Interpreting Celsius' Bankruptcy Filing to Understand Its Past, Present, and Future

TechFlow Selected TechFlow Selected

Interpreting Celsius' Bankruptcy Filing to Understand Its Past, Present, and Future

"You have an illness in your skin's surface; if left untreated, it will likely worsen."

Author: @0x_cryptodada, TechFlow

"You have an illness in the superficial layers; if untreated, it will deepen."

When the market is bullish, such ailments are easily ignored. But when conditions turn sour, Celsius ultimately filed for bankruptcy.

On July 15, Celsius submitted a bankruptcy petition to a New York court. The document spans 61 pages, detailing Celsius’s current financial status, core business operations, list of creditors, and reasons for filing bankruptcy.

Image source: https://coinquora.com/

For most casual observers inside and outside China’s crypto community, their understanding of Celsius barely extends beyond knowing it as another platform that collapsed—one primarily engaged in cryptocurrency lending. Few grasp the finer details. To truly understand its journey from glory to collapse, perhaps the best approach is to listen to what Celsius itself says—especially what it declares under oath in legal filings.

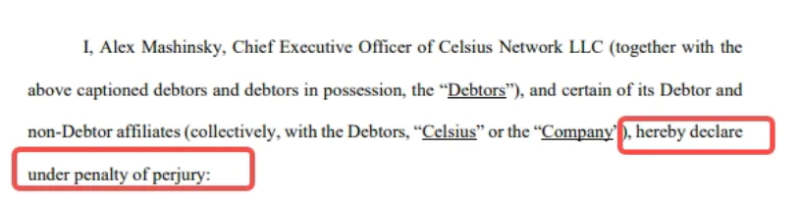

After all, this bankruptcy filing begins with a clear warning: If I commit perjury, I voluntarily accept punishment.

Given the length of the filing, few uninvolved individuals would read it cover to cover. So here, I’ve digested it for you, extracting and interpreting key insights.

Past: Did It Simply Ride the Right Wave?

At the outset, the filing outlines Celsius’s “glorious” past:

Launched in 2018, by year-end users had deposited $50 million worth of crypto assets on the platform. By 2019, that figure reached $200 million. In March 2021, it surpassed $10 billion.

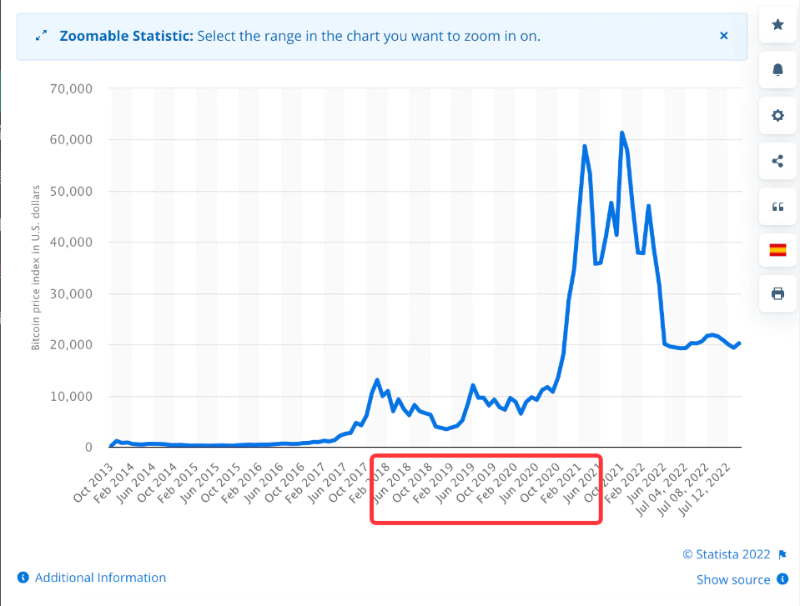

This narrative raises questions. Was this growth due to Celsius’s strong user acquisition, or simply because bull markets inflated asset values?

The chart below reveals the answer: Celsius seemingly perfectly rode the wave of rising crypto prices. From 2018 to March 2021 was a major bull run, when BTC was still hailed as the ultimate faith by true believers. Most likely, the value of assets on the platform grew organically due to price appreciation. Higher valuations led to higher lending yields, creating an illusion of prosperity. For a time, inflows far exceeded withdrawals.

Data source: Statista.com

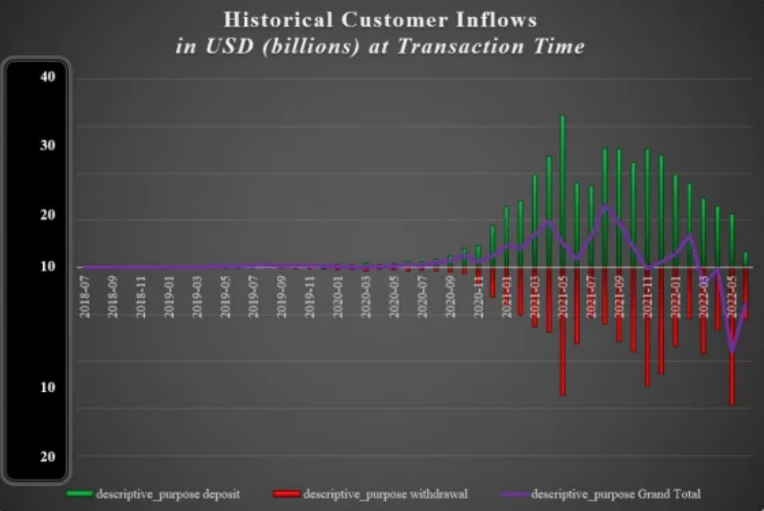

Celsius’s asset inflow and outflow trends

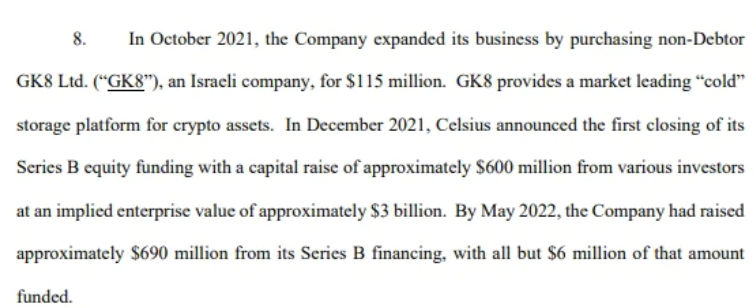

But user numbers tell a different story. According to point 9 of the filing, Celsius had 1.7 million registered users as of July. Last year’s count was likely lower. While millions of users may seem common in traditional Web2 fintech apps in China, viewed through a conventional lens, this isn’t particularly impressive. Yet within Web3-adjacent spaces, capital clearly saw potential in Celsius. As stated in point 8 of the filing:

In October 2021, Celsius acquired GK8, an Israeli cold-storage firm, for $115 million. In December, it closed a Series B round raising $600 million at a $3 billion valuation. By May this year, total funding neared $690 million.

It really did have money—real money. Celsius planned to expand further; had the crisis not hit, it intended to launch Celsius Mining, a mining company aiming for IPO. This may also reveal a wealth playbook for B2B and institutional players: running bank-like lending and mining operations.

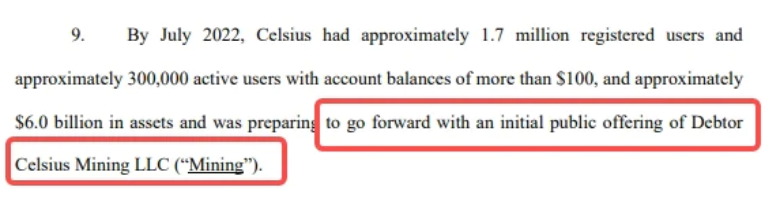

Yet cracks emerged beneath the surface. Amid global pandemic effects and the LUNA collapse, a crypto winter arrived, and digital assets plummeted. What followed is now well known: Celsius lent out or staked platform assets into various protocols. When counterparties failed and protocol yields dropped, it faced severe risk exposure. User confidence waned, withdrawal requests surged, and Celsius suffered a fatal bank run.

Interestingly, in its filing, Celsius attributes these events to “unexpected global developments” and “negative and misleading social media coverage.” This sounds like classic blame-shifting: taking credit during good times, blaming others during bad ones. Or perhaps it reflects the same old question: Where was Celsius’s risk management? Where was its ability to detect red flags in certain protocols (like Anchor’s 20% APY)?

Or worse, does this point to a deeper, uncomfortable truth about CeFi: User asset safety is never truly prioritized (despite claims), while chasing high yields and speculative bets always comes first?

Present: How Much Firepower Remains?

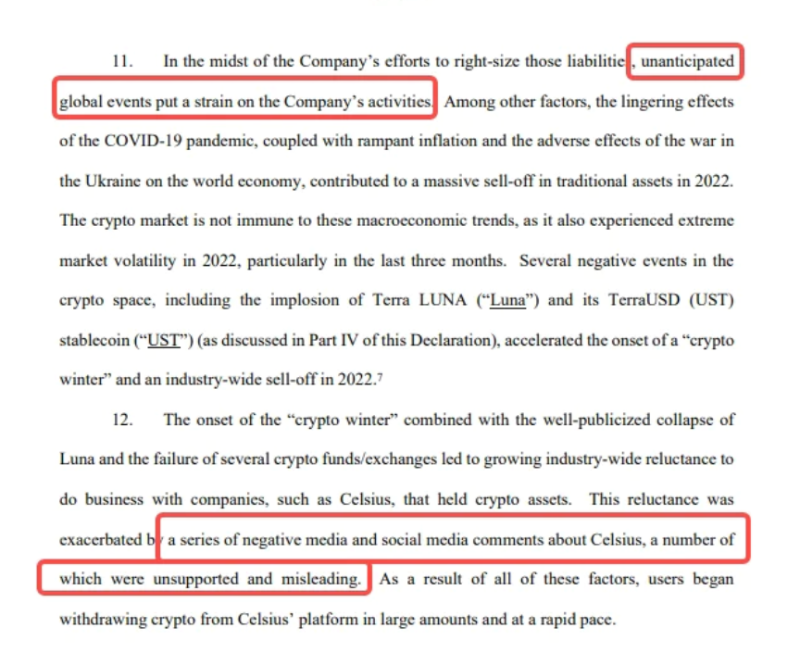

How much money does Celsius have left? Or more precisely, how much does it owe? According to the latest balance sheet disclosed in the bankruptcy filing, the shortfall stands at approximately $1.2 billion.

Note: Balance sheet figures are in millions; 1190 million = $1.19 billion

Part of this debt stems from its core financial services—something visible to users: well-known issues like stETH, contagion from Three Arrows Capital’s collapse, and the LUNA implosion. But one hidden factor often overlooked is its mining operation.

According to the filing, Celsius operates one of the largest mining companies in the U.S. To boost future profits and chase higher returns, Celsius entered mining in late 2020. It provided up to $750 million in revolving loans to fund mining activities, classifying this as a long-term investment. Currently, it owns 80,000 miners, with over 40,000 active, producing 14.2 BTC daily. Celsius hopes to gradually recoup its loan costs through this output.

This resembles traditional capital-intensive industries—like opening a restaurant with heavy upfront investment, recovering costs via steady revenue. But this assumes stable unit economics. Bitcoin has fallen over 50% from its peak, significantly extending payback periods. Combined with failures in other financial ventures, it became a case of misfortune piling upon misfortune. By the end of May, Celsius still had around $570 million in unrecovered loans.

Mining profitability hinges on Bitcoin’s price, while CeFi financial products depend on DeFi protocol and altcoin performance. These factors are highly correlated. Once the market turns, both BTC and alts crash together, inevitably crushing both Celsius’s financial and mining businesses. This is a universal risk for crypto firms—Celsius just happened to be the first domino.

Excluding terminated DeFi and FTX loans, the filing shows the company (debtor) currently holds about $130 million in cash. Additionally, it owns $4.31 billion in assets (nearly matching the earlier balance sheet). Non-user liabilities amount to $780 million (compared to $4.7 billion owed to users, plus $780 million elsewhere).

To bridge the balance sheet gap, Celsius intends to mine Bitcoin and sell it to cover deficits. In essence, it’s trading time for space—if Bitcoin stays above shutdown levels, mining continues, generating cash flow to patch financial holes.

Future: Who Would Suffer If No Bankruptcy Was Filed?

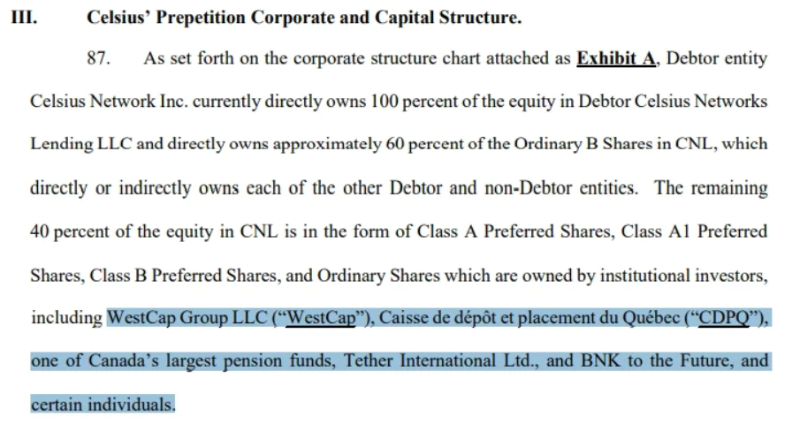

Looking at Celsius’s ownership structure, stakeholders include WestCap Group, a U.S.-based venture firm; CDPQ, Canada’s largest pension fund; Tether (the USDT issuer); and BNK to the Future (an investor in Bitstamp and Bitfinex)—none are minor players.

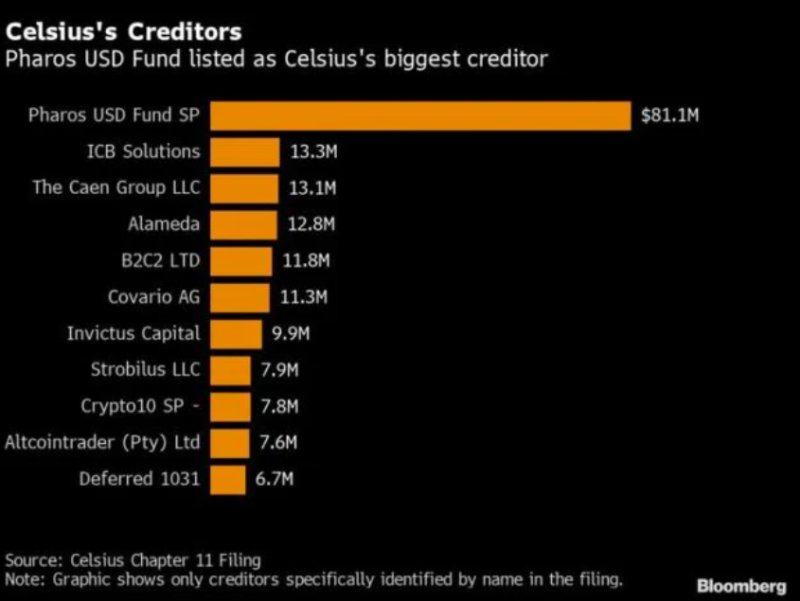

The creditor list is even more intriguing. The largest creditor is Pharos USD Fund SP, owed $80 million. By comparison, Alameda Research is owed only $12 million. This relatively unknown top creditor suddenly draws intense scrutiny.

news.bloomberglaw.com

However, according to Twitter user @Emily Nicolle’s investigation, several employees of this firm have ties to SBF, and its CEO was formerly a co-founder of Alameda. Those interested can check the original thread:

Overall, Celsius’s collapse implicates numerous internal and external creditors and debtors—a single thread pulling the entire web. No party wants to bear losses. Now that bankruptcy is filed, the hope is for some equitable resolution among stakeholders.

In this dark forest market, let us hope we won’t again see whales hunting, projects failing, and new cycles emerging—all paid for with retail investors’ hard-earned money.

And in the future, will you once again be the one left holding the loss?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News