The Lehman Moment for Crypto Entrepreneurs: The Rise and Fall of Unicorn Celsius

TechFlow Selected TechFlow Selected

The Lehman Moment for Crypto Entrepreneurs: The Rise and Fall of Unicorn Celsius

All gifts bestowed by fate have already been priced in the shadows.

By: 0xergou

“Celsius Network has twice as many users as all DeFi platforms combined… That’s because we give back 80% to our community, while Maker and other projects keep 50% for themselves.”

In 2019, Alex Mashinsky, founder of the crypto lending platform Celsius, boasted on Twitter, triggering backlash from DeFi enthusiasts. One user shot back: “DeFi protocols let us fully control our money, but when your platform collapses, we have no way to retrieve our funds…”

Data site DeFiPrime chose to delist Celsius Network entirely.

“We’re removing Celsius Network. Opaque company, crazy CEO—clear red flags. We no longer recommend this product,” said Stani, founder of AAVE, chiming in, “All CeFi platforms should be removed from DeFiPrime.”

Nearly three years later, Celsius Network—now a full-grown crypto unicorn—suddenly announced it would halt all withdrawals, trading, and transfers on its platform.

For most Chinese readers, Celsius Network may sound unfamiliar. But the story of its founder and the company contains nearly every element of a legendary tale:

A Ukrainian arrives in America with $100 and becomes a serial entrepreneur, founding eight companies and building three unicorns; turns venture capitalist, raises $1 billion, exits over $3 billion with a 54% IRR; Celsius suffers two major hacks; former CFO Moshe Hegog is arrested; a porn star serves as an executive…

Now, amid a massive withdrawal rush and frozen withdrawals, Celsius Network—once managing up to $30 billion in assets—has reached its “Lehman moment.” Where did the crisis come from? Can startup maverick Mashinsky pull off another miracle?

The Maverick: Mashinsky

On October 5, 1965, Mashinsky was born in Ukraine, then part of the Soviet Union. In 1972, he moved with his family to Israel, where he spent most of his childhood.

As a teenager, Mashinsky frequently bought and resold seized goods at customs auctions in Tel Aviv airport, showcasing sharp entrepreneurial instincts.

During university, he studied electrical engineering and economics at both the Open University of Israel and Tel Aviv University, though he completed neither degree.

After serving three years in the Israeli military, Mashinsky dreamed of doing something big in Europe. He started in Paris, but quickly grew frustrated by what he saw as European lack of imagination: “Why not just fly to New York and see how America really works?”

With only $100 in his pocket, Mashinsky arrived in New York and took a bus to 42nd Street, where, like any ambitious youth arriving in a big city, he made a vow: He would never return home unless he had achieved something significant.

In the U.S., Mashinsky launched into a frenzied startup spree.

In 1995, he founded Arbinet, a telecom company providing international voice traffic services to carriers and service providers. Today’s Skype, FaceTime, and WhatsApp are among its clients.

After six rounds of fundraising, Arbinet raised over $300 million from 12 VCs, went public in 2004 with a valuation exceeding $1 billion, and Mashinsky fully exited in 2005 after selling his shares.

Over that decade, Mashinsky didn’t stop at one company.

-

In 1997, he founded Comgates, a telecom software company, raising $20 million before its acquisition by Telco Systems.

-

In 2001, he founded Elematics, a network virtualization company, raising $23 million and exiting in 2004.

-

In 2003, he founded Transit Wireless, a telecom firm using distributed antenna systems, later acquired.

-

In 2005, he founded GroundLink, a ride-sharing app, later acquired.

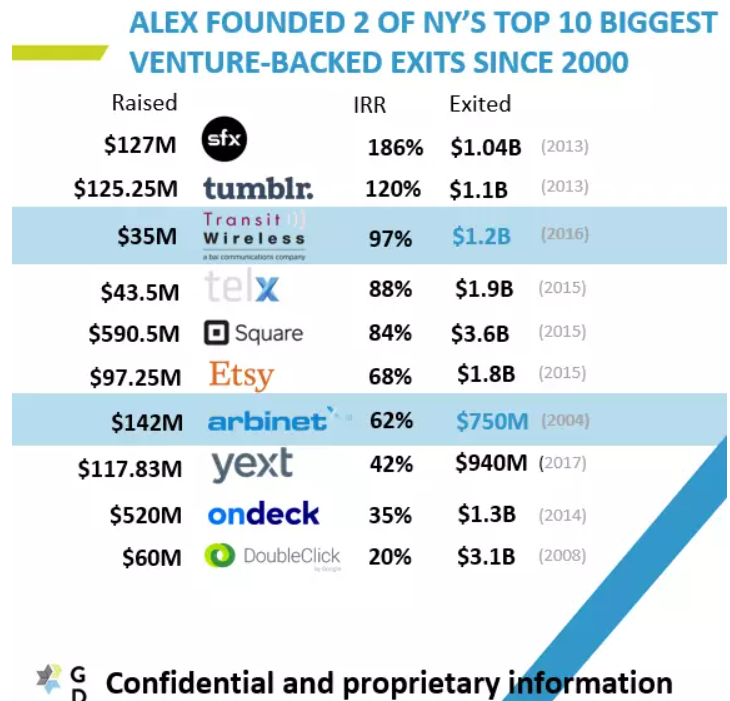

One sentence sums up Mashinsky’s track record: Among New York City’s top ten most successful VC-backed exits post-2000, two were companies he founded.

Beyond startups, Mashinsky also became a VC, founding the venture fund Governing Dynamics in 2004.

Don’t think he was just dabbling—Governing Dynamics raised over $1 billion, invested in more than 60 companies, generated over $3 billion in exits, and achieved a 54% IRR…

Beyond traditional investments, Governing Dynamics also backed blockchain ventures. Perhaps sensing its potential, Mashinsky jumped back into entrepreneurship, launching Celsius Network in 2017—a cryptocurrency deposit and lending platform—attractive for offering customers up to 18% annual yield.

In October 2021, Celsius Network raised $400 million, later expanded to $750 million, led by WestCap and Canada’s second-largest pension fund CDPQ, achieving a post-money valuation over $3 billion.

This marked Mashinsky’s eighth company and third unicorn.

Celsius: The Anti-Bank Crypto Bank

To most Chinese audiences, Celsius may be unknown. But in the English-speaking world, Celsius is a household-name CeFi star, boasting over 1.7 million users and managing over $30 billion in peak assets.

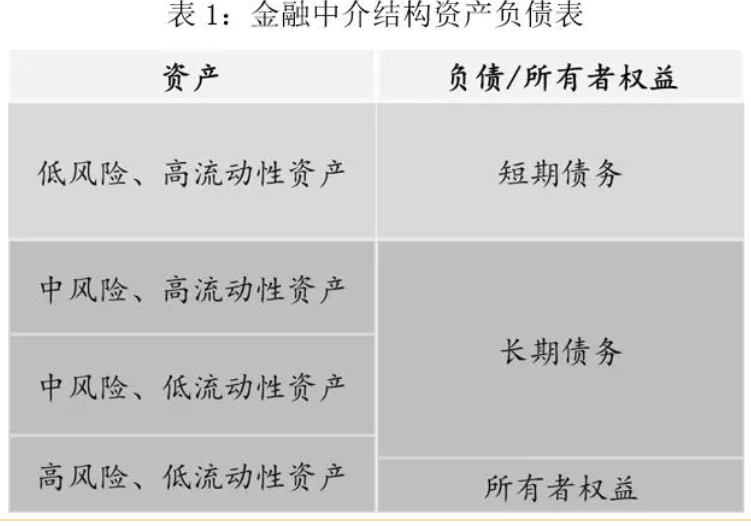

In business model, Celsius is no different from a “bank”: on the liability side, it takes in “crypto deposits”; on the asset side, it uses these pooled funds to generate returns through loans and other strategies, profiting from the spread.

How does Celsius attract customers to “deposit”?

Narratively, Celsius used a bank-like model to tell an “anti-bank” story.

“Traditional banking is broken. Blockchain will disrupt Wall Street!”

- Banking is Broken

- Unbank Yourself

- Replacing Wall Street with Blockchain

- 99% vs. 1%

Marketing-wise, Celsius stuck to the same script—but effectively: Deposit crypto and earn up to 18% APY, paid weekly.

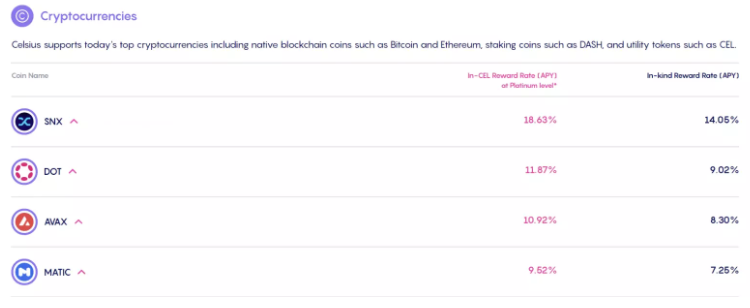

Celsius offers two interest models: in-kind Reward, where you deposit a crypto asset and earn interest in the same asset (e.g., deposit SNX, earn SNX); and in-Cel Reward, where you deposit a crypto asset but earn interest in CEL, Celsius’s native token, which yields a higher overall APY.

Overall yields: Bitcoin ~3–8%, Ethereum ~4–8%, USDT ~9–11%. So the question arises: Where does this risk-free high yield come from?

Lending is relatively stable, but faces capital efficiency issues—not all funds are matched to yield-generating activities. Low efficiency means lower APY, hurting deposit growth.

Hence, an industry-wide unwritten rule: Beyond lending, platforms like Celsius and BlockFi often seek returns elsewhere.

In the bull market party, earning “risk-free” returns via arbitrage wasn’t hard—GBTC arbitrage, futures premium plays, even leveraged DeFi strategies… In a bull run, such practices are commonplace—all players do it. To grow assets fast, you can’t afford not to.

But the music always stops eventually.

When stable arbitrage dries up, Celsius had to resort to increasingly exotic and risky financial instruments to maintain high yields for depositors.

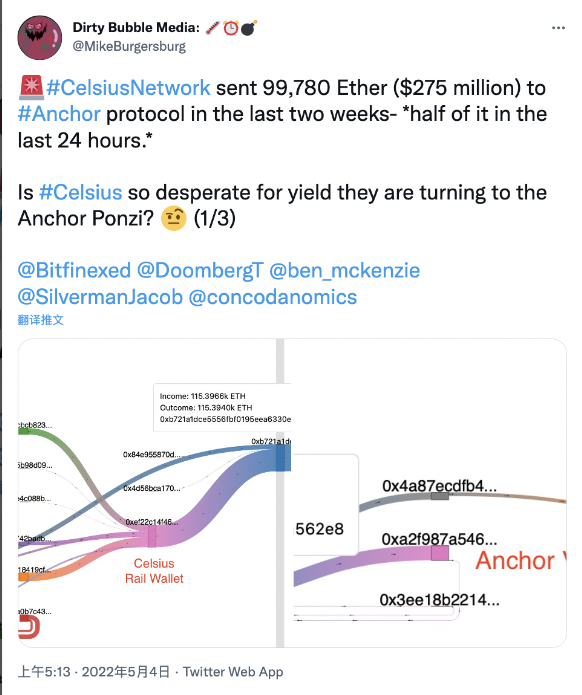

Take Terra’s Anchor Protocol—Celsius was a whale there, sending hundreds of millions in crypto to Anchor before the crash, becoming one of the final straws that broke UST.

Secondly, Celsius promised up to 8% yield on Ethereum deposits. To achieve this, it swapped large amounts of ETH into stETH and other ETH2.0 derivatives to capture staking rewards—planting the seeds for today’s liquidity crisis.

What Exactly Happened to Celsius?

Whether Celsius, BlockFi, or China’s once-booming P2P fintech firms, the collapse of any bank-like business ultimately stems from a liquidity crisis, typically unfolding in several ways:

1. Bad debt losses.

All banks incur bad debt, but it’s not critical unless catastrophic. The key is scale—worst case: massive shortfall, insolvency.

2. Mismatch between short-term liabilities and long-term assets.

Typically, liabilities are short-term (e.g., demand deposits), while assets are long-term (e.g., loans) to earn higher cash flow. But black swan events trigger liquidity crunches, forcing asset sales and runs.

The spread is essentially compensation for the “bank” taking on liquidity risk.

3. Rising withdrawal demands, shrinking liquidity.

Confidence is paramount in finance—on-chain or off-chain. Even traditional banks fear bank runs, since all face some degree of maturity mismatch.

For Celsius, tragically, it suffered from all three problems.

If we must pinpoint a trigger, it began with UST depegging.

Celsius held $535 million in Anchor Protocol. Later, Nansen’s on-chain analysis confirmed Celsius was one of seven whale wallets that helped drive UST’s depeg.

In other words, Celsius escaped before UST fully collapsed—perhaps avoiding major losses—but severely damaged market confidence and triggered distrust toward Celsius.

Since UST’s depeg, funds began fleeing Celsius—over $750 million withdrawn between May 6 and May 14.

Then, news of Celsius’s two past hacks resurfaced and intensified.

1. Lost 35,000 ETH on Stakehound

On June 22, 2021, Eth2.0 staking provider Stakehound announced loss of private keys for over 38,000 ETH deposited by clients. On-chain analysis later revealed 35,000 of those belonged to Celsius, which concealed the incident and still hasn’t acknowledged it.

2. $50 Million Loss in BadgerDAO Hack

In December 2021, BadgerDAO was hacked, losing $120.3 million—over $50 million came from Celsius, including about 2,100 BTC and 151 ETH.

A total $120 million in losses wouldn’t necessarily break Celsius’s balance sheet. As a unicorn that raised $750 million in 2021 and rode the bull market, its cash flow should have been healthy—but reality was less rosy.

During the bull run, Celsius pivoted into mining and pushed for an IPO.

-

In June 2021, Celsius announced a $200 million investment in Bitcoin mining, including equipment purchases and acquiring shares in Core Scientific.

-

In November 2021, Celsius added another $300 million to its mining business, bringing total investment to $500 million.

-

In May 2022, Celsius’s wholly-owned subsidiary Celsius Mining LLC secretly filed a draft Form S-1 registration statement with the SEC, beginning its IPO journey.

Mining is a capital-intensive, high-cost, slow-return business. Once money is sunk in, it’s hard to pull out quickly. And in today’s harsh market, high-valuation IPOs aren’t viable.

In this volatile environment, Celsius also faced severe maturity mismatch.

Celsius allows instant redemptions, but many assets aren’t liquid. If too many users redeem at once, Celsius can’t meet demand—for example, 73% of its ETH is locked in stETH or Eth2, leaving only 27% liquid.

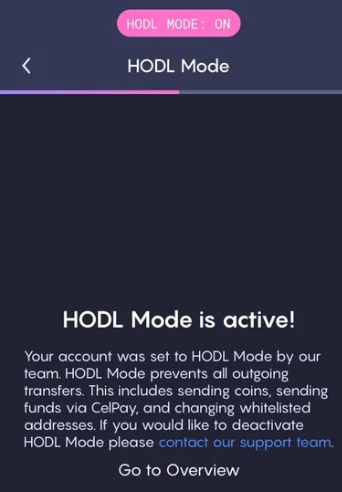

Under redemption pressure, Celsius kept pulling questionable moves, introducing “HODL Mode”—blocking withdrawals unless users submit extra documents to exit. This seemed to scream: We’re about to collapse—fueling panic.

To meet withdrawals and gain liquidity, Celsius simultaneously dumped BTC/ETH holdings and borrowed stablecoins like USDC from DeFi platforms such as AAVE and Compound by posting collateral.

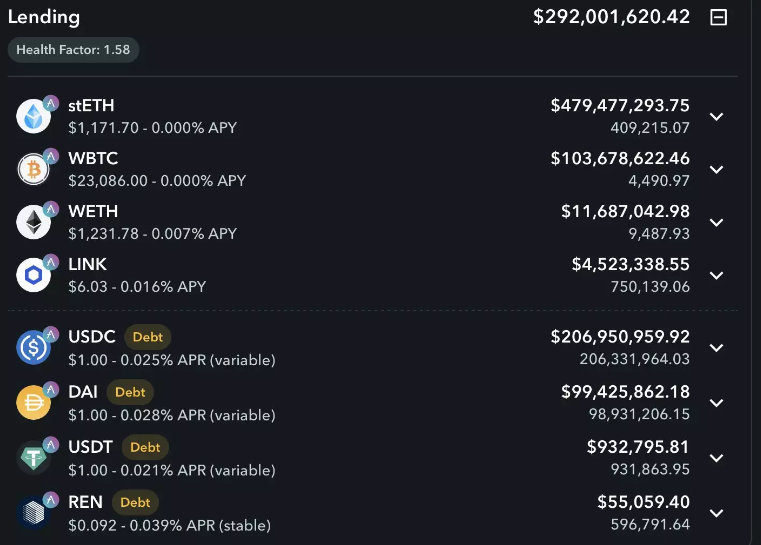

As of June 14, Celsius had $594 million in collateral on AAVE (over $400 million in stETH), borrowing $306 million.

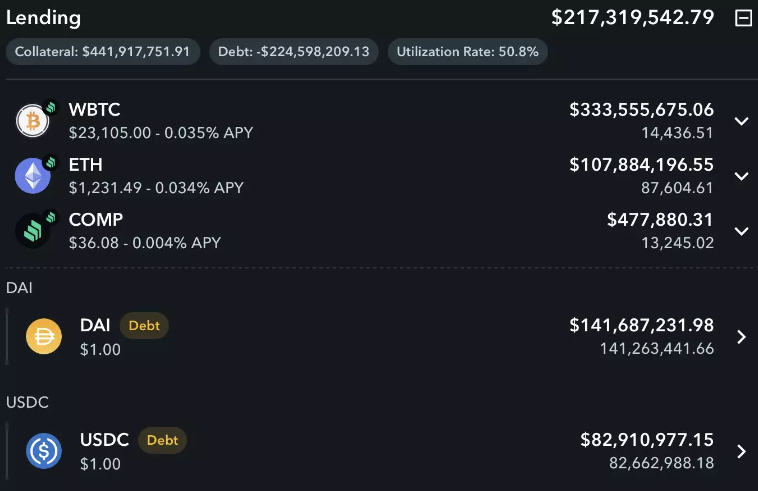

On Compound, Celsius posted over $441 million in collateral, with $225 million in debt.

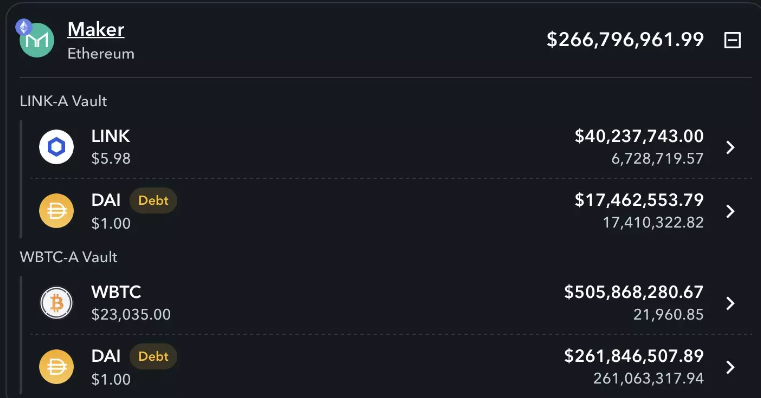

On Maker, Celsius held $546 million in assets and $279 million in debt.

Collateral ratios look acceptable on paper—but dangerously fragile in practice.

stETH depegging and continuous drops in ETH/BTC prices forced Celsius to post more collateral, while ongoing withdrawals drained liquid assets. Eventually, Celsius took the ultimate step—halting all withdrawals, trading, and transfers.

In DeFi’s dark forest, Celsius became a transparent target, under fire from hidden hunters ready to pull the trigger—liquidating positions, scavenging the remains.

It’s a terrifying vicious cycle:

No high returns → capital shortfall → maturity mismatch → bank run → collateral posting → price drop → margin calls → further drops → more runs…

Currently, Celsius’s balance sheet remains a black box. It may need a white knight—Nexo, another crypto lender, tweeted it could acquire any of Celsius’s remaining qualified assets, but Celsius responded coldly.

Some hope rests on early backers like Tether, issuer of USDT. But Tether seems eager to distance itself, stating: Celsius’s ongoing crisis is unrelated to Tether and won’t affect USDT reserves.

Every bull-to-bear transition brings deleveraging pain. Someone or some entity always becomes the sacrificed “cost.” After LUNA’s algorithmic stablecoin narrative collapsed, CeFi now faces its own narrative reckoning.

Mashinsky, the startup maverick, has rarely faced hardship. Arrogant and defiant, he may now have to bow his head and concede defeat to the market.

All gifts from fate were already priced behind the scenes.

Epilogue

History doesn’t repeat, but it rhymes. Today’s Celsius bears unmistakable echoes of China’s past P2P fintech firms.

In times of abundant liquidity, they grew wildly—luring deposits with sky-high yields, aggressively marketing, expanding liabilities. When lending couldn’t absorb all idle funds, they went on investment sprees: real estate, corporate bonds, VC LP stakes…

Chasing higher returns, assets drifted into subprime territory. Bad debt and maturity mismatches became the emperor’s new clothes—ignored by all, eyes fixed on going public, ringing the bell, writing their legends.

The music of liquidity always ends. Buffett’s wisdom endures: Only when the tide goes out do you discover who’s been swimming naked.

Humility matters. Whether in stocks or crypto, winners mostly ride beta. Most people’s wealth comes from cycles, not skill.

Do good deeds. Respect the cycle!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News