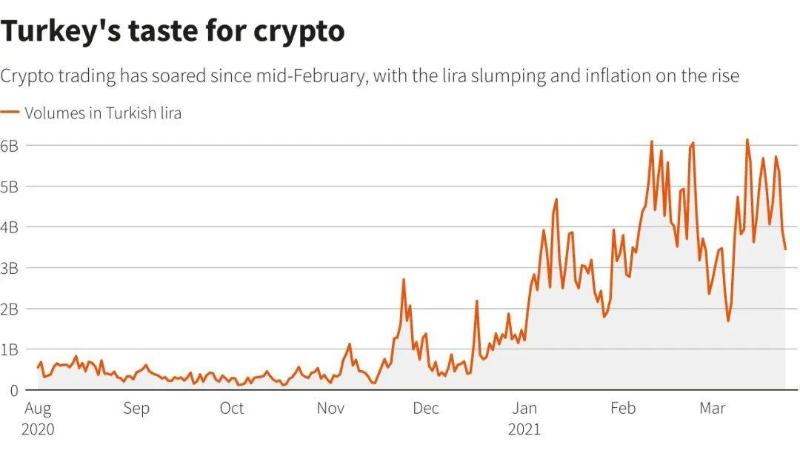

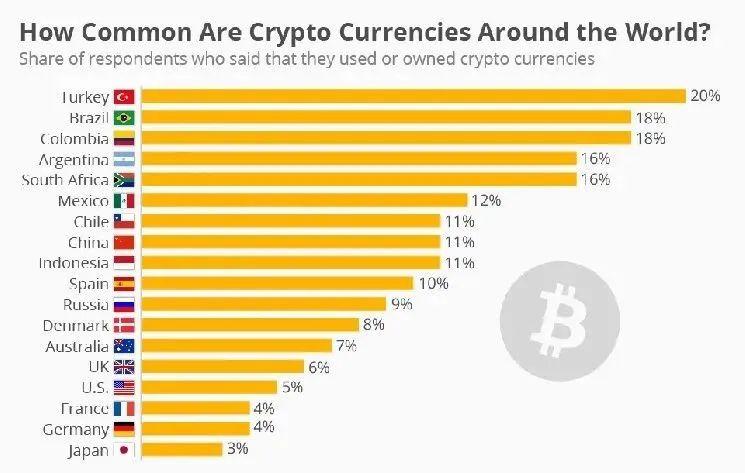

In recent years, severe inflation in countries such as Turkey and Argentina has led to sharp depreciation of local fiat currencies, prompting increasing numbers of residents to convert their national money into digital assets as globally liquid stores of value. The monetary devaluation resulting from governance issues in some nations has indirectly boosted digital assets’ importance as tools for value preservation.

Figure 1: Growth of cryptocurrency trading in Turkey amid inflation and currency depreciation

Figure 2: Turkey ranks highest globally in cryptocurrency adoption rate

1.1.2 Societal Demand for Open Financial Systems

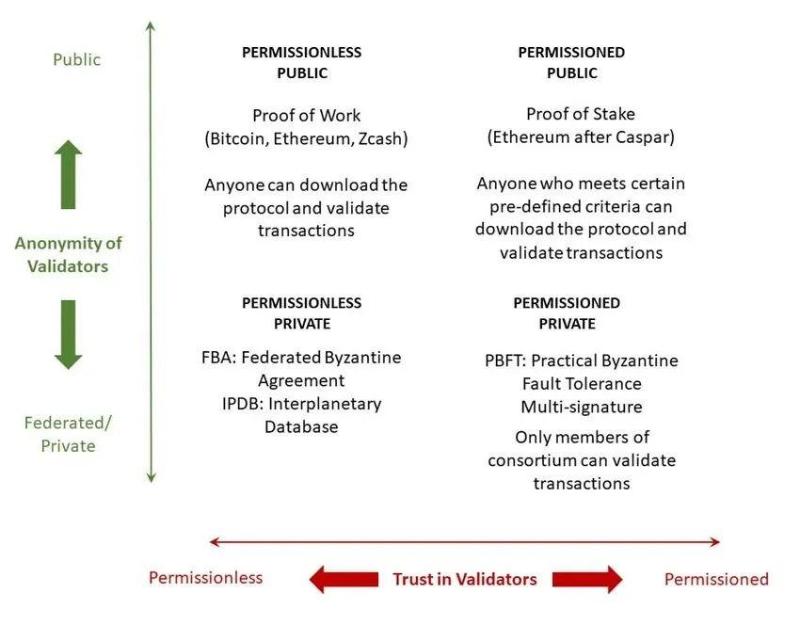

Since blockchain’s inception, the debate between decentralization and centralization has persisted. As the industry matures, the concept of open financial systems—or “Permissionless”—has become a more accurate descriptor for a free, accessible, and permission-free blockchain architecture.

Only openness and permissionless access can better promote diverse innovation, bring about fairer infrastructure, and drive circulation and prosperity within the on-chain ecosystem.

Figure 3: Permissionless vs. Permissioned Matrix

Meanwhile, rising populism and geopolitical conflicts have triggered a wave of deglobalization, hindering the free flow of capital and information across markets. Digital assets and blockchain continue to facilitate cross-border capital and information exchange from both financial and technological perspectives, better fulfilling users’ emotional and psychological needs in virtual spaces, which explains the growing public interest in emerging concepts such as DID (decentralized identities), SBTs (soulbound tokens), and Metaverse platforms.

Figure 4: Metaverse Market Project Map

The future world will feature coexisting realities—fragmented physical environments and unified virtual ones. Real-world divisions driven by pandemics and geopolitics will deepen, yet elites will use cyberspace to build a new open financial system, creating a virtual nation, with sub-states formed around shared interests and goals. Participants will continuously innovate infrastructures and dApps, connecting these virtual nations and states while enriching user experiences.

Figure 5: DApp Project Map 2021

1.1.3 Financial Product Innovation as Social Experimentation

In just over a decade, the digital asset industry has traversed developmental stages equivalent to centuries in traditional finance, advancing at an exponential pace. Traditional finance evolved alongside socioeconomic and cultural shifts, with regional policy differences shaping distinct regulatory landscapes.

By contrast, the digital asset industry is experimenting with building an entirely new financial system and ecosystem on blockchain—a global, always-on financial market. From OTC to exchanges, spot to derivatives, lending to AMM, DeFi to GameFi, SocialFi, CreatorFi.

New financial products emerge constantly, though their success depends on the maturity of underlying infrastructure and foundational financial offerings.

If product designs are too far ahead of infrastructure readiness or if basic financial products remain underdeveloped, such innovations may stall at the conceptual stage, requiring time before practical implementation.

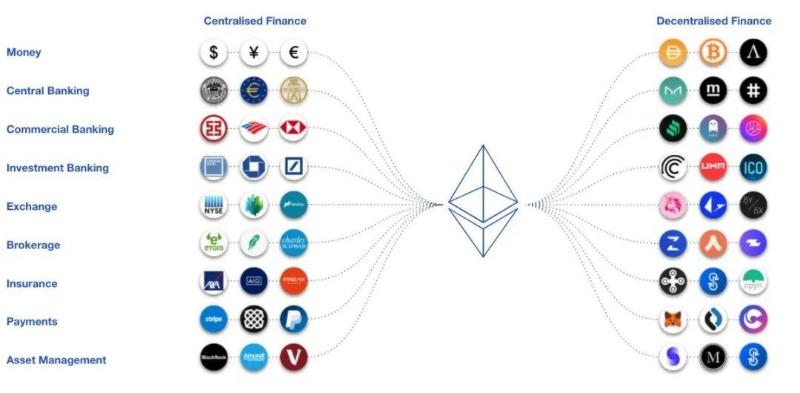

Nonetheless, financial innovation remains one of the industry’s core drivers. We can compare current offerings in traditional finance and digital assets to identify unexplored areas, forecast development phases, and position ourselves when key signals appear.

1.2 Internal Drivers

1.2.1 Attraction to Idealists: The Declaration of Independence for IT Geeks and Financial Investors

Natively crypto-native professionals often carry strong idealistic undertones. They possess technical expertise, transformative capabilities, and a spirit of adventure and innovation—evolving from niche experiments into broad social movements. Without sustained incentives or continued appeal to idealists, such movements would eventually fade.

On the contrary, Bitcoin’s deflationary model—with its halving every four years—and later tokenomic designs provided sufficient rewards to early adopters while also attracting more idealists to contribute talent and help build new infrastructure.

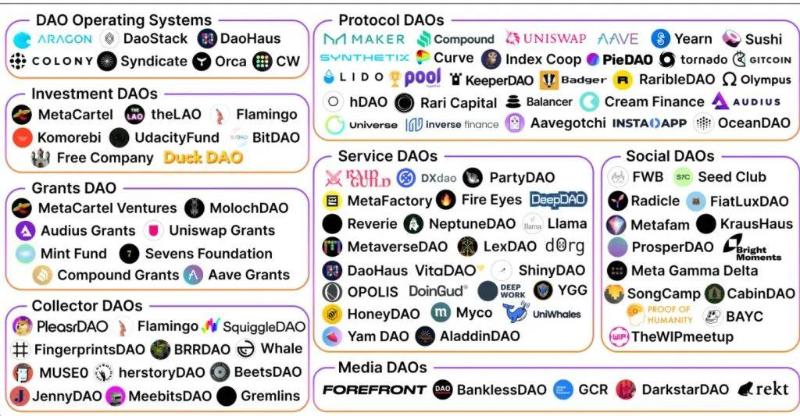

It is precisely due to these self-driven builders—who operate without formal organizations or salaries, often organizing as DAOs—that the industry can endure bull and bear markets alike, continuously developing new infrastructure and applications, driving financial innovation, attracting capital, expanding markets, and sustaining long-term growth.

Therefore, investing in these idealistic geeks and entrepreneurs increases the likelihood of identifying genuine industry trajectories and growing alongside them.

Figure 6: DAO Project Map

1.2.2 Pursuit of an Ideal Society: Democracy, Openness, Autonomy, Consensus, Privacy

Dissatisfaction with real-world conditions drives people to express themselves non-violently in virtual worlds. A tacit identity forms—anonymous profiles, PFP avatars, ENS domains, combined with Twitter, Telegram, and Discord—becoming standard identifiers in the crypto space.

Humans seem to be colonizing a new frontier—creating new avatars, funding Metamask wallets with ETH, and exploring various virtual platforms. Engaging in Twitter Spaces conversations, one can live anywhere as a digital nomad, no longer constrained by external circumstances affecting work, communication, or cognition.

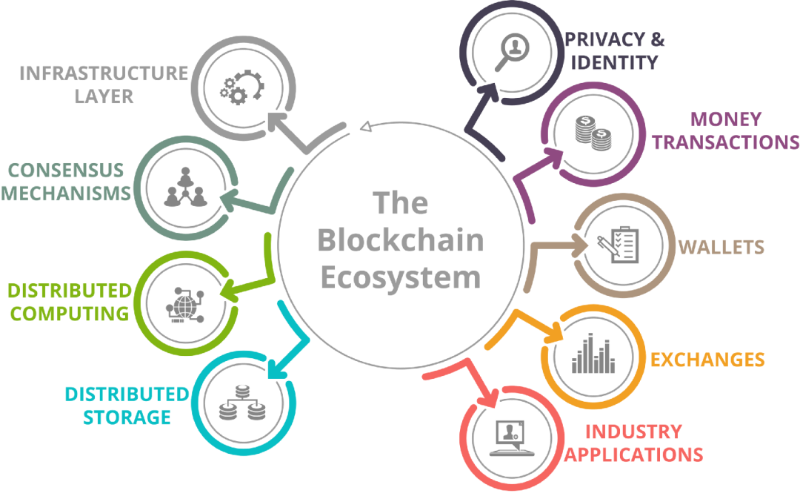

Users gain ownership via Web3.0 principles, participate in decision-making, and protect privacy—an appealing lifestyle attracting idealists of all ages, especially Millennials who grew up online and naturally embrace crypto-native rules and attitudes. Their involvement represents both vitality and continuity for the industry.

Figure 7: Blockchain Ecosystem Overview

1.2.3 Human Nature's Fundamental Needs: Greed and Speculation

All technological advancements come with dualities; technology itself is neutral, but different individuals apply it differently. This holds true for both the internet and digital assets.

Ideally, we begin with visions of a better society—reflecting purist ideals.

Yet as the industry grows, speculators recognize digital assets—as anonymous, unregulated instruments—as powerful tools for financial speculation.

Speculators know exactly what they’re doing and understand the risks—even after losses or liquidations. But “lambs forget in three seconds.” When prices rise again, past pain is forgotten.

Digital assets fulfill humanity’s deepest instincts: greed and speculation—unchangeable aspects of human nature. This explains why so many cannot resist temptation, pouring capital into trading, losing personal funds, and even borrowing to recover.

Though regulators increasingly protect retail investors, the innate desire for speculation remains deeply rooted. That’s why DeFi, GameFi, and similar models tap into core motivations, fueling new bull runs. Any model that stimulates greed and speculation tends to draw massive user inflows.

Thus, fundamental human desires propel the digital asset industry through cycles, amplifying these impulses in each subsequent bull market and drawing ever more capital and users.

#2 Evolution Logic and Direction of the Digital Asset Industry

After experiencing industry ups and downs, witnessing waves of hype across concepts and sectors, seeing idealistic stories flourish during bull markets—where everyone abandons caution amid tales of wealth—we see influencers shouting in chat groups to grow followers, and newbies happily sharing their latest “successful investment” story, believing this blissful era will last forever.

But before newcomers realize gains, markets suddenly reverse. The brutality of finance hits harder in digital assets—within moments, portfolios drop 80%, positions get liquidated, profits vanish, and principal disappears. Stories of ruin abound.

Then, in the next bull run, new narratives emerge, fresh investors enter—the cycle repeats endlessly.

After several such cycles, we must ask ourselves: What are the industry’s evolutionary logic and patterns? Which themes are mere hype? Which represent true value drivers?

Only by deeply reflecting on these questions can we better predict and position for the next cycle. This article attempts to answer and summarize the following logics and patterns.

2.1 Performance and Efficiency Driven

The blockchain trilemma remains a key area where the industry relentlessly seeks optimization. Compared to decentralization and security, scalability improvements yield more visible benefits—they directly impact user experience, transaction efficiency, and the cost of deploying large-scale applications.

Thus, performance enhancement remains a relentless pursuit for engineers, driven by growing demand for on-chain transfers and transactions pushing infrastructure upgrades. Since Ethereum ushered in the smart contract era, new public chains have competed fiercely on TPS, gas fees, consensus mechanisms, and scalability.

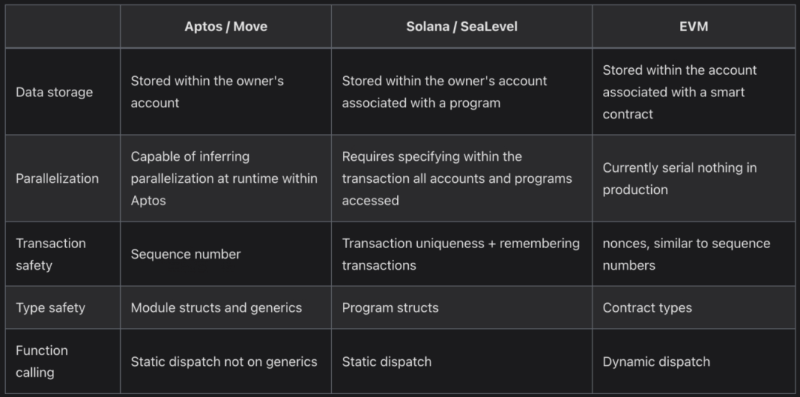

The 2018–2020 wave of new public chains gave rise to next-gen blockchains like Solana, Avalanche, Near, Polygon, Cosmos, etc., including recently U.S.-backed favorites Aptos and Sui, along with the底层 MOVE language—all signaling strong confidence in ongoing improvements to foundational infrastructure.

Figure 8: Comparison of Three Public Chain Technologies

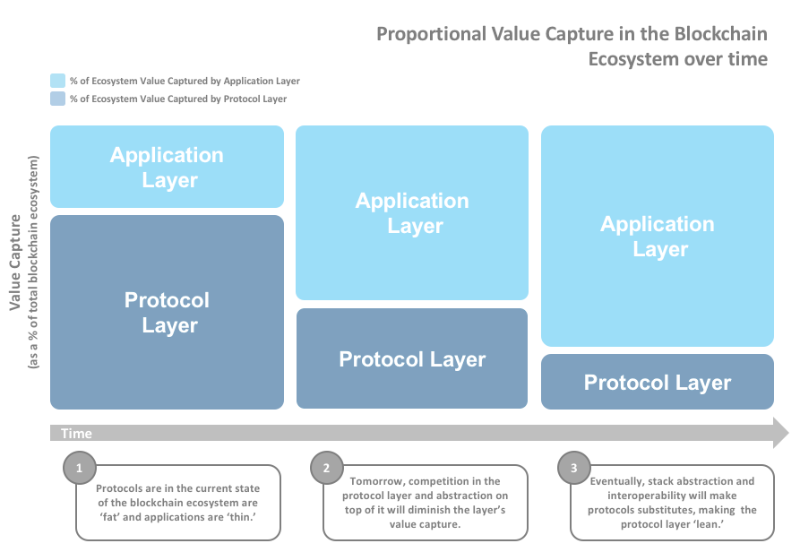

Higher-performance infrastructure can survive market cycles, generate cash flows, offer greater potential, evolve into Fat Protocols, host valuable data and assets—aligning perfectly with institutional investment logic and making it a top-tier investment theme.

Efficiency manifests in transaction speed, fees, and user experience.

Figure 9: Value Capture Ratio Over Time Across Blockchain Ecosystems

From a CeFi perspective, exchange evolution reflects persistent pursuit of efficiency. From offline OTC markets to early limited-platform exchanges, then to high-throughput trading venues, each step accommodates more participants and volume.

Exchanges became central hubs of value ecosystems—core platforms matching assets, capital, and users. Thus, they compete aggressively on order throughput, execution speed, bid-ask spreads, liquidity depth, low fees, and UX.

Platforms aligning with these criteria win market and user adoption—Binance, FTX, OKX, Kucoin, Bybit, Huobi have achieved leadership in their respective niches.

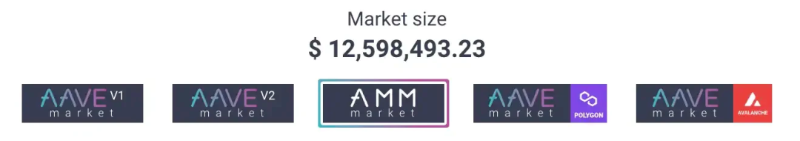

From the DeFi angle, UNI’s progression from V1 to V2 to V3 reflects relentless pursuit of liquidity efficiency. The evolution of AMMs, yield aggregators, lending protocols like AAVE—all highlight the industry’s obsession with efficiency. Hence, identifying current pain points affecting DeFi and liquidity efficiency offers strategic investment opportunities.

Figure 10: AMM and AAVE Market Size (as of March 2022)

Wallet evolution—from complex Bitcoin clients to user-friendly dApp gateways like Metamask, multi-chain options like Trust and SafePal—shows growing emphasis on usability. Successful wallets become critical infrastructure, generating stable cash flows.

Currently, bridging fiat-digital payment channels within regulatory frameworks remains a key focus area for capital and experts.

2.2 Financial Assets and Model Driven

The continuous enrichment of digital assets and financial model innovation constitute a core development logic. From native BTC to ETH-enabled altcoins, stablecoins, and various derivatives—the industry continues evolving.

We now see novel assets: on-chain treasury-backed instruments, index products, interest rate derivatives, fixed-income offerings. While regulatory concerns exist, the next cycle may unveil more native on-chain innovations.

Figure 11: Shift from CeFi to DeFi Ecosystem

Financial model innovation acts as a catalyst for industry acceleration. From simple OTC spot trades to centralized order books, futures contracts, lending, staking, DeFi, and derivatives.

Each bull run introduces richer financial models: 2018 brought futures trading; 2020 ignited DeFi mania—both leveraging innovative models to deliver high leverage and liquidity, rapidly generating wealth effects and attracting more investors.

Ironically, overuse of financial models contributes to market tops—excessive leverage leads to liquidity crunches, triggering collapse and bear markets with widespread investor losses. The 2020 DeFi surge, 2021 GameFi craze, and 2022 Luna/UST crash all originated in innovation but collapsed due to unsustainable model excesses.

DeFi’s rich landscape of lending, leverage, and liquidity markets further amplified efficiency. Many projects lured users with APYs exceeding 10,000%. As more users joined, coupled with "farm-sell-exit" behavior and advantages held by early whales, many turned into financial Lego games—essentially races to exit first.

Early farmers earned quick returns, but latecomers faced lengthening payback periods—from days to months, even years. Such valueless innovation severely harms market participants.

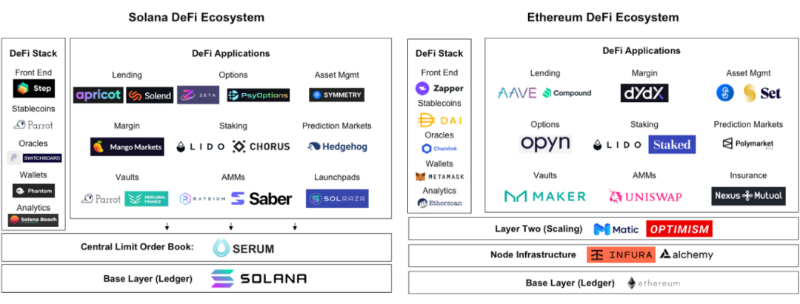

Still, DeFi innovations delivered solid infrastructure: DEXs, lending markets, AMMs, yield vaults, derivatives—lowering costs and removing intermediaries, enabling easier wallet-based access to applications.

DeFi is beginning to reach beyond crypto—providing payment rails or liquidity for real-world projects. In regions with weak financial systems—like parts of Africa—DeFi and digital wallets enable microloans, supporting local economies. These are socially meaningful, impactful use cases.

Figure 12: Solana and Ethereum DeFi Ecosystems

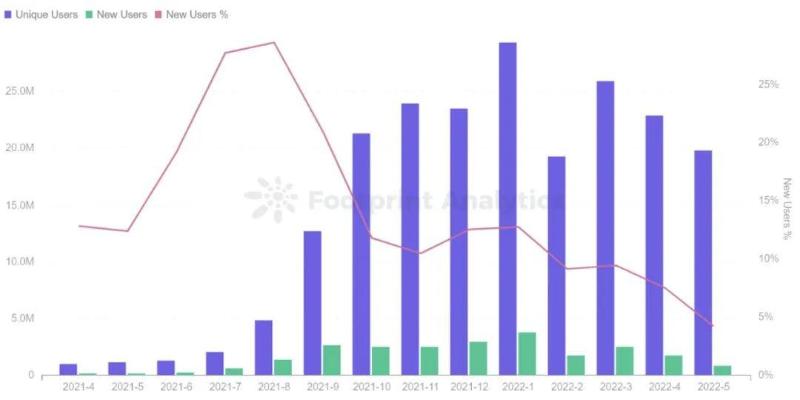

GameFi introduced new twists to DeFi—but largely emperor’s new clothes, adding interactive elements without changing fundamentals. At its core, GameFi still hinges on sustainable tokenomics, user acquisition prowess, and secondary market manipulation skills.

With tightening macro liquidity and lessons learned from user losses, the next generation of GameFi must solve the core challenge: balancing new user inflows against token unlock pressures—or risk death spirals.

Most GameFi projects during the last bull run lasted less than three months—mirroring the lifecycle of typical Ponzi schemes. Once a death spiral begins, developers lack incentive or ability to rescue it. Restarting a new game is cheaper. Without retained users or assets, players abandon Play-to-Earn titles once rewards dry up, moving to the next project. Hence, GameFi carries extreme risk. Rare successes like Axie result from unique confluences of macro and micro factors—not easily replicable.

Still, the industry keeps rebuilding GameFi foundations: game distribution, launch studios, open-metaverse collaborative gaming.

Major traditional gaming studios are entering with higher-quality content, but must resolve the tension between token incentives and new user acquisition. After this market cleanse, we hope to see GameFi projects with lasting engagement and robust economic models in the next cycle.

Figure 13: GameFi Market User Growth Trend

The collapse of Luna/UST marked the definitive turning point from bull to bear market. Even before the event, BTC and other majors had already dropped ~50% from peak. Amid declining liquidity and user attrition, Do Kwon kept offering high yields while allocating vast sums to buy BTC—drawing attention from short sellers who exploited LUNA/UST mint-burn mechanism flaws, shorting both LUNA/BTC, causing UST to depeg and triggering panic.

Insufficient reserves led to bank runs, cascading through the system—LUNA hyperinflated, investors wiped out.

LUNA was once a rising star among new public chains, home to promising dApps and hailed as Korea’s flagship project. Yet regardless of technical merit or VC/market maker support, Genesis Trading suffered heavy losses trying to save UST.

Whenever leverage is too high, liquidity crises erupt, growth becomes unsustainable, and there’s insufficient respect for market dynamics, collapse is merely a matter of time. LUNA/UST fell from grace in just 72 hours—showcasing the brutal efficiency of market clearing and fragility of unchecked mechanisms.

Figure 14: The Collapse of Luna

Hence, balancing financial innovation with liquidity risk control will be crucial in the next market cycle.

2.3 Liquidity and Narrative Driven

Liquidity drivers fall into three categories: macro liquidity, capital flow, and asset liquidity. Only when all three align does a full bull market emerge. Partial alignment results in temporary or localized rallies. Thus, liquidity serves as a key engine and marker of market transitions.

Macro liquidity refers to the global financial cycle. Bull markets coincided with abundant liquidity periods—such as 2017–2018 and 2020–2022.

When central banks raise rates to curb inflation, reducing liquidity, digital assets—which are now tightly linked to U.S. markets—are affected as risk assets influenced by institutional investor sentiment.

Thus, when markets anticipated the end of the pandemic and six Fed rate hikes in 2022 by late 2021, the prior bull market was already nearing its end. November–December 2021 thus represented an optimal window to realize gains.

Figure 15: Macro Liquidity Peaked at End of 2021

Capital liquidity includes the volume of new capital entering and activity levels of existing capital.

When hot money floods into specific sectors or projects, localized or temporary bull markets often follow—e.g., 2019’s meme coin frenzy sparked brief rallies during a bear market.

During the 2020 DeFi Summer, new inflows energized dormant capital—resulting in ample market liquidity. Amplified by leveraged models that generated synthetic liquidity, a full bull market took off. Asset liquidity encompasses metrics such as number of new funded projects, founder activity, community engagement, and exchange listings—indicating supply of new assets and narrative material. Only when supply is abundant can asset liquidity thrive, offering diversified investment opportunities across primary and secondary markets to absorb new capital in the next bull run.

Narrative economics is a vital marketing tool in the digital asset industry. Consensus conferences, public companies, popular apps, and even sovereign states join the narrative bandwagon: PayPal accepting Bitcoin payments, El Salvador adopting Bitcoin as legal tender, Central African Republic launching its

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News